Minnesota Notice of Dishonored Check - Civil and Criminal - Keywords: bad check, bounced check

What this document covers

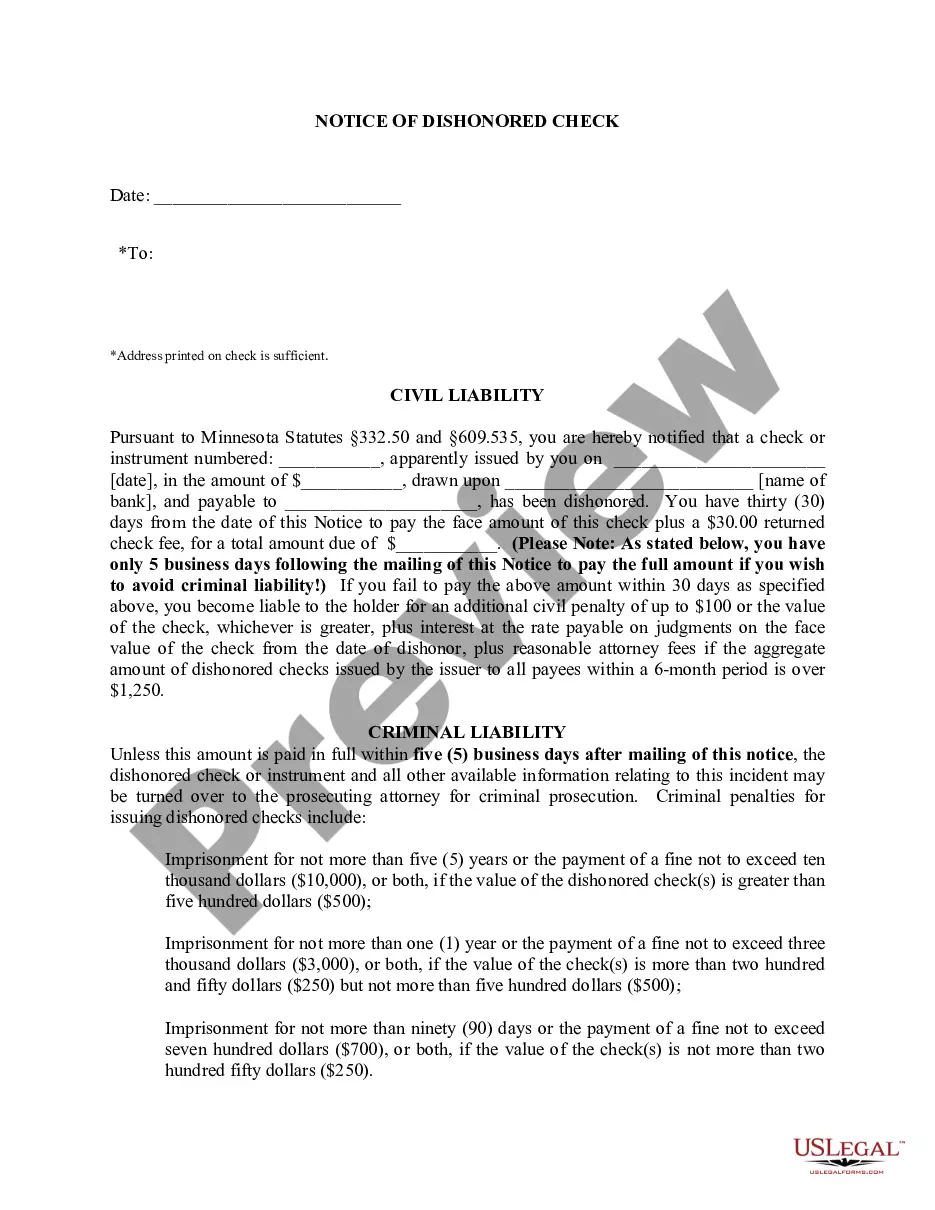

The Notice of Dishonored Check is a legal document used to inform a debtor that a check they issued has been returned unpaid, commonly known as a bad check or bounced check. This form serves as a formal notification that the check was dishonored due to insufficient funds or because the account does not exist. Utilizing this form is crucial for the recovery process and may be necessary under state law before any further action is taken against the debtor.

Key parts of this document

- Sender's Information: Name and address of the person or business notifying the debtor.

- Debtorâs Information: Name and address of the individual who issued the dishonored check.

- Check Details: Amount of the check and the date it was issued.

- Notice of Dishonor: Statement indicating that the check was not paid and the method of delivery for the notice.

- Payment Instructions: Instructions on how and where the debtor should send payment.

- Legal Implications: Information about potential criminal penalties if the check remains unpaid.

When this form is needed

This form is necessary when a check you receive has bounced, meaning there are insufficient funds in the debtor's account or the account does not exist. It is often used by business owners, individuals who have provided services or goods, or landlords collecting rent. Sending this notice informs the debtor of their non-payment status and outlines the consequences of failing to address the issue within a specified timeframe.

Intended users of this form

- Business owners and service providers who have received a bad check.

- Landlords collecting rent payments by check.

- Individuals who provide personal loans or services and have been issued dishonored checks.

- Any entity requiring formal notification for legal compliance before pursuing further recovery actions.

Steps to complete this form

- Identify the parties involved by filling in the sender's and debtor's names and addresses.

- Detail the dishonored check by entering the amount and issue date of the check.

- Clearly state that the check has been dishonored and include the date you are sending the notice.

- Provide payment instructions, including methods and where to send the payment.

- Notify the debtor of the possible legal consequences if the debt remains unpaid.

Notarization guidance

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to send the notice by certified mail, which can impact legal enforceability.

- Not including specific details about the dishonored check, such as the check number and date.

- Overlooking to outline the consequences of non-payment clearly.

- Sending the notice to the wrong address due to inaccurate debtor information.

Advantages of online completion

- Convenient access from any device, allowing you to complete the form quickly.

- Editability ensures you can customize the form to fit your specific situation.

- Reliable templates drafted by licensed attorneys to ensure legal compliance.

Looking for another form?

Form popularity

FAQ

In Minnesota, a debt typically becomes uncollectible after six years from the date of the last payment or acknowledgment. This includes debts related to bad checks or bounced checks. If you have received a Minnesota Notice of Dishonored Check, it is crucial to act promptly. Resources like US Legal Forms can help you navigate the complexities of collecting on these debts and ensure you understand your rights.

Statute 609.10 outlines the criminal implications of issuing a bad check in Minnesota. This law classifies the act of writing a check without sufficient funds as a criminal offense under certain conditions. Being aware of this statute can help individuals avoid serious legal consequences associated with bounced checks.

In Minnesota, the statute regarding worthless checks falls under Section 604.113. This law specifies the legal ramifications for issuing a check without sufficient funds, classifying it as a civil offense. If you find yourself dealing with a bounced check, it’s important to understand your rights and obligations under this statute.

Statute 473.4465 addresses the collection of bad debt, including issues related to dishonored checks within specific jurisdictions. This statute provides guidance on how municipalities can manage and collect on bounced checks issued for services. Familiarity with this law can be beneficial for both individuals and businesses dealing with bad checks.

Statute 524.2 101 pertains to the handling of financial management and fiduciary responsibilities in Minnesota. It outlines the obligations of individuals managing another person’s finances, including the duties related to dealing with any dishonored checks. Understanding this statute can help protect against legal issues related to bounced checks.

Yes, bouncing checks is considered illegal in Minnesota and can lead to both civil and criminal repercussions. When a check is returned due to insufficient funds, the issuer may be held liable for the amount of the check along with additional penalties. It's advisable to manage your finances carefully to avoid the complications associated with bad checks.

To write a letter regarding a bounced check, start by clearly stating the issue. Include details such as the check number, date, amount, and the reason for the dishonor. It’s important to request payment for the bounced check and provide a deadline for response. Utilizing the Minnesota Notice of Dishonored Check template from US Legal Forms can simplify this process.

In Minnesota, the statute for dishonored checks falls under Section 604.113. This law establishes the penalties for issuing a bad check, including civil and criminal consequences. If a check bounces due to insufficient funds, the issuer may face fines or potential criminal charges depending on the amount. Understanding this statute is crucial for anyone dealing with bounced checks.

In Minnesota, the statute of limitations for collecting a debt, such as a bounced check or bad check, typically lasts for six years. This means you have six years from the date of the dishonored check to pursue legal action for recovery. After this period, the debt becomes uncollectible, and you cannot enforce payment through the courts. If you need assistance with a Minnesota Notice of Dishonored Check - Civil and Criminal, consider using US Legal Forms, which offers templates and guidance to help you navigate the process effectively.

A legal letter for a bounced check, often referred to as a Minnesota Notice of Dishonored Check, serves as a formal communication to the check writer regarding their insufficient funds. This letter notifies the individual that their check was returned due to non-payment, and it typically includes details about the original transaction. It is important to include specific information, such as the check number, amount, and the date it was issued. Utilizing a platform like US Legal Forms can help you easily create this letter, ensuring you follow the proper legal guidelines.