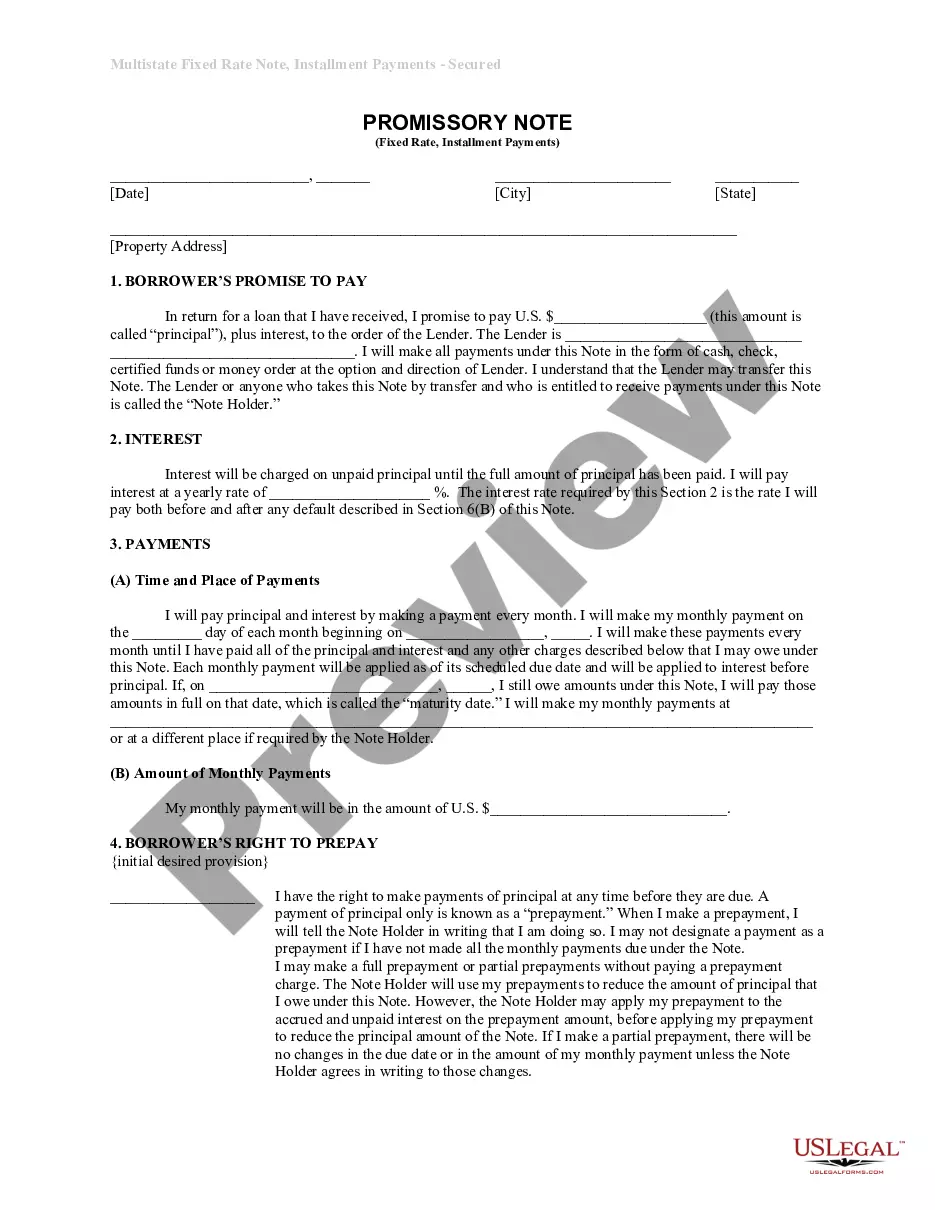

The New York Loss of Wage Earning Capacity Vocational Data Form is a document used by the New York State Worker's Compensation Board to assess the vocational impact of a disabling injury or illness on an injured worker. It includes information about the worker's employment history, educational background, and occupational skills. It also includes an assessment of the worker's PRE and post-injury earning capacity, as well as a review of the worker's ability to perform job tasks. There are two types of New York Loss of Wage Earning Capacity Vocational Data Forms: one for workers with disabilities and one for workers without disabilities.

New York Loss of Wage Earning Capacity Vocational Data Form

Description

Key Concepts & Definitions

Loss of Wage Earning Capacity refers to the reduction in the ability of an injured worker to earn wages at their pre-injury level following a workplace accident or illness. Vocational Data Form is a document used by rehabilitation professionals to assess and record the vocational status of an injured worker, essential in designing a suitable rehabilitation plan. Assisted Reemployment encompasses services and support to help injured workers return to the workforce, potentially in new roles that accommodate their restrictions.

Step-by-Step Guide to Using the Vocational Data Form

- Obtain the form from the responsible rehabilitation service provider or download it from the official website.

- Complete the form with accurate information including employer name, job title, and the nature of the injury.

- Include a detailed description of the injured worker's previous duties and any permanent limitations.

- Discuss the form with a vocational rehabilitation counselor to identify potential opportunities for reemployment.

- Submit the completed form to the insurance provider and follow up for any additional requests or assessments.

Risk Analysis of Inaccurate Data Submission

Submitting inaccurate information on the Loss of Wage Earning Capacity Vocational Data Form can lead to several risks including incorrect eligibility assessment for benefits, delays in receiving necessary rehabilitation services, and potential legal repercussions. It is crucial for both the employer and the claimant to ensure all provided information is accurate and up-to-date.

Comparison Table of Vocational Rehabilitation Services

| Service | Description | Benefit to Injured Worker |

|---|---|---|

| Assessment | Evaluation of working capacity and skills | Identifies suitable employment options post-injury |

| Training | Education or skills development | Enhances qualifications for new roles |

| Job Placement | Assistance in finding suitable employment | Facilitates faster return to the workforce |

Key Takeaways

- Thoroughly complete the vocational data form to ensure it reflects the true impact of the injury on the worker's earning capacity.

- Engage with professional rehabilitation services early to maximize the chances of successful reemployment.

- Maintain open and honest communication between all parties involved (injured worker, employer, rehabilitation counselor) to facilitate a smooth vocational rehabilitation process.

How to fill out New York Loss Of Wage Earning Capacity Vocational Data Form?

Preparing legal paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state regulations and are verified by our experts. So if you need to fill out New York Loss of Wage Earning Capacity Vocational Data Form, our service is the best place to download it.

Obtaining your New York Loss of Wage Earning Capacity Vocational Data Form from our catalog is as simple as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they locate the proper template. Later, if they need to, users can take the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a brief guideline for you:

- Document compliance verification. You should carefully review the content of the form you want and check whether it suits your needs and complies with your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab above until you find an appropriate template, and click Buy Now once you see the one you want.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your New York Loss of Wage Earning Capacity Vocational Data Form and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

To calculate the impairment award, the CE multiplies the percentage points of the impairment rating of the employee's covered illness or illnesses by $2,500.00. For example, if a physician assigns an impairment rating of 40% or 40 points, the CE multiplies 40 by $2,500.00, to equal a $100,000.00 impairment award.

A detailed narrative progress/supplemental report is filed to document any significant change in the worker's medical or disability status.

Loss of wage earning capacity, or LWEC, is a determination made by the Workers' Compensation Board in cases where a worker has a permanent partial injury as a result of his or her work-related injury. It is meant to show how the permanent injury affects the injured worker's ability to earn a living.

How much is an SLU award? Your SLU award is determined by Workers' Compensation law (statute), which contains a schedule (list) of the maximum number of weeks of benefits you can receive ing to the body part you have permanently injured.

Typically, the employer and employee work together to determine the total weekly compensation to be paid (not to exceed 162 weeks). This number is then multiplied by 60% of the employee's AWW to determine total compensation.

The Board will calculate the rate of the award by looking at the injured worker's Average Weekly Wage. The rate the award is payable is two thirds of the worker's Average Weekly Wage. The lawyer must then add weeks of compensation to the award if there is a protracted healing period.

Schedule awards are paid for a certain number of weeks, calculated by multiplying the percentage of impairment of a body part (determined by the rating physician) times the number of weeks set out in the schedule in the FECA for that body part.

What is a Schedule Loss of Use ( SLU ) award? A cash benefit that pays you for the loss of wage-earning capacity (as determined by the Workers' Compensation Board, with proper consideration of the Workers' Compensation law and the current Permanent Impairment Guidelines.)