Louisiana Notice of Contract - Corporation or LLC

What is this form?

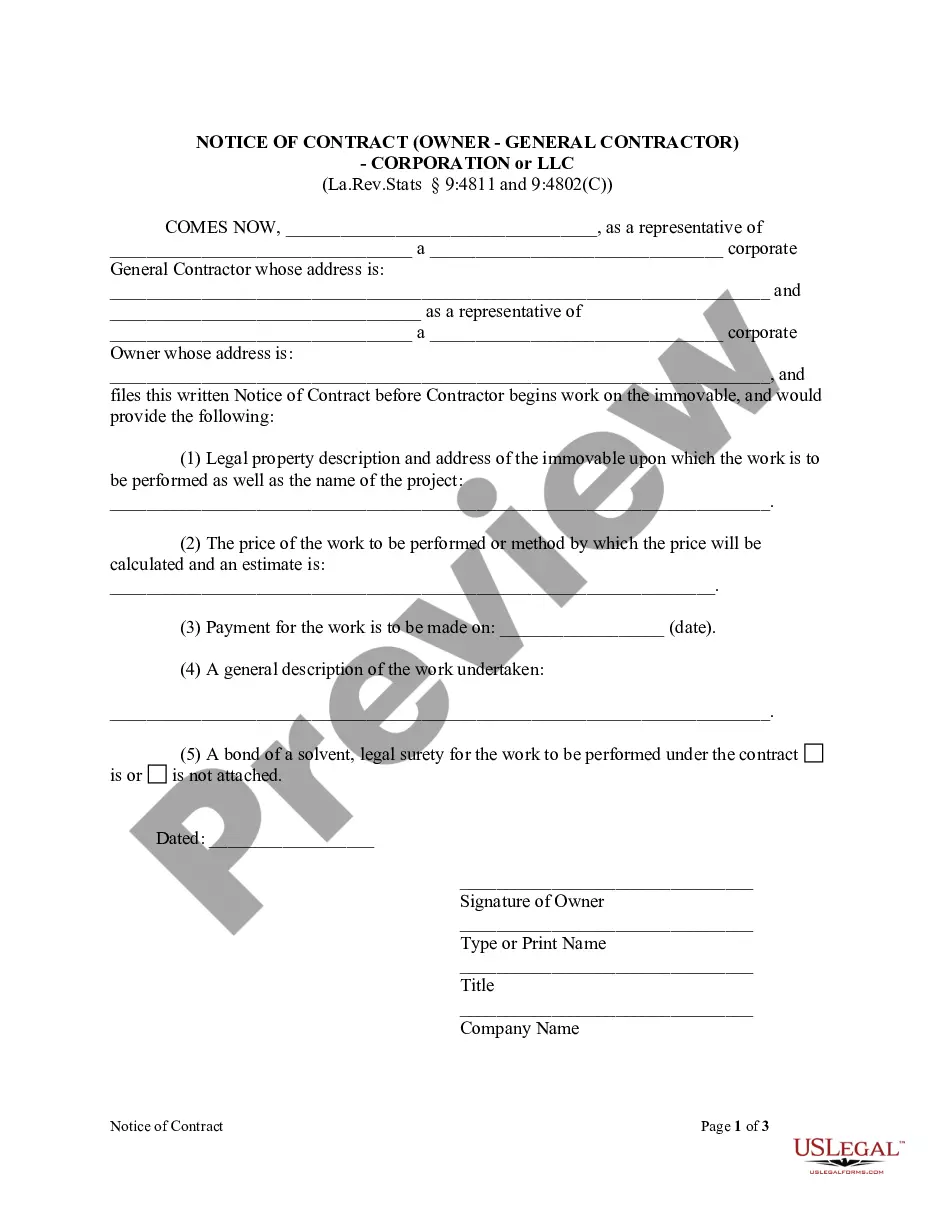

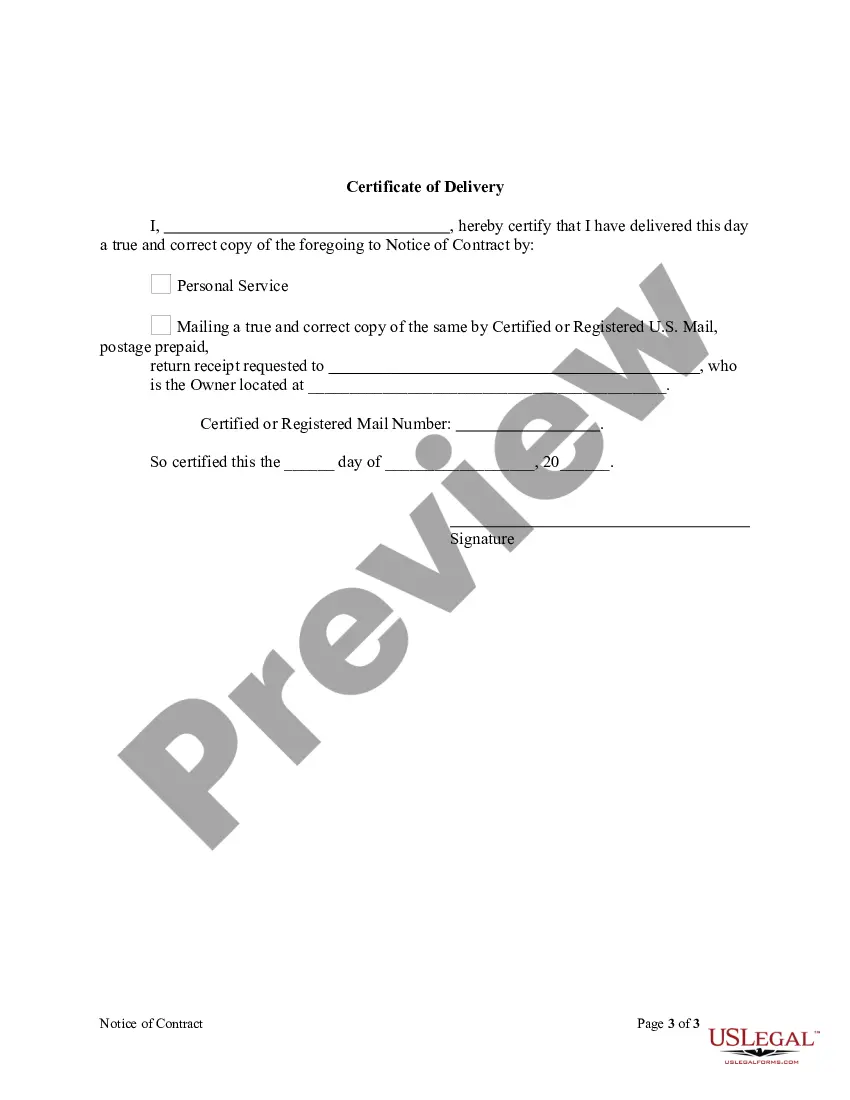

The Notice of Contract - Corporation or LLC is a legal document that notifies stakeholders of a contract between a contractor and an owner before work begins on a property. This form outlines crucial details such as the legal property description, project name, estimated price, payment dates, and a general description of the work to be performed. Unlike similar documents, this notice specifically applies to corporations and LLCs, setting clear expectations for both parties involved in the contractual agreement.

What’s included in this form

- Legal property description and address.

- Name of the project.

- Price of the work or method for price calculation.

- Payment date for the work performed.

- General description of the work undertaken.

- Indication of whether a bond for surety is attached.

When to use this document

This form should be used when a corporation or LLC is entering into a contract for work on a property. It is applicable before the contractor commences any work, ensuring that all parties are informed about the terms and obligations associated with the project. Use this form to establish legal recognition of the contract and to protect the interests of both the contractor and property owner.

Who should use this form

- Corporations that wish to engage a contractor for construction or renovation work.

- LLCs entering contracts for property improvements.

- Property owners who are hiring corporate contractors.

- Legal representatives of corporations and LLCs involved in construction contracts.

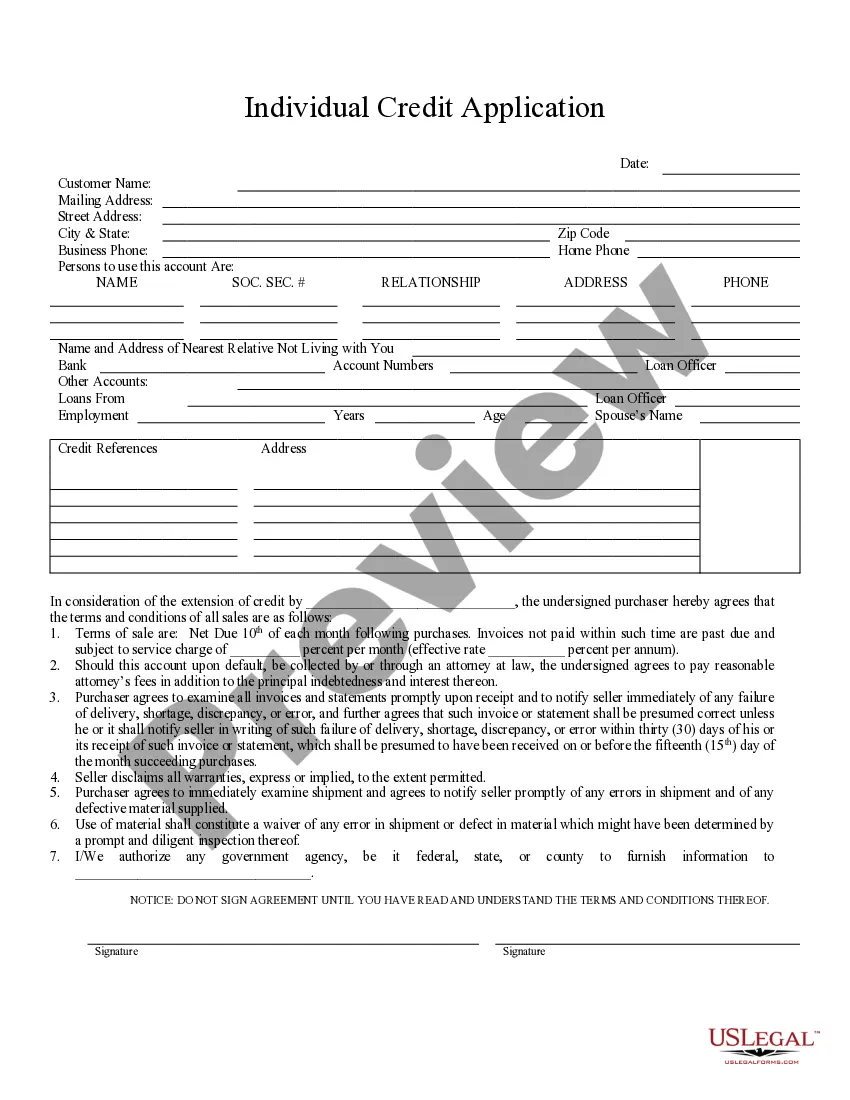

How to prepare this document

- Identify the parties involved: enter the names and addresses of both the owner and the contractor.

- Specify the property: provide the legal description and address of the property where work will be conducted.

- Enter project details: include the project name and estimated price or pricing method.

- Include payment information: state the date when payment for work is due.

- Describe the work: give a general overview of the tasks to be performed.

- Attach a surety bond: indicate whether a bond is provided for the work under the contract.

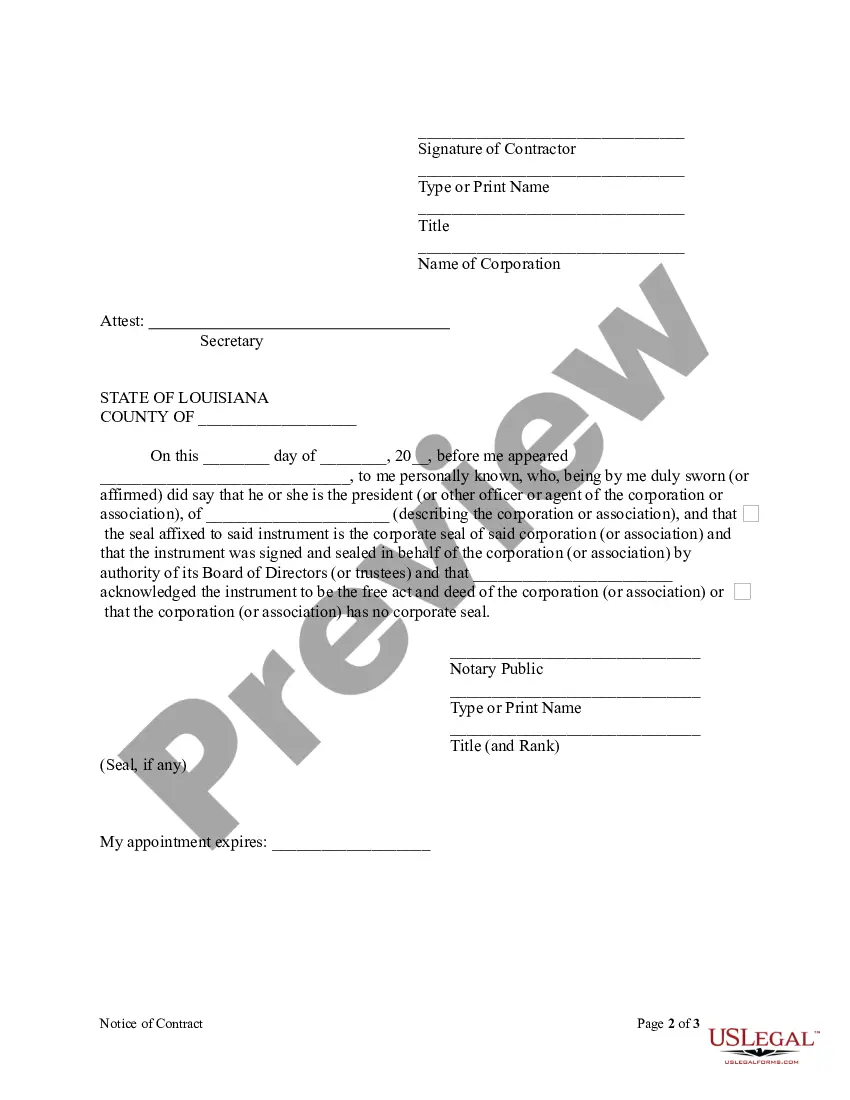

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include a legal property description.

- Not specifying the payment method or date clearly.

- Leaving out project details or a description of the work.

- Not acquiring necessary signatures from all involved parties.

- Neglecting to attach the bond if required.

Why use this form online

- Convenient access to download and complete the form anytime.

- Edit and customize the document according to specific project needs.

- Reliable source of templates drafted by licensed attorneys.

- Secure storage of completed forms for future reference.

Looking for another form?

Form popularity

FAQ

The State of Louisiana requires you to file an annual report for your LLC. You can file your annual report online at the SOS website. You also can go online to print out a paper annual report to file by mail. The annual report is due on or before the anniversary date of your LLC's formation.

The State of Louisiana requires you to file an annual report for your LLC. You can file your annual report online at the SOS website. You also can go online to print out a paper annual report to file by mail. The annual report is due on or before the anniversary date of your LLC's formation.

After a certain amount of time past the due date, if the report still isn't filed, the jurisdiction will revoke your company's good standing or put it into a forfeited status.Most states require the past due annual report as well as an additional certificate of reinstatement and more fees.

STEP 1: Name your Louisiana LLC. STEP 2: Choose a Registered Agent in Louisiana. STEP 3: File the Louisiana LLC Articles of Organization. STEP 4: Create a Louisiana LLC Operating Agreement. STEP 5: Get an EIN.

How to File Your Annual Report. If you do need to file an annual report for your LLC or corporation, you can normally do so online, through your state's website. In addition to filing your annual report, you will also need to pay a fee These fees do vary from state to state and could range between $50 and $400.

LLC Taxes in CaliforniaCalifornia LLCs must pay an annual $800 LLC tax. California LLC taxes are due by April 15th, just like federal taxes, and should be paid to the California Franchise Tax Board. You must pay this tax even if your LLC doesn't earn any income.

Step 1: Name Your LLC. Step 2: Choose Your Louisiana Registered Agent. Step 3: File the Louisiana LLC Articles of Organization. Step 4: Create an LLC Operating Agreement. Step 5: Get an EIN and Complete Form 2553 on the IRS Website.

SuBCHAPTER s CORPORATIONs Louisiana law does not recognize Subchapter S corporation status, and an S corporation is required to file in the same manner as a C corporation. However, in certain instances, all or part of the corporation income can be excluded from Louisiana tax.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Obtain an EIN. File Annual Reports.