Michigan Quitclaim Deed from Individual to Corporation

Overview of this form

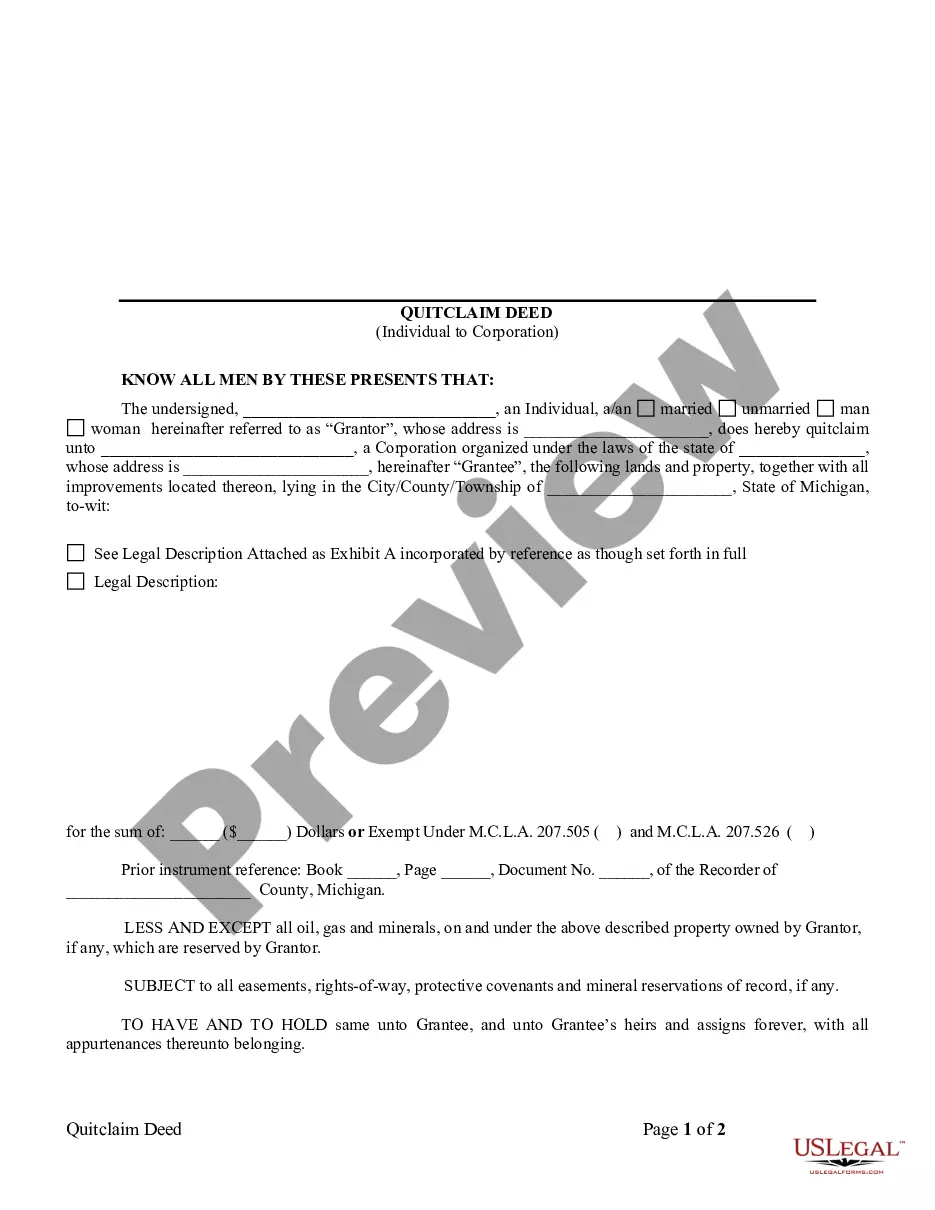

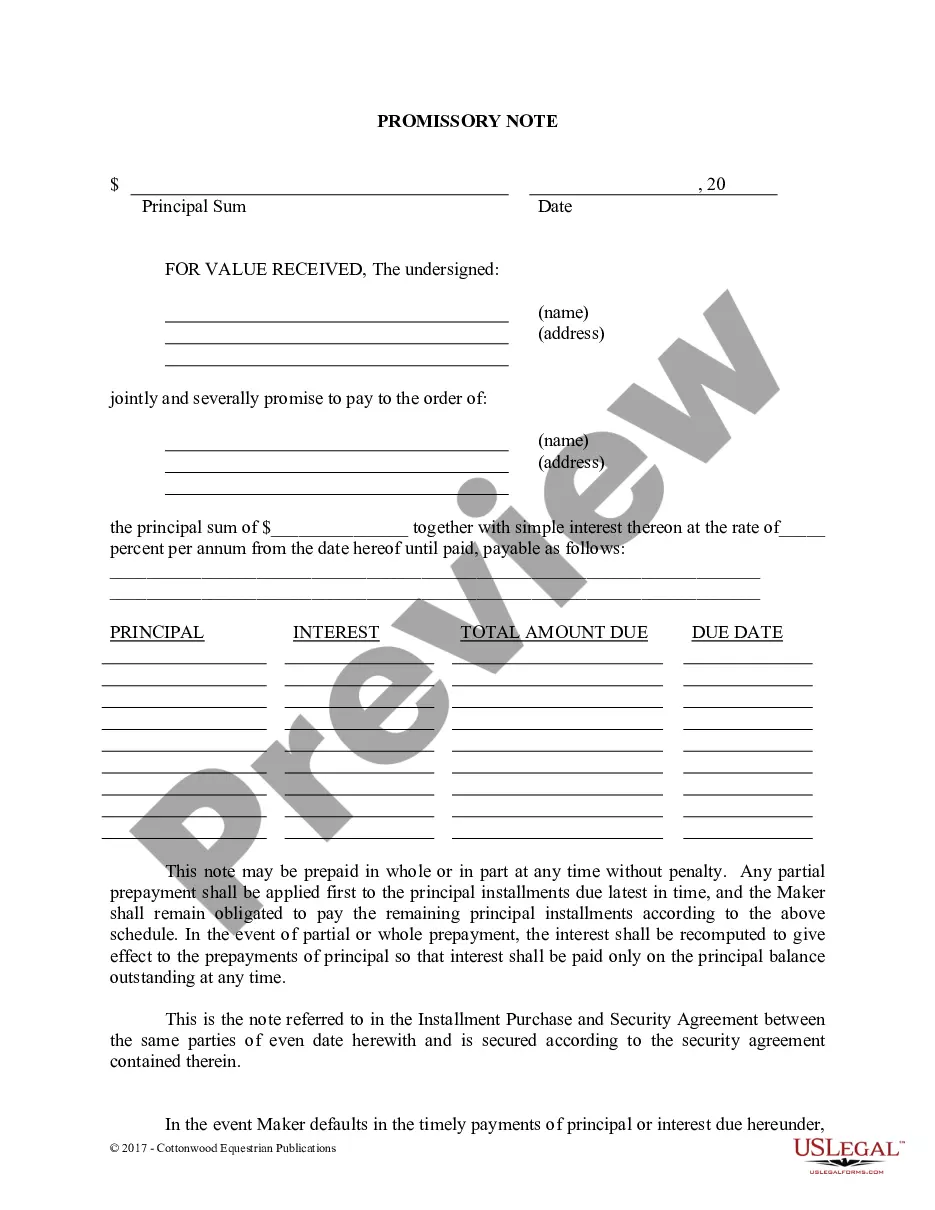

The Quitclaim Deed from Individual to Corporation is a legal document that allows an individual (the grantor) to transfer their interest in a property to a corporation (the grantee). Unlike other types of deeds, a quitclaim deed does not guarantee that the grantor holds clear title to the property. This form is particularly useful for transferring property ownership without a sale, such as between family members or as part of a business transaction.

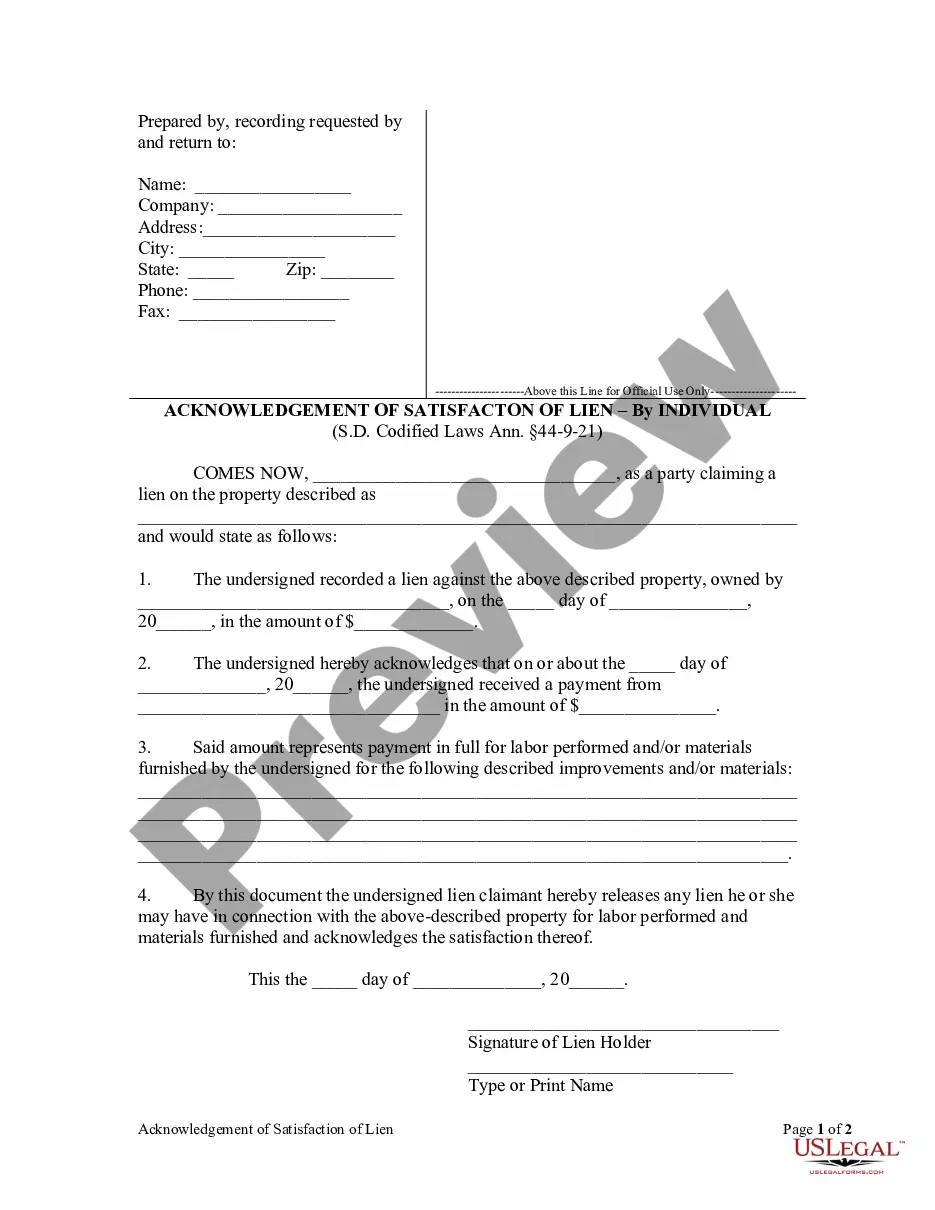

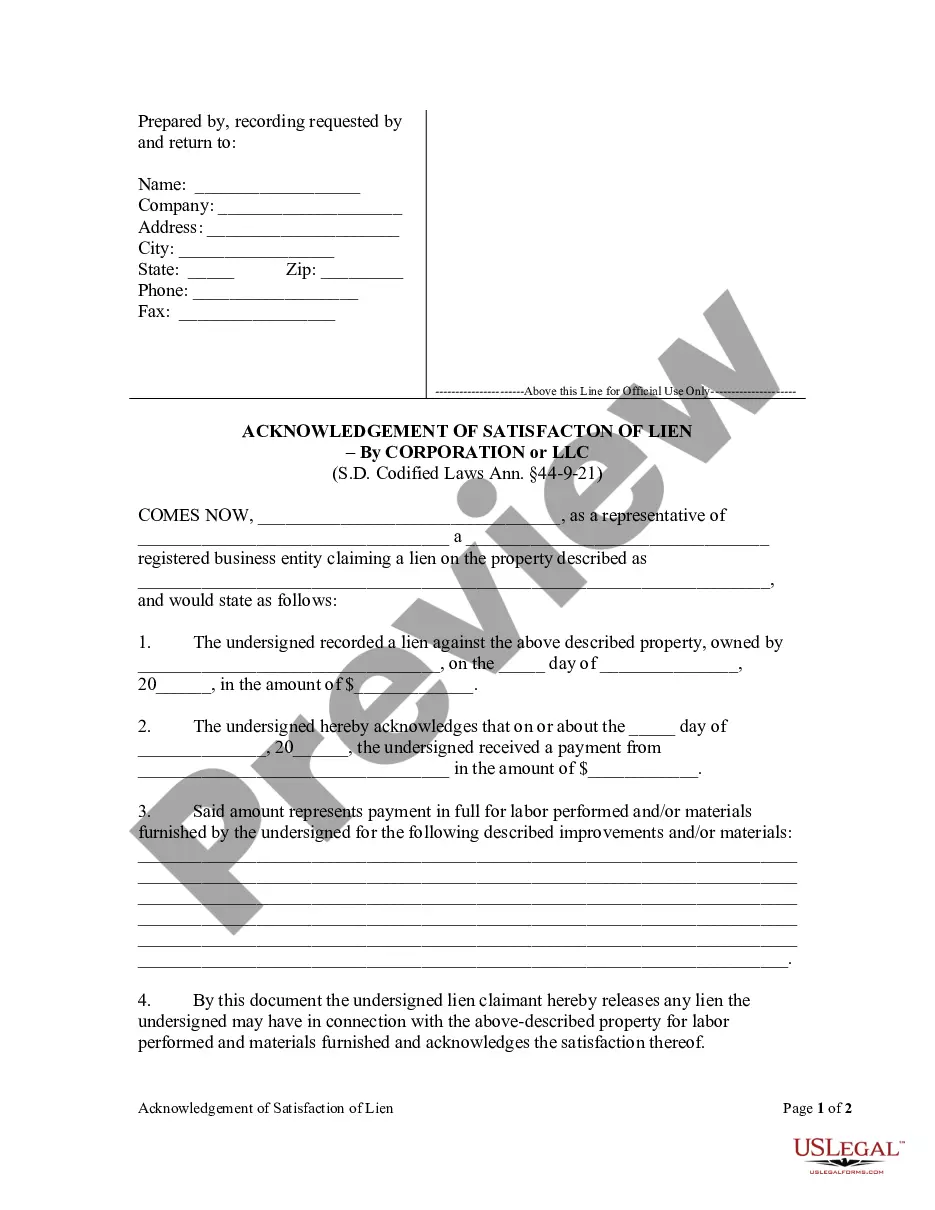

Form components explained

- Grantor's and Grantee's details including names and addresses.

- Description of the property being transferred, including any attached exhibits.

- Reservation clauses specifying any interests retained by the grantor, such as oil, gas, or minerals.

- Conditions such as easements or rights-of-way that apply to the property.

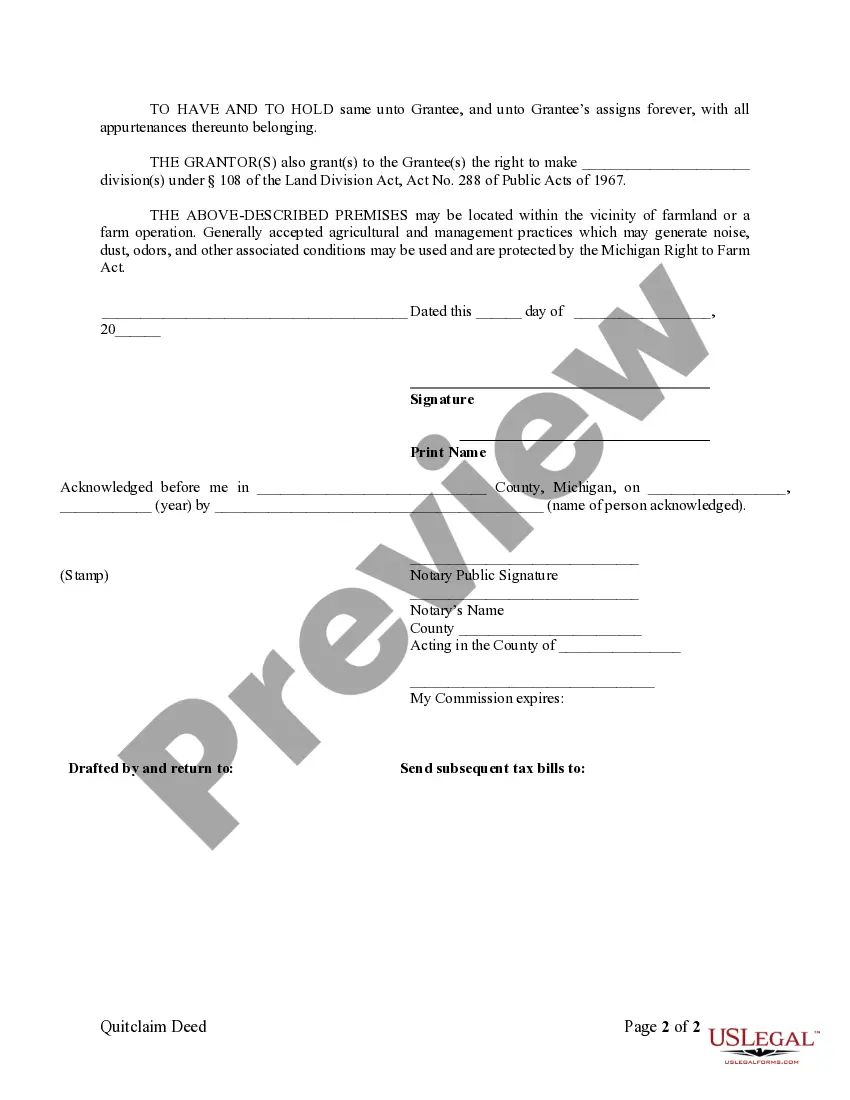

- Notary acknowledgment section to verify the identity of the grantor.

When this form is needed

This form is ideal in situations where an individual is transferring their property to a corporation. It is frequently used in estate planning, or when consolidating business assets under a corporate entity. It may also apply when a corporation is acquiring property from an individual without a sale, such as through a family gift or business merger.

Who should use this form

- Individuals looking to transfer property ownership to a corporation.

- Business owners needing to consolidate property under a corporate structure.

- Estate planners managing property transfers for beneficiaries.

How to complete this form

- Identify the parties involved: enter the names and addresses of both the grantor and the corporation.

- Specify the property: provide a thorough legal description of the property being transferred, including any exhibits.

- Note any reservations: indicate any retained rights, such as oil, gas, or mineral rights, as necessary.

- Include relevant conditions: list any easements or covenants affecting the property.

- Final step: sign the document in the presence of a notary public to ensure its legal validity.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include a complete legal description of the property.

- Not reserving rights for any minerals or other interests if applicable.

- Neglecting to have the document notarized before submitting it for recording.

- Incorrectly identifying the corporation or grantor's legal status.

Advantages of online completion

- Convenience of downloading and printing forms from home.

- Easy customization to meet specific needs without requiring expensive legal fees.

- Access to forms drafted by licensed attorneys ensures legal compliance.

Key takeaways

- The Quitclaim Deed from Individual to Corporation is used to transfer property ownership without warranty.

- Understand the implications of not guaranteeing clear title during the transfer.

- Complete the form accurately and ensure notarization for legal validity.

Looking for another form?

Form popularity

FAQ

No, in most states, the Grantee is not required to sign the Quitclaim Deed. However, some counties do require that the Quitclaim Deed be signed by the Grantee in addition to the Grantor.Whether or not you need witnesses in addition to a notary public for your Quitclaim Deed depends on your location.

There will be a $30 recording fee. If you prepare a quitclaim deed using the Do-It-Yourself Quitclaim Deed (after Divorce) tool, detailed instructions on what to do next will print out along with the deed.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

In Michigan, a quit claim deed must be signed by a witness, in addition to the notary, to make it legal.After all required signatures are collected and notarized, file the document with your local register of deeds to complete the transaction.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A Michigan quitclaim deed form provides no warranty of title. That means that the new owner has no legal right to sue the prior owner if there is a problem with the title to the property. The new owner simply takes whatever title that the prior owner has.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.