Michigan Non-Foreign Affidavit Under IRC 1445

Overview of this form

The Non-Foreign Affidavit Under IRC 1445 is a legal document used by sellers of real property to confirm that they are not foreign persons as defined by the Internal Revenue Code. This affidavit serves to establish the sellerâs exemption from the federal withholding requirement associated with the sale of property. It is important to understand that this form is specific to real estate transactions and is essential for compliance with tax regulations.

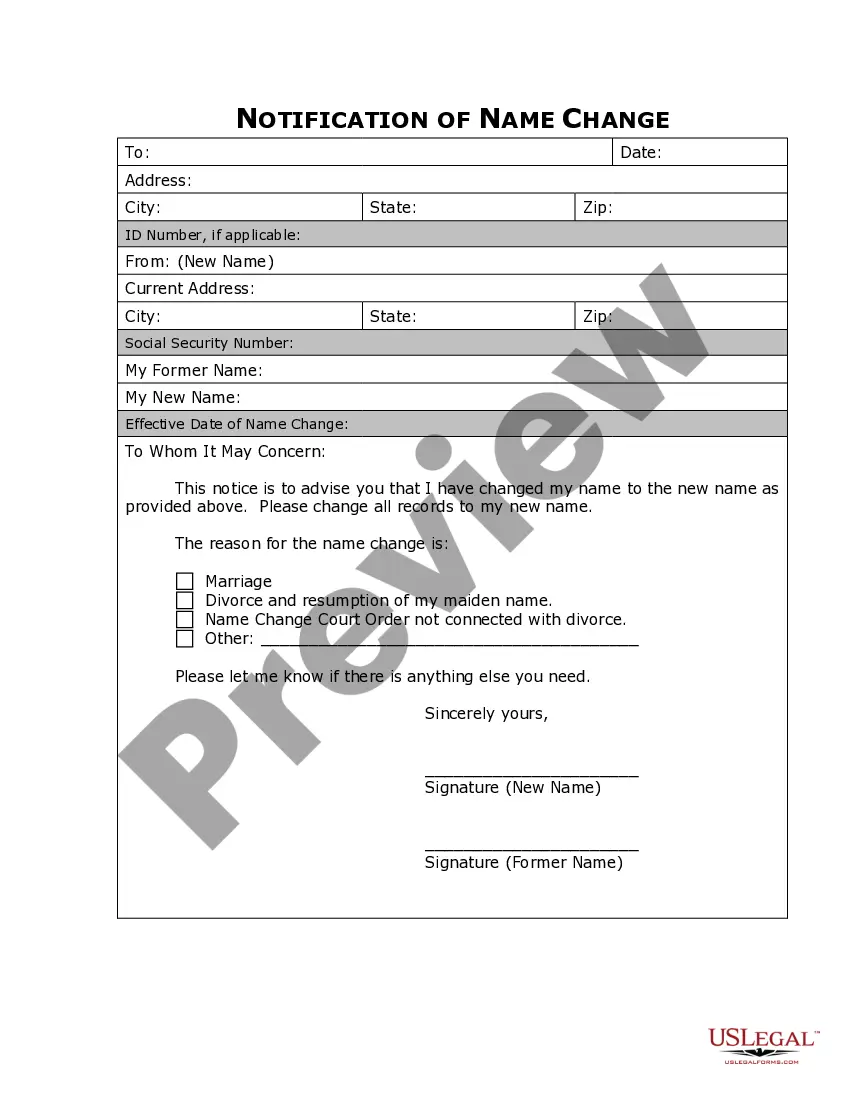

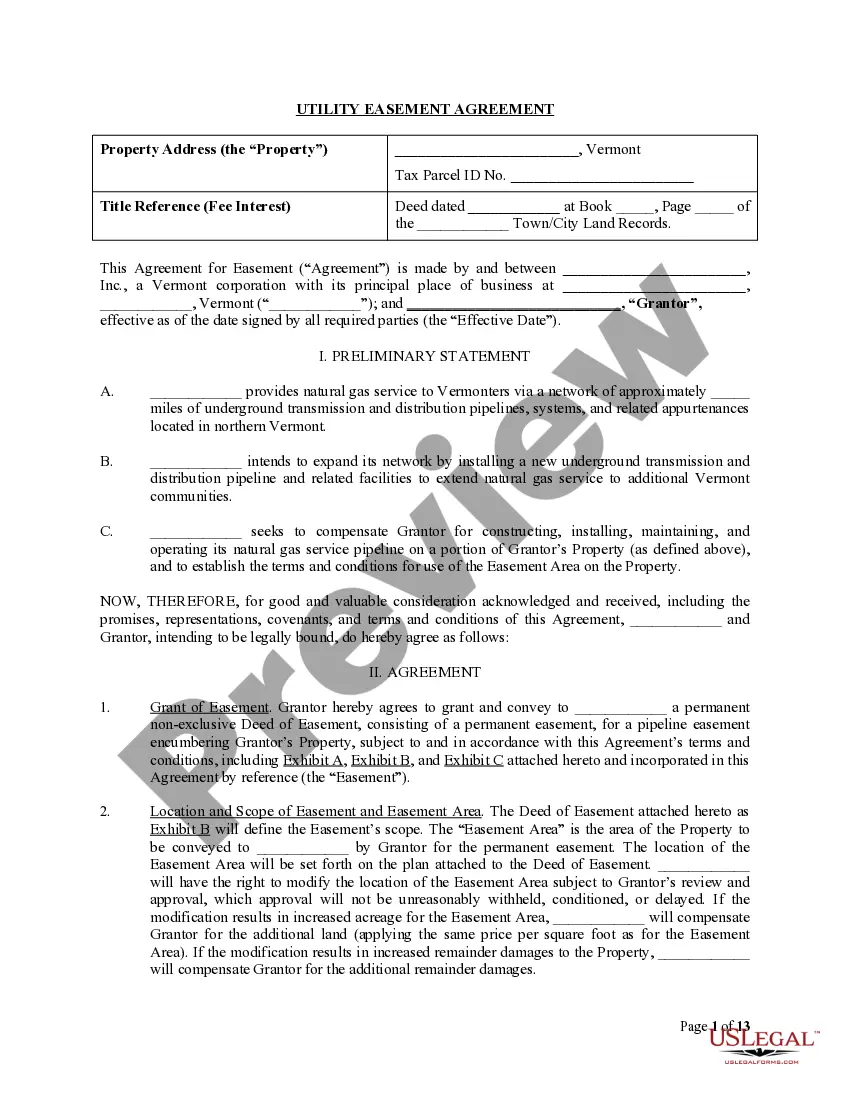

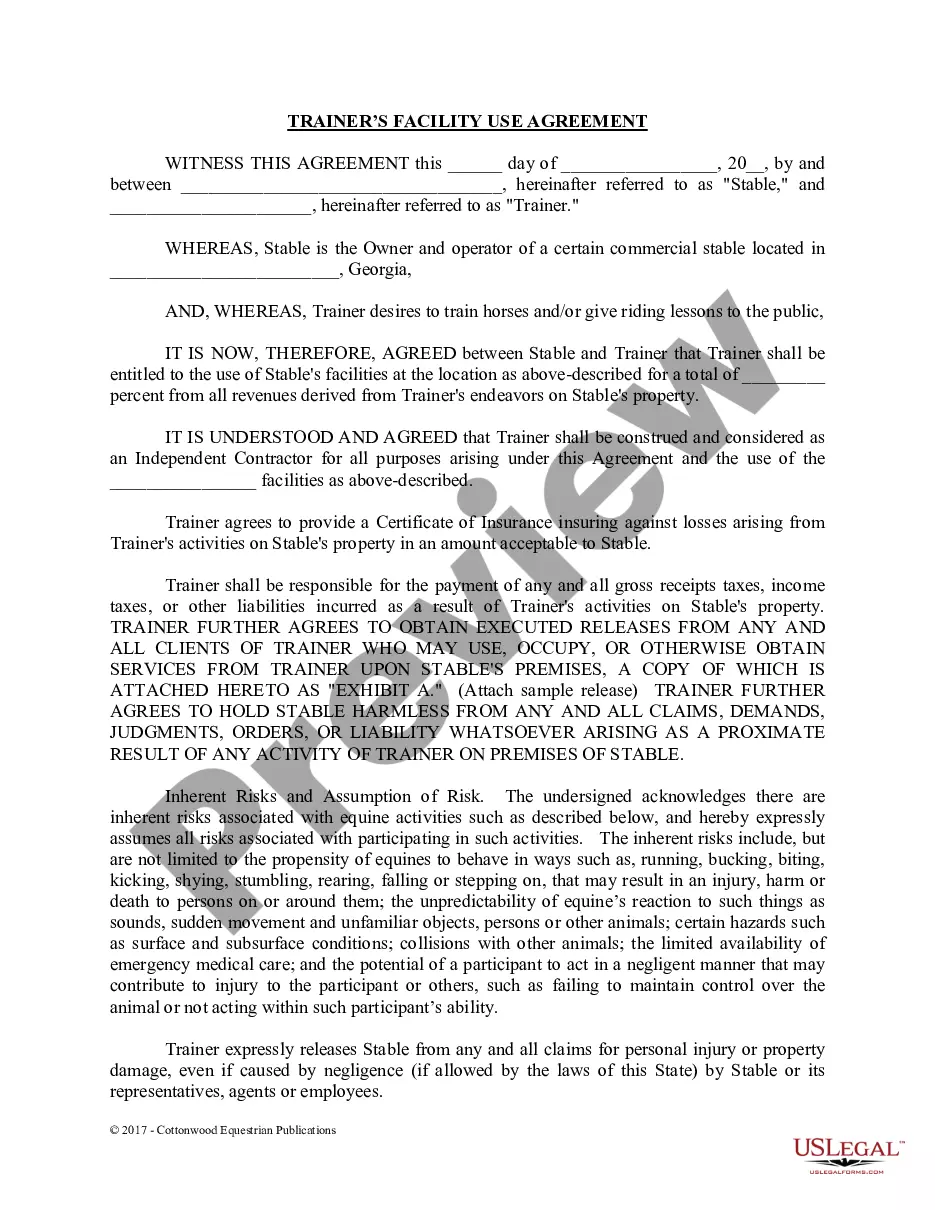

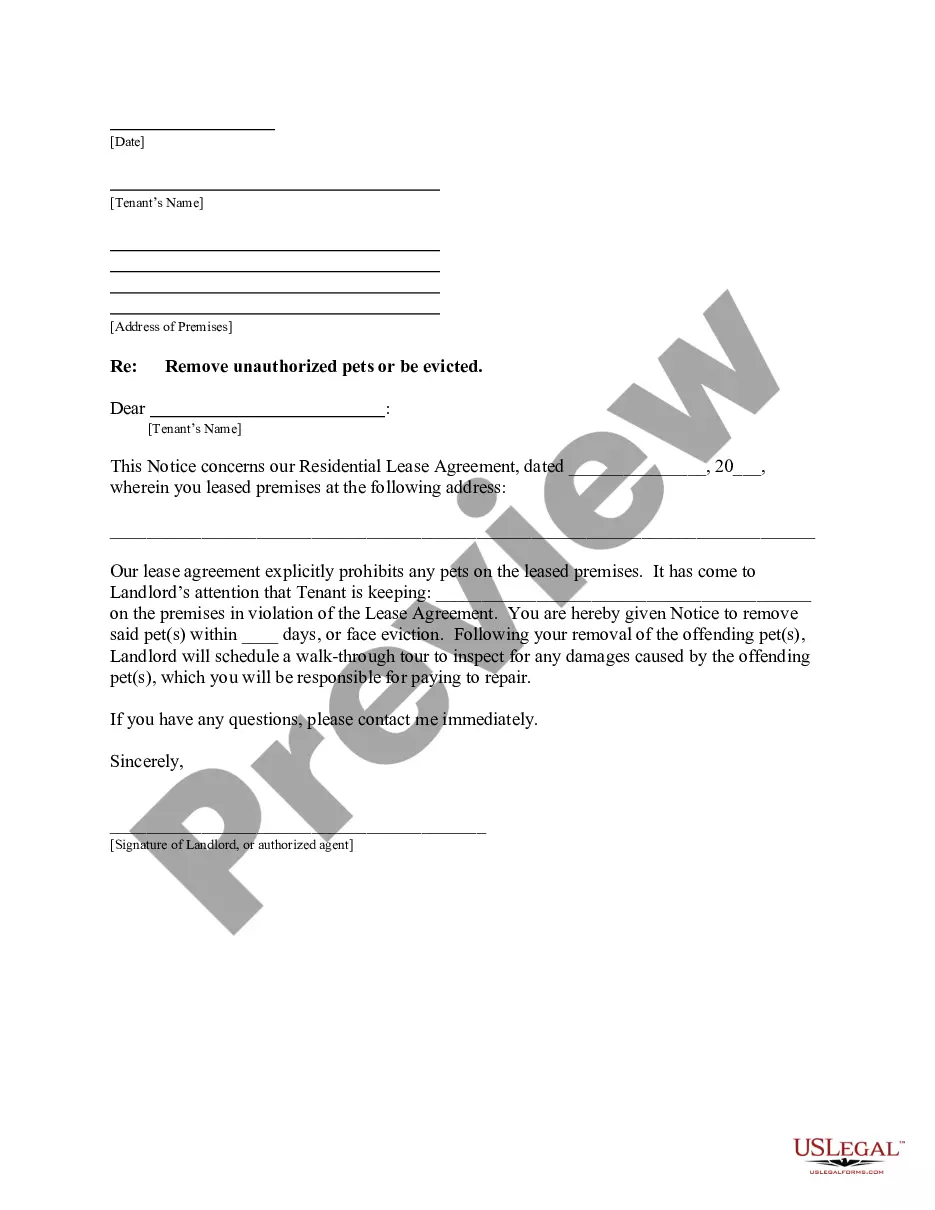

Main sections of this form

- Identification of the seller(s) and their taxpayer identification numbers.

- Property details including location and description.

- Declaration that the seller(s) are not foreign persons as defined by the Internal Revenue Code.

- Signature area for the seller(s) and a notary public.

- Date of signing for record-keeping purposes.

Situations where this form applies

This affidavit should be used when a seller of real estate is completing a property transaction in the United States and needs to confirm that they are not a foreign entity. It is particularly relevant in transactions where Title Companies or Buyers require documentation to ensure compliance with federal tax withholding rules under IRC 1445. Completing this form can prevent unnecessary withholding from the sale proceeds.

Who this form is for

- Individuals selling real property in the United States.

- Business entities concluding property sales.

- Foreign sellers seeking to document their non-foreign status to comply with U.S. tax laws.

Steps to complete this form

- Identify the seller(s) and their taxpayer identification numbers.

- Provide the full address and legal description of the property being sold.

- State affirmatively that the seller(s) are not classified as foreign persons.

- Sign and date the affidavit in the designated areas.

- Have the affidavit notarized to ensure its legal validity.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide full and accurate property descriptions.

- Not signing the document in the presence of a notary.

- Skipping the declaration about non-foreign status.

- Incorrectly filling out taxpayer identification numbers.

Main things to remember

- This affidavit proves that the seller is not a foreign person for tax purposes.

- Proper completion and notarization are essential for legal validity.

- It helps sellers avoid unnecessary withholding on the sale of property.

Looking for another form?

Form popularity

FAQ

foreign status affidavit is a declaration that confirms an individual or entity is not classified as a foreign person under IRS regulations. This is crucial when conducting real estate transactions, particularly in Michigan, as it affects tax withholding requirements. By utilizing the Michigan NonForeign Affidavit Under IRC 1445, you can assert your nonforeign status, facilitating smoother transactions with fewer complications. To ensure accuracy and compliance, you might explore the options available through US Legal Forms, which can guide you through the process.

You should send your Michigan property transfer affidavit to your local county register of deeds. Each county has specific requirements for submitting these documents, so it’s best to check their website or contact them directly for guidance. For further assistance, consider using US Legal Forms, which provides comprehensive resources to ensure your Michigan Non-Foreign Affidavit Under IRC 1445 is completed correctly and sent to the right location. Proper submission can prevent delays in your property transfer.

A foreign affidavit is a legal document used to affirm that a person or entity is not a foreign person for tax purposes. In the context of the Michigan Non-Foreign Affidavit Under IRC 1445, it helps to establish the status of individuals involved in property transactions. By submitting this affidavit, you can streamline the sale process and ensure compliance with federal tax laws. This declaration is particularly important for real estate transactions to avoid withholding taxes.

The FIRPTA Affidavit is usually provided by the seller of the property, especially if they qualify for the Michigan Non-Foreign Affidavit Under IRC 1445. This document confirms non-foreign status, which helps in streamlining the real estate transaction. If you are unsure about the requirements or need assistance, consider reaching out to USLegalForms for easy access to the necessary forms and expert advice.

You need to file a Michigan property transfer Affidavit at your local county clerk's office. This is the official place for property-related documents, ensuring that your affidavit complies with local regulations. When submitting your Michigan Non-Foreign Affidavit Under IRC 1445, make sure to include all necessary information to prevent any delays. Using USLegalForms can simplify your filing process by providing accurate forms and guidance.

foreign Affidavit is a declaration confirming that the seller is not a foreign person according to IRS guidelines. This document reassures buyers that they will not face a withholding tax when closing the property deal. By using the Michigan NonForeign Affidavit Under IRC 1445, buyers can streamline their real estate transactions and comply with legal requirements seamlessly. It acts as a safeguard for both parties, ensuring a more confident and secure property transfer.

Under section 1445, a foreign person includes entities like non-resident aliens and foreign corporations that sell U.S. real property. This definition impacts tax withholding obligations for the buyer, making it essential to identify the seller's status accurately. Buyers should remain informed about these distinctions to avoid unexpected liabilities in their transactions. Submitting a Michigan Non-Foreign Affidavit Under IRC 1445 helps clarify these concerns and protects the transaction from additional tax complications.

The IRS defines a foreign person as any individual, corporation, partnership, or trust that is not a U.S. citizen or resident. In the context of real estate, this designation can affect how taxes are withheld during property sales. Understanding who qualifies as a foreign person is vital for anyone dealing with real estate transactions in Michigan. Utilizing a Michigan Non-Foreign Affidavit Under IRC 1445 can aid in clearly establishing the seller's status.

A section 1445 Affidavit is a document used in real estate transactions involving foreign sellers. This affidavit certifies whether the seller is a foreign person according to IRS regulations. The Michigan Non-Foreign Affidavit Under IRC 1445 serves as a crucial tool to avoid withholding taxes at the time of property transfer. By completing this affidavit, buyers can ensure they comply with IRS requirements and protect their investment.