North Carolina Complex Will with Credit Shelter Marital Trust for Large Estates

About this form

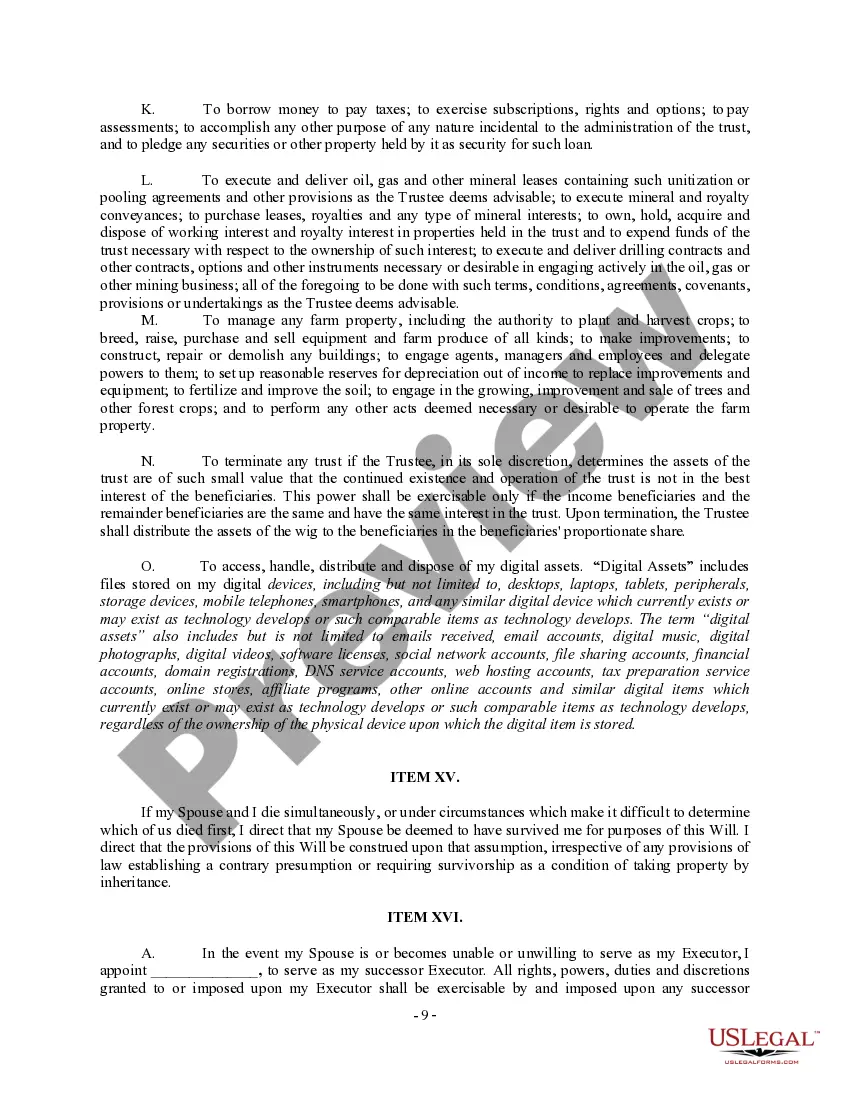

This Complex Will with Credit Shelter Marital Trust for Large Estates is a legal document designed to help couples minimize estate taxes upon death. It allows a significant portion of the estate to be placed in a tax-exempt trust, enabling more assets to pass to beneficiaries without tax liabilities. This form is particularly beneficial for larger estates and offers greater tax efficiency compared to simpler wills.

What’s included in this form

- Identification of the testator and their family members.

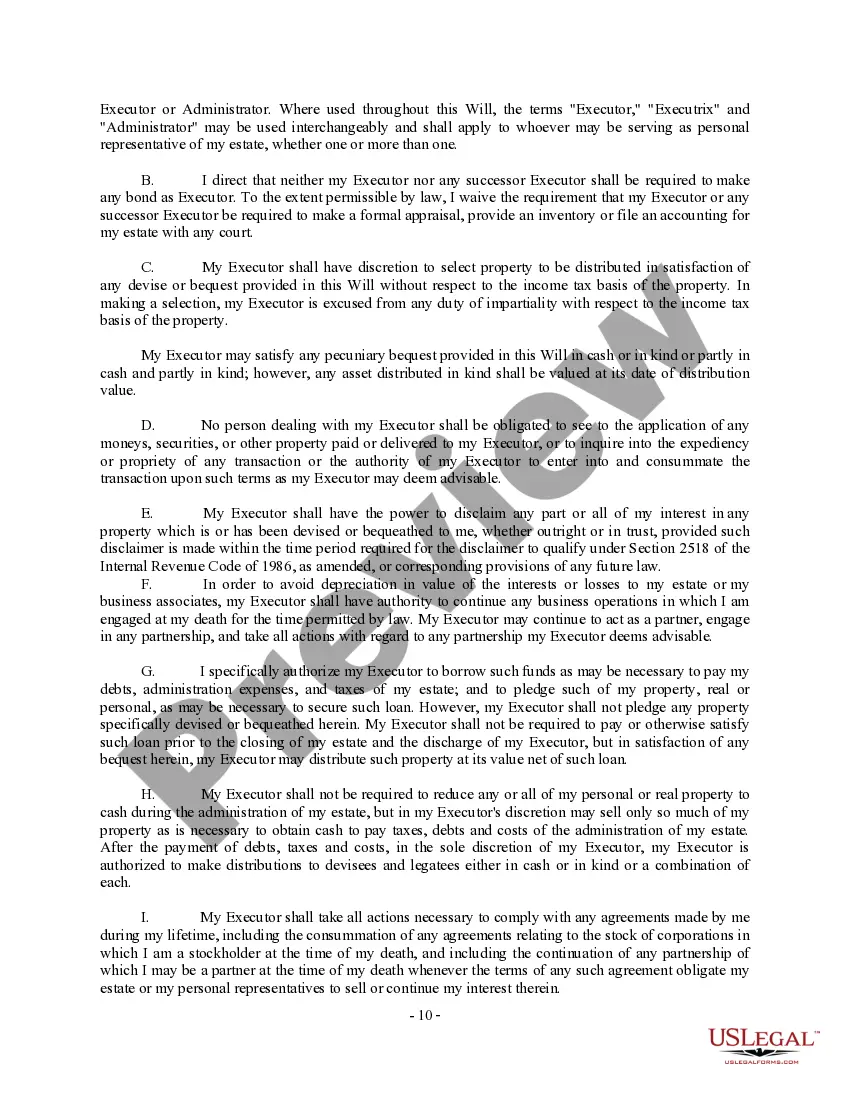

- Appointment of the spouse as the executor of the estate.

- Provisions for payment of debts and taxes from the estate and trust.

- Specific bequests of personal property, including the family home and personal belongings.

- Creation of a marital trust to benefit the surviving spouse and children.

- Directions for managing trust assets and distributions post-death.

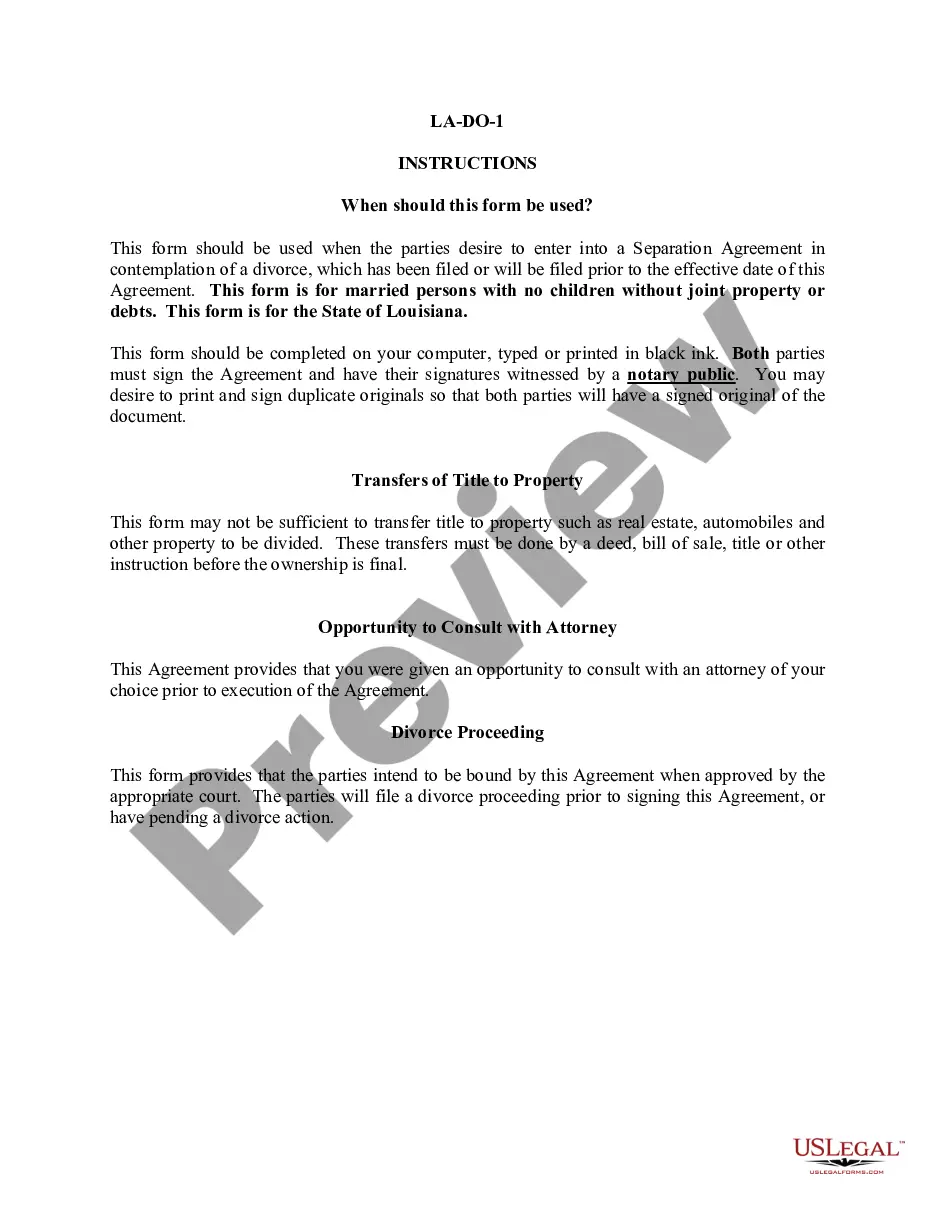

When to use this document

This form is ideal for married couples who have substantial assets and want to ensure that their estate is handled efficiently after their passing. It is especially valuable for those wishing to reduce or eliminate estate taxes, as well as for parents who want to provide for their children while also supporting a surviving spouse.

Intended users of this form

- Married couples with large estates.

- Individuals seeking to protect their heirs from significant estate tax liabilities.

- Parents with minor or adult children, aiming to ensure their financial security.

Instructions for completing this form

- Identify yourself as the testator and provide personal information.

- List your spouse and children, detailing their names and relationships.

- Appoint an executor for your estate, typically your spouse.

- Outline specific bequests for personal property and financial assets.

- Detail the provisions for a family trust, including management and distribution guidelines.

- Sign and date the document in the presence of witnesses for validation.

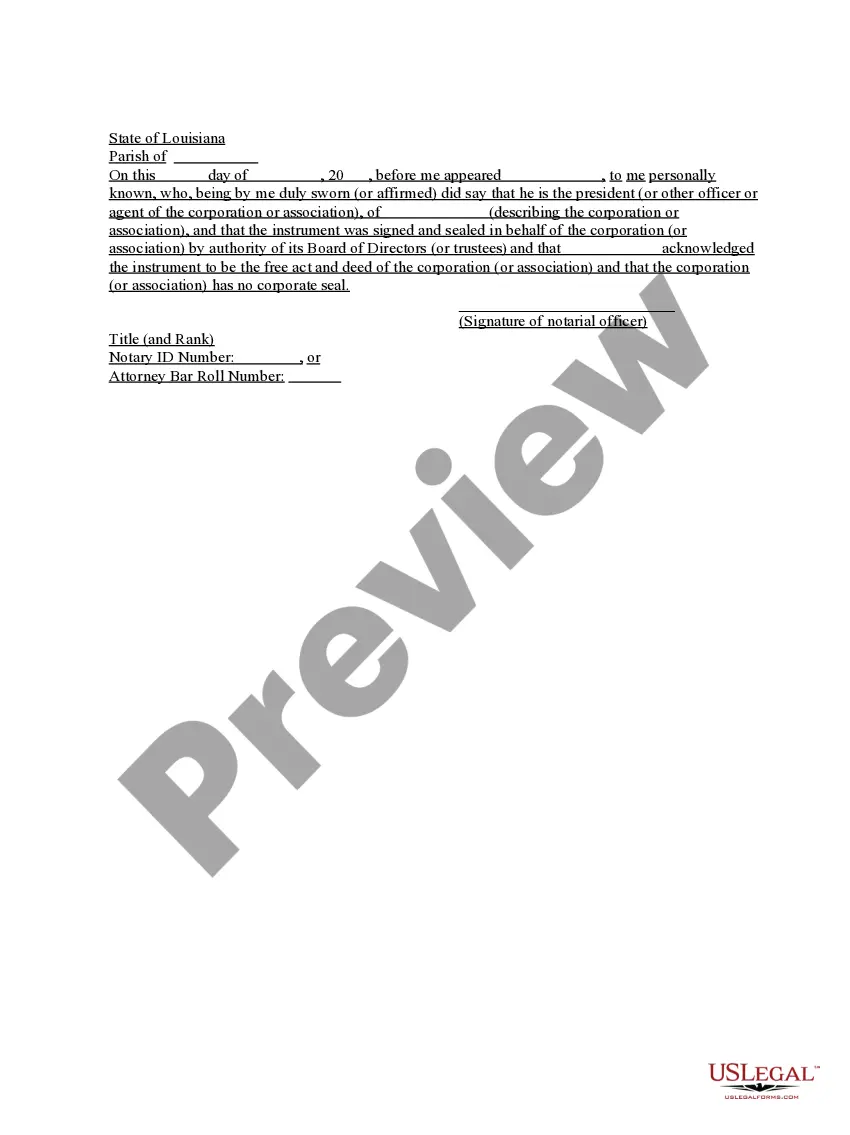

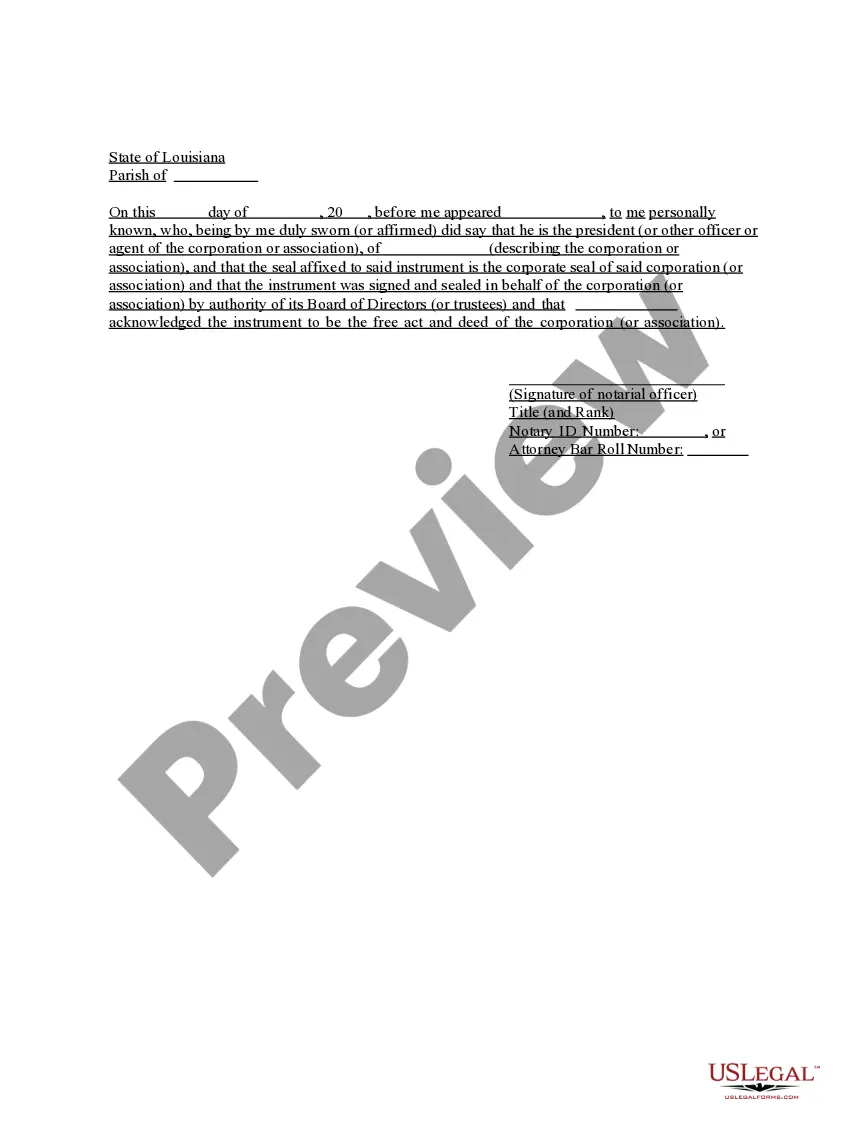

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to update the will after major life changes (such as marriage or divorce).

- Not properly witnessing the document, leading to potential challenges in probate.

- Overlooking specific provisions for tax payments which may lead to unexpected liabilities.

Why use this form online

- Convenient and quick access to essential legal documents from home.

- Easy to edit and customize to meet specific situations and needs.

- Reliability of documents drafted by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

A marital trust starts as a revocable living trust. A surviving spouse can be its trustee.

A Trust (or Marital Trust) It is a trust that takes advantage of the unlimited marital deduction in order to avoid estate taxes at the time of the first spouse's death in the event that the first spouse's individual estate is more than the individual exemption amount.

A bypass trust, or AB trust, is a legal arrangement that allows married couples to avoid estate tax on certain assets when one spouse passes away.The first part is the marital trust, or A trust. The second is a bypass, family or B trust. The marital trust is a revocable trust that belongs to the surviving spouse.

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.

A marital trust is a type of irrevocable trust that allows you to transfer assets to a surviving spouse tax free. It can also shield the estate of the surviving spouse before the remaining assets pass on to your children.

Yes, the surviving spouse may serve as trustee of the credit shelter trust.All of the assets in the credit shelter trust, including any appreciation in value during the surviving spouse's lifetime, pass free of estate tax to the beneficiaries.

A bypass trust can still be useful in some circumstances. If your estate is greater than the current estate tax exemption, a bypass trust is still a good way to protect your assets from the estate tax.