Idaho Complex Will with Credit Shelter Marital Trust for Large Estates

Description

How to fill out Idaho Complex Will With Credit Shelter Marital Trust For Large Estates?

Searching for Idaho Complex Will with Credit Shelter Marital Trust for Large Estates samples and completing them can be challenging.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the suitable template specifically for your state in just a few clicks.

Our attorneys prepare all documents, so you solely need to complete them. It's genuinely that simple.

Now you can print the Idaho Complex Will with Credit Shelter Marital Trust for Large Estates form or complete it using any online editor. There’s no need to fret about making mistakes since your form can be utilized and submitted, and printed as many times as you like. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the document.

- All your downloaded documents are stored in My documents and are accessible at any time for future use.

- If you haven’t registered yet, you must sign up.

- Check out our comprehensive instructions on how to obtain the Idaho Complex Will with Credit Shelter Marital Trust for Large Estates template in just a few minutes.

- To obtain a valid sample, confirm its legitimacy for your state.

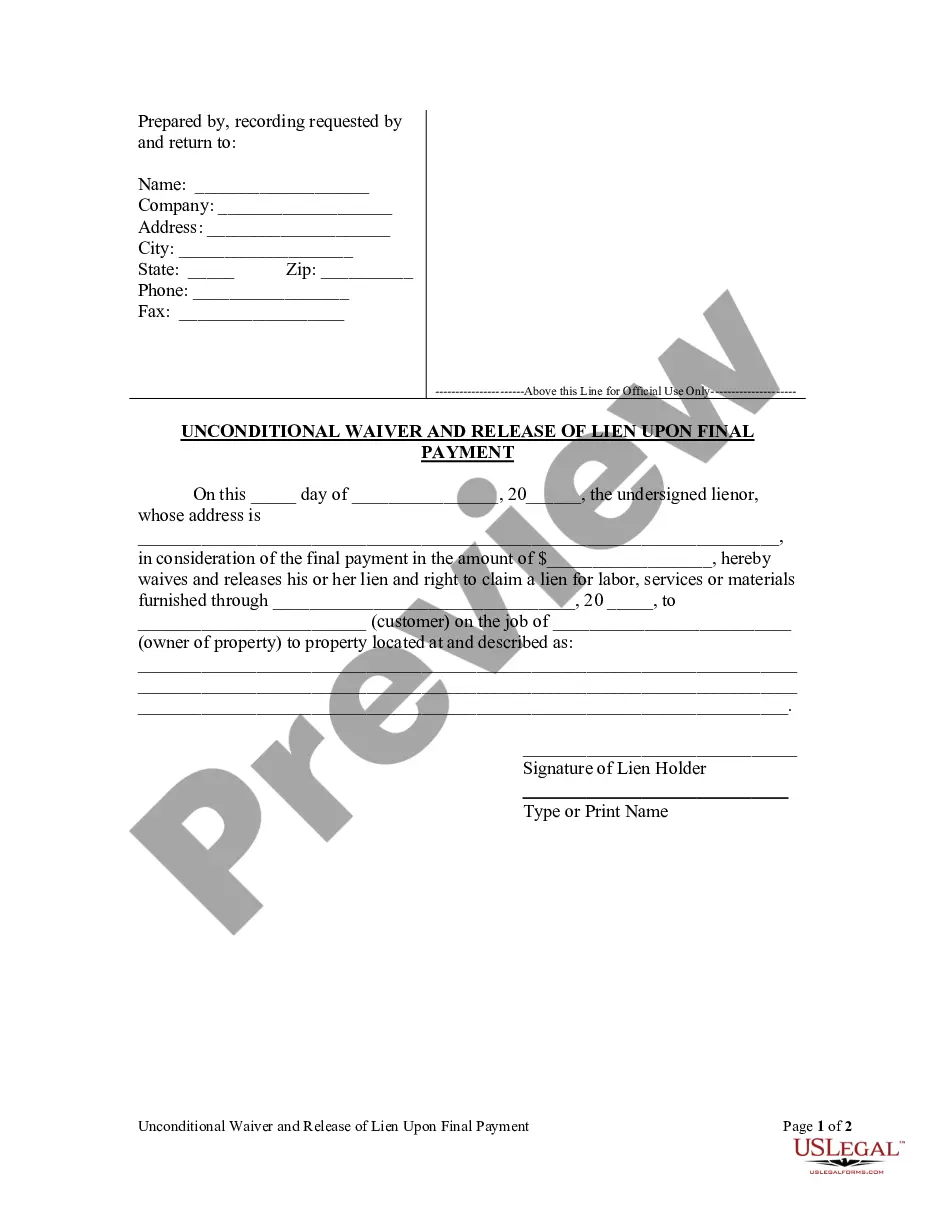

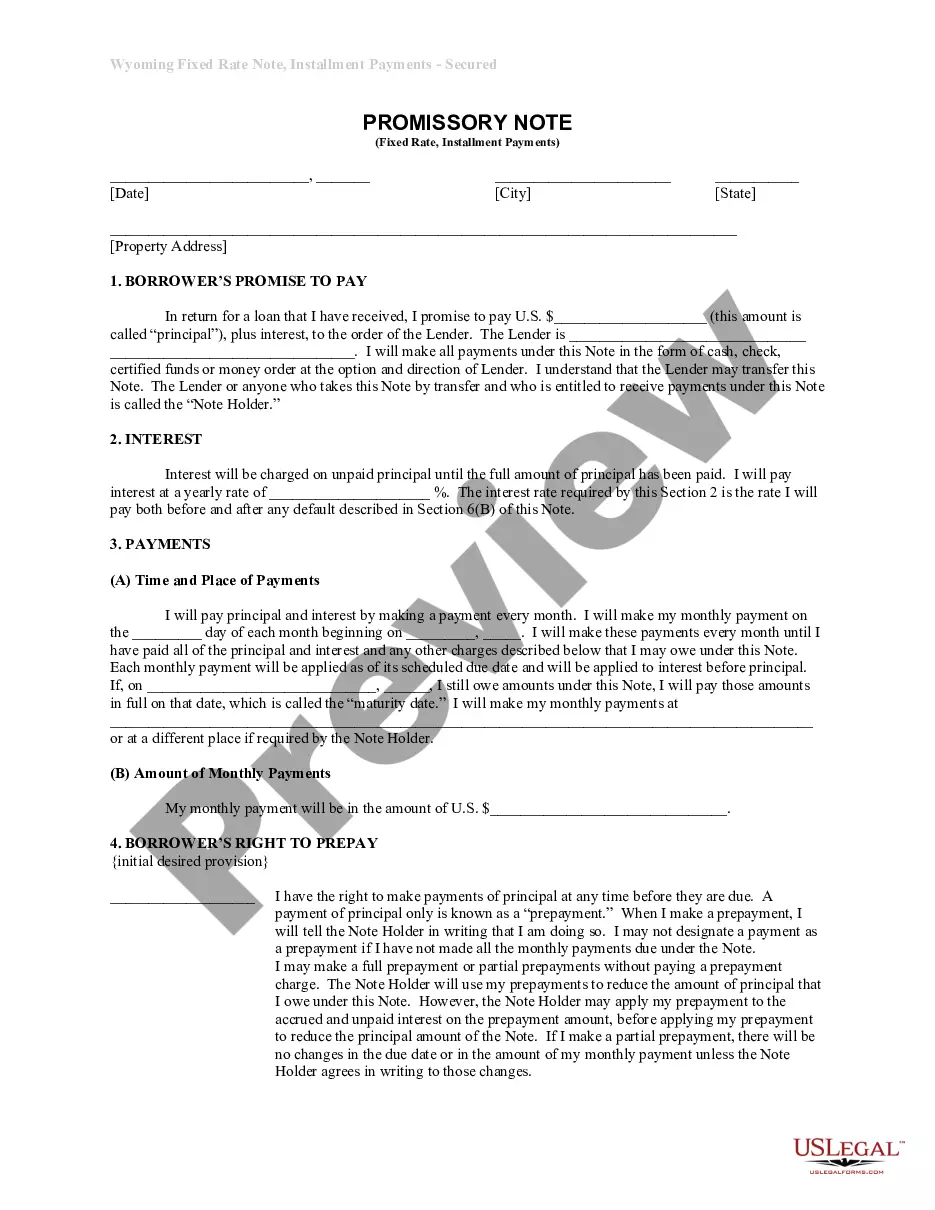

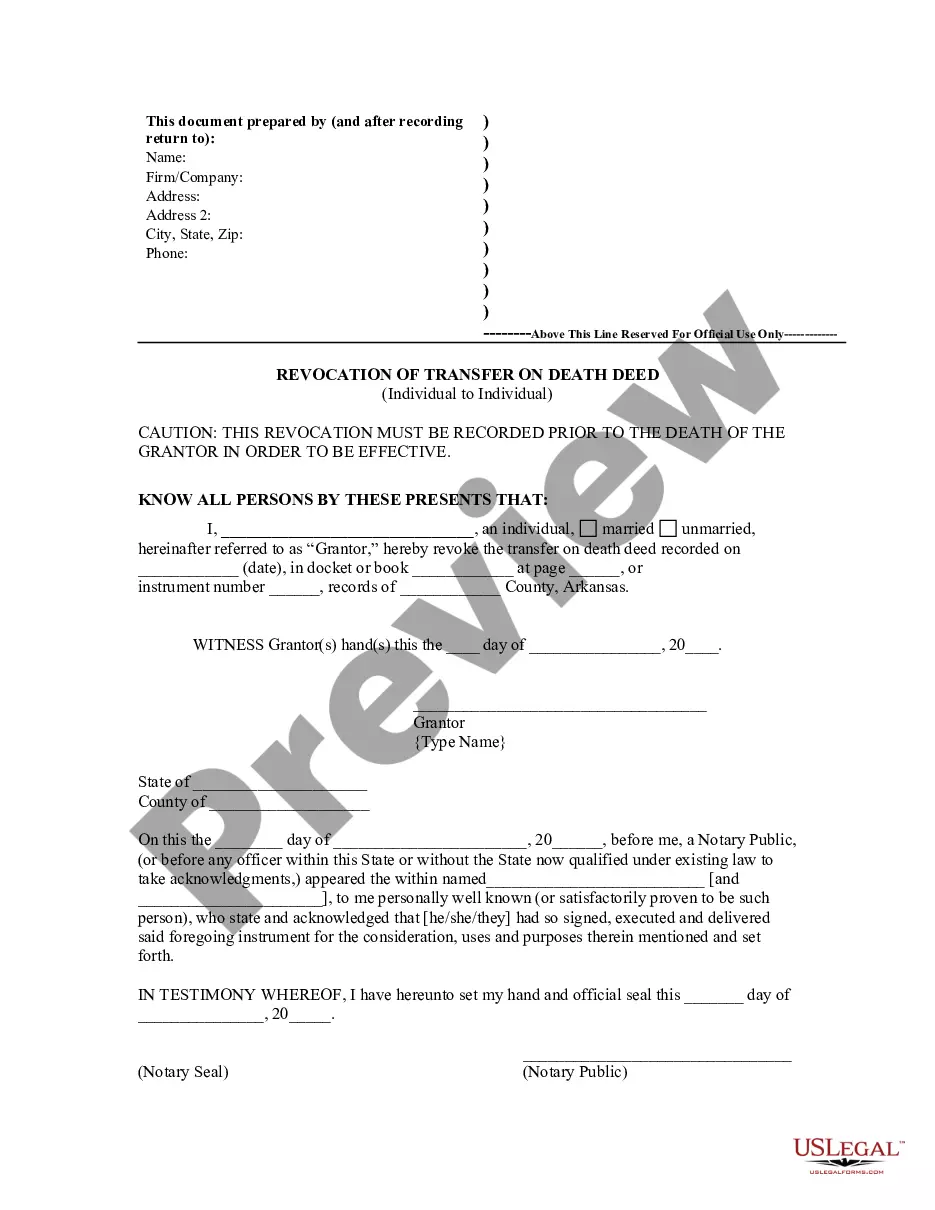

- Examine the form using the Preview function (if available).

- If there's a description, read it to understand the specifics.

- Click Buy Now if you found what you're looking for.

- Choose your plan on the pricing page and create your account.

- Indicate whether you prefer to pay by card or via PayPal.

- Download the sample in your desired format.

Form popularity

FAQ

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

An estate plan is a comprehensive plan that includes documents that are effective during your lifetime as well as other documents that aren't in effect until your death.A will details where you want your assets to go at your death, and who you would like to serve as guardian of your minor children.

Estate planning prevents unwanted inheritors Or if you die without a will, then the state will decide who will be your beneficiaries. In Alberta, the wills and succession act specifies what will happen to your wealth if you don't have a will.

Give Gifts. One way to get around the estate tax is to hand off portions of your wealth to your family members through gifts. Set up an Irrevocable Life Insurance Trust. Make Charitable Donations. Establish a Family Limited Partnership. Fund a Qualified Personal Residence Trust.

An estate plan is a collection of documents that protects your assets and personal property (your estate) and explains how you want to pass them down. It documents your wishes and specifies exactly who will guard those wishes and act on them in your absence.

First, the property must be included in the decedent's gross estate. Second, the property must be transferred to the surviving spouse. Third, the interest must not be a terminable interest.To qualify for the unlimited marital deduction, the surviving spouse must inherit the property.

A trust is traditionally used for minimizing estate taxes and can offer other benefits as part of a well-crafted estate plan. A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries.Other benefits of trusts include: Control of your wealth.

The unlimited marital deduction allows spouses to transfer an unlimited amount of money to one another, including upon death, without penalty or tax.Under current rules, the limit on non-taxable gifts is $15,000 per individual and the estate tax exemption is $11.58 million.

Estate planning is the preparation of tasks that serve to manage an individual's asset base in the event of their incapacitation or death. The planning includes the bequest of assets to heirs and the settlement of estate taxes. Most estate plans are set up with the help of an attorney experienced in estate law.