Missouri Living Trust for Husband and Wife with Minor and or Adult Children

What is this form?

This Living Trust for Husband and Wife with Minor and Adult Children is a legal document that establishes a revocable trust designed to manage and distribute assets during the lifetime of the trustors and after their passing. Unlike a will, a living trust helps avoid probate, allowing for a smoother transition of assets to beneficiaries. This trust is particularly beneficial for married couples, affording them control over their property while providing for their children, whether they are minors or adults.

Form components explained

- Name of Trust: Specifies the title of the trust.

- Trustors: Identifies the husband and wife establishing the trust.

- Trustee Appointments: Designates the individuals who will manage the trust, including successor trustees.

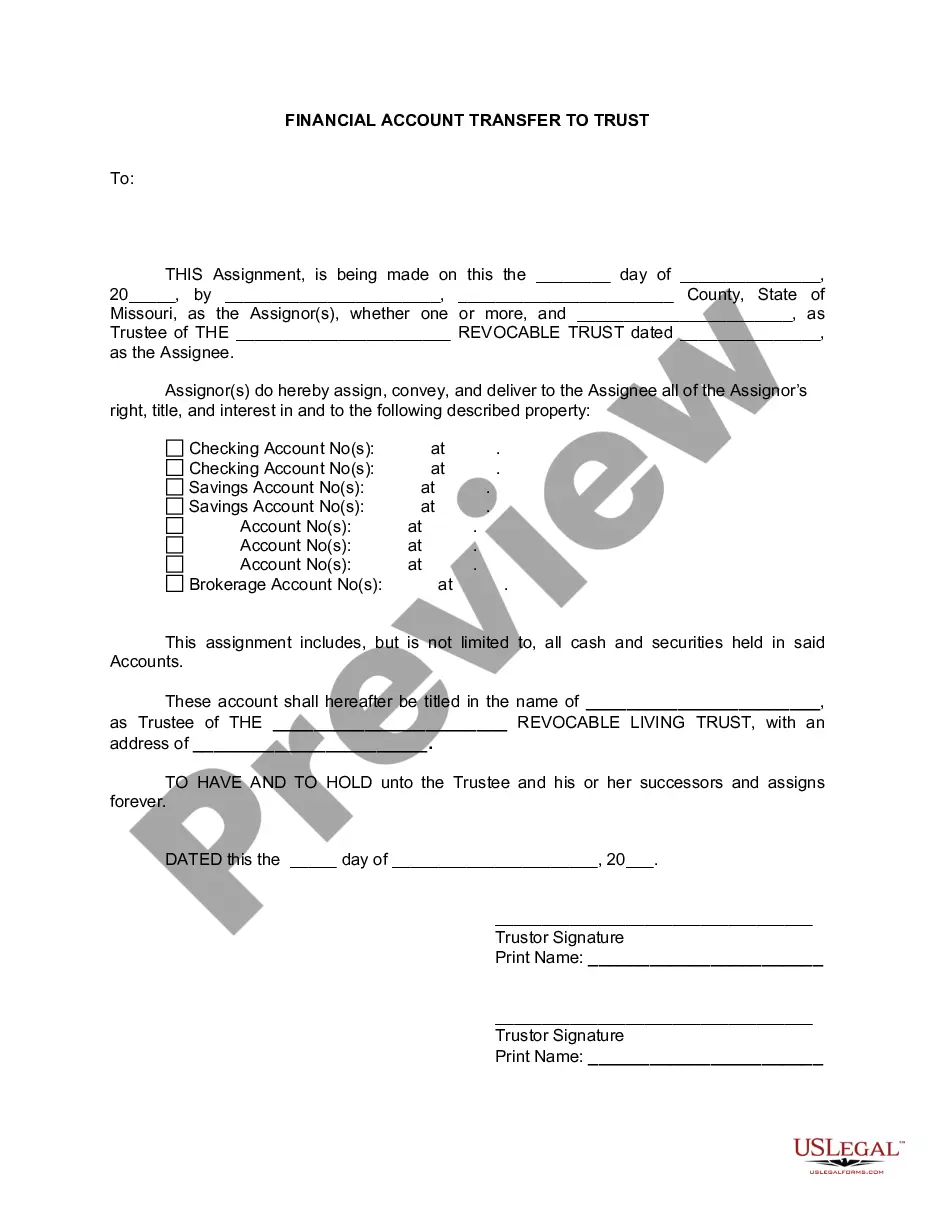

- Assets of Trust: Lists the property and assets included in the trust.

- Trustee Powers: Outlines the powers granted to the trustee to manage the trust effectively.

- Distribution Provisions: Details how the assets will be distributed to beneficiaries upon the death of the trustors.

When to use this form

This living trust form is ideal for married couples looking to ensure effective estate planning. It is particularly useful when the couple has minor or adult children and wishes to maintain control over their assets while providing for their children's future. Use this form when you want to simplify the distribution of your estate and avoid the probate process, which can be time-consuming and costly.

Who needs this form

- Married couples who want to establish a joint living trust.

- Parents of minor or adult children looking to secure their family's financial future.

- Individuals interested in avoiding probate for their estate.

- Those seeking to maintain control over how their assets are managed and distributed during their lifetime.

Steps to complete this form

- Enter the name of the trust in the appropriate section.

- Identify the trustors, typically the husband and wife, along with their place of residence.

- Designate the trustee and any successor trustees who will manage the trust.

- List all assets intended to be included in the trust.

- Review and sign the document in the presence of a notary public if required.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to list all relevant assets within the trust.

- Not updating the trust after significant life events, such as the birth of a child.

- Neglecting to designate successor trustees.

- Forgetting to ensure the trust is funded by transferring titles to the trust.

Why complete this form online

- Convenient access to trusted legal documents tailored to your situation.

- Edit and customize the document easily to fit your specific needs.

- Secure storage of your completed forms ensuring privacy and easy retrieval.

- Fast processing time compared to traditional methods of obtaining legal forms.

Looking for another form?

Form popularity

FAQ

The best way to leave your assets to your children is through a well-structured estate plan, such as a Missouri Living Trust for Husband and Wife with Minor and or Adult Children. This method allows you to specify when and how your children will receive their inheritance, providing peace of mind and financial security. Establishing a trust can also help you avoid probate, ensuring that your wishes are honored efficiently and effectively.

While it is possible to set up a trust without a lawyer, working with a legal professional can provide valuable insights and ensure compliance with Missouri laws. A Missouri Living Trust for Husband and Wife with Minor and or Adult Children involves specific legal considerations that a lawyer can help navigate. However, platforms like uslegalforms offer resources and templates that can guide you through the process, making it accessible for those who prefer a more hands-on approach.

Yes, a husband and wife can create a joint living trust, which is often referred to as a Missouri Living Trust for Husband and Wife with Minor and or Adult Children. This type of trust allows both spouses to manage their assets together, providing a streamlined approach to estate planning. By setting up a joint living trust, couples can simplify the transfer of assets to their children, both minor and adult, while avoiding the lengthy probate process.

Yes, you can leave everything to your son and not your wife if that aligns with your wishes. A Missouri Living Trust for Husband and Wife with Minor and or Adult Children enables you to clearly define how your assets should be distributed. It is essential to create this trust thoughtfully, considering the implications for all parties involved. Using a platform like uslegalforms can simplify the process, ensuring your estate plan reflects your intentions.

The Bible encourages parents to provide for their children, making it a common practice to leave an inheritance. While specific verses may support this idea, they also emphasize the importance of balance in family relationships. Establishing a Missouri Living Trust for Husband and Wife with Minor and or Adult Children can honor your biblical values while ensuring fair distribution among your loved ones. This trust can reflect your commitment to both your spouse and your children.

Prioritizing your children over your spouse can lead to emotional and legal complications. In Missouri, a Living Trust for Husband and Wife with Minor and or Adult Children can help clarify your intentions. This trust can secure your children's inheritance while also addressing your spouse's needs. Open discussions and proper legal documentation can help maintain family harmony.

Yes, you can choose to leave everything to your children instead of your husband through a Missouri Living Trust for Husband and Wife with Minor and or Adult Children. This type of trust allows you to specify your wishes regarding asset distribution. However, it is important to communicate your intentions clearly to avoid potential conflicts. Consulting with a legal expert can help ensure your wishes are honored.