Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Understanding this form

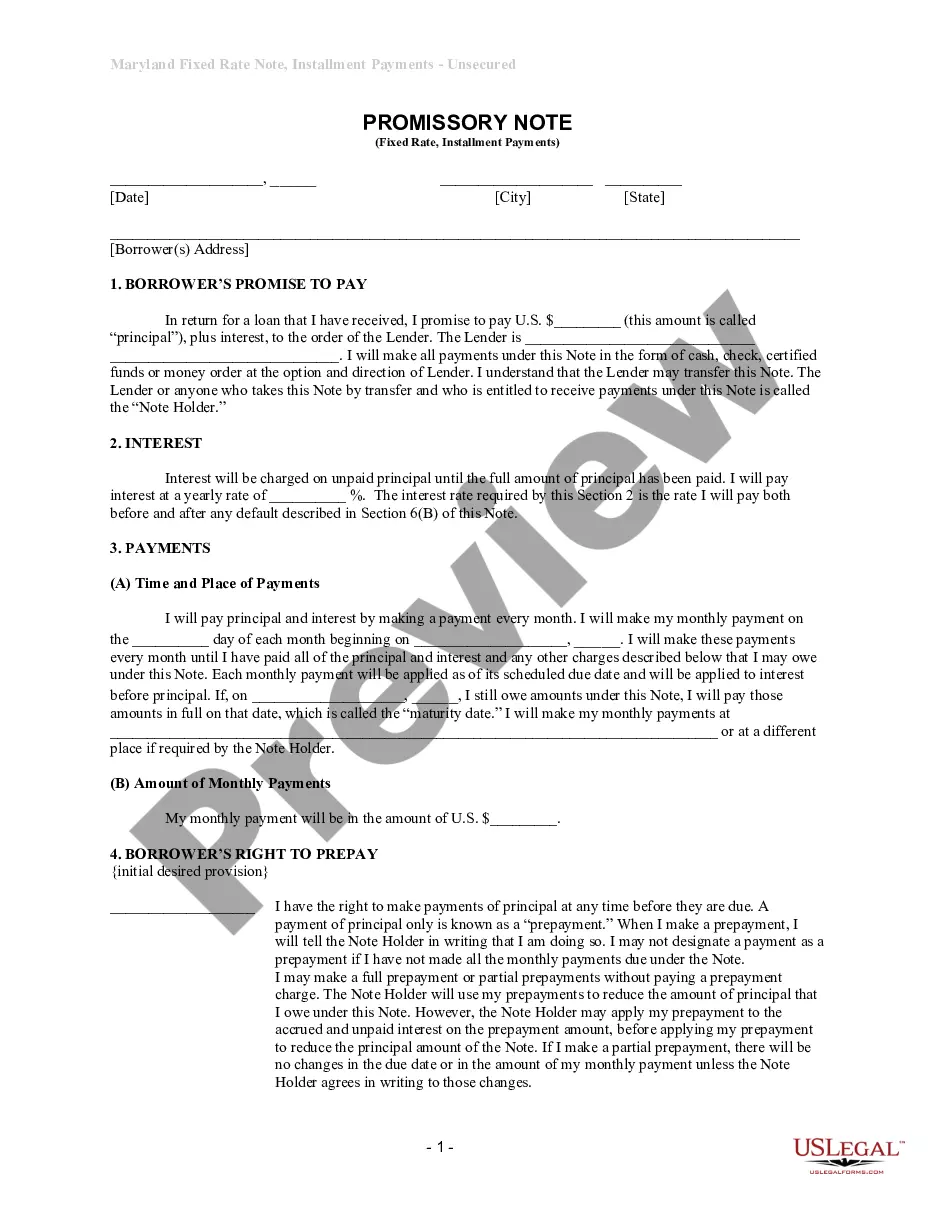

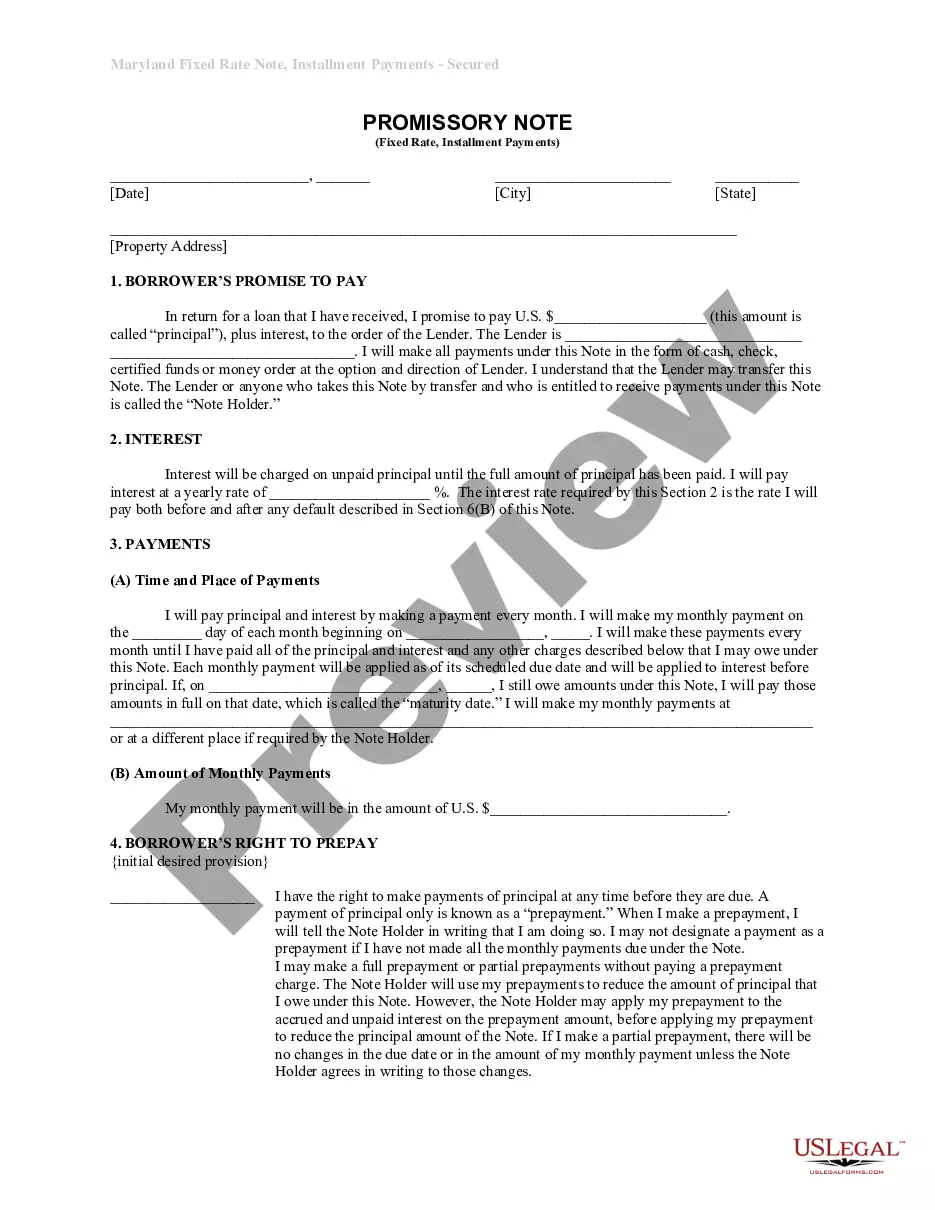

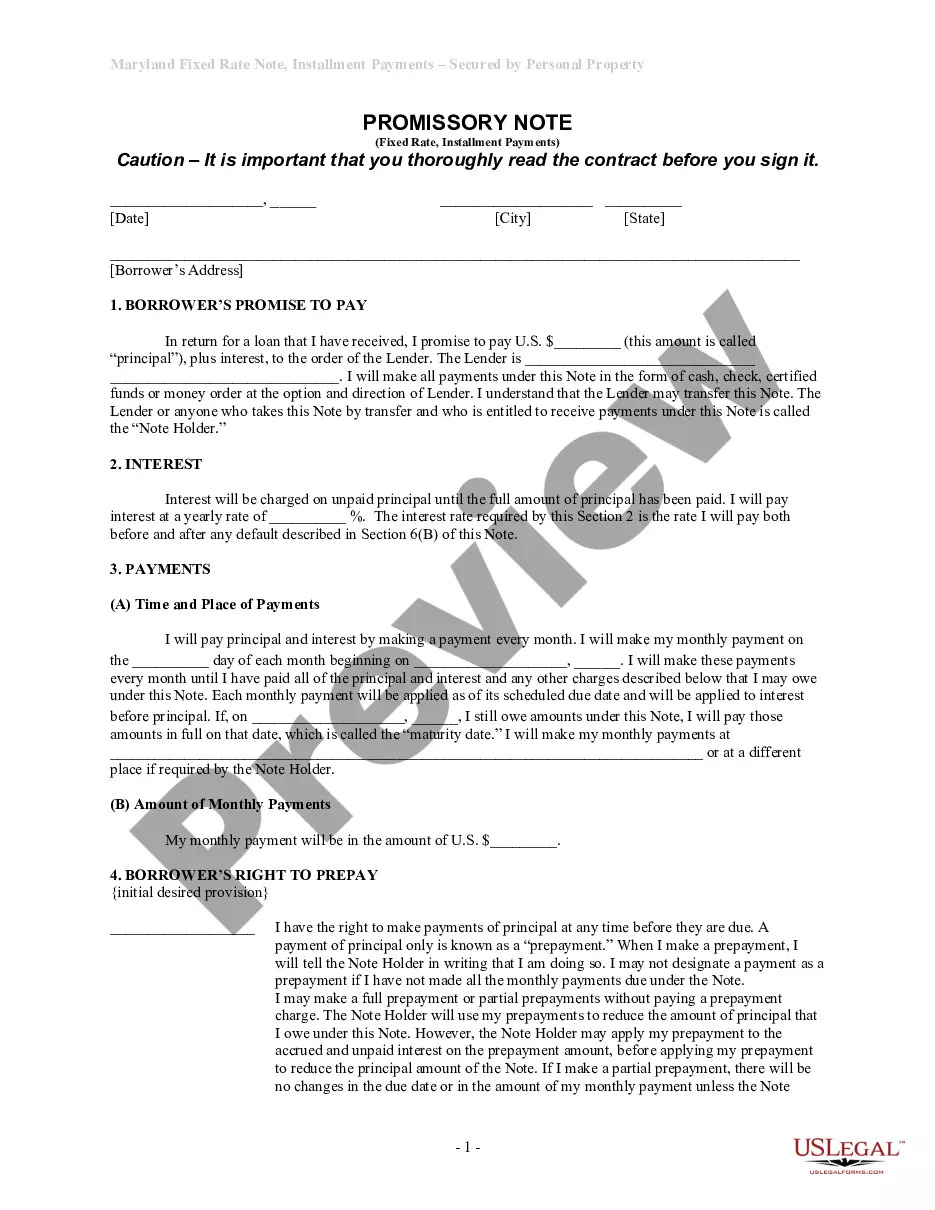

The Maryland Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal document that outlines an agreement between a borrower and a lender regarding a secured loan for commercial property. This form is specifically designed for situations where the loan is secured by commercial real estate, distinguishing it from unsecured promissory notes. The document provides clear terms for repayment, including interest rates, payment schedules, and the consequences of default.

Key components of this form

- Borrower's promise to pay the principal and interest to the lender.

- Specifications of the interest rate and type of payments (fixed rate, installment payments).

- Details regarding the schedule of monthly payments and a maturity date.

- Borrower's right to prepay the loan, including any penalties for early payment.

- Conditions and consequences for defaulting on payments.

- Notice requirements for both the borrower and lender regarding communication.

- Security provisions, outlining how commercial real estate acts as collateral.

Situations where this form applies

This promissory note should be used in situations where a borrower intends to secure a loan with commercial real estate as collateral. Common scenarios include financing for purchasing commercial property, refinancing existing loans, or securing additional funding where the property can be used to secure the loan. This form is essential to clearly outline repayment terms and obligations, providing legal protection for both parties involved.

Intended users of this form

- Businesses seeking to finance commercial property purchases.

- Real estate investors looking to secure loans with their properties.

- Lenders needing a formalized agreement for loans secured by commercial real estate.

- Any party involved in commercial real estate transactions requiring documentation of loan terms.

Steps to complete this form

- Identify and enter the names and addresses of the borrower(s) and lender.

- Specify the loan amount (principal) and the interest rate.

- Indicate the payment schedule, including the start date and monthly payment amount.

- Include any provisions regarding prepayment rights and penalties.

- Sign and date the document to finalize the agreement.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to specify the correct interest rate can lead to confusion later.

- Not clearly stating the repayment schedule, which could result in missed payments.

- Forgetting to include provisions for default or late payments.

- Not obtaining all necessary signatures from all borrowers involved.

Why use this form online

- Convenience of completing the form at your own pace without the need for an attorney.

- Editable templates allow for customization to meet specific needs.

- Access to professionally drafted documents ensures legal accuracy and compliance.

Looking for another form?

Form popularity

FAQ

There are four significant types of promissory notes in India. A personal note is the kind of promissory note that an individual should seek when lending money to family members or close relatives. A commercial note is the type of promissory note that is signed between a borrower and a financial institution.

When a loan changes hands, the promissory note is endorsed (signed over) to the new owner of the loan. In some cases, the note is endorsed in blank which makes it a bearer instrument under Article 3 of the Uniform Commercial Code. So, any party that possesses the note has the legal authority to enforce it.

The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.

A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

What Is a Promissory Note? A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

What is the difference between a Promissory Note and a Loan Agreement? Both contracts evidence a debt owed from the Borrower to the Lender, but the Loan Agreement contains more extensive clauses than the Promissory Note. Further, only the Borrower signs the promissory note while both parties sign a loan agreement.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Personal Promissory Notes This is a particular loan taken from family or friends. Commercial Here, the note is made when dealing with commercial lenders such as banks. Real Estate This is similar to commercial notes in terms of nonpayment consequences.