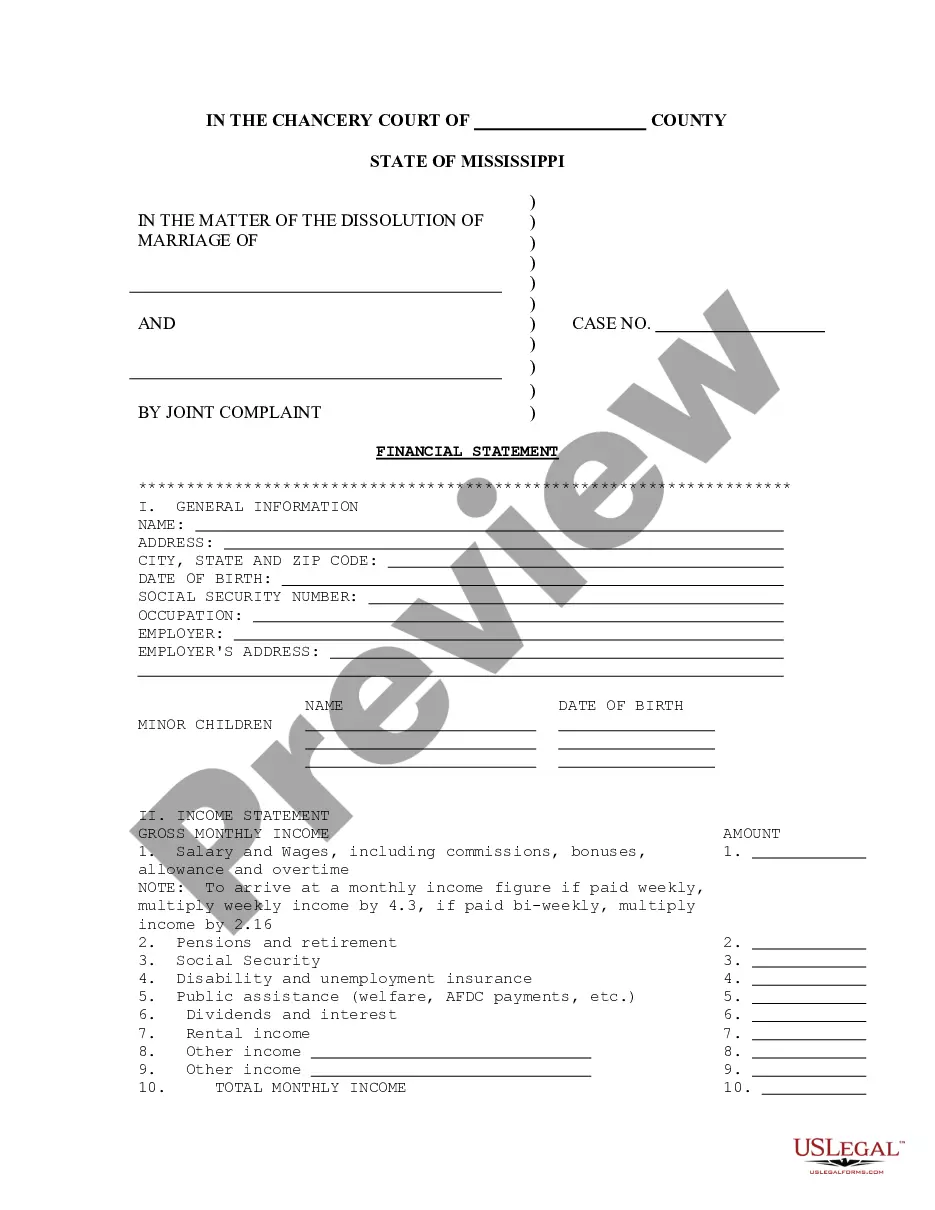

Mississippi Financial Statement

Overview of this form

The Financial Statement is a critical legal document in family law proceedings. Its primary purpose is to provide a clear overview of an individual's financial situation, including income, assets, liabilities, and expenses. This distinguishes it from other financial documents as it is specifically tailored for court-related matters within family law, ensuring transparency between the parties involved and the court.

What’s included in this form

- Personal information, including your name and contact details

- Income sources, detailing all earnings and their amounts

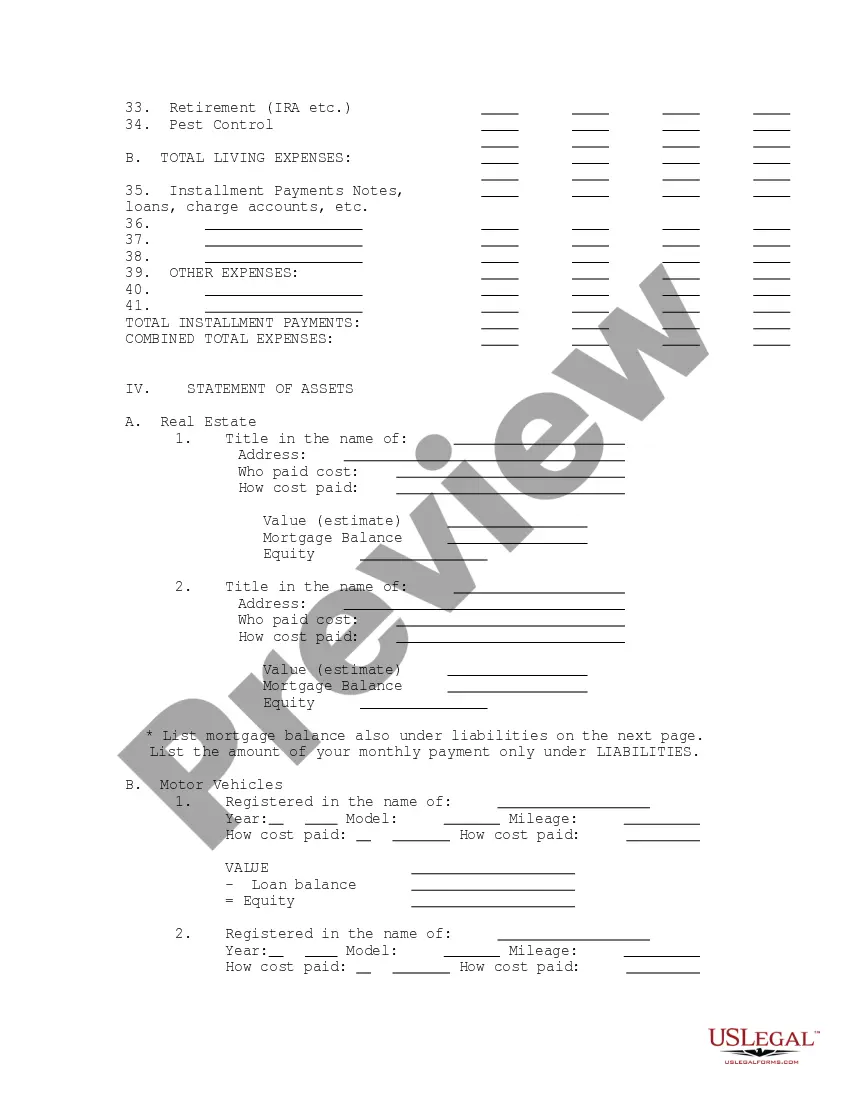

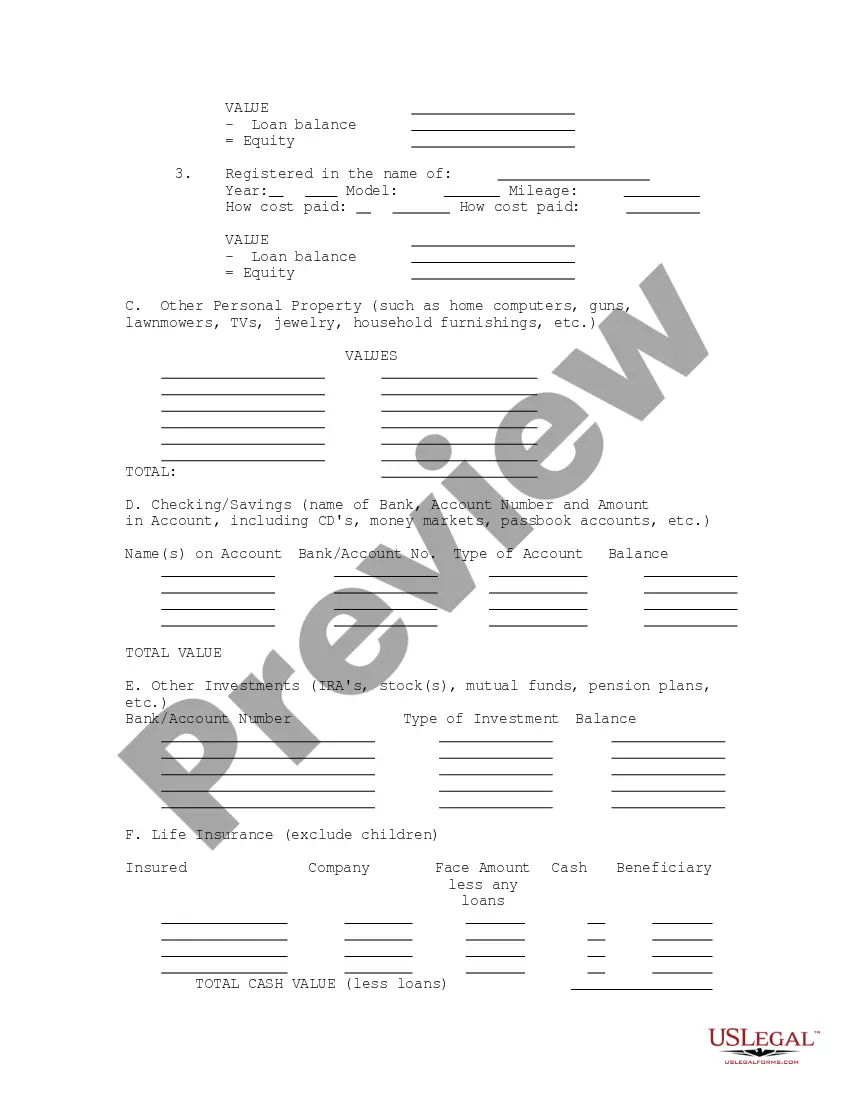

- List of assets, such as real estate, vehicles, and investments

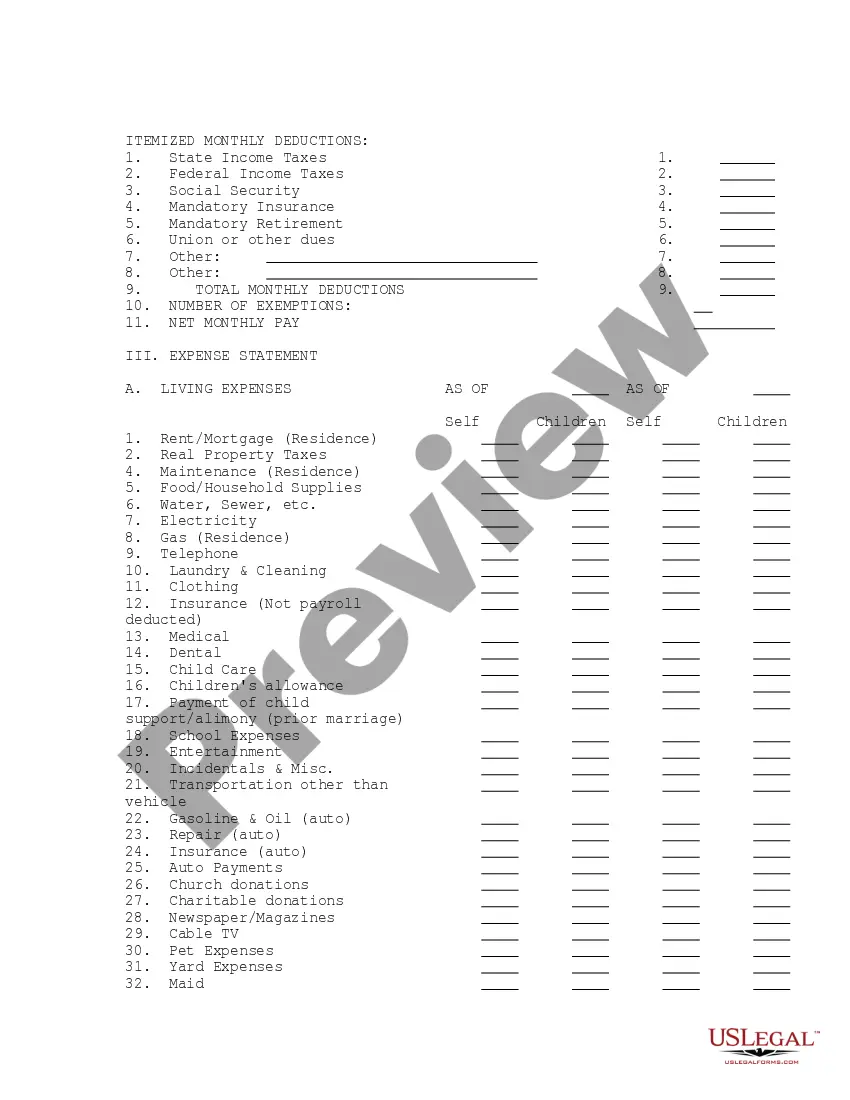

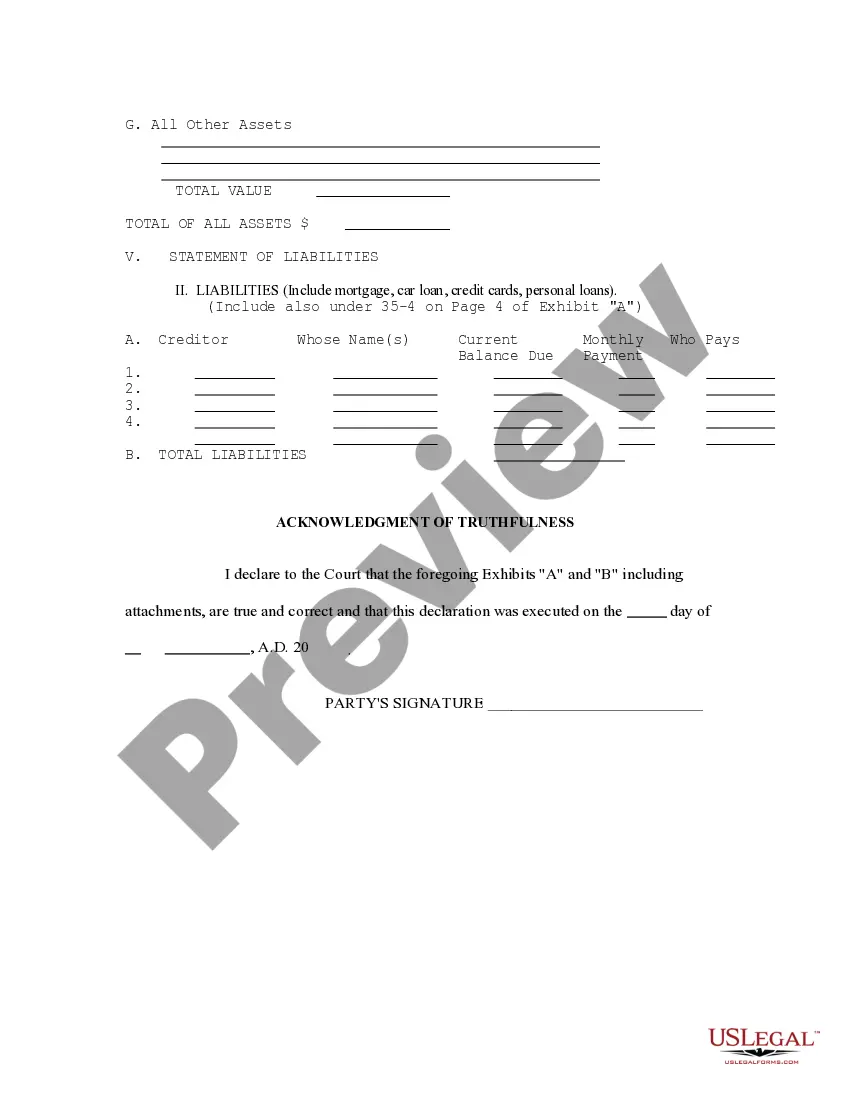

- Liabilities section, outlining all debts and financial obligations

- Monthly expenses, providing insight into your cost of living

When this form is needed

This Financial Statement should be used in various family law contexts, such as divorce proceedings, child support determinations, or custody hearings. It is essential whenever there is a need to disclose financial information to ensure fair proceedings and support decisions made by the court.

Who should use this form

This form is intended for:

- Individuals initiating or responding to a family law case

- Parties involved in divorce or custody disputes

- Anyone required to provide financial disclosure to the court

Instructions for completing this form

- Identify yourself at the top of the document with your name and contact information

- List all sources of income in the designated section, providing accurate amounts

- Detail your assets, including real property and personal belongings

- Outline your liabilities by including any outstanding debts

- Complete the monthly expenses section to reflect your living costs

Does this document require notarization?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all sources of income

- Underestimating or omitting liabilities

- Not providing accurate or complete descriptions of assets

- Forgetting to sign and date the form

Advantages of online completion

- Convenient access from anywhere with an internet connection

- Easy to fill out and edit before final submission

- Reliable templates created by licensed attorneys to ensure accuracy

Looking for another form?

Form popularity

FAQ

Balance Sheet. Income Sheet. Statement of Cash Flow. Step 1: Make A Sales Forecast. Step 2: Create A Budget for Your Expenses. Step 3: Develop Cash Flow Statement. Step 4: Project Net Profit. Step 5: Deal with Your Assets and Liabilities.

List your assets (what you own), estimate the value of each, and add up the total. Include items such as: List your liabilities (what you owe) and add up the outstanding balances. Subtract your liabilities from your assets to determine your personal net worth.

A complete set of financial statements is made up of five components: an Income Statement, a Statement of Changes in Equity, a Balance Sheet, a Statement of Cash Flows, and Notes to Financial Statements. This chapter of the Accounting 101: The Basics course presents the components of a financial statements package.

There are four main financial statements. They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders' equity. Balance sheets show what a company owns and what it owes at a fixed point in time.

The statement of financial position is formatted like the accounting equation (assets = liabilities + owner's equity). Thus, the assets are always listed first.

The basic format for an income statement states revenues first, followed by expenses. The expenses are subtracted from the revenue to calculate the net income of the business.

For example, if you have a house and a car with a value of $100,000, and you have a mortgage and car loan for $75,000, your net worth is $25,000. Net worth for an individual is similar to owner's equity for a business. Therefore, a personal financial statement is similar to a business's balance sheet.

Statement of Cash Flows. A cash flow statement is one of the most important planning tools you have available. Income Statement. Like a cash flow statement, an income statement is one of the most important and valuable financial statements at your disposal. Balance Sheet. Statement of Changes in Equity.

Calculate your income carefully. Be sure to include all income. Be sure to also include all expenses. Do not double dip. Only include your income. Only include your expenses. Gather all appropriate documentation. Don't forget to designate separate property.