Louisiana Closing Statement

About this form

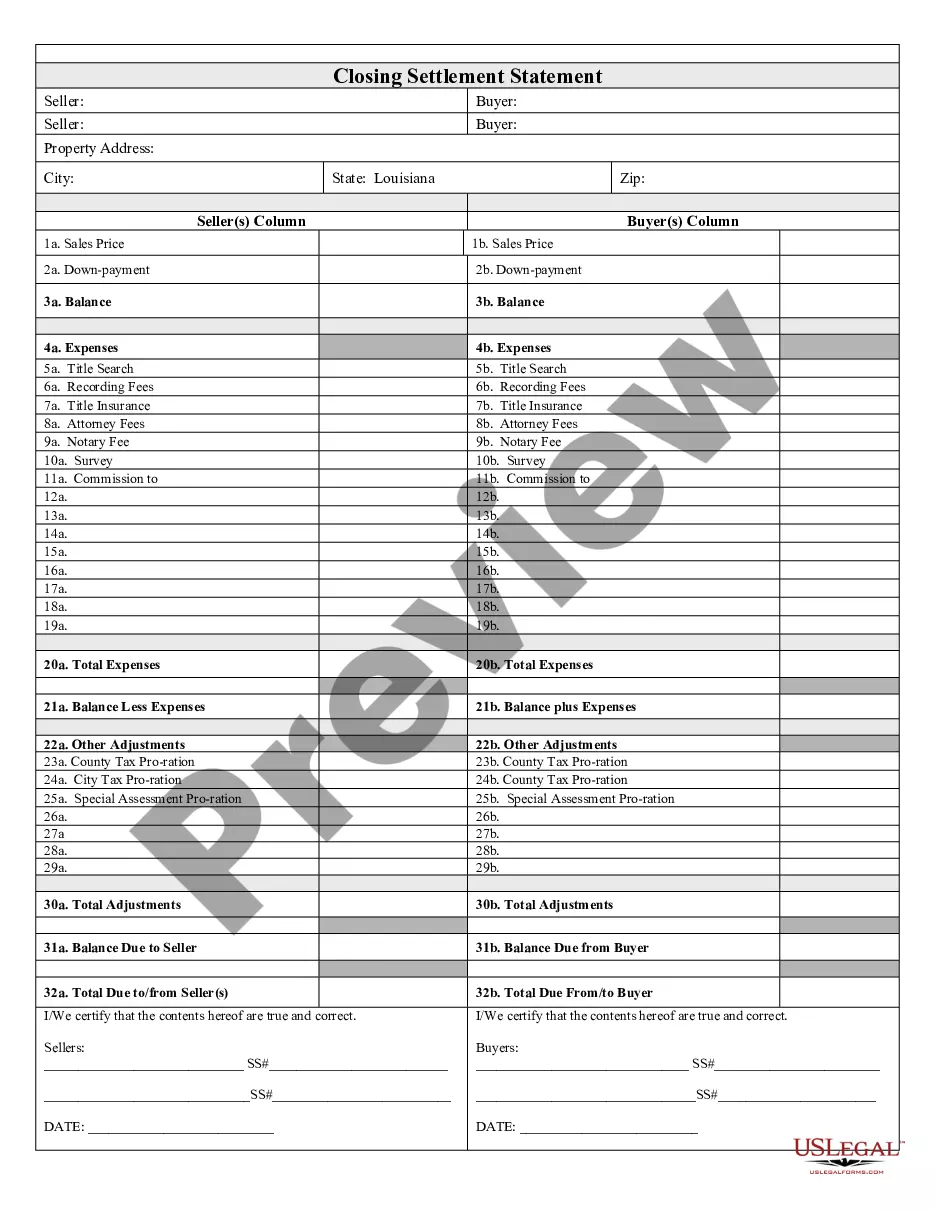

The Closing Statement is a key document used in real estate transactions, particularly for cash sales or owner financing. It provides a detailed account of the financial aspects of the sale, including expenses, adjustments, and the final amounts owed by both buyer and seller. Unlike other generic closing documents, this statement is verified and signed by both parties, ensuring accuracy and clarity in the transaction's financial details.

What’s included in this form

- Balance calculations: Sections to assess total expenses and balances due to/from the seller and buyer.

- Expense breakdown: Detailed listings of fees including title searches, recording fees, title insurance, attorney fees, notary fees, and survey costs.

- Adjustments: Includes county and city tax prorations and other financial adjustments relevant to the transaction.

- Certification: Space for signatures from both seller and buyer, certifying that the information presented is accurate.

Situations where this form applies

This Closing Statement is necessary when finalizing a real estate transaction involving a cash sale or owner financing. It ensures that all monetary aspects are clearly documented and understood by both the buyer and seller, avoiding any misunderstandings regarding costs and payments at the time of closing.

Who can use this document

This form is intended for:

- Real estate sellers and buyers engaged in a cash sale or owner-financed transaction.

- Real estate agents and attorneys involved in closing the sale of property.

- Individuals handling their own property transactions and seeking to ensure legal compliance and clarity.

Completing this form step by step

- Identify the parties involved: Enter the names of both the seller and the buyer at the top of the document.

- Specify the property details: Include the property address and any identifying information relevant to the transaction.

- List all expenses: Fill out sections for each expense, including title search fees, recording fees, and attorney fees.

- Calculate total adjustments: Add any necessary tax prorations and adjustments for a comprehensive final balance.

- Certify the statement: Ensure that both parties sign and date the document, confirming that the information is accurate.

Does this form need to be notarized?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to list all expenses can lead to disputes or unexpected costs.

- Not having both parties sign the document, which can invalidate the statement.

- Incorrectly calculating total balances or adjustments, leading to financial discrepancies.

Why use this form online

- Convenience of downloading and filling out at your own pace.

- Editability to customize the document specific to your transaction needs.

- Immediate access to legally vetted forms created by licensed attorneys.

Legal use & context

- The Closing Statement is an important legal document that outlines the details of financial transactions in real estate.

- It provides transparency and accountability to both parties and can be used as a reference in case of disputes.

- Ensure that all entries are accurate to maintain the enforceability of the document.

Main things to remember

- The Closing Statement is essential for documenting the financial details of a real estate transaction.

- Accuracy in completing the form is crucial for avoiding disputes and ensuring compliance.

- Both the seller and buyer must review and sign the statement to validate it.

Looking for another form?

Form popularity

FAQ

According to data from ClosingCorp, the average closing cost in Louisiana is $3,365 after taxes, or approximately 1.68% to 3.37% of the final home sale price.

According to data from ClosingCorp, the average closing cost in Louisiana is $3,365 after taxes, or approximately 1.68% to 3.37% of the final home sale price.

Closing costs are fees and expenses you pay when you close on your house, beyond the down payment. These costs can run 3 to 5 percent of the loan amount and may include title insurance, attorney fees, appraisals, taxes and more.

A mortgage closing disclosure is a type of standard settlement statement that is formulated and regulated for the mortgage lending market. The HUD-1 settlement statement is a type of closing statement used in reverse mortgages.

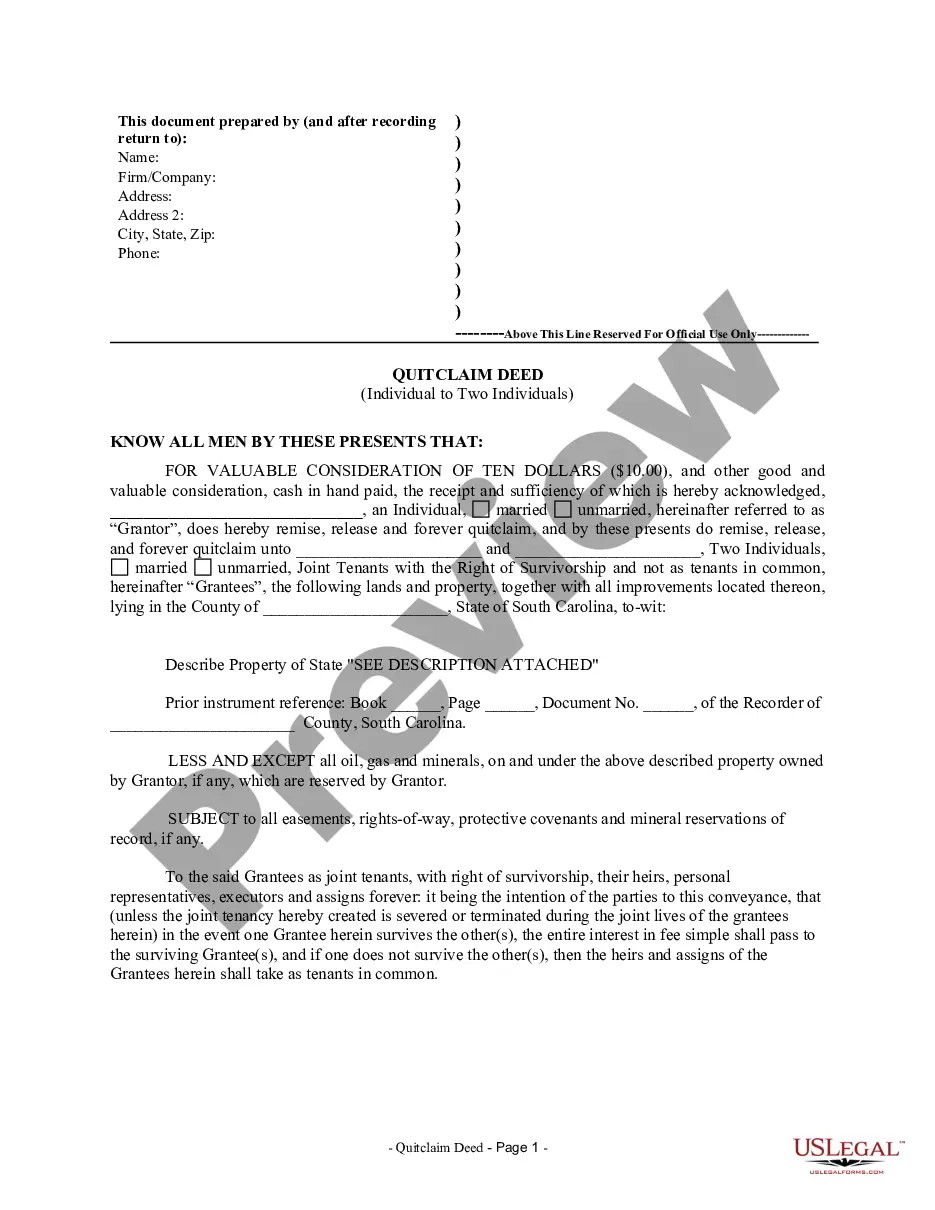

Louisiana is a community-property state. Attorneys conduct closings. Conveyance is by warranty or quitclaim deed. Mortgages are the security instruments.

A closing statement, also called a HUD1 or settlement sheet, is a legal form your closing or settlement agent uses to itemize all of the costs you and the seller will have to pay at closing to complete a real estate transaction.

Total closing costs to purchase a $300,000 home could cost anywhere from approximately $6,000 to $12,000 or even more. The funds can't typically be borrowed because that would raise the buyer's loan ratios to a point where they might no longer qualify.

According to lines 235 to 237 of the Louisiana Residential Agreement to Buy or Sell, SELLER's title shall be merchantable and free of all liens and encumbrances except those that can be satisfied at Act of Sale. All costs and fees required to make title merchantable shall be paid by SELLER.

The deed and mortgage documents are filed with the county recorder and these become public record. 3feff You can always obtain copies of these from the recorder's office or from a title company. Most documents are digitized in some form, especially those related to the transaction.