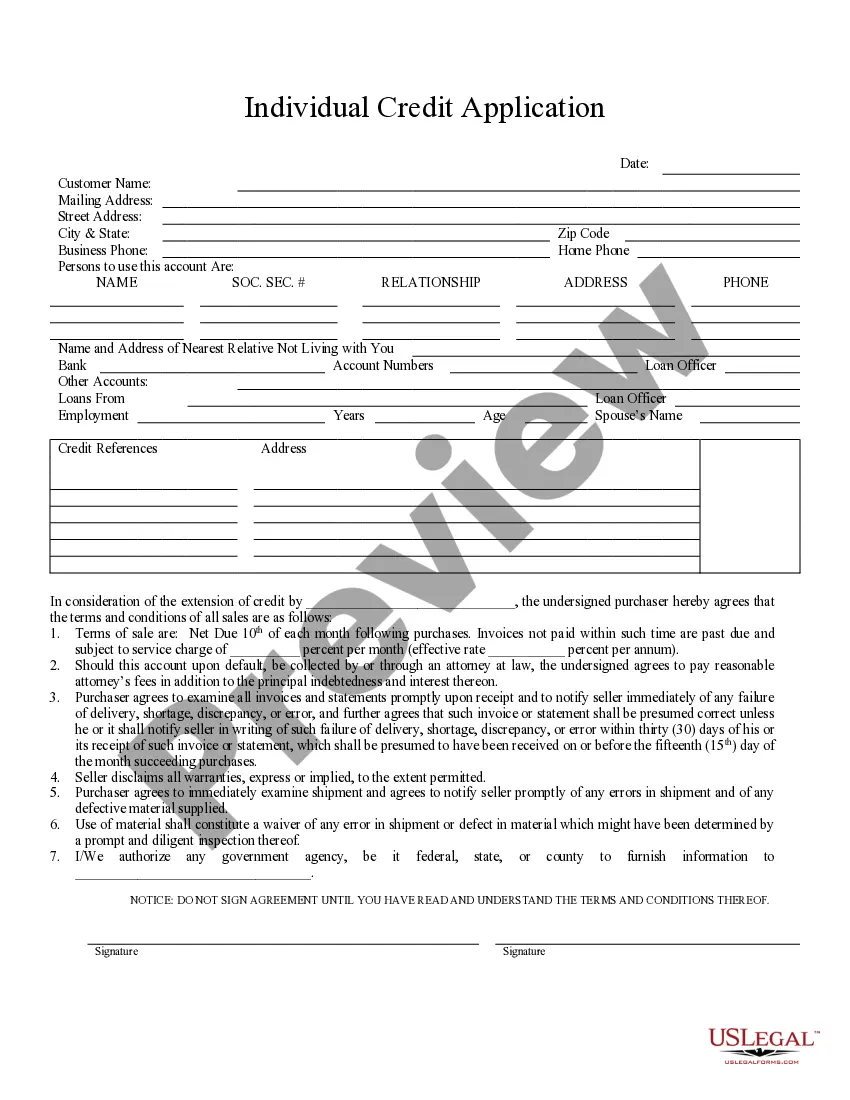

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Iowa Individual Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Iowa Individual Credit Application?

Gain access to one of the largest collections of legal documents.

US Legal Forms is a platform where you can discover any state-specific paperwork within moments, including Iowa Individual Credit Application formats.

No need to waste hours searching for a legally acceptable sample.

After choosing a pricing option, create an account. Pay using a credit card or PayPal. Download the document to your device by clicking Download. That's it! You should complete the Iowa Individual Credit Application format and review it. For assurance that everything is accurate, consult your local legal advisor for assistance. Register and easily access over 85,000 useful samples.

- To utilize the forms library, choose a subscription plan and create your account.

- Once done, simply Log In and then select Download.

- The Iowa Individual Credit Application format will instantly be saved in the My documents section (the section for all documents you save on US Legal Forms).

- To set up a new account, follow the straightforward instructions provided below.

- If you plan to use a state-specific document, ensure you select the correct state.

- If possible, check the description to understand all details of the document.

- Use the Preview feature if available to inspect the document's details.

- If everything looks good, select Buy Now.

Form popularity

FAQ

In Iowa, there is no standard age at which seniors stop paying property taxes; however, certain programs can significantly reduce their property tax burden. These programs often depend on income and other qualifying criteria. When completing the Iowa Individual Credit Application, seniors should explore available tax relief options to better understand how to manage their property taxes.

Eligibility for the Iowa homestead tax credit typically includes homeowners who use their property as their primary residence and meet specific income requirements. This credit helps lower property taxes for eligible applicants. The Iowa Individual Credit Application will guide you through the process of determining your eligibility and applying for this benefit.

The disadvantages of PTET include the initial complexity of filing and the requirement for entity-level taxation, which may not be ideal for all businesses. Additionally, not every entity can benefit from this election, and it may lead to higher upfront costs. However, if you assess your situation carefully, using the Iowa Individual Credit Application can highlight how PTET may still be advantageous for you.

The personal exemption credit in Iowa is a tax benefit that reduces the amount of tax you owe based on your personal circumstances, such as the number of dependents. This credit is designed to alleviate some of the tax burden and provide financial relief. When applying through the Iowa Individual Credit Application, make sure to consider this credit as part of your overall tax strategy.

Personal exemption credit refers to a tax benefit that lowers your taxable income based on the number of allowed exemptions for yourself and your dependents. This credit is designed to alleviate some of the tax burden on individual taxpayers. To ensure you are receiving every available credit, using the Iowa Individual Credit Application can help streamline the process and keep you informed about what you qualify for.

A personal exemption in Iowa significantly reduces your taxable income. As of recent guidelines, the exemption can amount to several thousand dollars, allowing taxpayers to lower their overall tax liability. When completing the Iowa Individual Credit Application, be sure to account for your personal exemptions to maximize your refund or minimize your tax due.

If you qualify as head of household, you may be entitled to a special tax credit designed to benefit individuals supporting dependents. The amount of this credit can vary based on your income and filing status, but it generally offers preferred treatment compared to other filing statuses. The Iowa Individual Credit Application serves as a valuable tool to assess your eligibility and calculate the potential credit.

The homestead exemption in Iowa can provide significant savings on property taxes. Homeowners may benefit from a reduction in the assessed value of their home, leading to lower overall taxes. Utilizing the Iowa Individual Credit Application can help you confirm your eligibility for this exemption and ensure you are maximizing your savings.

To determine if you are exempt from Iowa income tax, you should first review the specific eligibility criteria set by the Iowa Department of Revenue. Generally, certain retirement incomes, disability payments, and a few other categories might qualify for exemption. Additionally, using the Iowa Individual Credit Application can help guide you through the process and clarify your tax responsibilities.

Real property tax credit is generally available to eligible homeowners who meet certain income and residency requirements. This program helps alleviate the tax burden based on assessed property value. To determine your eligibility and apply, utilize the Iowa Individual Credit Application for a straightforward process.