Illinois Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Understanding this form

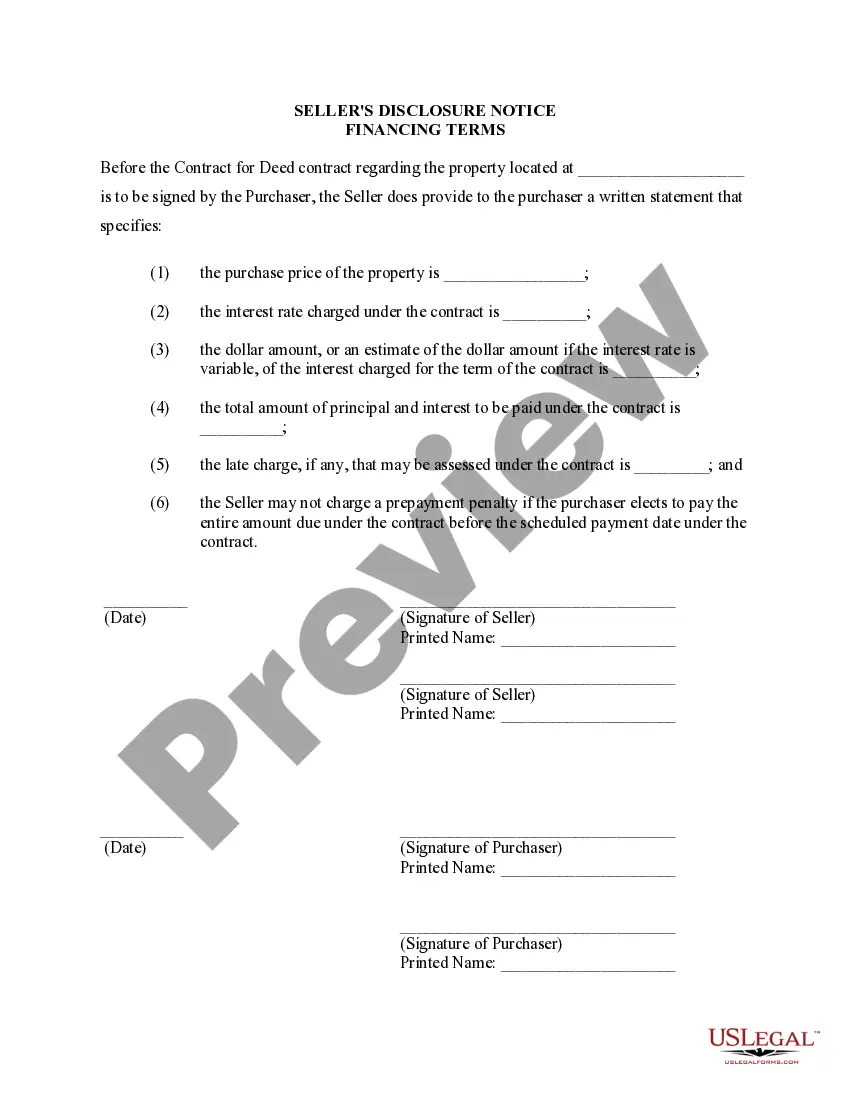

The Seller's Disclosure of Financing Terms for Residential Property is a legal document that provides detailed information regarding the purchase price, payment terms, interest rates, and any late charges associated with a property being sold under a contract for deed. This form serves as a crucial notice to the purchaser, ensuring transparency in financial terms before finalizing the agreement. It differs from general contracts as it specifically outlines financing details that are essential for both parties to understand their financial obligations clearly.

Key parts of this document

- Identification of parties involved: Seller and Purchaser details.

- Property description: Specifics about the residential property being sold.

- Purchase price: Total amount for the property being sold.

- Payment terms: Outline of installment amounts, schedule, and due dates.

- Interest rates: Specification of any applicable interest on the amounts due.

- Late charges: Information on penalties if payments are not made on time.

When to use this document

This form should be used when selling residential property under a contract for deed, often referred to as a land contract. It is essential to provide this disclosure to the purchaser before or during the contract signing to ensure both parties are informed about the financing terms involved in the purchase.

Who can use this document

This form is intended for:

- Property sellers who are offering a contract for deed sale.

- Purchasers interested in buying residential property through financing arrangements.

- Real estate professionals facilitating the sale between the buyer and seller.

Instructions for completing this form

- Identify the parties: Fill in the names and contact information of the Seller and Purchaser.

- Specify the property: Provide a clear description of the residential property being sold.

- Enter the purchase price: Clearly state the total dollar amount to be paid for the property.

- Detail the payment terms: List the monthly payment amount, schedule, and due dates.

- Include the interest rate: Specify the interest rate applicable to the total amount financed.

- State late charges: Indicate any fees or penalties that will be charged for late payments.

Does this document require notarization?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Not providing complete contact information for both parties.

- Failing to specify the property accurately, leading to confusion.

- Omitting relevant financing details such as interest rates and late charges.

- Not delivering the notice to the purchaser before the contract signing.

Benefits of completing this form online

- Convenience: Access and complete the form from the comfort of your home.

- Editability: Easily make changes to customize the form to your situation.

- Reliability: Obtain a form created by licensed attorneys, ensuring it meets legal standards.

Looking for another form?

Form popularity

FAQ

With seller-financing, often the insurance and tax payments are paid directly to the owner, who is expected to make the annual payment personally. If, for some reason these payments aren't made, both parties can be put at risk of either a tax foreclosure, or a cancellation of the home owner's insurance.

What's a Seller Addendum? It's an addition to the normal sale and purchase agreement that severely limits Seller's liability during and after the sale process. For example, the Seller Addendum might limit damages to which Buyer is entitled in the event Seller fails to disclose some problem with the property.

Step 1 Get the Original Purchase Agreement. The buyer and seller should get a copy of the original purchase agreement. Step 2 Write the Addendum. Complete a blank addendum (Adobe PDF, Microsoft Word (. Step 3 Parties Agree and Sign. Step 4 Add to the Purchase Agreement.

Illinois law requires you, as a home seller, to tell a prospective buyer, in writing, about any material defects you actually know about. This means anything you're aware of that affects the value, healthfulness, and safety of your property.

As a seller in California, you must also complete an additional disclosure form, the Natural Hazard Disclosure Report/Statement, prior to any home sale.You will need to include information about all appliances in the home, including which are included in the sale as well as whether they are operational.

The seller financing addendum outlines the terms at which the seller of the property agrees to loan the money to the buyer in order to purchase their property.Once complete, this addendum should be signed and attached to the purchase agreement made between the parties.

In seller financing, the seller takes on the role of the lender. Instead of giving cash to the buyer, the seller extends enough credit to the buyer for the purchase price of the home, minus any down payment. The buyer and seller sign a promissory note (which contains the terms of the loan).

Complete the addendum, including your name, the purchaser's name and a description of the property. Include the type of financing that you are providing, such as first mortgage, second mortgage or deed of trust. List the terms of the loan.