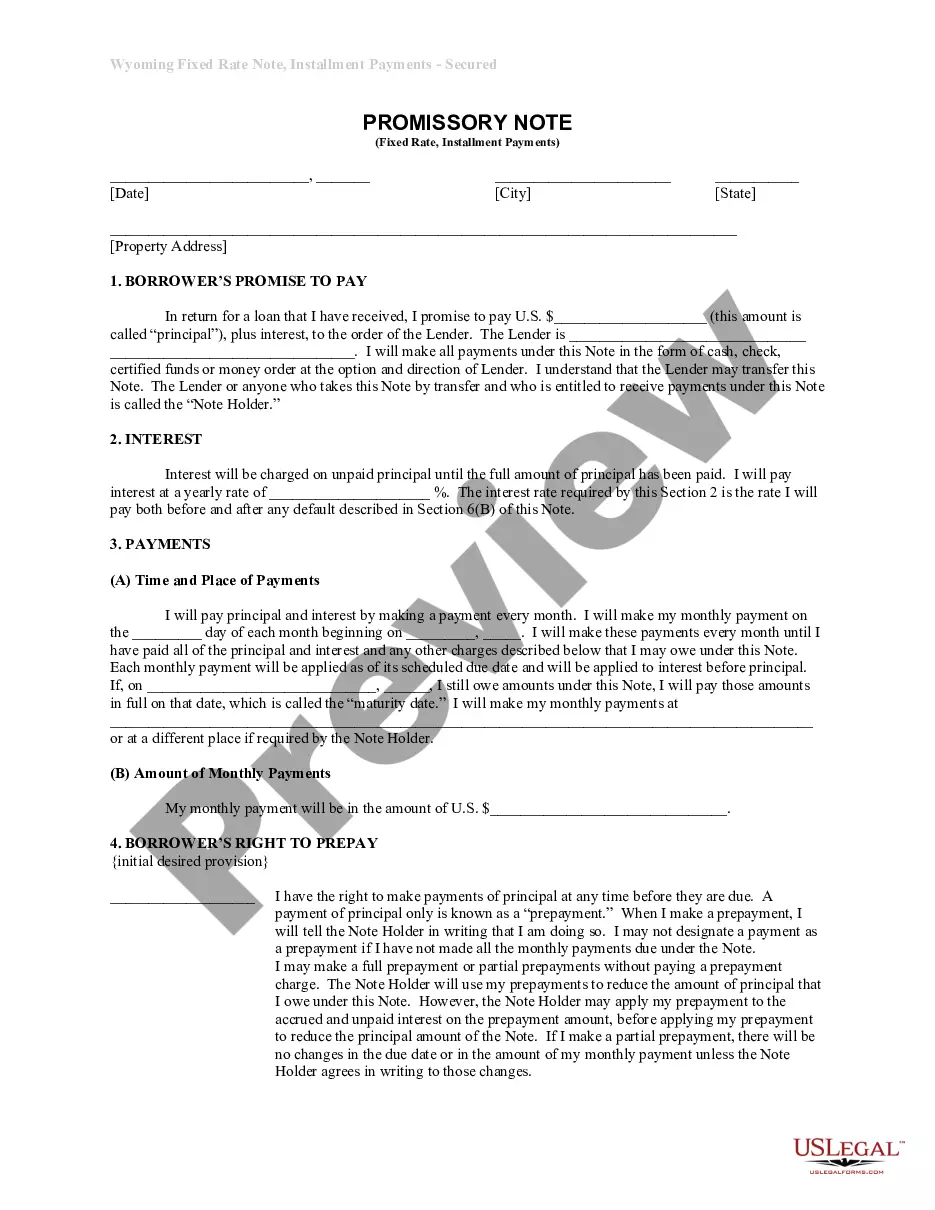

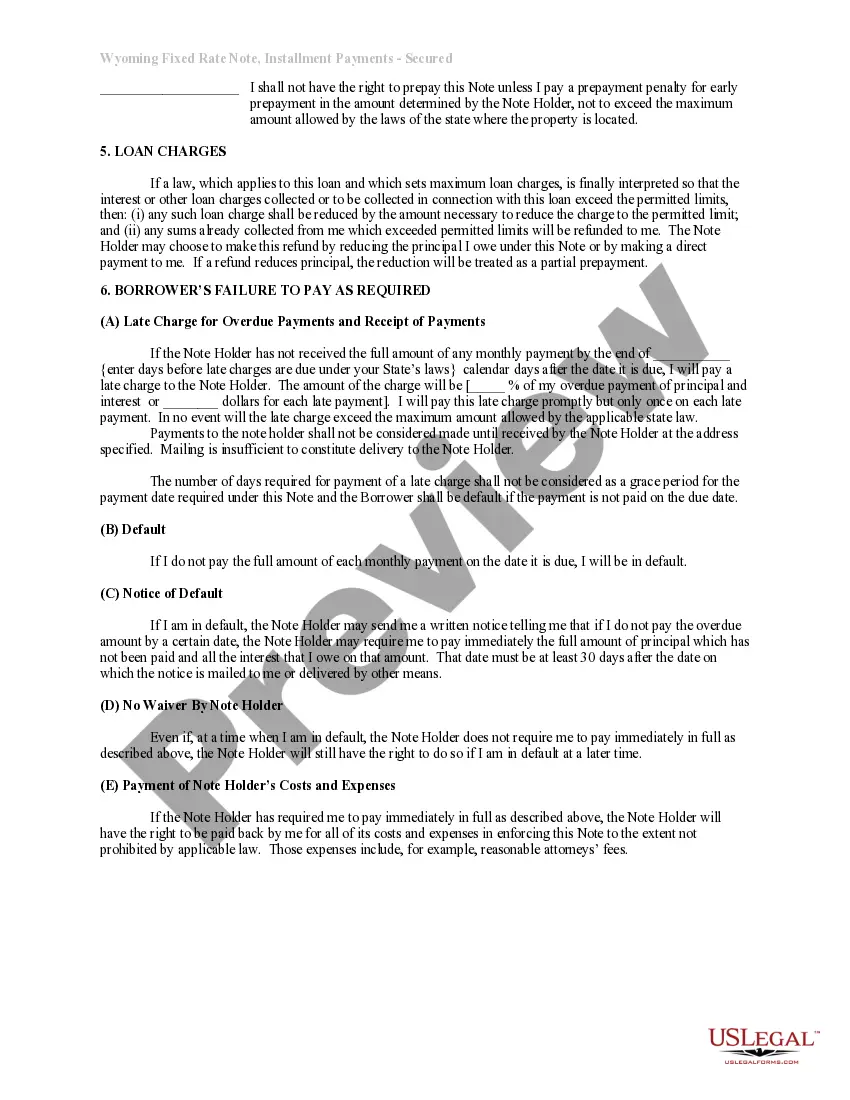

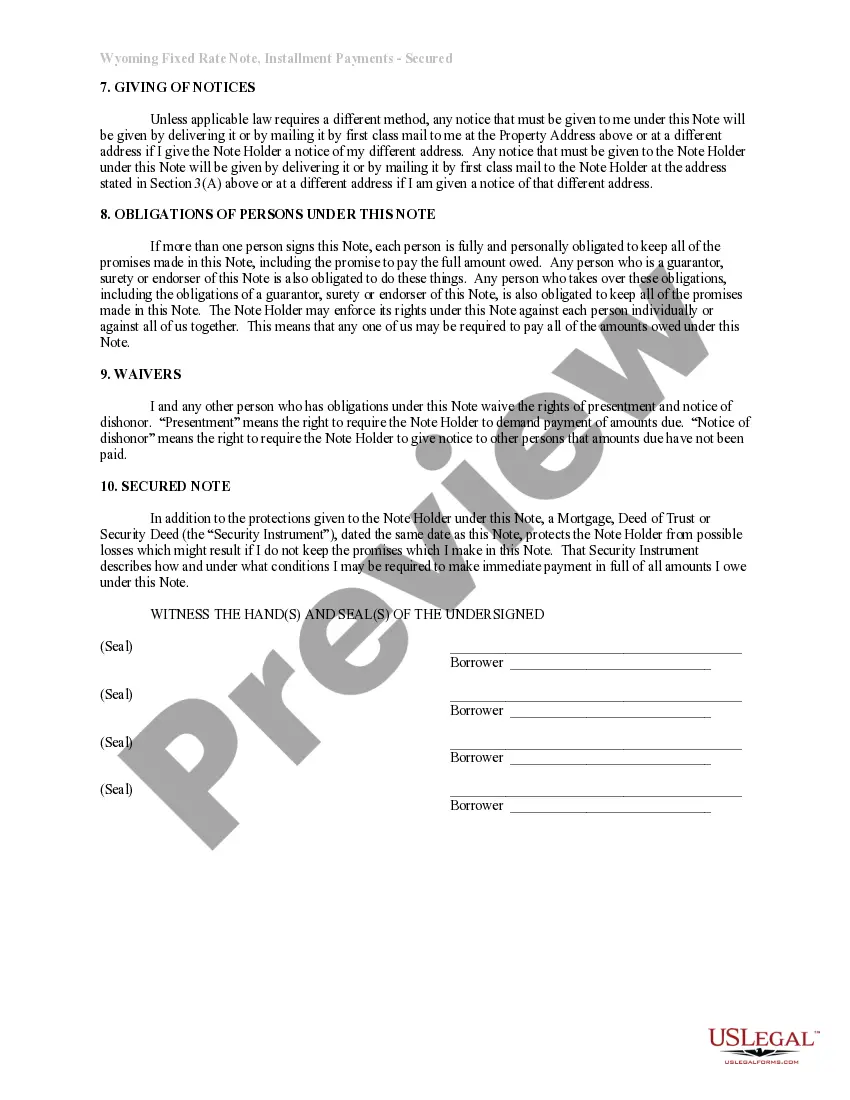

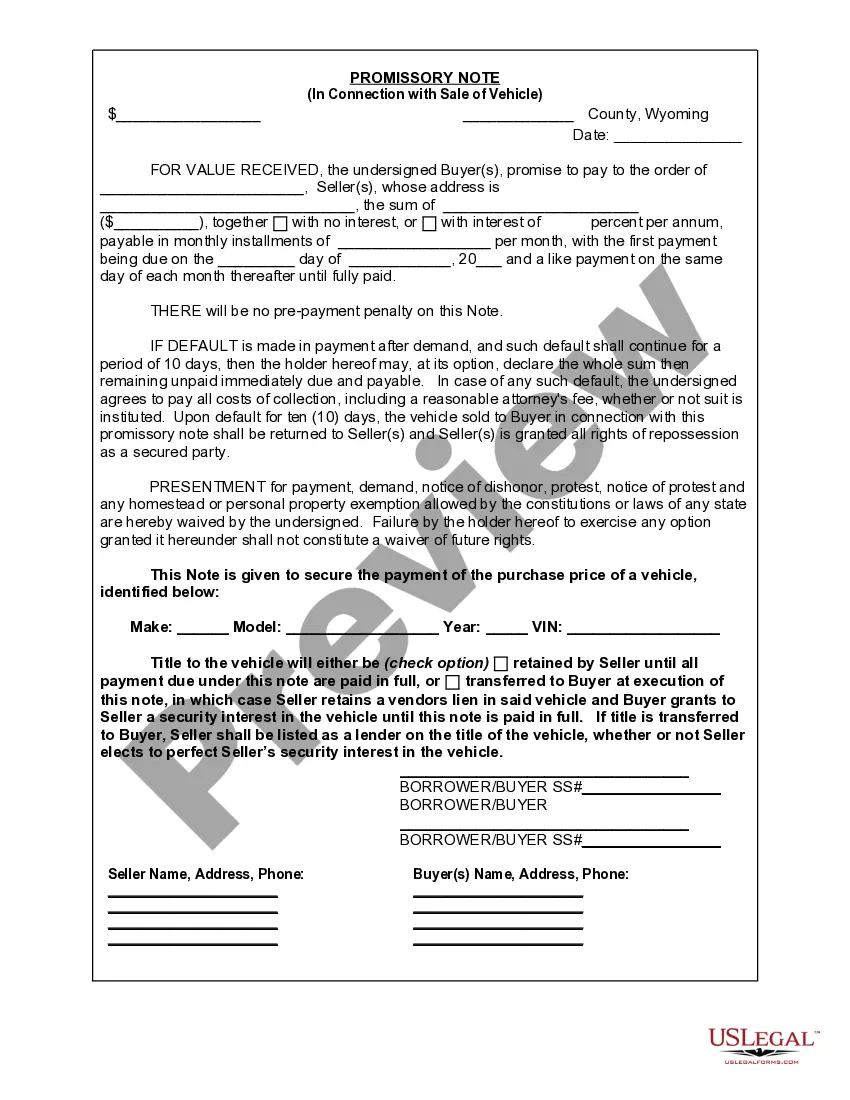

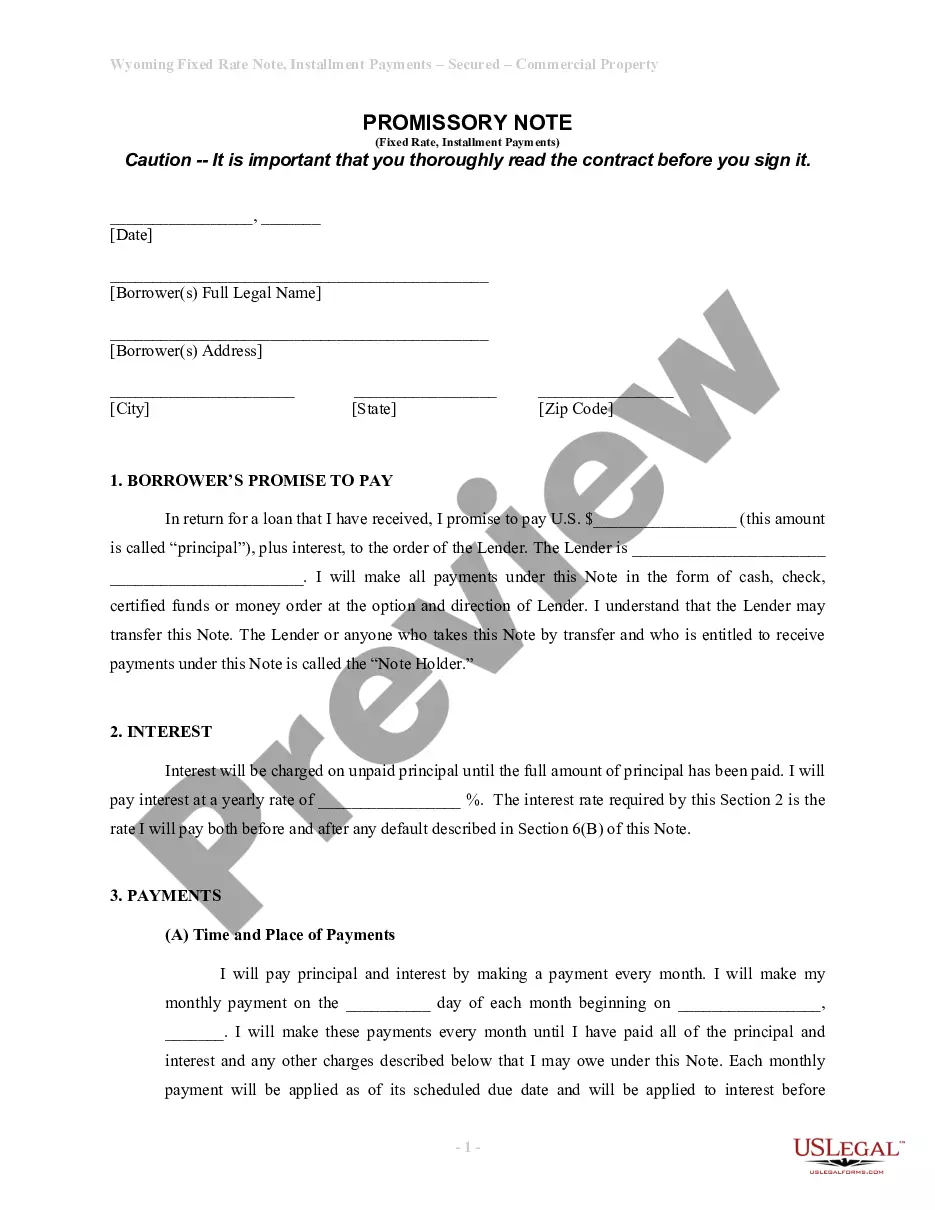

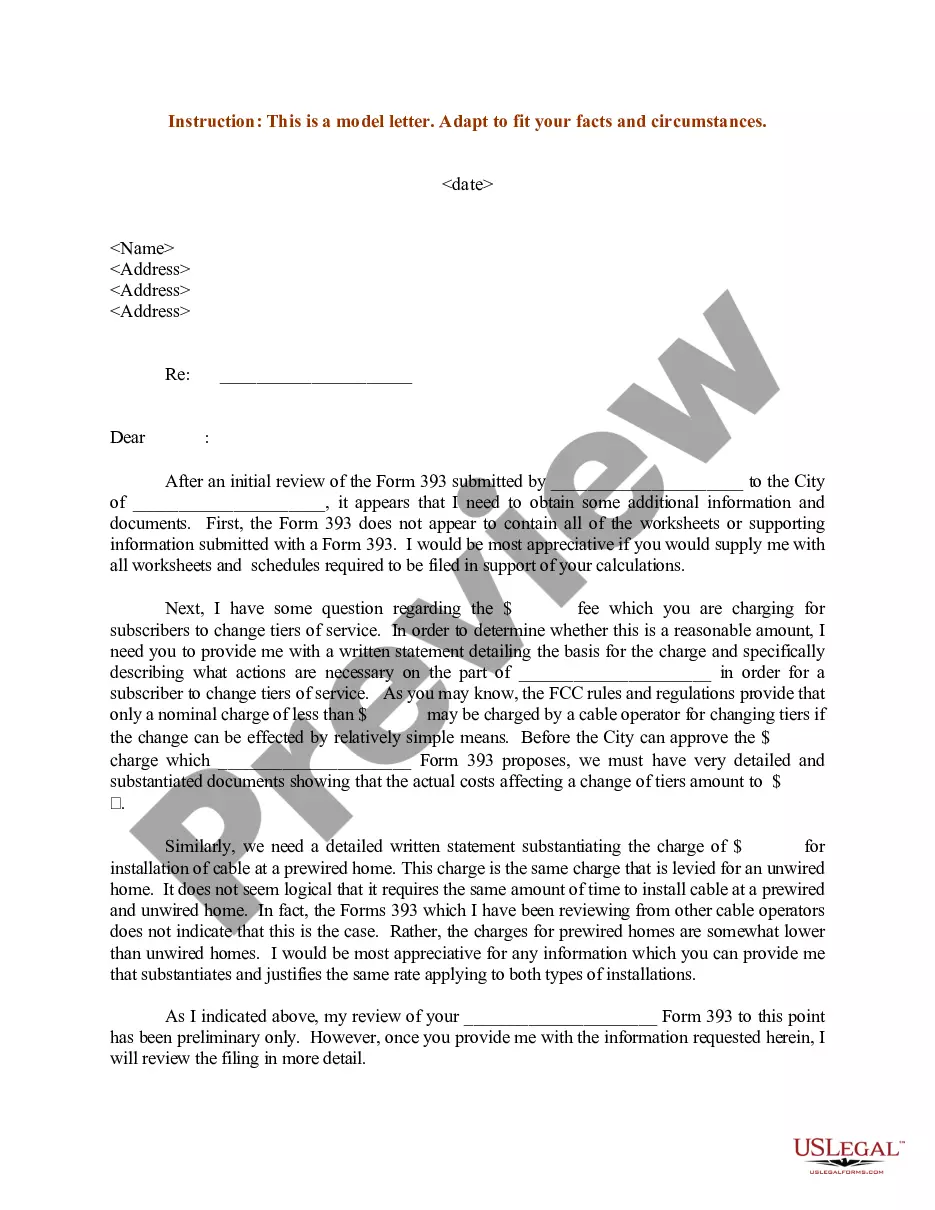

This is a Promissory Note for use where commercial property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Wyoming Promissory Note with Installment Payments and Fixed Rate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

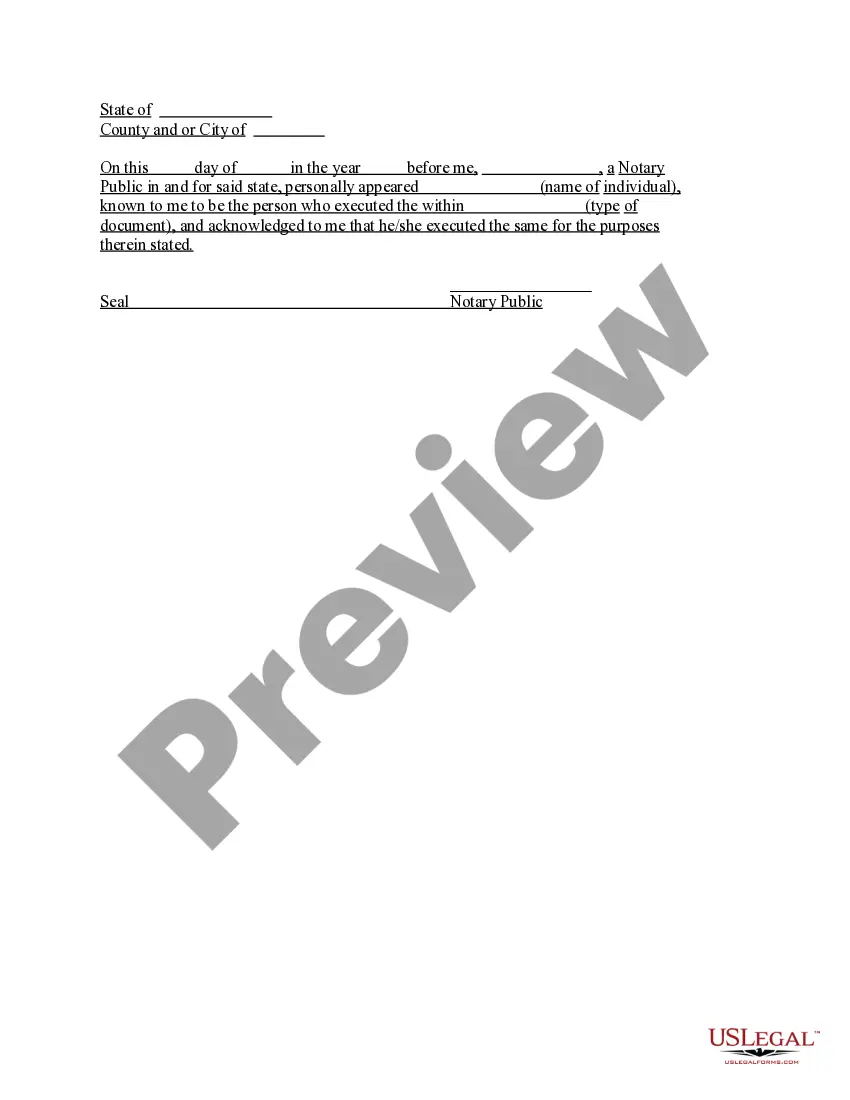

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Wyoming Promissory Note With Installment Payments And Fixed Rate?

Use US Legal Forms to obtain a printable Wyoming Promissory Note with Installment Payments and Fixed Rate. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms catalogue online and provides affordable and accurate samples for consumers and legal professionals, and SMBs. The templates are categorized into state-based categories and many of them might be previewed prior to being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to easily find and download Wyoming Promissory Note with Installment Payments and Fixed Rate:

- Check to make sure you have the right template with regards to the state it is needed in.

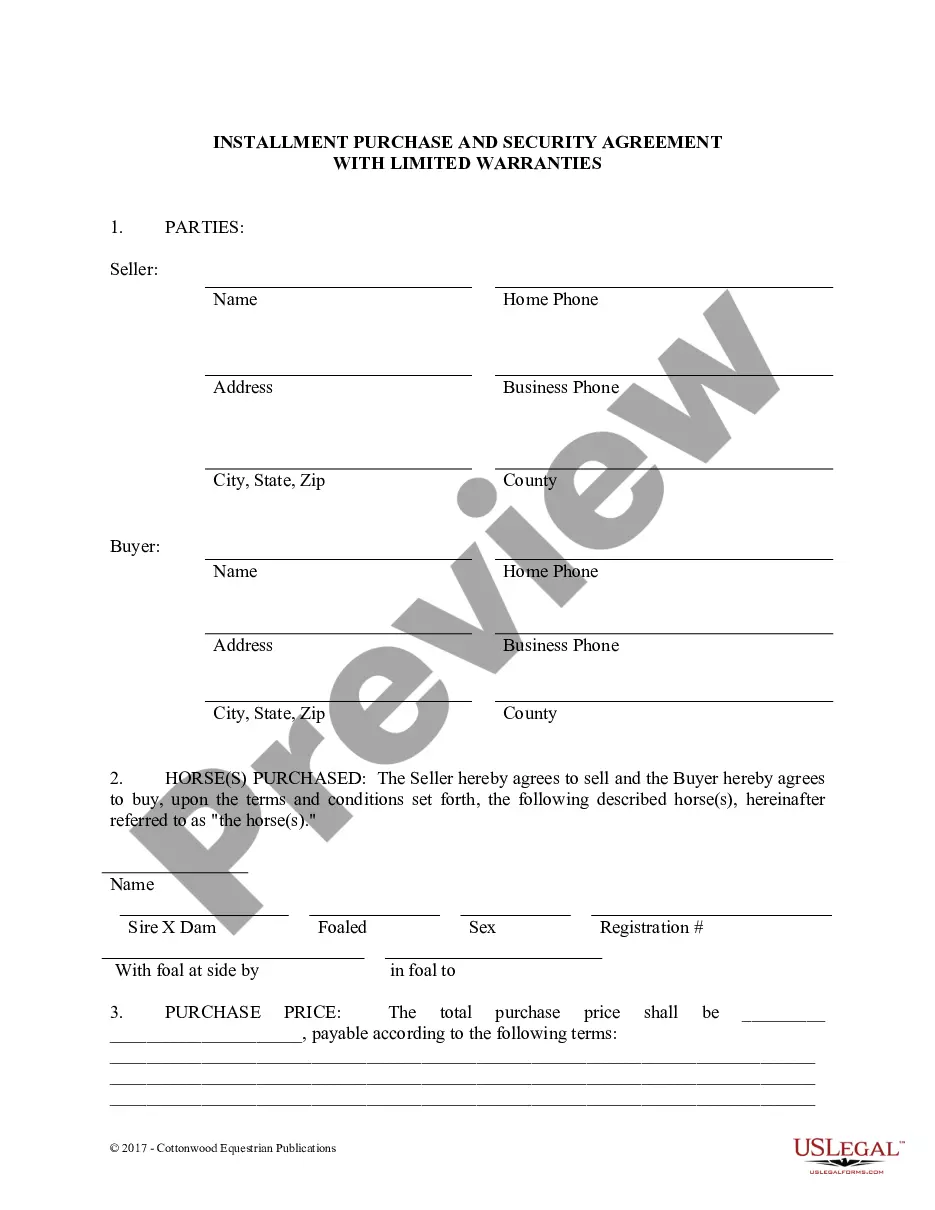

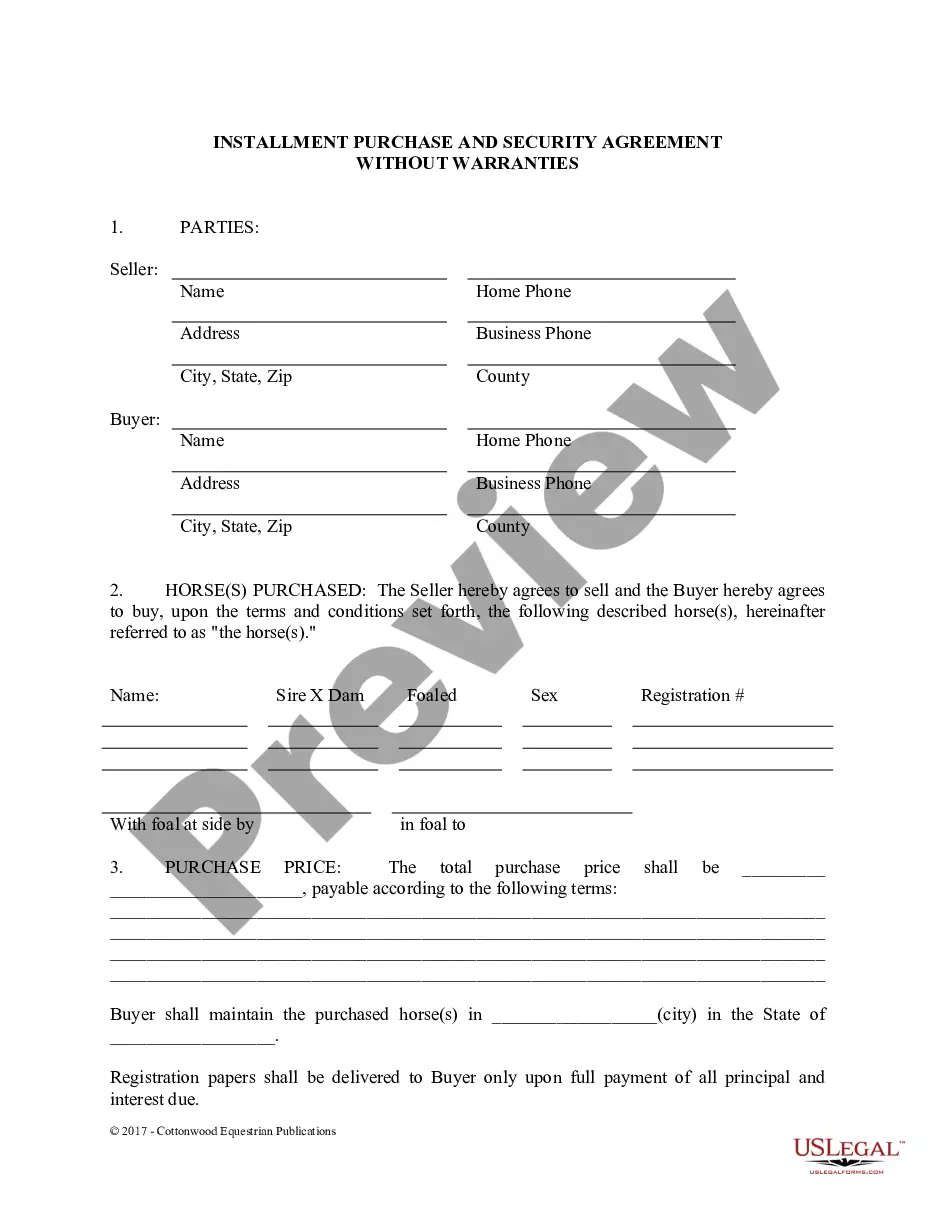

- Review the form by reading the description and using the Preview feature.

- Press Buy Now if it’s the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Use the Search engine if you want to get another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Wyoming Promissory Note with Installment Payments and Fixed Rate. More than three million users have utilized our platform successfully. Select your subscription plan and have high-quality forms in a few clicks.

Form popularity

FAQ

Step 1 Agree to Terms. Step 2 Run a Credit Report. Step 3 Security and Co-Signer(s) Step 4 Writing the Promissory Note. Step 5 Paying Back the Borrowed Money. Calculating Total Interest Owed. Calculating the Final Payment Amount. Calculating the Monthly Payment Amount.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

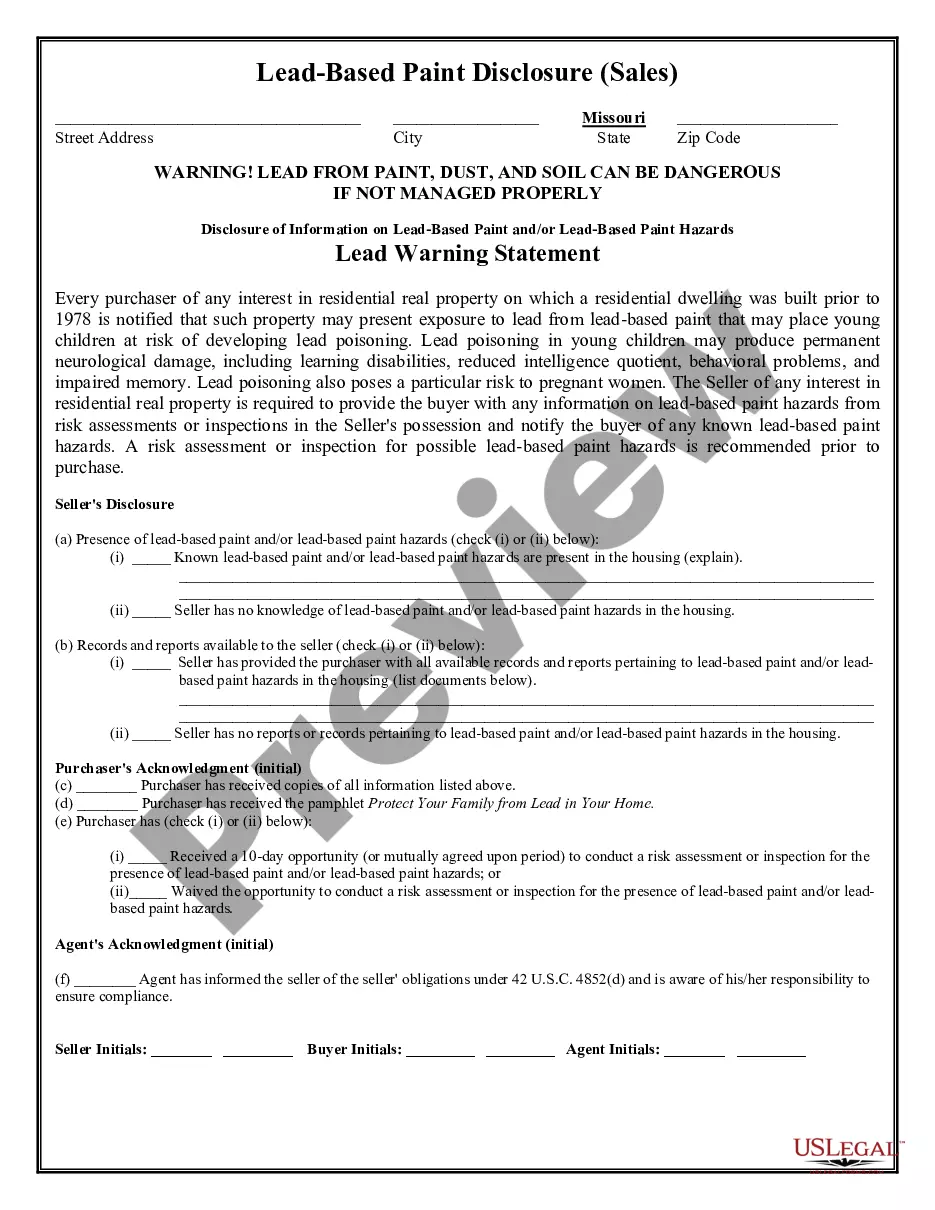

Personal Promissory Notes This is a particular loan taken from family or friends. Commercial Here, the note is made when dealing with commercial lenders such as banks. Real Estate This is similar to commercial notes in terms of nonpayment consequences.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.