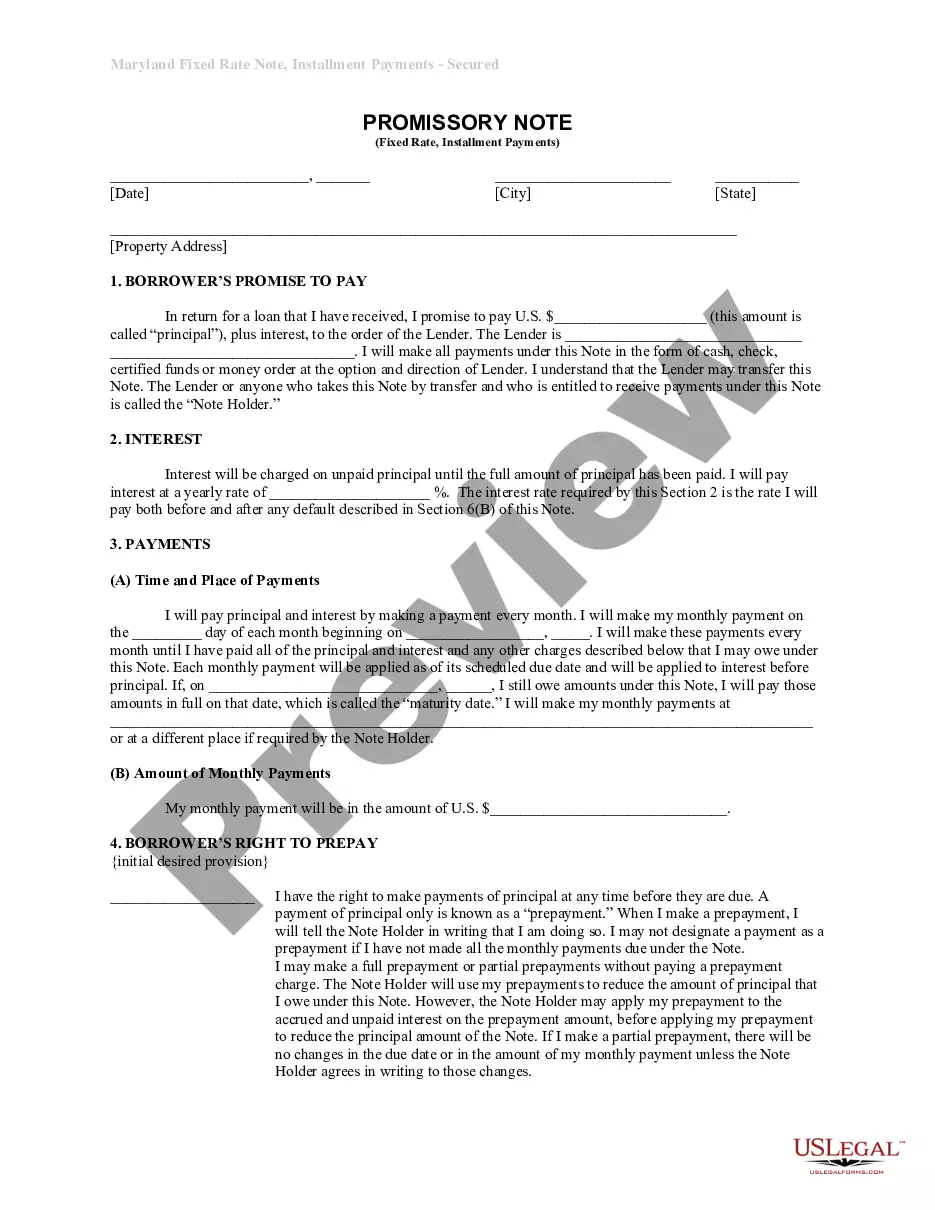

Maryland Installments Fixed Rate Promissory Note Secured by Personal Property

Overview of this form

The Maryland Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that establishes a loan agreement where personal property serves as collateral. This form allows borrowers to repay their loan in fixed installments while agreeing to specific terms regarding interest, payment schedules, and potential penalties. It differs from unsecured promissory notes as it includes added security for the lender, ensuring they have a claim to the personal property if the borrower defaults.

Form components explained

- Borrower's promise to pay the loan amount (principal) plus interest.

- Specification of the interest rate applicable until full repayment.

- Details on payment schedules including amounts and due dates.

- Information on prepaying the loan and associated conditions.

- Consequences of late payments and definitions of default.

- Secured lien on personal property as collateral for the loan.

When this form is needed

This form should be used when borrowing money and providing personal property as security for the loan. It is suitable for individuals or businesses needing funds while being willing to offer tangible assets as collateral. Use this promissory note when establishing a structured repayment plan that includes fixed interest rates and specified terms.

Intended users of this form

- Borrowers seeking a loan secured by personal property.

- Lenders who require assurance in the form of collateral.

- Individuals or businesses engaging in financing transactions involving tangible assets.

- Parties looking for a clear, legally binding repayment agreement.

How to complete this form

- Enter the date, city, and state at the top of the form.

- Fill in the borrower's address and the amount of the loan (principal).

- Specify the interest rate and the scheduled monthly payment amount.

- Indicate the start date for monthly payments and the maturity date.

- Sign and date the document, ensuring all parties involved complete their signatures.

Does this document require notarization?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to accurately state the interest rate or loan amount.

- Not specifying the payment due date or creation of a vague repayment schedule.

- Ignoring the terms under which prepayments can be made.

- Neglecting to have all signatories complete their portion of the document.

Why use this form online

- Convenient access to customizable legal templates at any time.

- Editable form sections to ensure it meets specific borrowing needs.

- Easy to download and print, facilitating quick processing.

- Reliable, legally vetted content drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

To write a secured promissory note, begin by clearly stating the obligations of the borrower and the lender. Include terms about the collateral securing the note, such as personal property, which is crucial for a Maryland Installments Fixed Rate Promissory Note Secured by Personal Property. Make sure to outline repayment conditions and the consequences of default. For additional support, consider leveraging uslegalforms to access templates and expert advice.

Filling out a promissory note format starts with providing essential details such as the borrower's name, the lender's name, and the principal amount. Next, specify the interest rate and include payment terms, especially if it’s a Maryland Installments Fixed Rate Promissory Note Secured by Personal Property. Finally, ensure to sign and date the document to validate it. Using a reliable platform like uslegalforms can simplify this process with templates and guidance.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

"A promissory note is enforceable through an ordinary breach of contract claim." In other words, it's not required that the loan be secured; an unsecured loan is still enforceable as long as the promissory note is fully completed. Lender and borrower information.

Whether a promissory note is a security is one of the most vexatious issues in US securities laws.In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

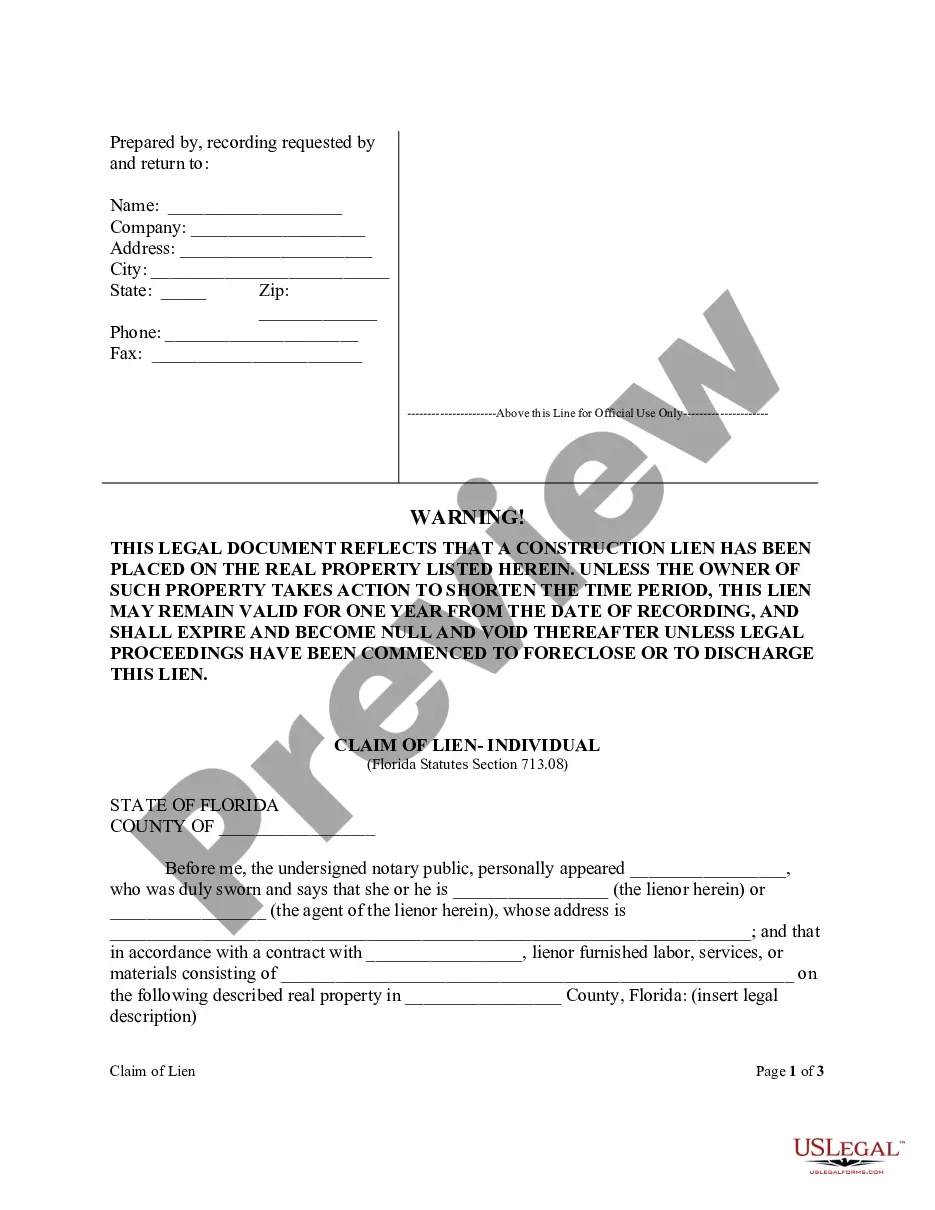

To secure a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan.