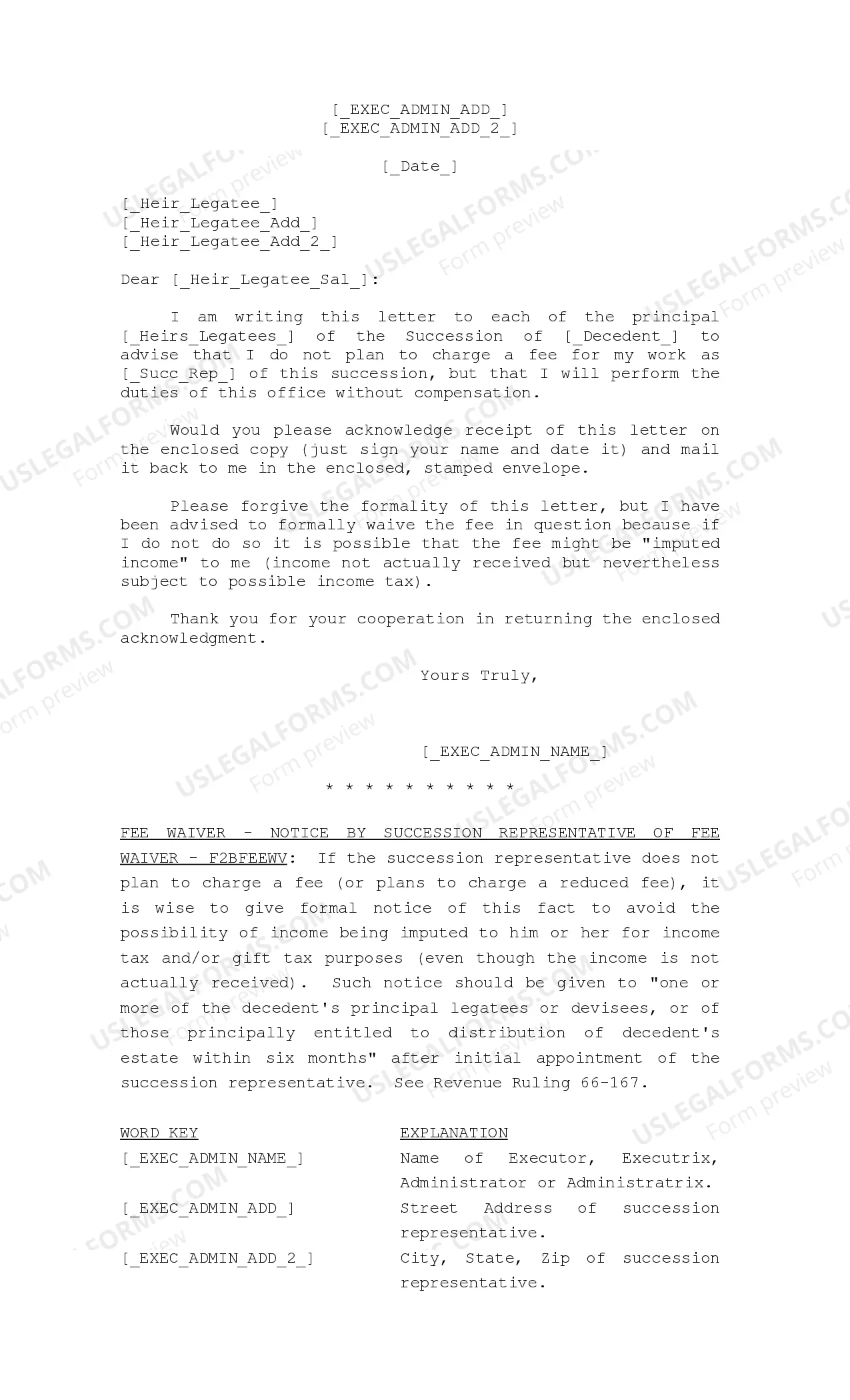

Louisiana Letter to principal Heirs Legatees of the Secession of Decedent

Description

How to fill out Louisiana Letter To Principal Heirs Legatees Of The Secession Of Decedent?

Greetings to the largest repository of legal documents, US Legal Forms. Here you can discover any template, such as Louisiana Letter to principal Heirs Legatees of the Secession of Decedent samples and download them (as many as you require). Prepare official paperwork in a matter of hours, rather than days or even weeks, without having to spend a fortune on an attorney. Obtain your state-specific template with just a few clicks and feel confident knowing it was created by our licensed attorneys in your state.

If you’re an existing subscriber, simply Log Into your account and hit Download beside the Louisiana Letter to principal Heirs Legatees of the Secession of Decedent you wish to acquire. Being that US Legal Forms is a digital service, you will typically have access to your saved documents, regardless of the device you’re using. View them in the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our guidelines below to begin: If this is a document tailored for your state, verify its relevance to your state. Review the description (if provided) to determine if it’s the suitable template. Explore more details using the Preview feature. If the document fulfills all your requirements, click Buy Now. To create your account, choose a pricing option. Utilize a credit card or PayPal account to register. Save the template in your preferred format (Word or PDF). Print the document and fill it in with your or your business’s information. Once you’ve completed the Louisiana Letter to principal Heirs Legatees of the Secession of Decedent, send it to your attorney for review. It’s an extra step, but an important one to ensure you’re completely protected. Join US Legal Forms today and gain access to a multitude of reusable templates.

When you’ve filled out the Louisiana Letter to principal Heirs Legatees of the Secession of Decedent, forward it to your attorney for validation. It’s an extra measure but a crucial one for ensuring you’re fully protected. Become a member of US Legal Forms now and tap into a wealth of reusable templates.

- If this is a document specific to your state, confirm its applicability in your region.

- Check the description (if there is one) to ensure it’s the correct template.

- View additional information with the Preview option.

- If the document meets all your criteria, click Buy Now.

- To create your account, choose a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Download the template in your desired format (Word or PDF).

- Print the document and complete it with your or your business’s details.

Form popularity

FAQ

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

Court costs for Louisiana successions can range from $250 to $500 depending on parish. If any issues are apparent or litigation is necessary, the cost could easily go higher.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

Immediately at the death of the decedent, universal successors acquire ownership of the estate and particular successors acquire ownership of the things bequeathed to them.

Under Louisiana's intestate succession laws, separate property is distributed first to a deceased person's children. Each child of the deceased person will share equally in the separate property.At Shemp's death, his two surviving children (Curly and Larry) will each inherit one-third of his separate property.

Maximum $125,000 (CCP 3421 Small Successions Defined) Laws CCP 3432. Step 1 Write in the full name of the person who died. Step 2 Write in the State and County or Parish in which the decedent resided at the time of death. Step 3 Write in the names of the two people signing the petition.

Harris County Civil Courthouse. 201 Caroline, Suite 800. (713) 274-8585.