Mississippi Heirship Affidavit - Descent

Understanding this form

The Heirship Affidavit - Descent is a legal document completed by an individual to declare the heirs of a deceased person. This form serves to establish ownership of the deceasedâs personal and real property, often utilized in situations where the decedent died without a will. Unlike a probate proceeding, this form allows heirs to confirm their rights to inherit property without going through formal court processes. It can be filed in official land records when necessary, simplifying property transactions for heirs.

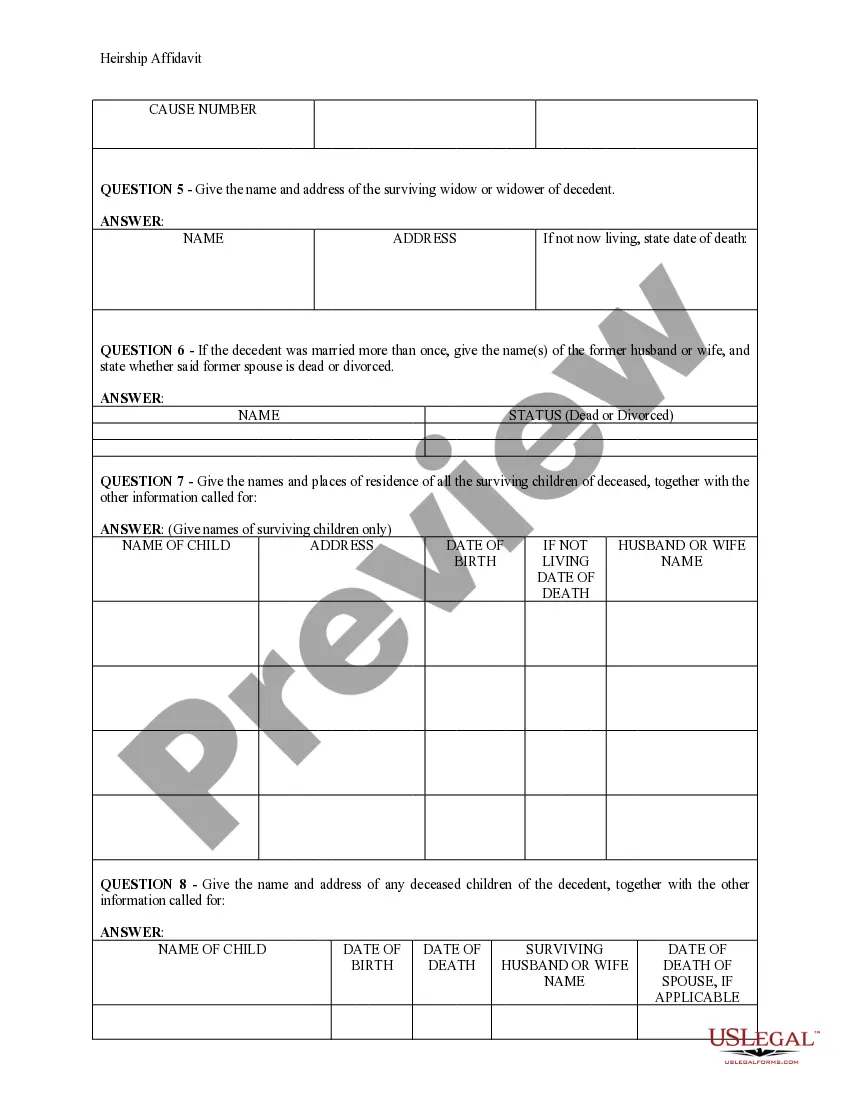

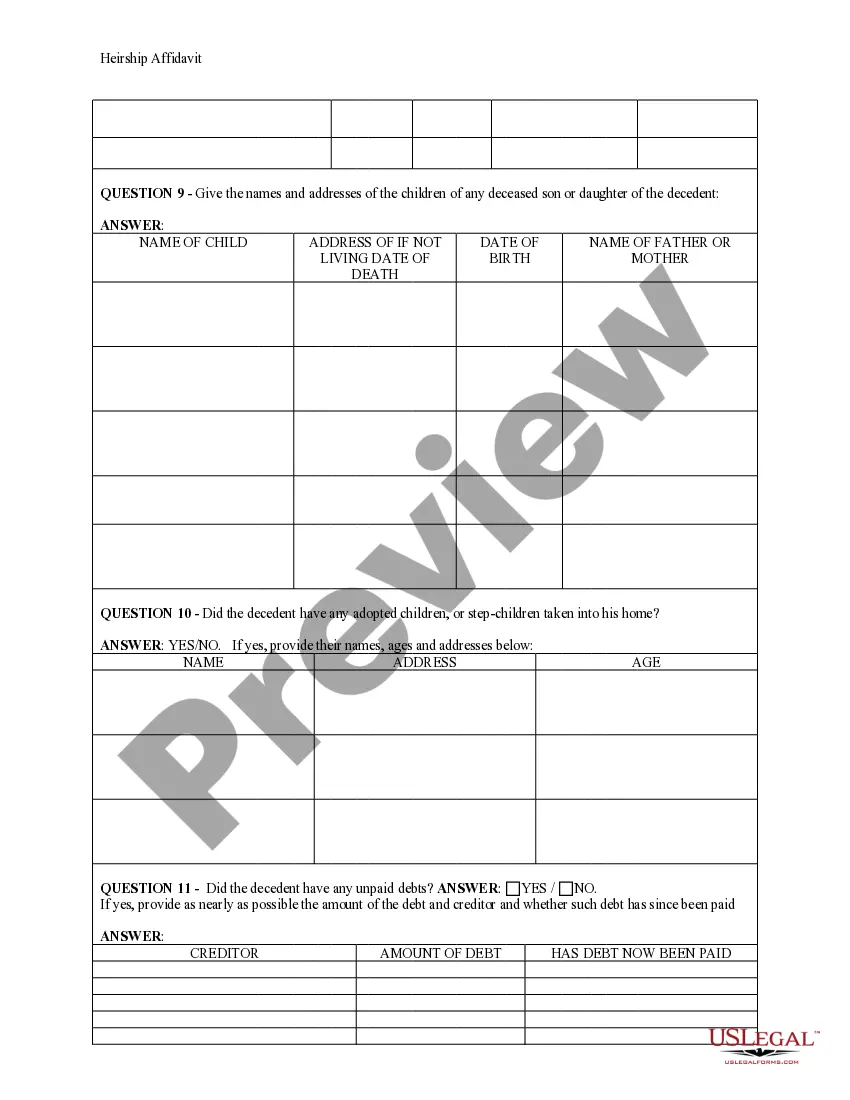

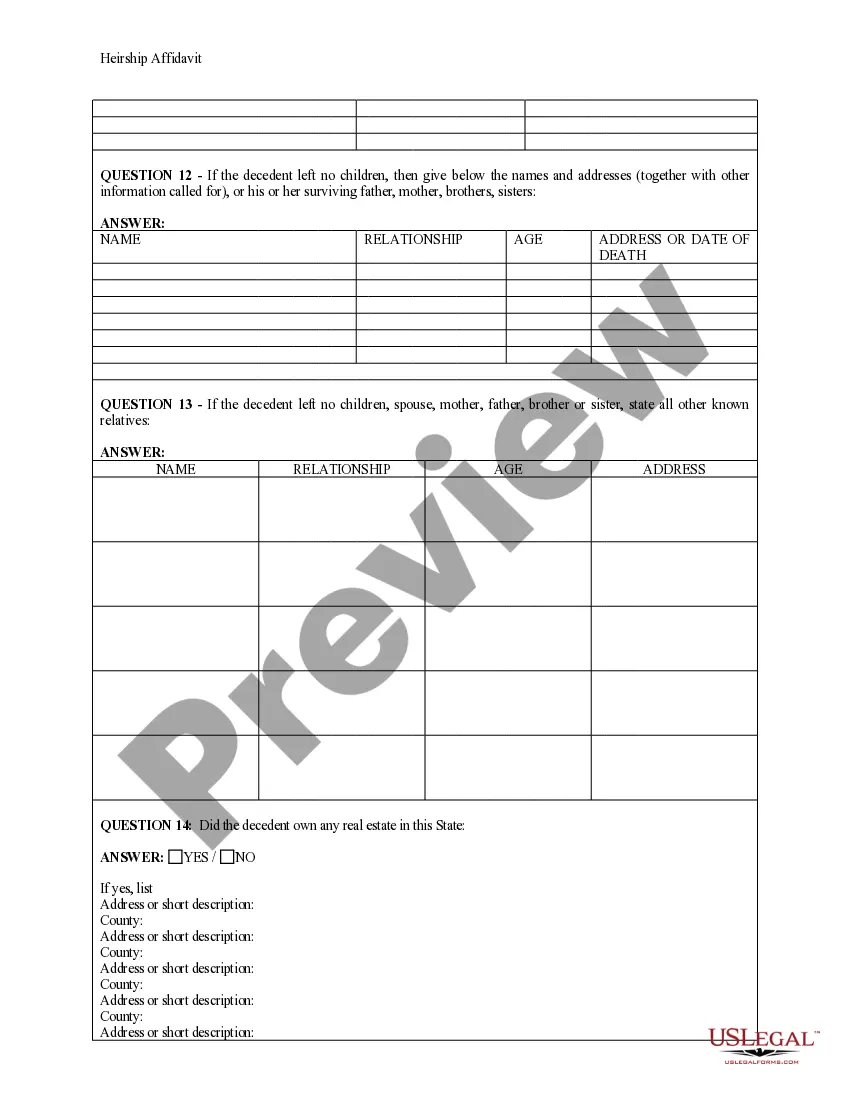

Key parts of this document

- Question about whether the decedent left a will.

- Information on the probate status of the decedent's will, if applicable.

- Details regarding any appointed administrator or personal representative.

Situations where this form applies

This form is typically used when an individual dies without a will, leaving behind property that needs to be claimed by the heirs. Specific scenarios include selling inherited real estate, transferring personal property, or addressing estate claims when no formal probate process has been initiated. The Heirship Affidavit facilitates the legal recognition of heirs, which may be required for various legal and financial transactions.

Who can use this document

- Heirs of a deceased person who did not leave a will.

- Individuals managing the estate of a deceased person without formal probate proceedings.

- Beneficiaries needing to assert their rights to inherited property.

How to prepare this document

- Identify if the decedent left a will and answer accordingly.

- Determine if the will has been admitted to probate, and provide relevant details.

- If applicable, include information about any court-appointed administrator or personal representative.

- Gather signatures from witnesses if local laws require them.

- File the completed affidavit with the relevant land records office as needed.

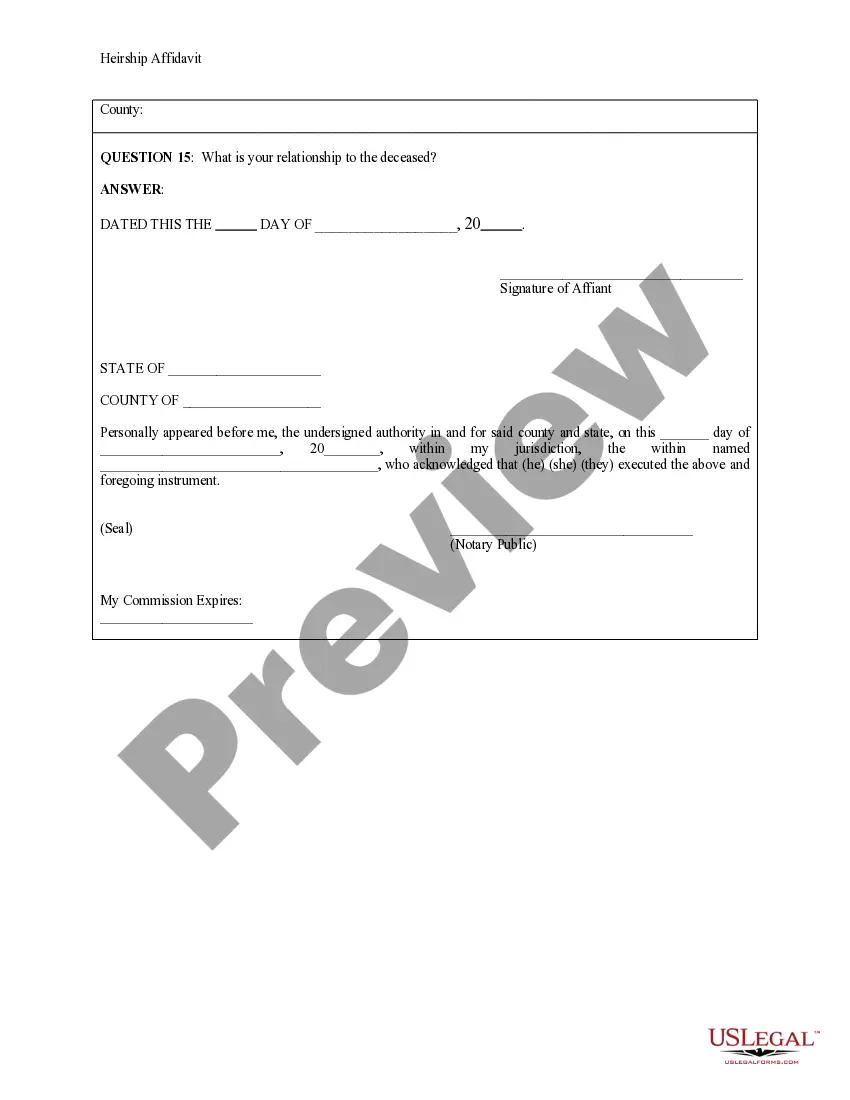

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to indicate whether a will exists, which can impact the affidavit's validity.

- Omitting necessary details about the probate process, leading to confusion about the estate's status.

- Not completing the form accurately or fully, which may result in legal complications.

Why use this form online

- Convenience of downloading and completing the form at your own pace.

- Editability allows you to input specific information accurately.

- Access to reliable, attorney-drafted forms that meet legal standards.

Legal use & context

The Heirship Affidavit serves as a legal declaration of heirship, which can enhance the legitimacy of claims made by heirs regarding property ownership. While it is not a substitute for probate, it helps convey the rights of heirs in a clear and documented manner, especially in cases where formal processes are avoided.

Main things to remember

- The Heirship Affidavit is crucial for establishing ownership when a decedent passes without a will.

- Correctly completing this form can simplify the transfer of inherited property.

- Understanding state-specific rules is essential to ensure the form's legality and effectiveness.

Looking for another form?

Form popularity

FAQ

An affidavit of heirship is needed to transfer a deceased person's interest in real or personal property to his or her heirs when the decedent dies without leaving a last will and testament or without disposing of all of his or her property in a will.

An affidavit is used for the purpose of proving in court that a claim is true, and is typically used in conjunction with witness statements and other corroborating evidence. Through an affidavit, an individual swears that the information contained within is true to the best of their knowledge.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

An Affidavit of Heirship is a sworn statement that heirs can use in some states to establish property ownership when the original owner dies intestate. Affidavits of Heirship are generally used when the decedent only left real property, personal property, or had a small estate.

An heir-at-law is anyone who's entitled to inherit from someone who dies without leaving a last will and testament or other estate plans.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

Following approval by the court, heirs can use this affidavit to acquire property from the estate. Estates with no will or a will that has not been probated by the Texas courts within four years of the deceased's death can be inherited via the use of an affidavit of heirship.