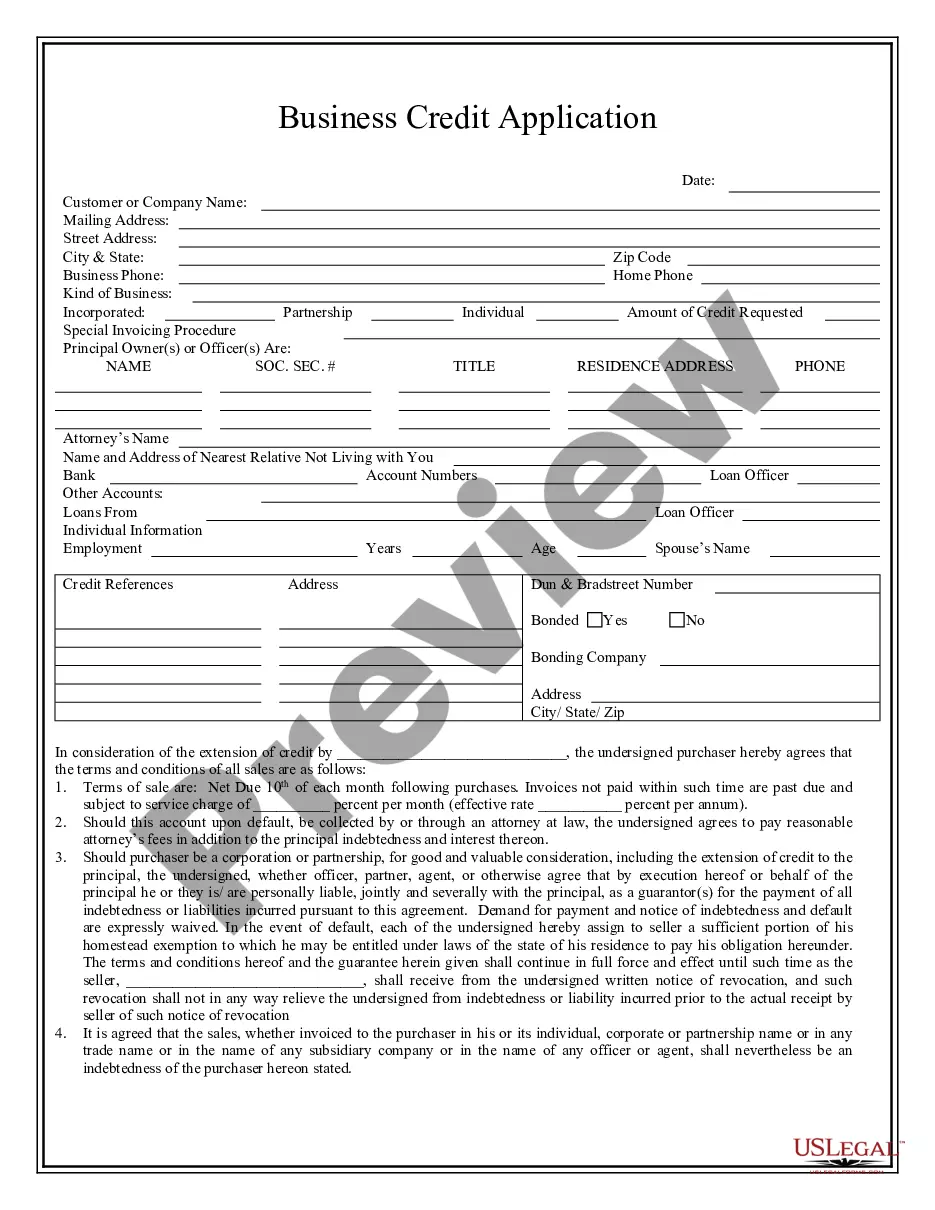

North Carolina Business Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

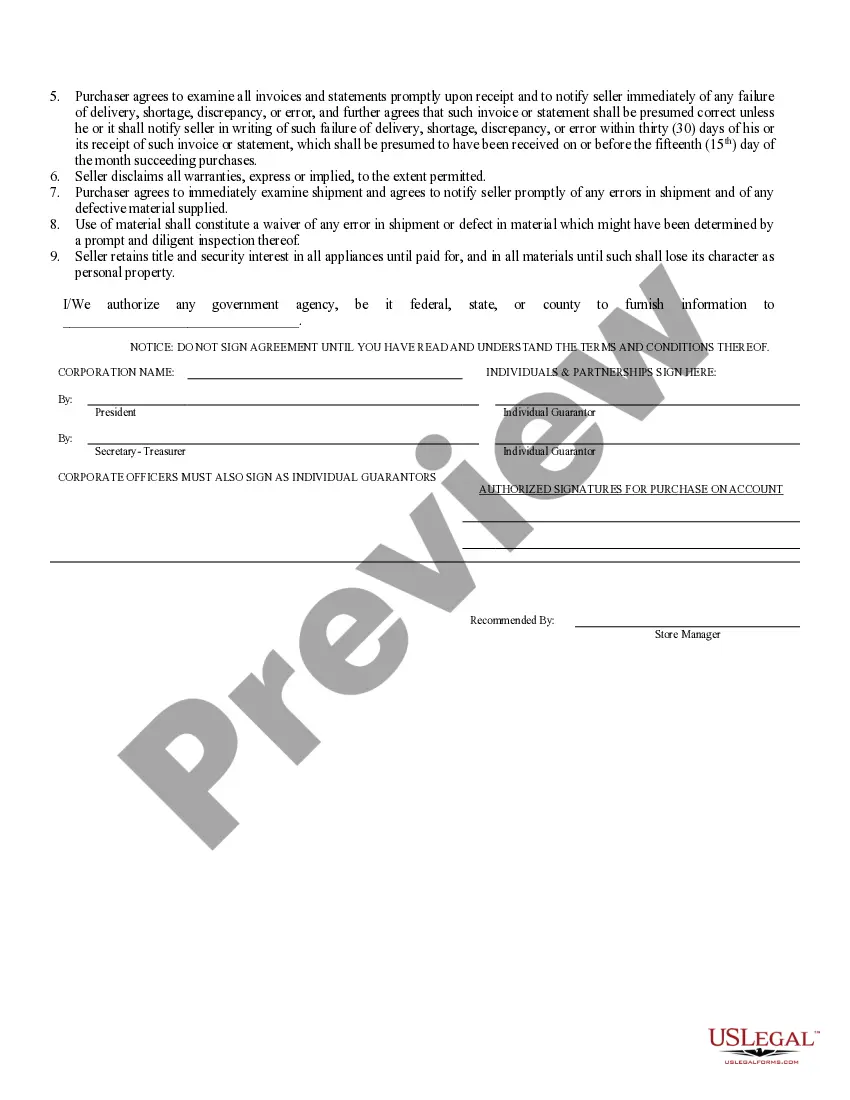

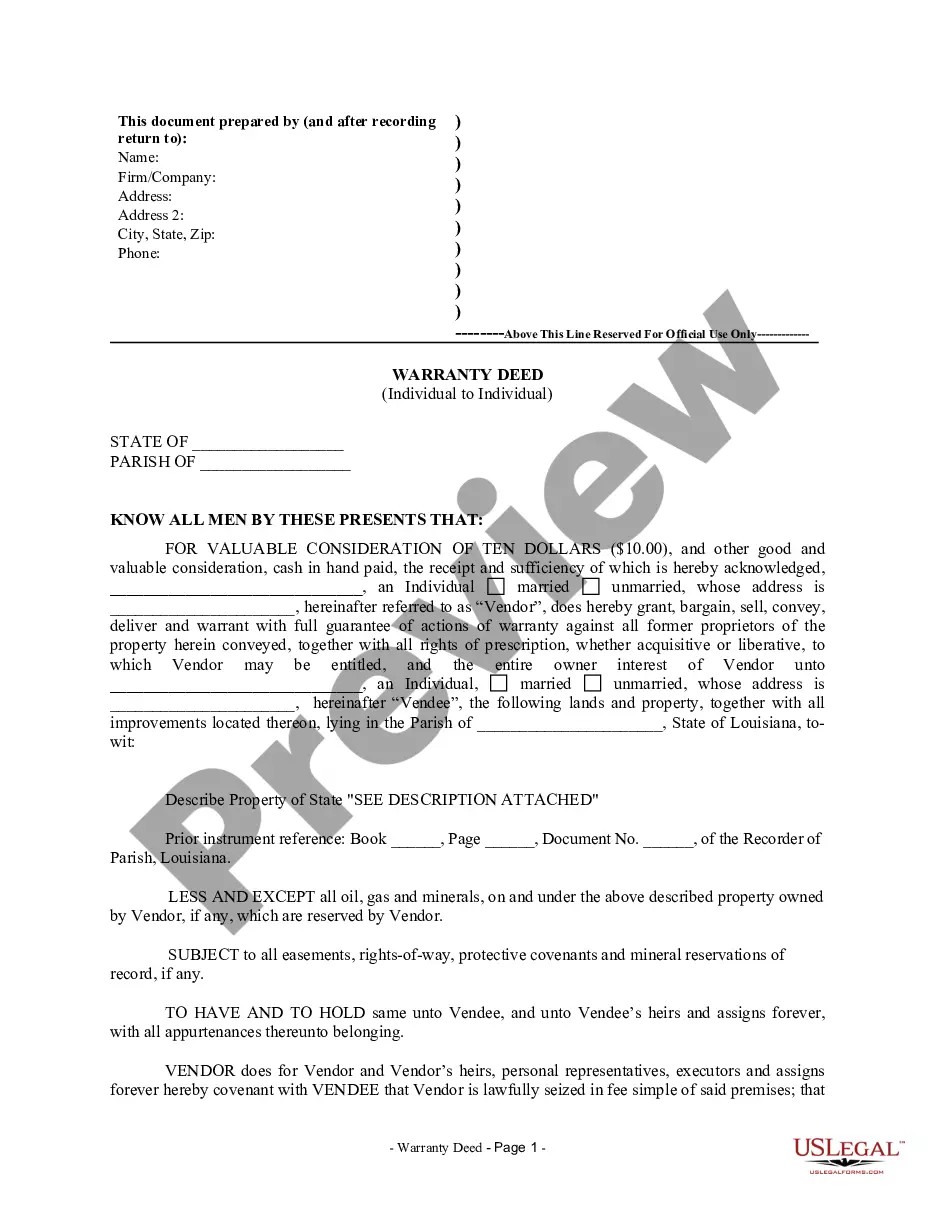

How to fill out North Carolina Business Credit Application?

Steer clear of costly attorneys and locate the North Carolina Business Credit Application you desire at a reasonable price on the US Legal Forms site.

Utilize our straightforward groups feature to search for and acquire legal and tax documents. Examine their summaries and preview them before downloading.

Choose to download the form in PDF or DOCX format. Click on Download and locate your document in the My documents section. You can save the form to your device or print it out. After downloading, you can fill out the North Carolina Business Credit Application manually or using editing software. Print it out and use the template multiple times. Achieve more for less with US Legal Forms!

- Moreover, US Legal Forms provides clients with detailed guidance on how to download and fill out each form.

- US Legal Forms users simply need to sign in and obtain the specific document they require in their My documents section.

- Those who haven't subscribed yet should adhere to the instructions listed below.

- Ensure the North Carolina Business Credit Application is valid for use in your location.

- If accessible, review the description and utilize the Preview feature before downloading the document.

- If you're assured the template is suitable for you, click on Buy Now.

- If the template is incorrect, use the search bar to find the appropriate one.

- Then, create your account and choose a subscription option.

- Make payment via credit card or PayPal.

Form popularity

FAQ

Choose a business name. File an assumed name certificate with the county register of deeds office. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

To choose corporate tax treatment for your LLC, file IRS Form 2553. This requires the LLC to file a separate federal income tax return each year. Corporations are also taxed by North Carolina at a rate of 5 percent of annual income and must pay a franchise tax each year. File Form CD-405 with the Department of Revenue.

An LLC that is not considered a separate entity from its owner is taxed as a sole proprietor. Therefore, the LLC's income and expenses are reported as self-employment income on Schedule C of the owner's personal tax return. A taxpayer is required to file Schedule C if the LLC's income exceeds $400 for the tax year.

The IRS treats one-member LLCs as sole proprietorships for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS. As the sole owner of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your 1040 tax return.

You can only file your personal and business taxes separately if your company it is a corporation, according to the IRS.Corporations file their taxes using Form 1120. Limited liability companies (LLCs) can also choose to be treated as a corporation by the IRS, whether they have one or multiple owners.

North Carolina families with qualifying children who were 16 or younger at the end of 2019 who did not already receive the $335 check from the NC Department of Revenue. Qualifying individuals who were not required to file a 2019 state tax return and have NOT already received the $335 grant.

To form an LLC in North Carolina you will need to file the Articles of Organization with the North Carolina Secretary of State, which costs $125. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your North Carolina limited liability company.

The State of North Carolina requires you to file an annual report for your LLC.The annual report must be filed each year by April 15 except that new LLCs don't need to file a report until the first year after they're created. The filing fee is $200.

You can register your business with the North Carolina Department of Revenue by completing and submitting Form NC-BR, or by registering online. When you register, you will be issued an account ID number for such tax purposes as income tax withholding, sales and use tax, and machinery and equipment tax.