Mississippi Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children

About this form

This Living Trust for an Individual Who is Single, Divorced, or a Widow (or Widower) with Children is a legal document designed to help individuals manage their assets and ensure their children's well-being after their passing. Unlike a will, this trust allows for assets to pass directly to beneficiaries without going through probate, making the process faster and more private. It provides the individual (the Trustor) with control over their assets during their lifetime while outlining how those assets should be distributed upon their death. This form is specifically tailored for those who want to set up a living trust while considering their unique circumstances as a single parent or individual.

Main sections of this form

- Identification of the Trustor, Trustee, and Beneficiaries.

- Specification of assets included in the trust, such as property and financial accounts.

- Trustee powers, allowing them to manage and control the trust assets.

- Distribution terms outlining how assets will be divided and managed after the Trustor's death.

- Provisions for the care of the Trustor in case of incapacity.

When to use this document

This living trust form is useful for individuals who are single, divorced, or widowed and wish to manage their estate while providing for their children. You should consider using this form if you want to:

- Avoid probate for your assets upon your death.

- Maintain control over your assets during your lifetime.

- Specify how your assets will be handled if you become incapacitated.

- Ensure that your children are financially protected and cared for after your passing.

Who can use this document

This form is intended for:

- Individuals who are single, divorced, or widowed.

- Parents with one or more children who want to secure their children's inheritance.

- People seeking to have greater control over the management of their assets.

How to complete this form

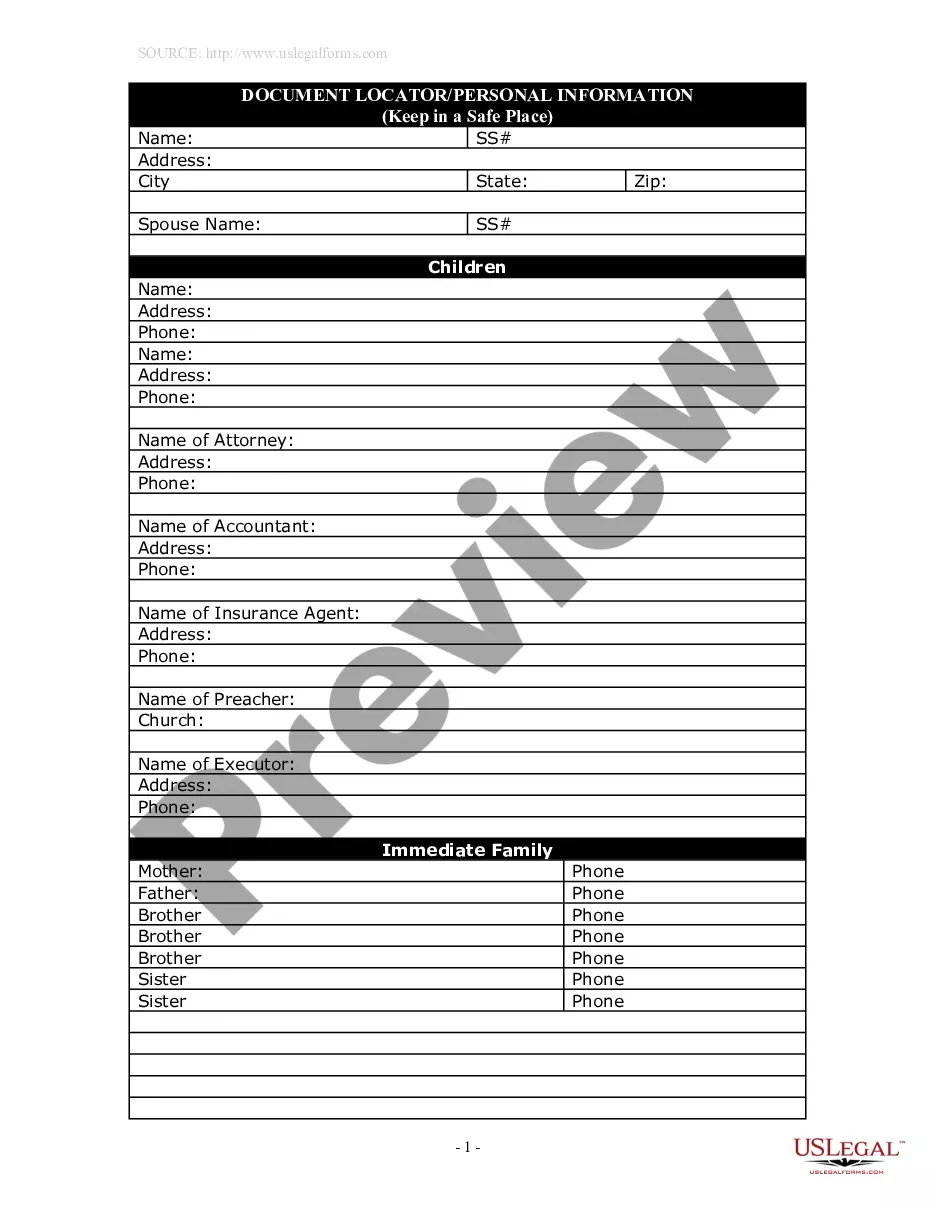

- Identify the Trustor and enter their full legal name and address.

- Designate the Trustees, who will manage the trust, including any successor Trustees if needed.

- List all assets that will be included in the trust, detailing any real estate or financial accounts.

- Specify the Beneficiaries, typically your children, and outline how the assets will be distributed upon your passing.

- Sign the document in front of a notary, ensuring that all parties involved acknowledge their agreement to the terms of the trust.

Does this form need to be notarized?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to list all assets that need to be included in the trust.

- Not properly identifying successor Trustees which can lead to complications.

- Neglecting to update the trust as circumstances change, such as new children or changes in marital status.

- Forgetting to sign and notarize the document, which invalidates the trust.

Benefits of using this form online

- Convenience of accessing and downloading the form at any time.

- Editability allows users to fill out the form according to their specific needs.

- Consistency and reliability, as the form is drafted based on state laws and professionally reviewed.

Looking for another form?

Form popularity

FAQ

Using a revocable living trust instead of a will means assets owned by your trust will bypass probate and flow to your heirs as you've outlined in the trust documents. A trust lets investors have control over their assets long after they pass away.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

The average cost for an attorney to create your trust ranges from $1,000 to $1,500 for an individual and $1,200 to $1,500 for a couple. Legal fees vary by location, so your costs could be much higher or slightly lower.

When it comes to protecting your loved ones, having both a will and a trust is essential. The difference between a will and a trust is when they kick into action. A will lays out your wishes for after you die. A living revocable trust becomes effective immediately.

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.

Anyone who is single and has assets titled in their sole name should consider a Revocable Living Trust. The two main reasons are to keep you and your assets out of a court-supervised guardianship and to allow your beneficiaries to avoid the costs and hassles of probate.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

In this article: A living trust is a type of estate planning tool that allows you to transfer ownership of your assets to a separate fund while you're still alive.In some circumstances, you can use a living trust to protect money you owe to creditors.

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.