South Dakota Lien Statement by Corporation

Understanding this form

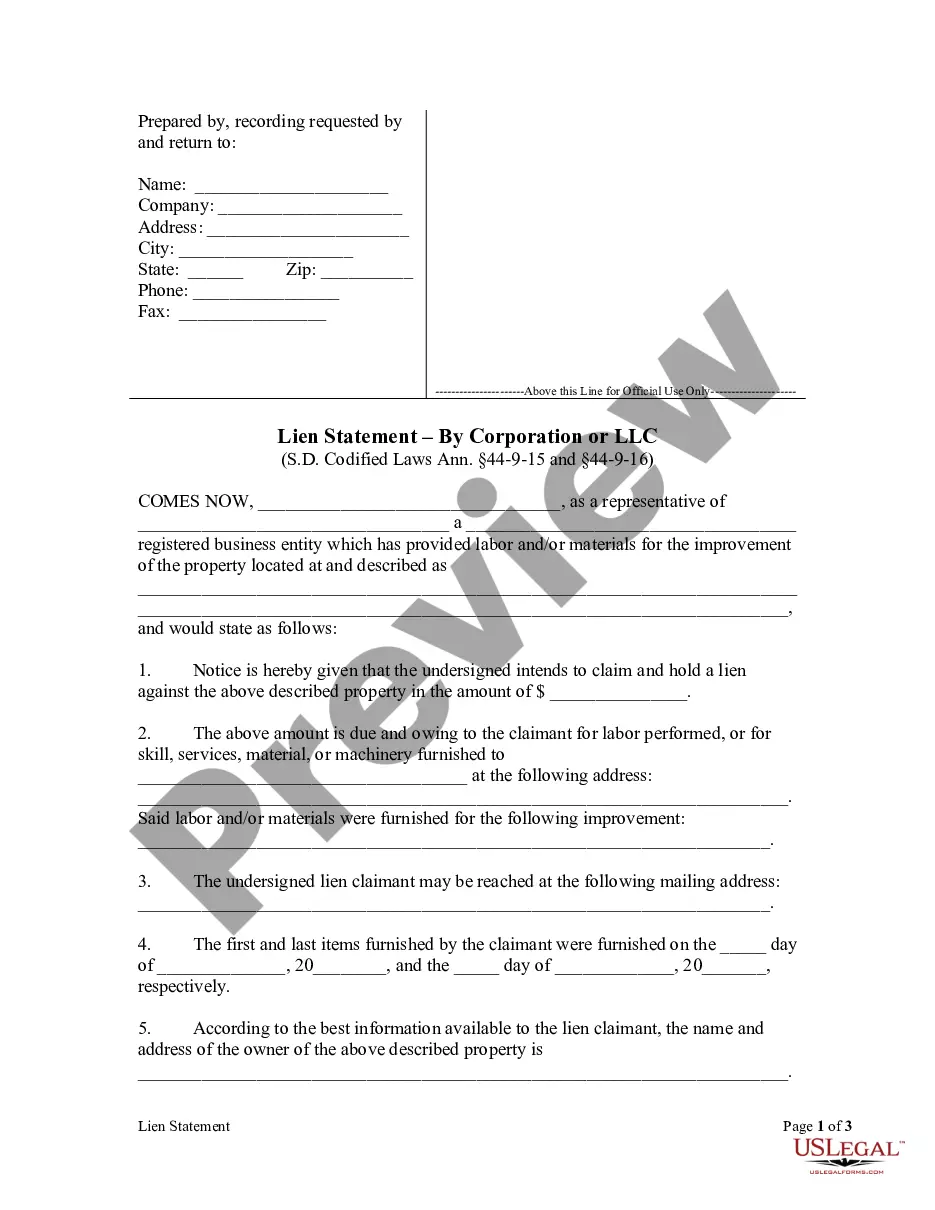

The Lien Statement by Corporation is a legal document used by corporations to formally assert a lien against a property for unpaid labor or materials provided during property improvements. Unlike other lien forms, this one is specifically drafted for use by corporate entities under South Dakota law, reflecting the unique requirements for corporations in lien claims.

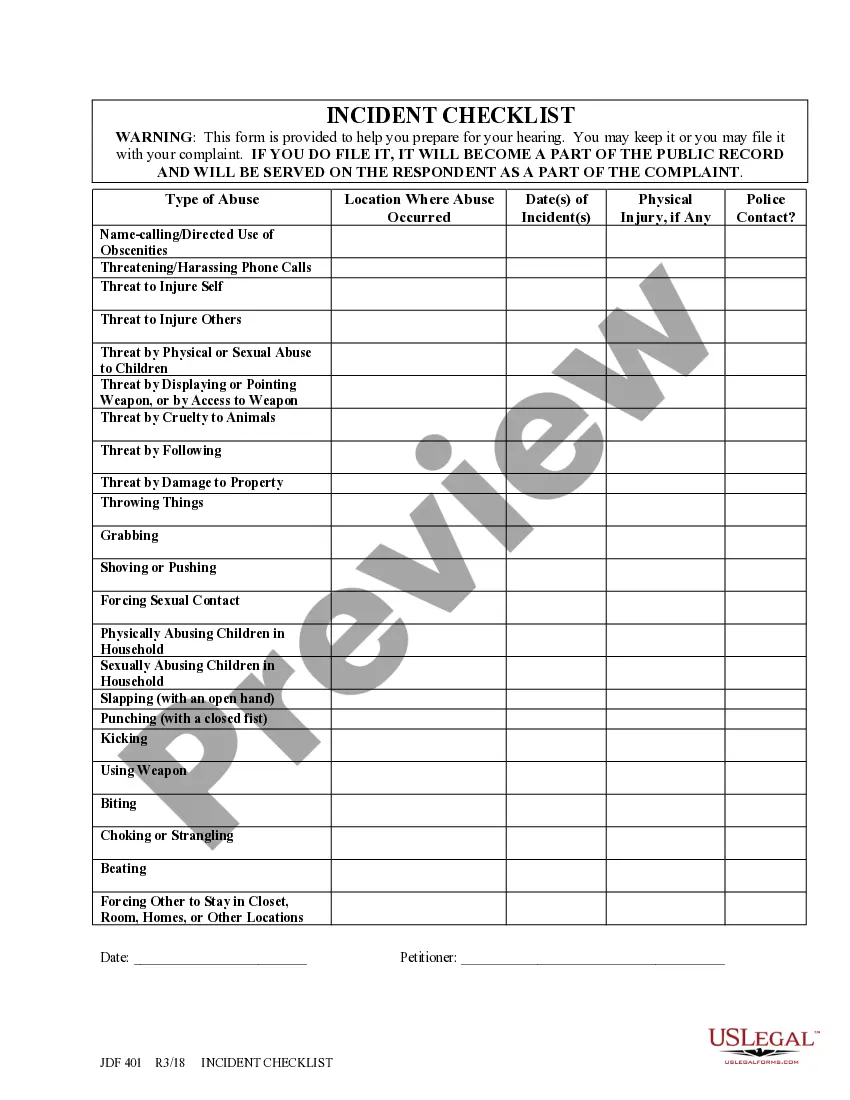

Key components of this form

- Name and contact information of the corporation and its representative.

- Description of the property involved in the lien claim.

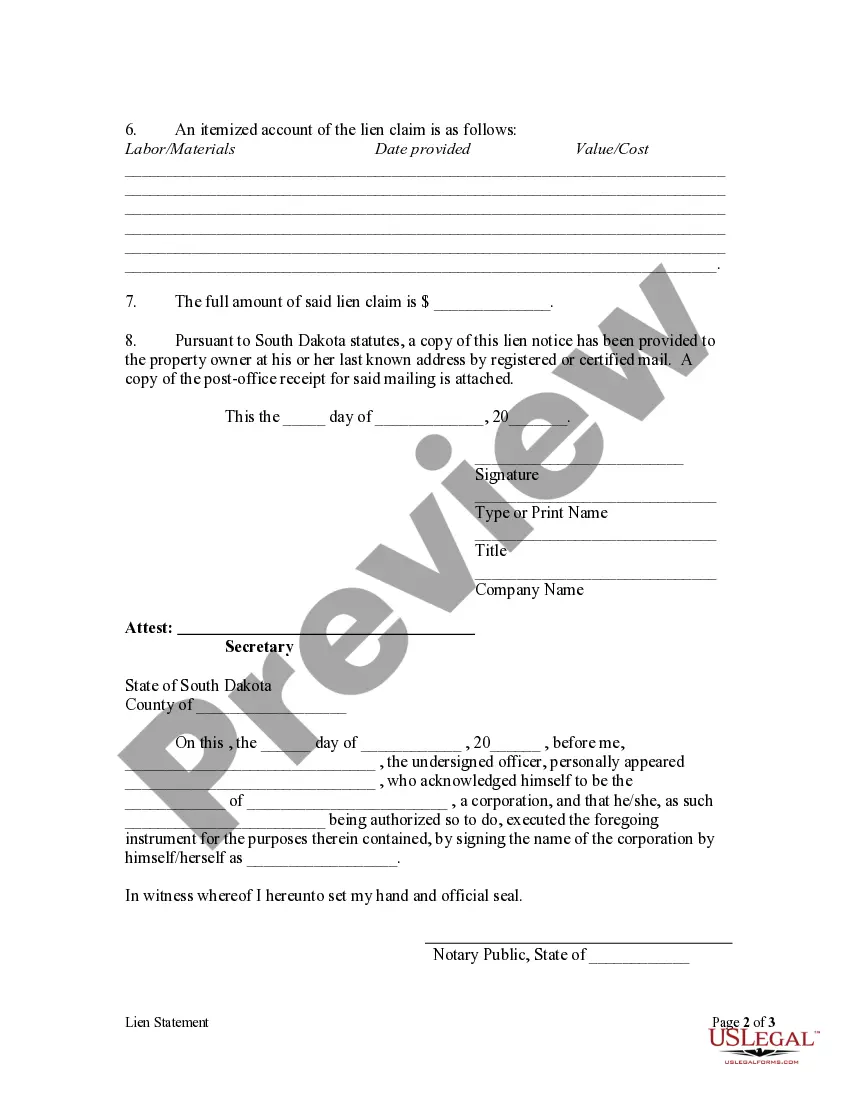

- Details of the services or materials provided, including dates and costs.

- Statement of intent to claim a lien and the amount owed.

- Certification of mailing the lien notice to the property owner.

- Notarization section for official validation of the document.

Situations where this form applies

This form should be used when a corporation has provided labor or materials to improve a property and has not been paid. It is necessary to file this lien statement with the appropriate county office to secure the corporation's claim to payment. The lien must be filed within one hundred and twenty days of the last service or item provided.

Who this form is for

This form is intended for:

- Corporations that have provided materials or labor for property improvements.

- Representatives of a corporation acting on behalf of the business.

- Any corporation seeking to enforce its right to payment through a lien on improved property.

Steps to complete this form

- Identify the corporation's name and contact information at the top of the form.

- Provide the property description for which the lien is being claimed.

- Detail the labor or materials provided, including the amount owed and the dates of service.

- Ensure the statement of intent to claim the lien is clearly stated.

- Sign the document and have it notarized to validate the claim.

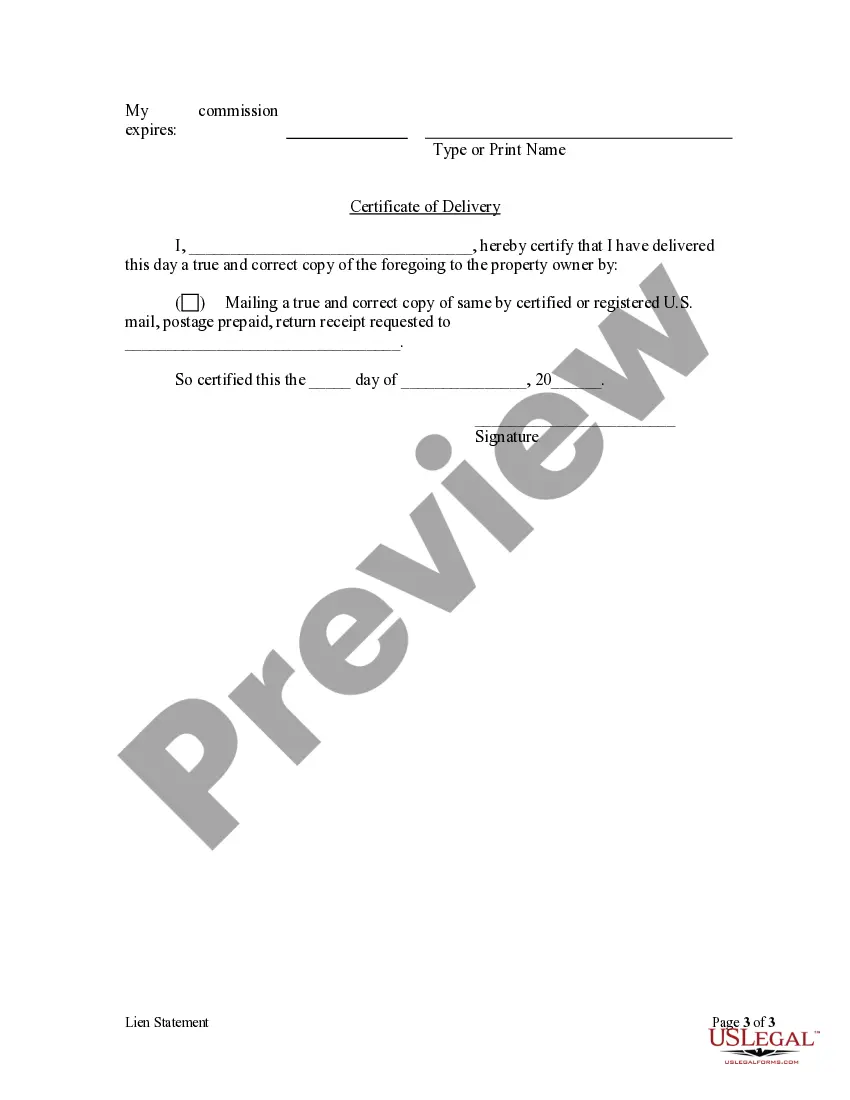

- Mail a copy of the completed lien statement to the property owner and attach proof of mailing.

Does this form need to be notarized?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to file the lien within the one hundred and twenty days deadline.

- Not providing complete property descriptions or amounts owed.

- Neglecting to send a copy of the lien to the property owner.

- Forgetting to have the document notarized, when required.

Why use this form online

- Convenience of downloading the form at any time, from any location.

- Editable templates allow for quick customization to fit specific needs.

- Secure storage and retrieval options for completed forms.

Looking for another form?

Form popularity

FAQ

Be sure to include the following pieces of information in your lien: The name, company name and address (including county) of the property owner against whom your lien is filed; the same information about the delinquent client, if different; the beginning and ending dates of the unpaid service; the due date for payment

A Lien Demand Letter or Notice of Intent to Lien is a formal demand for payment.A lien demand letter puts a debtor on notice of your intent to lien the job site property by a specific date deadline. Increase your odds of getting paid with a lien demand letter.

Most states require all mechanics lien claims be filed with the county recorder or clerk of court. In South Dakota, however, there are at least 2 offices where mechanics lien claims can be filed, and the lien claimant must make certain they file their lien claim in the right office.

South Dakota has been an ELT state since October 2012.

The nine non-title holding states are: Michigan, Minnesota, New York, Arizona, Kentucky, Oklahoma, Wisconsin, Maryland, and South Dakota.

Motor vehicle titling and registration is handled through your local county treasurer's office. An Motor Vehicle or Boat Title & Registration Application must be signed by the record owner(s) or by an authorized agent for the record owner(s).

Michigan is one of only nine states that are non-title holding states, in which titles are mailed to the owner rather than the lien holder. These states include: Arizona, Kentucky, Maryland, Michigan, Minnesota, New York, Oklahoma, South Dakota and Wisconsin.

A contractor's lien (often known as a mechanic's lien, or a construction lien) is a claim made by contractors or subcontractors who have performed work on a property, and have not yet been paid.After all, contractors would rather work out a deal than go through the hassle of filing a lien against your property.