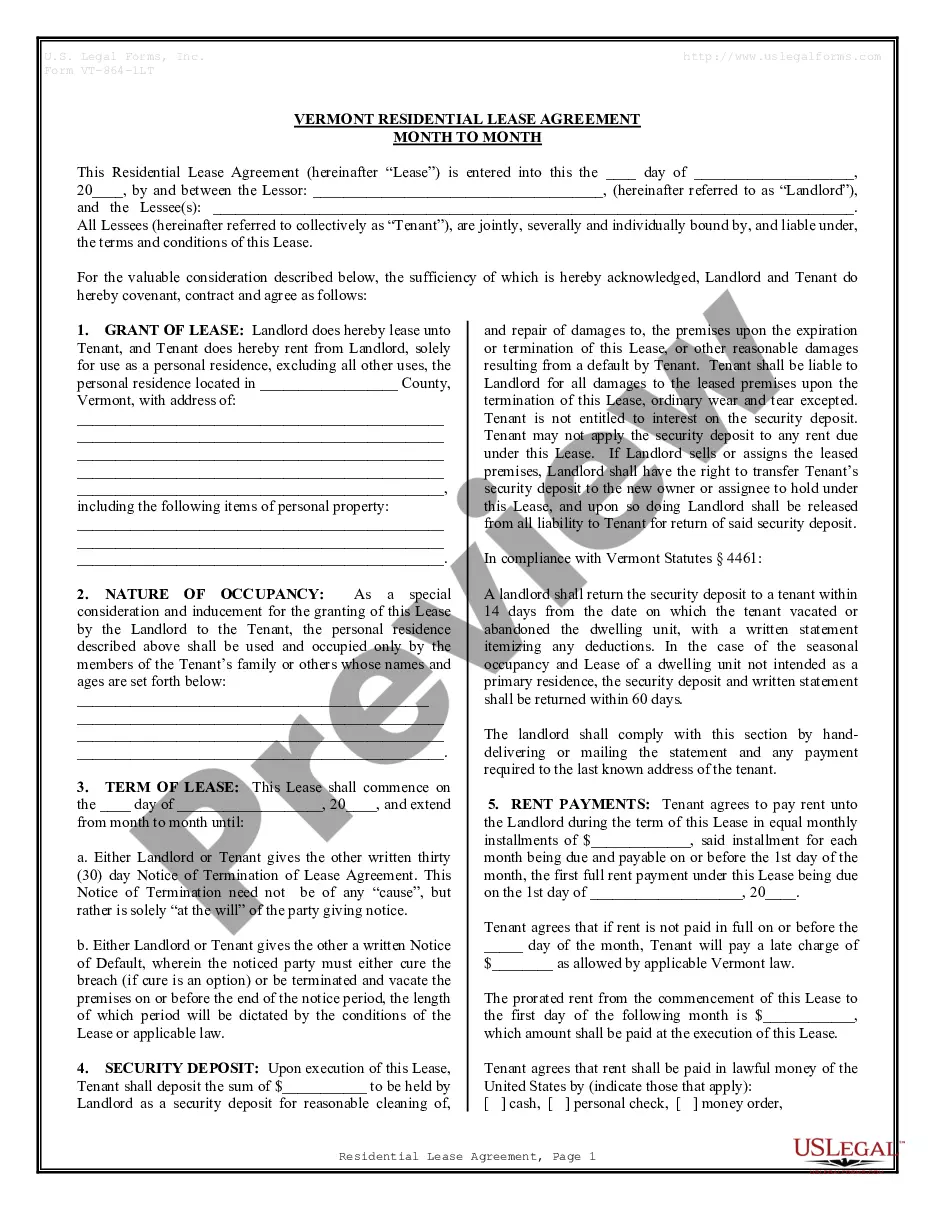

The New York County Use Tax Exemption Certificate is a form issued by the New York State Department of Taxation and Finance that exempts a taxpayer from paying county use tax on certain purchases. This certificate can be used when purchasing tangible personal property and services within a specific county in New York. There are two types of New York County Use Tax Exemption Certificates: the General Exemption Certificate and the Resale Certificate. The General Exemption Certificate is used by organizations, businesses, or individuals who are exempt from paying county use tax. The Resale Certificate is used by businesses who are reselling tangible personal property or services, and who are required to pay county use tax on the purchase of the items or services for resale.

New York County Use Tax Exemption Certificate

Description

How to fill out New York County Use Tax Exemption Certificate?

Working with official documentation requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your New York County Use Tax Exemption Certificate template from our service, you can be certain it meets federal and state regulations.

Working with our service is easy and fast. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to find your New York County Use Tax Exemption Certificate within minutes:

- Remember to attentively check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for another formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the New York County Use Tax Exemption Certificate in the format you need. If it’s your first time with our website, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the New York County Use Tax Exemption Certificate you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

To make tax exempt purchases: Complete Form ST-119.1 (This form is mailed with your exemption certificate, and is not available on our Web site. To get additional copies of this form, contact our sales tax information center.) Present the completed form to the store at the time of purchase.

If you're granted sales tax exempt status We'll issue Form ST-119, Exempt Organization Certificate, to you. It will contain your six-digit New York State sales tax exemption number.

How To Fill Out ST-120 New York State Resale Certificate - YouTube YouTube Start of suggested clip End of suggested clip Number is blank. So if you're a new york state vendor. You click that one. And then you put in yourMoreNumber is blank. So if you're a new york state vendor. You click that one. And then you put in your certificate of authority number right here.

How you can apply. If you're entitled to a certificate because of your medical condition, speak to your GP or doctor. They'll give you an application form. You'll get a paper certificate in the post within 10 working days of us receiving your application.

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

Use Tax - applies if you buy tangible personal property and services outside the state and use it within New York State. Clothing and footwear under $110 are exempt from New York City and NY State Sales Tax. Purchases above $110 are subject to a 4.5% NYC Sales Tax and a 4% NY State Sales Tax.

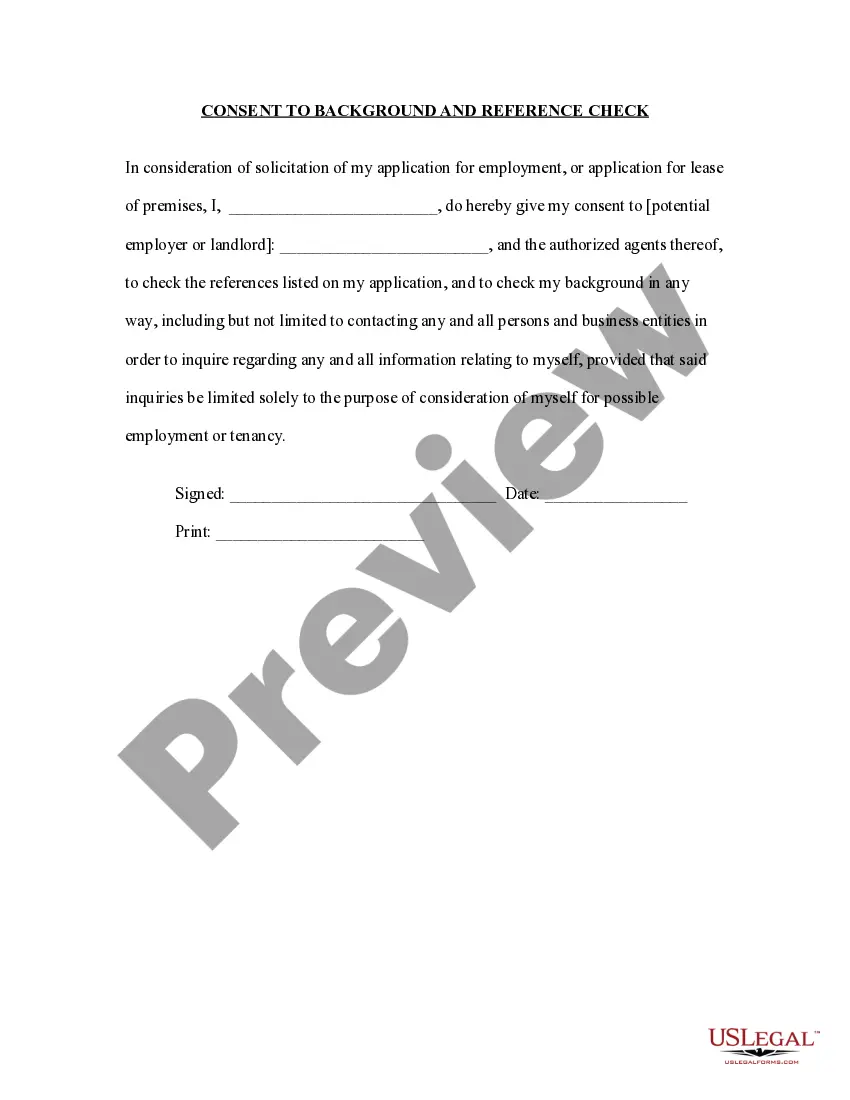

Purchasers submit resale certificates to vendors, who typically initiate the request. The person or company making the payment, rather than the person receiving the payment, typically requests the Form W-9. The W-9 relates to federal income tax, while resale certificates relate to state sales tax.

To request a copy of either the exemption application (including all supporting documents) or the annual information or tax return, submit Form 4506-A, Request for a Copy of Exempt or Political Organization IRS FormPDF or Form 4506-B, Request for a Copy of Exempt Organization IRS Application or LetterPDF.