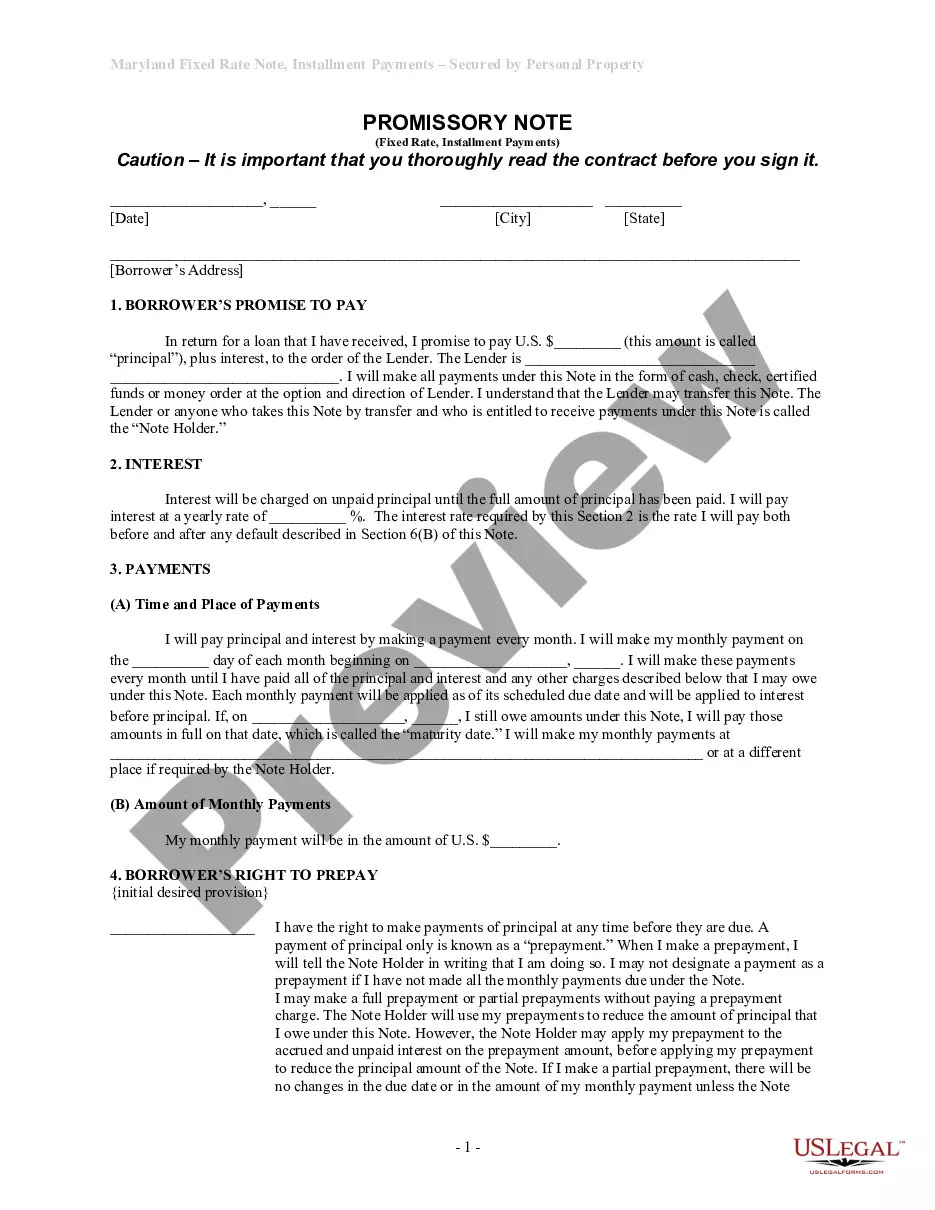

Maryland Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

You are invited to the biggest legal document repository, US Legal Forms. Here, you can acquire any example such as Maryland Installments Fixed Rate Promissory Note Secured by Residential Real Estate templates and store them (as many as you wish to possess). Prepare official papers within a few hours, rather than days or weeks, without spending a fortune on a lawyer. Obtain your state-specific example in just a few clicks and have peace of mind knowing it was created by our licensed attorneys.

If you’re already an enrolled user, simply Log In to your profile and then click Download next to the Maryland Installments Fixed Rate Promissory Note Secured by Residential Real Estate you require. Because US Legal Forms is online-based, you’ll always have access to your downloaded documents, no matter the device you’re using. View them in the My documents section.

If you haven't registered for an account yet, what are you waiting for? Follow our guidelines below to get started: If this is a state-specific example, verify its relevance in the state where you reside. Review the description (if available) to determine if it’s the right example. Explore more details using the Preview feature. If the document satisfies your needs, click Buy Now. To create an account, choose a pricing option. Use a credit card or PayPal account to register. Download the document in your desired format (Word or PDF). Print the document and complete it with your or your business’s details. Once you’ve finalized the Maryland Installments Fixed Rate Promissory Note Secured by Residential Real Estate, send it to your attorney for validation. It’s an extra step but an essential one to ensure you’re completely protected. Register for US Legal Forms now and access thousands of reusable templates.

Form popularity

FAQ

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.