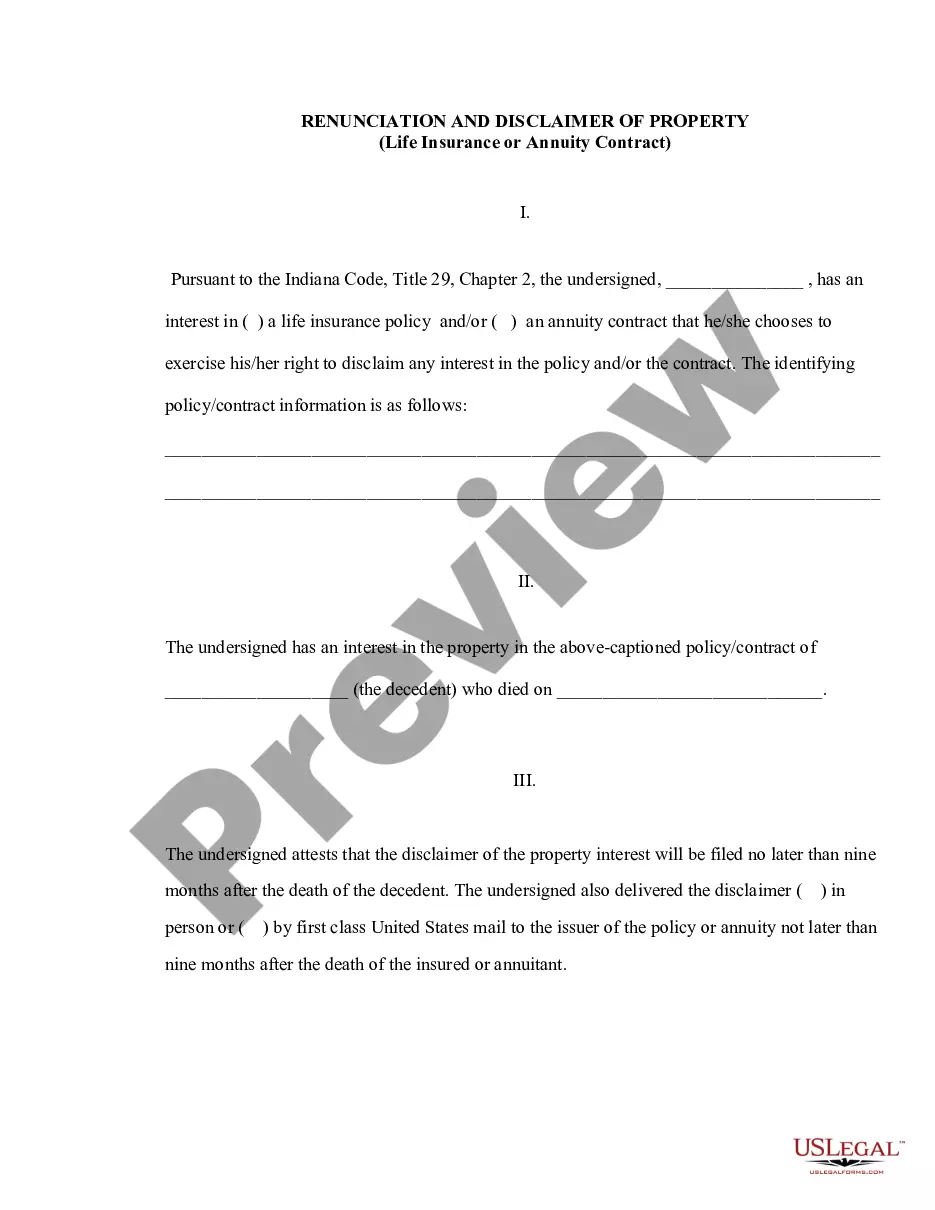

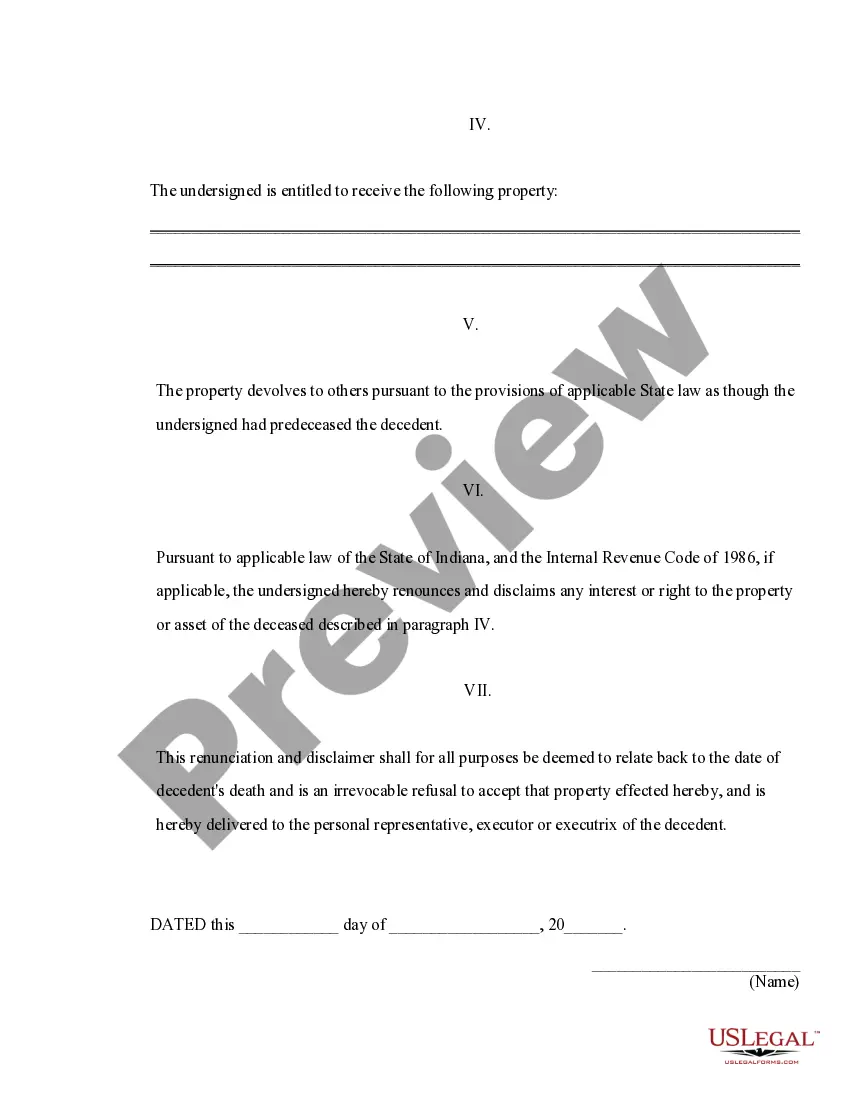

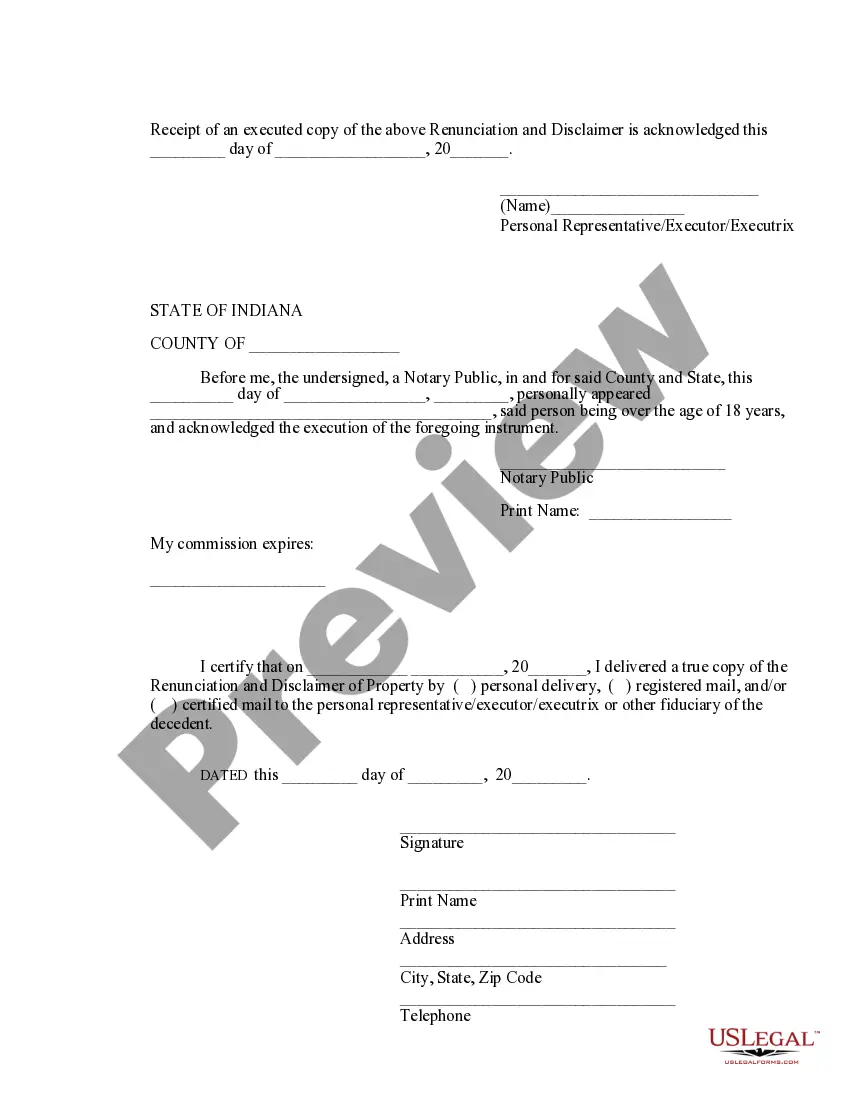

This form is a Renunciation and Disclaimer of a Life Insurance Policy and/or Annuity Contract proceeds. Upon the death of the decedent, the beneficiary gained an interest in the proceeds of the decedent's policy and/or contract. Pursuant to the Indiana Code, Title 29, Chapter 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. The renunciation will relate back to the date of death of the decedent and will serve as an irrevocable refusal to accept the proceeds. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Indiana Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Indiana Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

Searching for Indiana Waiver and Disclaimer of Assets from Life Insurance or Annuity Agreement example and completing them could pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate template tailored for your state with just a few clicks.

Our legal experts prepare every document, so you only need to complete them. It's truly that simple.

Click the Buy Now button if you've found what you're looking for. Choose your plan on the pricing page and create your account. Select whether you wish to pay by credit card or via PayPal. Download the file in your preferred format. Now you can print the Indiana Waiver and Disclaimer of Assets from Life Insurance or Annuity Agreement form or complete it using any online editor. No need to worry about typographical errors as your sample can be used and submitted, and printed out as many times as you require. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to download the document.

- All of your saved templates are stored in My documents and are available anytime for further use later.

- If you haven’t signed up yet, you need to register.

- Follow our comprehensive guidelines on how to obtain your Indiana Waiver and Disclaimer of Assets from Life Insurance or Annuity Agreement form in a few minutes.

- To find a valid sample, verify its eligibility for your state.

- Review the sample using the Preview option (if it’s available).

- If there's a description, read it to understand the details.

Form popularity

FAQ

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

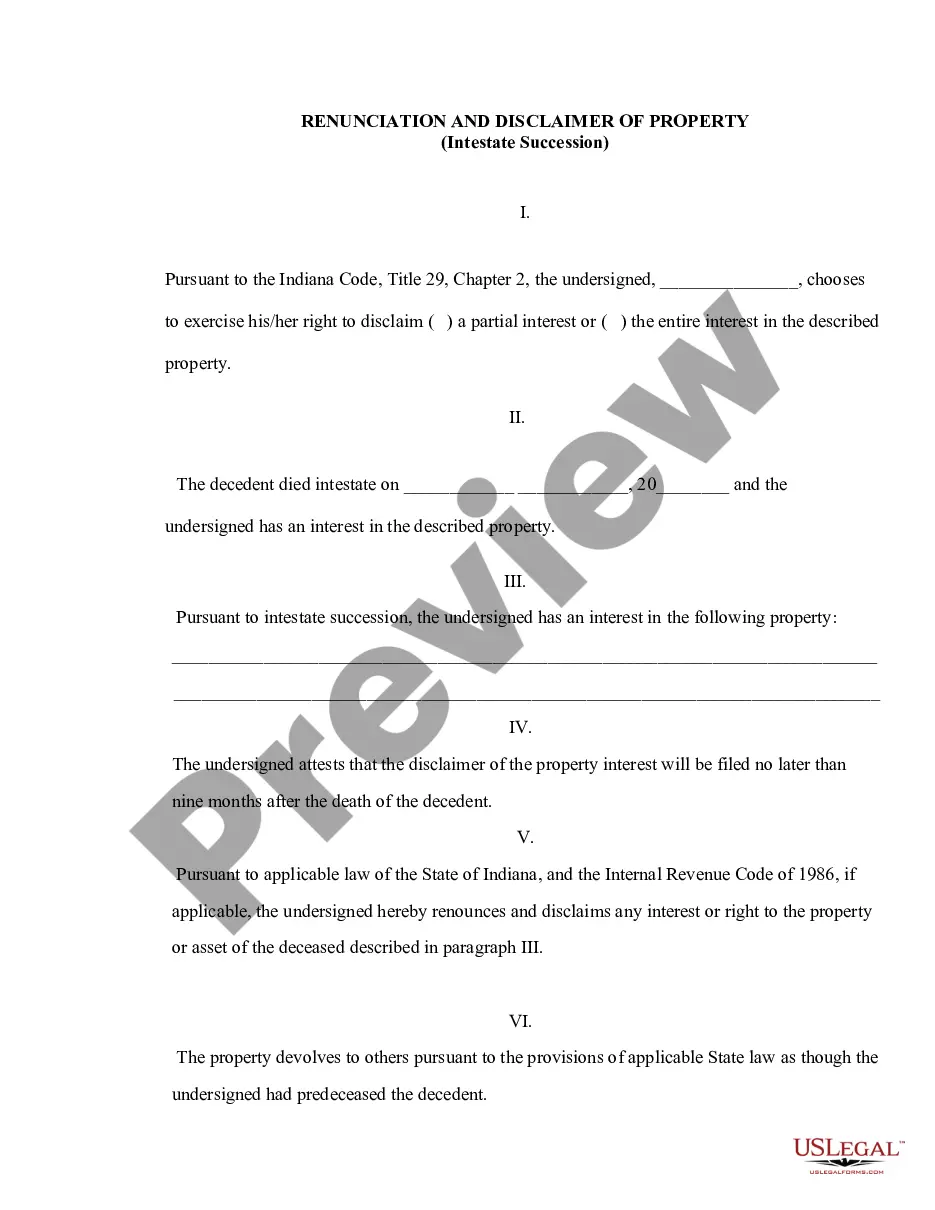

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.

No, a disclaimer does not need to be notarized.To get the most legal protection out of your disclaimers, display them in accessible places for users to see, such as linking to the disclaimer page in the website footer, and including it in the terms and conditions.