Kentucky Warranty Deed to Child Reserving a Life Estate in the Parents

What is this form?

This Warranty Deed to Child Reserving a Life Estate allows parents to transfer property ownership to their child while retaining a life estate. This means that the parents can continue to live on and use the property throughout their lifetime, even after the title has been formally transferred. This type of deed can help avoid complications in inheritance and provides peace of mind for parents who wish to maintain their living arrangement.

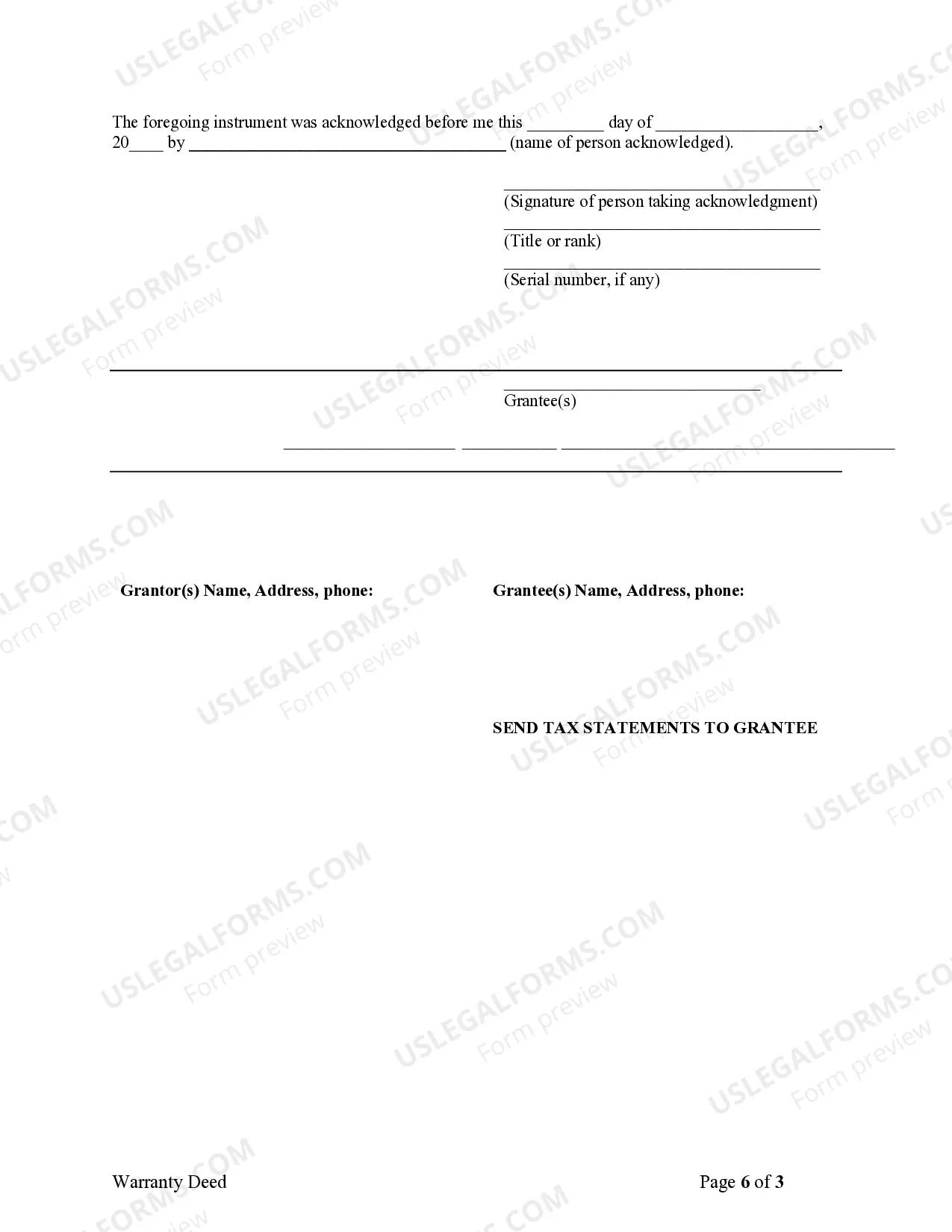

Key parts of this document

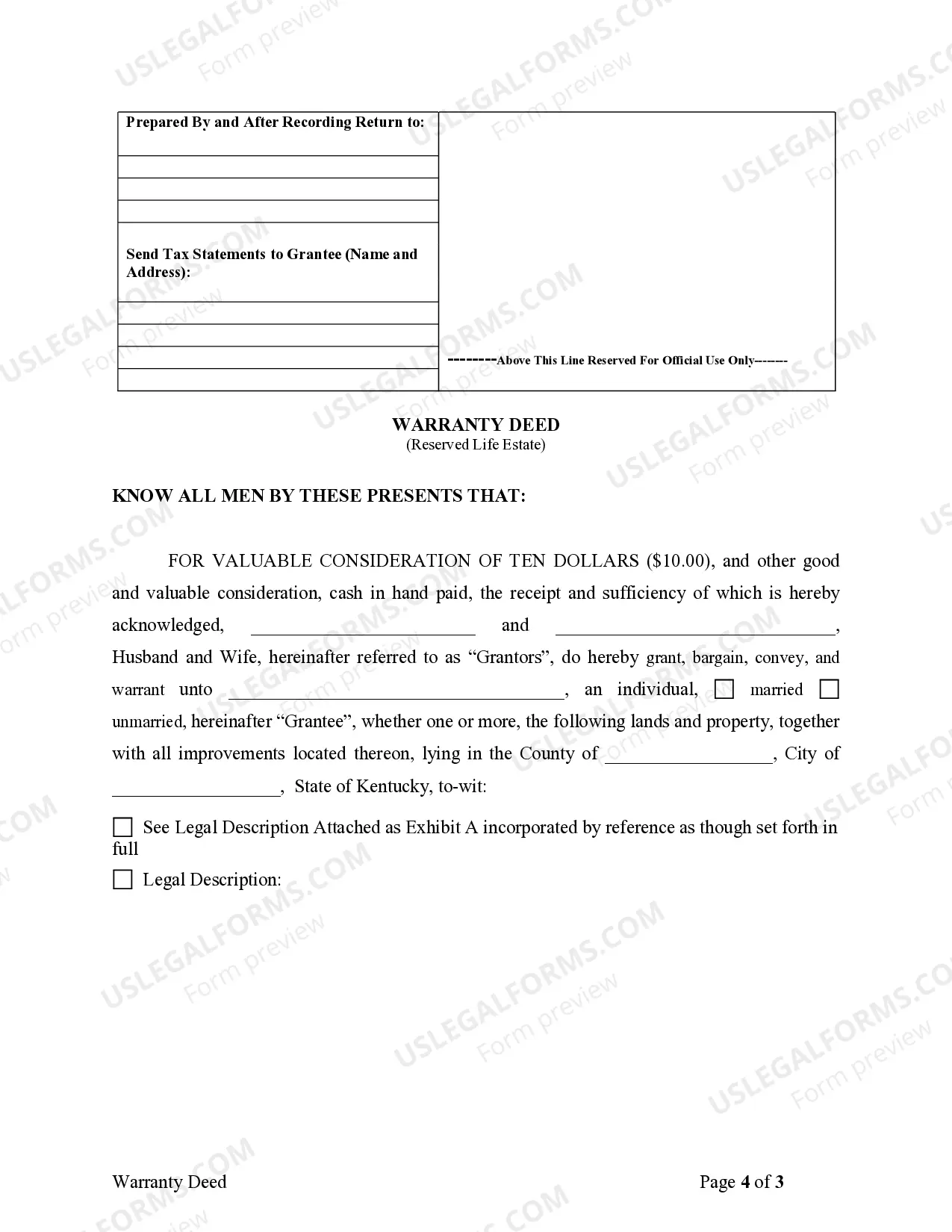

- Names of the grantor(s) and grantee(s).

- Description of the property being conveyed.

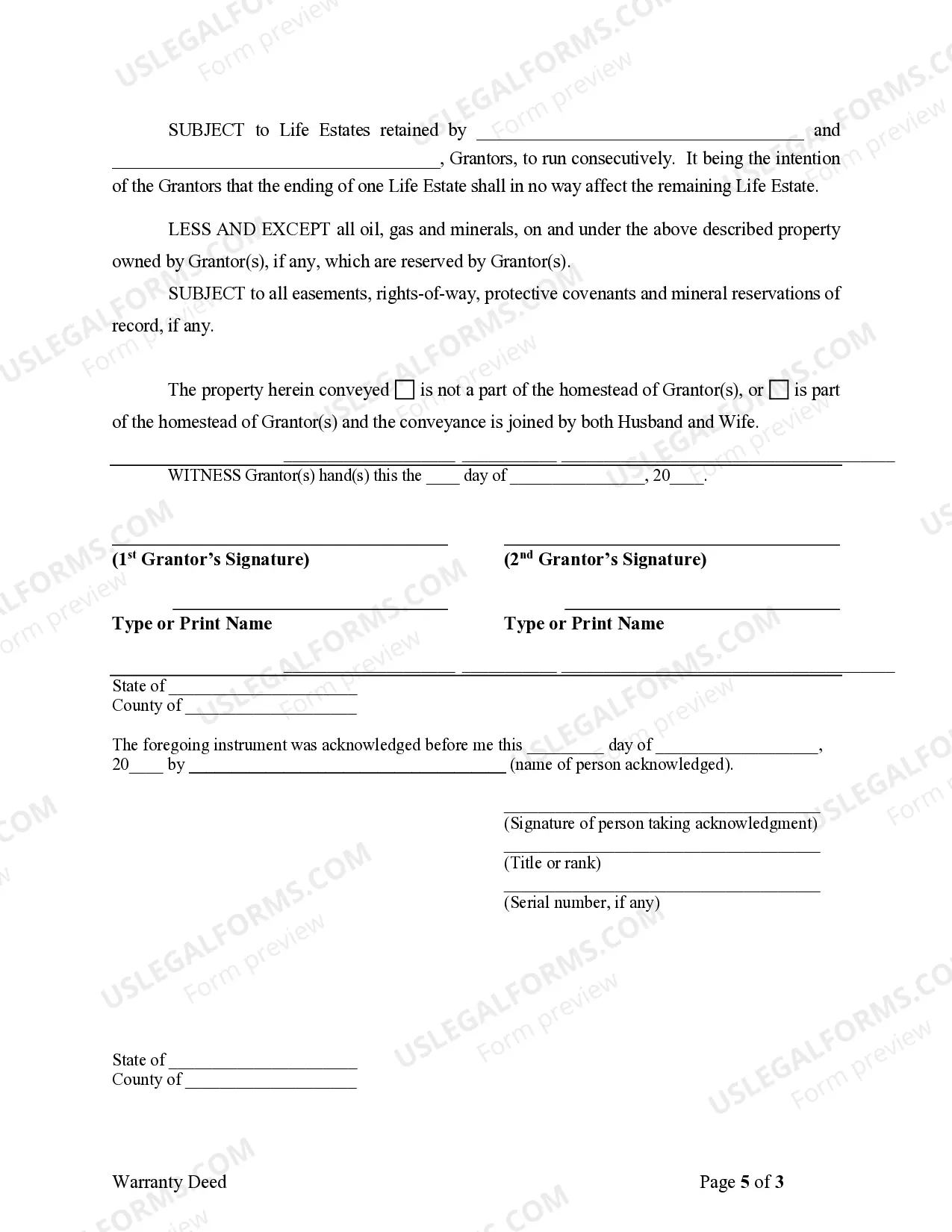

- Reservation of a life estate for the grantor(s).

- Signatures and dates for legal validation.

- Notary public acknowledgment.

When to use this document

This form is ideal when parents wish to transfer property ownership to their child but want to retain the right to live in or use the property until they pass away. It is often used in estate planning to ensure a smooth transfer of assets while allowing the parents to remain in the home they love.

Who needs this form

Individuals who should consider using this form include:

- Parents looking to transfer property to their children.

- Individuals wishing to maintain control and use of a property during their lifetime.

- Estate planners seeking to simplify property transfer after death.

How to prepare this document

- Identify the parties involved, including the names of the parents (grantor(s)) and the child (grantee).

- Provide a clear description of the property being transferred.

- Indicate the date of transfer and any conditions regarding the life estate.

- Obtain the necessary signatures from all grantor(s) and include the date.

- Have the form notarized to validate the transaction formally.

Does this document require notarization?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all required signatures.

- Not providing a complete or accurate legal description of the property.

- Overlooking the need for notarization before submitting the form.

- Not understanding the implications of reserving a life estate.

Advantages of online completion

- Convenient access to legal documents at any time.

- Editability to ensure all information is accurate before printing.

- Reliability of forms drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

A life estate deed allows you to transfer property while reserving an interest during your lifetime or during the lifetime of someone else. Once the person who holds the life estate passes away, the Grantee fully owns the property.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.

Reservation of the present interest allows the owner to retain ownership for a period of time measured by the life of one or more individuals, by a term of years, or by a combination of the two.

The two types of life estates are the conventional and the legal life estate. the grantee, the life tenant. Following the termination of the estate, rights pass to a remainderman or revert to the previous owner.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.In the right situations, it can be a streamlined and easy way to transfer ownership.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.