Michigan Heirship Affidavit - Descent

What this document covers

The Heirship Affidavit - Descent is a legal document that allows an individual (the affiant) to certify the heirs of a deceased person. This form serves to establish legal rights to inherit personal and real property when there is no will. Unlike a will, which specifies how the deceased's assets should be distributed, an heirship affidavit is often used to assert rightful ownership, particularly when selling property or settling an estate.

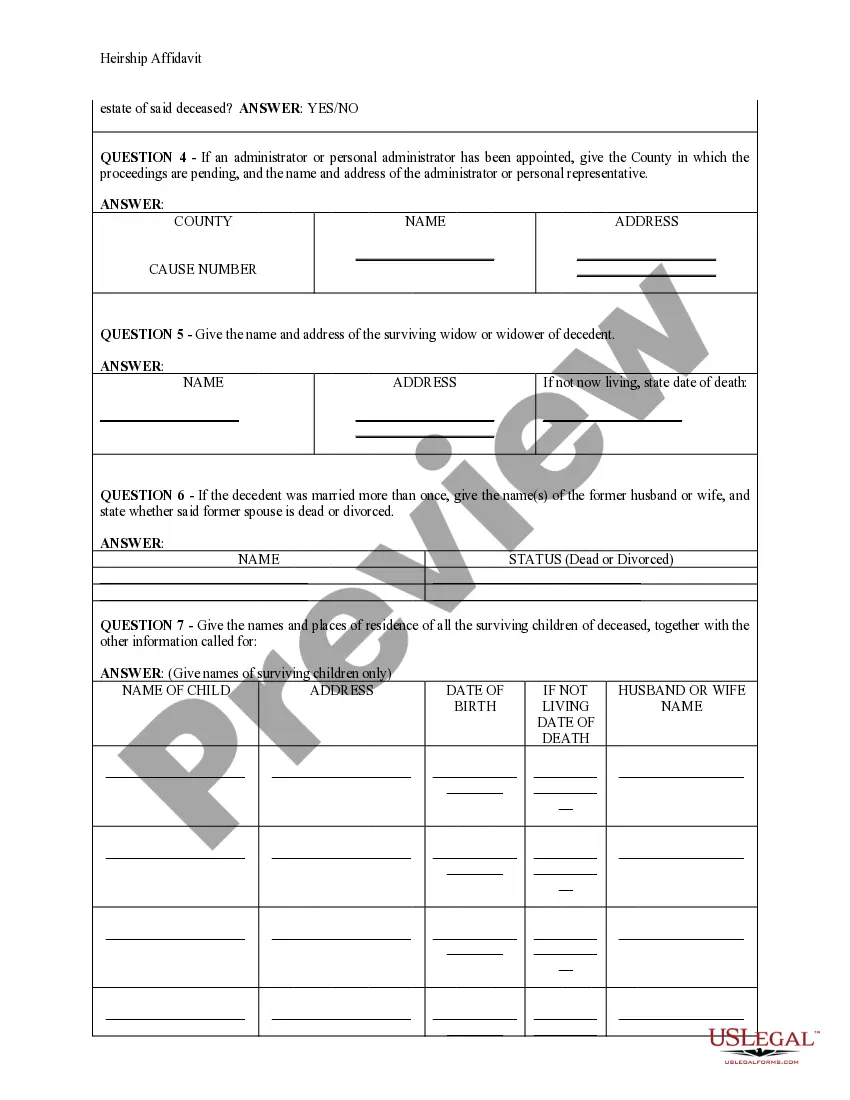

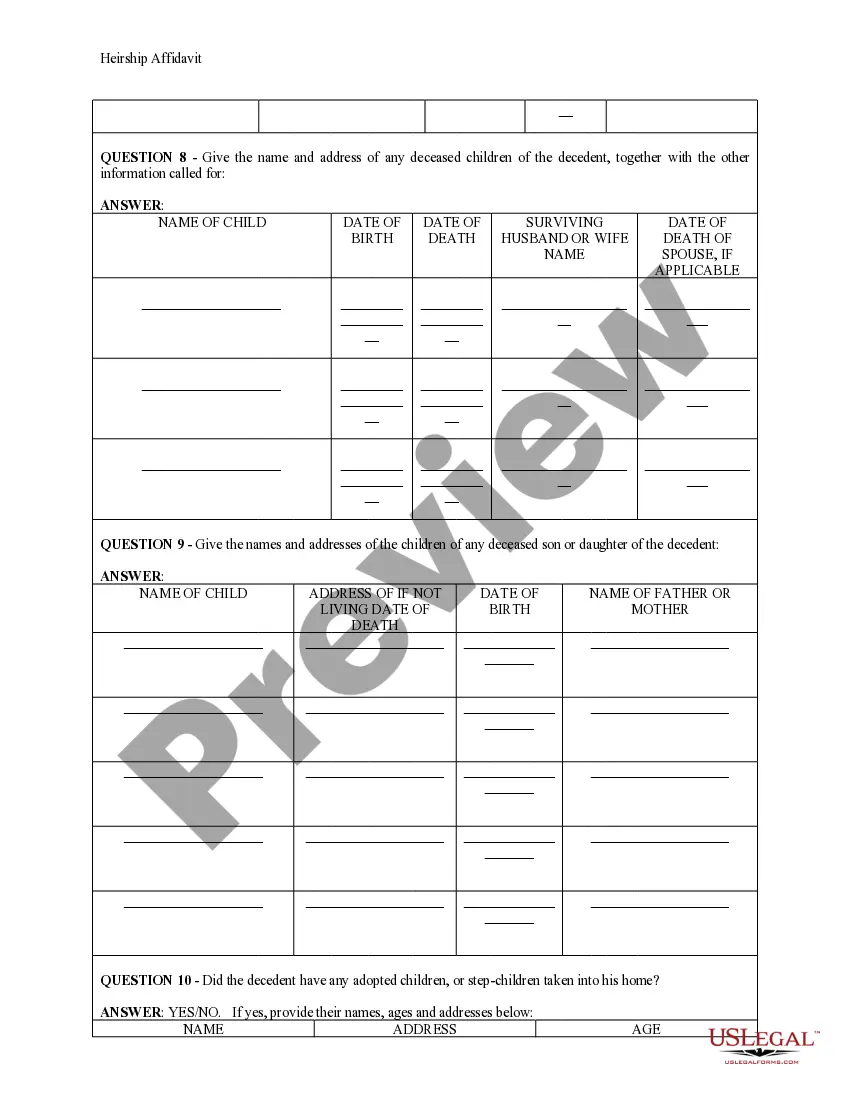

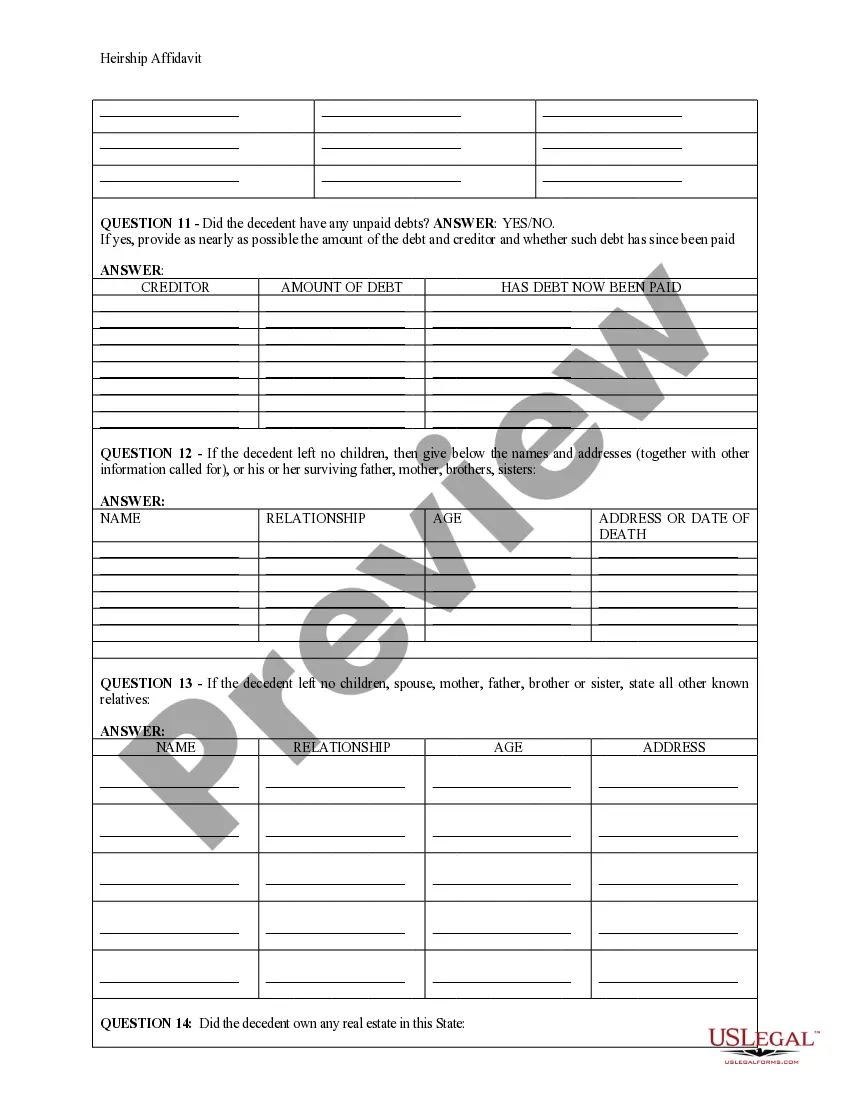

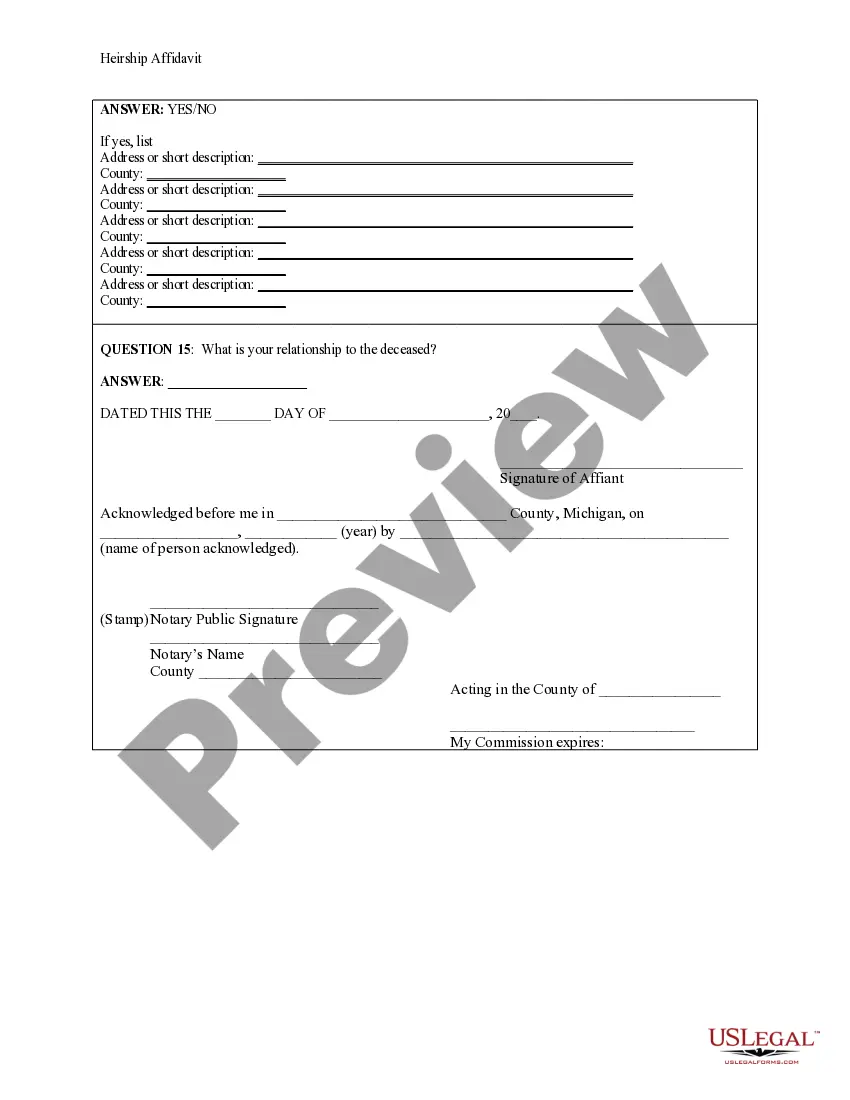

What’s included in this form

- Affiant's personal information and relationship to the deceased

- Details about the deceased, including their name, date of death, and last residence

- Questions about the existence of a will and the probate process

- Information on surviving family members, including spouses, children, and other relatives

- Declaration of whether the deceased owned any real estate

- Signature of the affiant and the notary public

Common use cases

This form is commonly used in situations where an individual needs to declare heirs of a deceased person, particularly when the deceased died without a will. For example, if a person passes away and leaves behind property but has not designated heirs through a will, the heirs can use this affidavit to establish their right to the property for purposes such as sale or transfer.

Who can use this document

- Individuals who need to declare the heirs of a deceased family member

- Those selling property that belonged to the deceased

- Surviving family members who need to settle the estate

- Affiants who are not heirs or directly involved in the estate

How to prepare this document

- Identify the affiant and enter their name and address.

- Provide information about the deceased, including their name, date of death, and residence details.

- Answer the questions concerning the decedent's will and the probate status.

- List the names and addresses of surviving family members and any relevant relationships.

- Sign the affidavit in the presence of a notary public to ensure its validity.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to provide complete information about the deceased.

- Not answering all questions thoroughly, especially regarding the existence of a will.

- Having the wrong person act as affiant when they are also an heir.

- Neglecting to verify the affidavit before signing, leading to inaccuracies.

Benefits of using this form online

- Convenience of accessing and downloading the form from home.

- Ability to fill out the form at your own pace and edit as needed.

- Access to templates drafted by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

In Michigan you can use an Affidavit if the estate does not include real property and the value of the entire estate, less liens and encumbrances, is less than $15,000. There is a 28-day waiting period.

The Illinois small estate affidavit provides a streamlined way for an heir-at-law of a decedent to gather and distribute the assets of the estate of a person who died, provided that no other petition to open an estate in probate court has been filed and that the assets of the person who died do not exceed $100,000.

To be able to file a small estate affidavit in Texas for a loved one, when no will was executed, you must be a person who would inherit under Texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or children).

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

But for estates in Michigan that exceed the small estate's threshold, and for which there is either no Will, or a Will (but not a Living Trust), probate will be required before an estate can be tranferred to the decedent's heirs or beneficiaries.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.