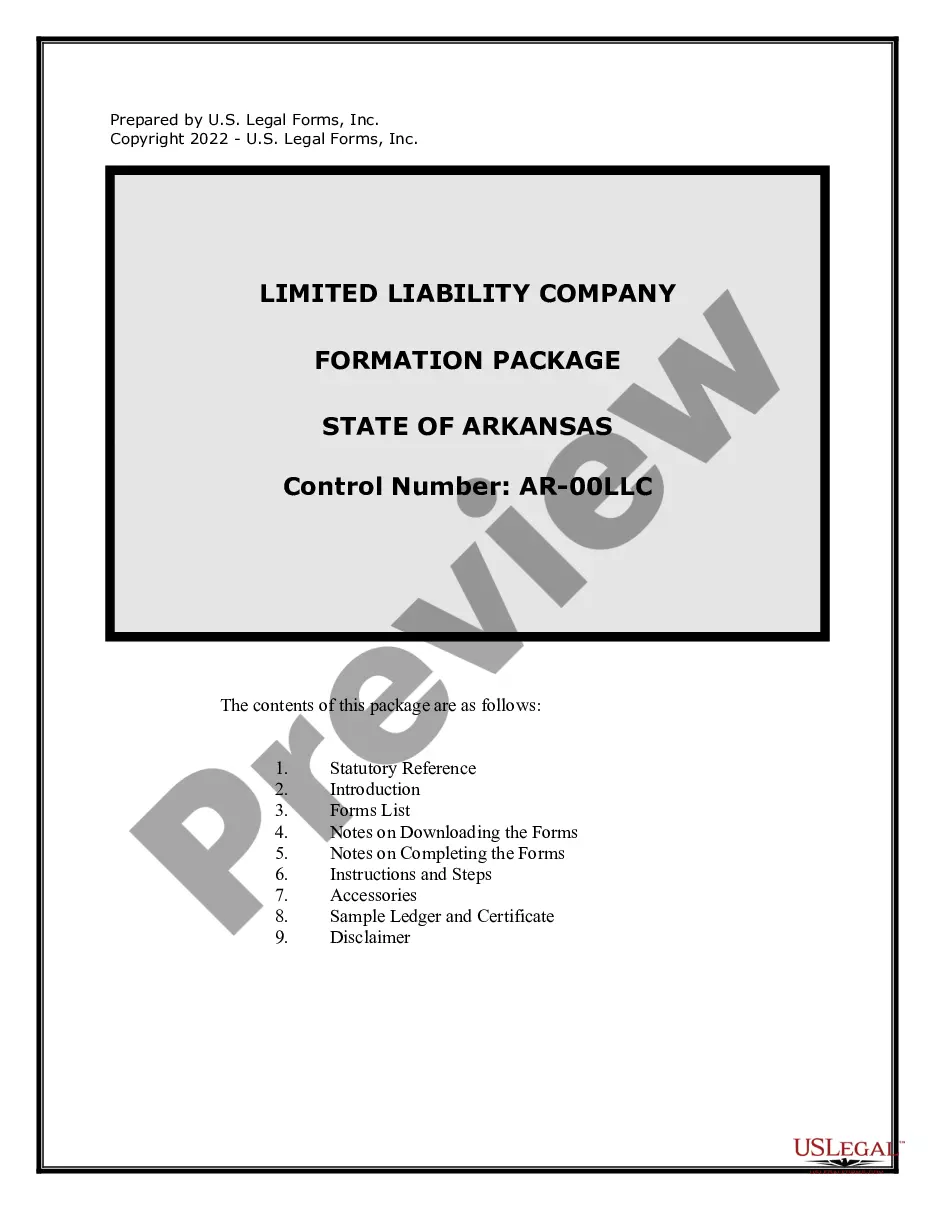

Maryland Limited Liability Company LLC Formation Package

Understanding this form package

The Maryland Limited Liability Company (LLC) Formation Package is a comprehensive set of downloadable forms designed to help you establish a limited liability company in the State of Maryland. This package includes step-by-step instructions, Articles of Formation, an Operating Agreement, resolutions, and additional necessary forms. Unlike general business formation packages, this specifically addresses the legal requirements and nuances of forming an LLC in Maryland, ensuring compliance with state statutes.

Forms you’ll find in this package

- Limited Liability Company LLC Operating Agreement

- Single Member Limited Liability Company LLC Operating Agreement

- Maryland Articles of Organization for Domestic Limited Liability Company LLC

- LLC Notices, Resolutions and other Operations Forms Package

- Sample Cover Letter for Filing of LLC Articles or Certificate with Secretary of State

- Maryland Application for Reservation of LLC Name

- I.R.S. Form SS-4 (to obtain your federal identification number)

Situations where these forms applies

This form package is ideal for individuals or businesses looking to form a limited liability company in Maryland. You should consider using this package when you:

- Want to protect personal assets from business liabilities.

- Require a flexible business structure with fewer formalities than a corporation.

- Plan to have multiple members or a single-member LLC.

- Need to establish operational agreements between members.

Who this form package is for

- Entrepreneurs starting a new business in Maryland.

- Individuals wanting to convert an existing business structure to an LLC.

- Business partners forming a joint venture with shared responsibilities.

- Freelancers or consultants seeking limited liability without hefty fees.

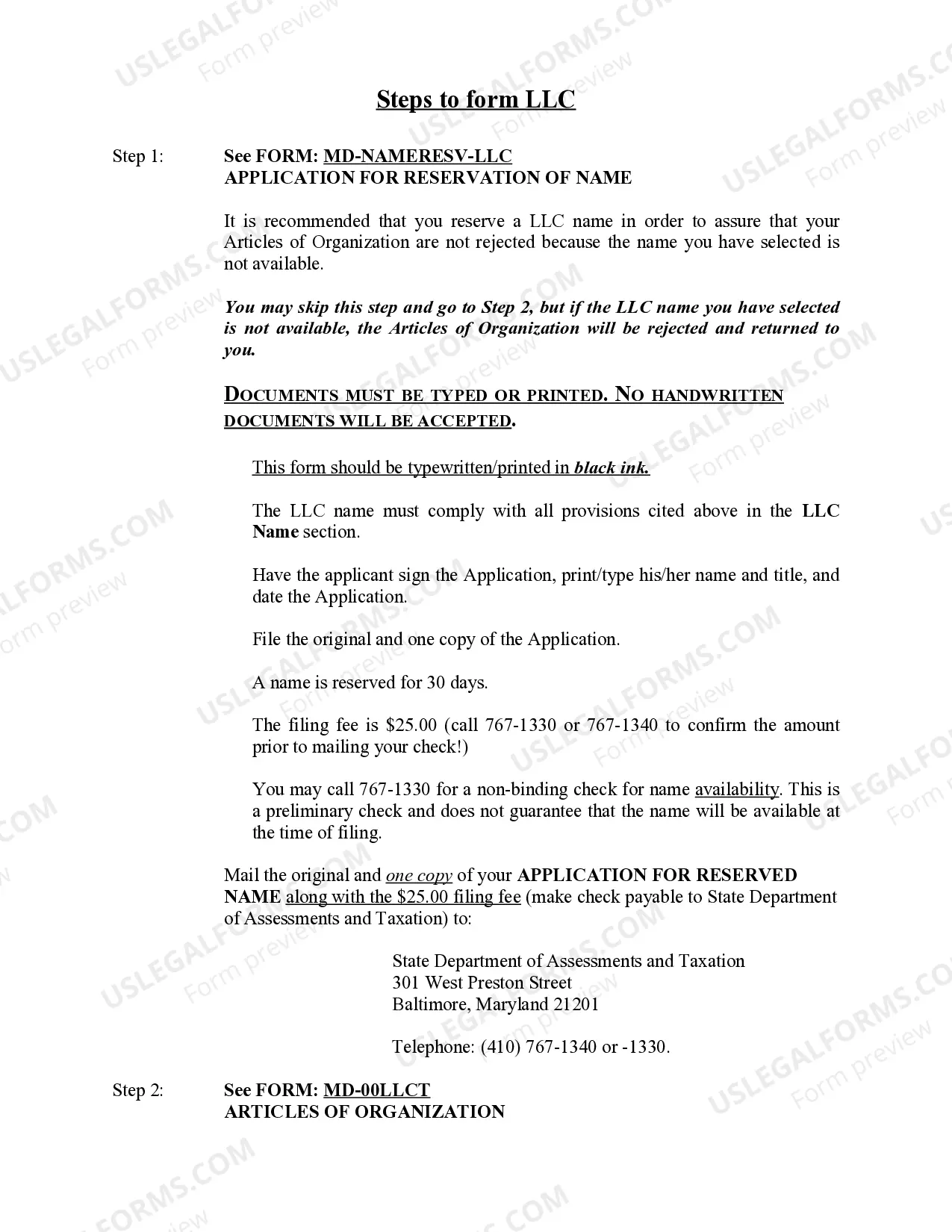

How to complete these forms

- Review the included forms carefully to understand the requirements.

- Complete the Articles of Organization with the necessary information, including the LLC name and registered agent details.

- Draft an Operating Agreement outlining the management structure and member obligations.

- File the completed Articles of Organization with the Maryland Secretary of State.

- Obtain a Federal Tax Identification Number (EIN).

- Open a bank account for your LLC to manage finances properly.

Notarization guidance for this package

Certain documents in this package must be notarized for legal effectiveness. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Choosing a name already in use or failing to adhere to naming conventions.

- Omitting signatures from key documents like the Articles of Organization.

- Neglecting to create an Operating Agreement, which can lead to disputes later.

- Not securing a registered agent within Maryland.

Why complete this package online

- Convenience of downloading the forms directly from your device.

- Editability allows you to fill in the forms at your own pace.

- Access to forms created by licensed attorneys to ensure compliance and accuracy.

- Streamlined guidance through each step of the LLC formation process.

Looking for another form?

Form popularity

FAQ

LLCs are formed by filing articles of organization with the secretary of state's office.Depending on the state, the filing fee varies, and the articles of organization may be referred to as a different name, like the certificate of formation.

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

If money's tight, or you don't want to use a company formation service, we've got good news for you you can form an LLC yourself. Although you'll still need to pay your state filing fees (they're unavoidable!), you can save on the costs of having your LLC filed through a professional incorporation business.

A limited liability company (LLC) is not a separate tax entity like a corporation; instead, it is what the IRS calls a "pass-through entity," like a partnership or sole proprietorship.The LLC itself does not pay federal income taxes, although some states impose an annual tax on LLCs.

Register Your Business in Maryland. Obtain a Federal Tax ID Number from the IRS. Apply for Maryland Tax Accounts and Insurance. Obtain Licenses or Permits. Purchase Business Insurance.

To form an LLC in Maryland you will need to file the Articles of Organization with the Maryland Department of Assessments and Taxation, which costs $100. You can apply online, by mail, or in-person.

Online: You can complete business registration and document filing online via the Maryland EGov Business portal at https://egov.maryland.gov/businessexpress. The cost is $100.00, and all online filed documents are considered expedited and will be processed within 7 business days.

More expensive than some other services: The cost of forming a LLC ranges from $79 to $359 plus filing fees. Other websites provide similar services for filing fees only (as part of a trial) or from $49 plus filing fees.