Wyoming Promissory Note in Connection with Sale of Vehicle or Automobile

Understanding this form

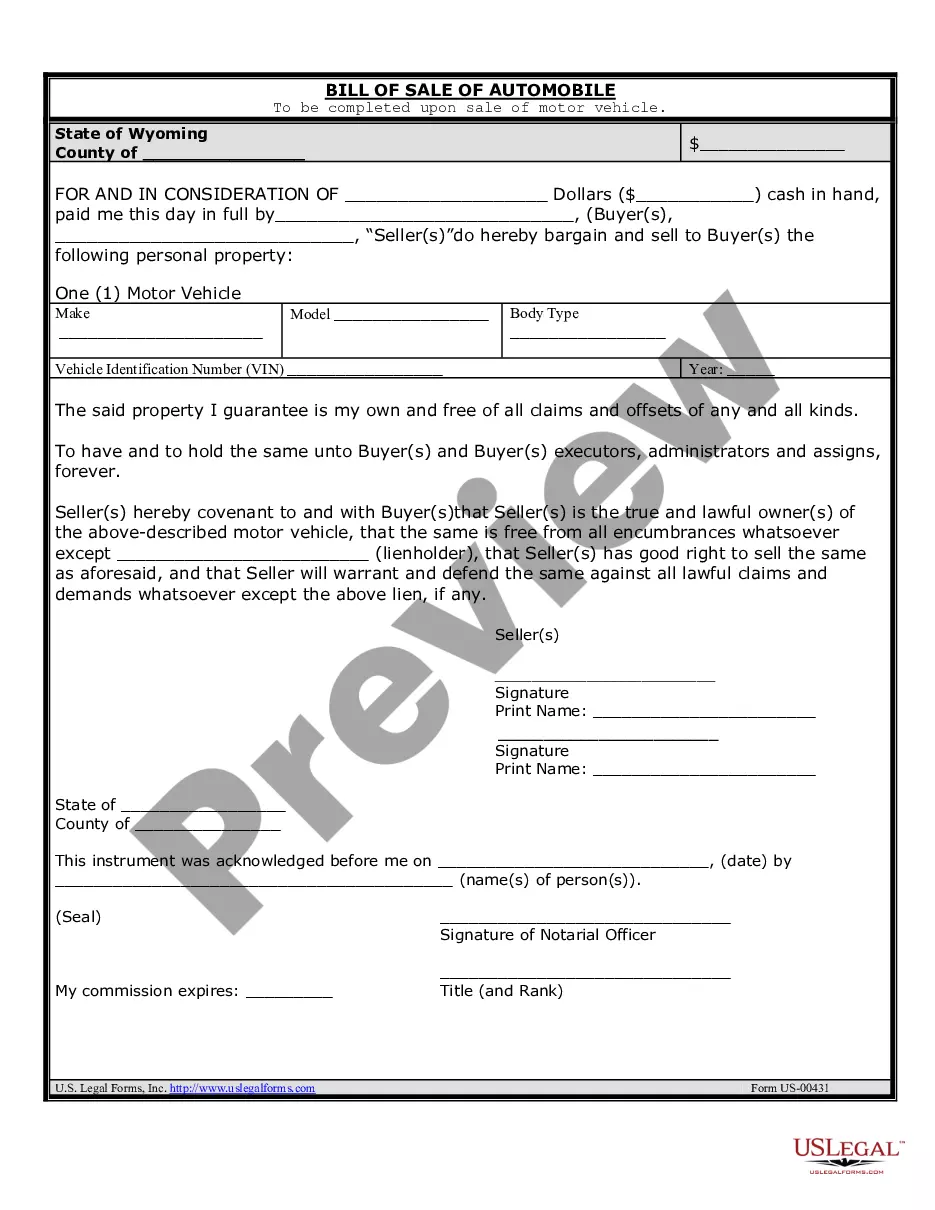

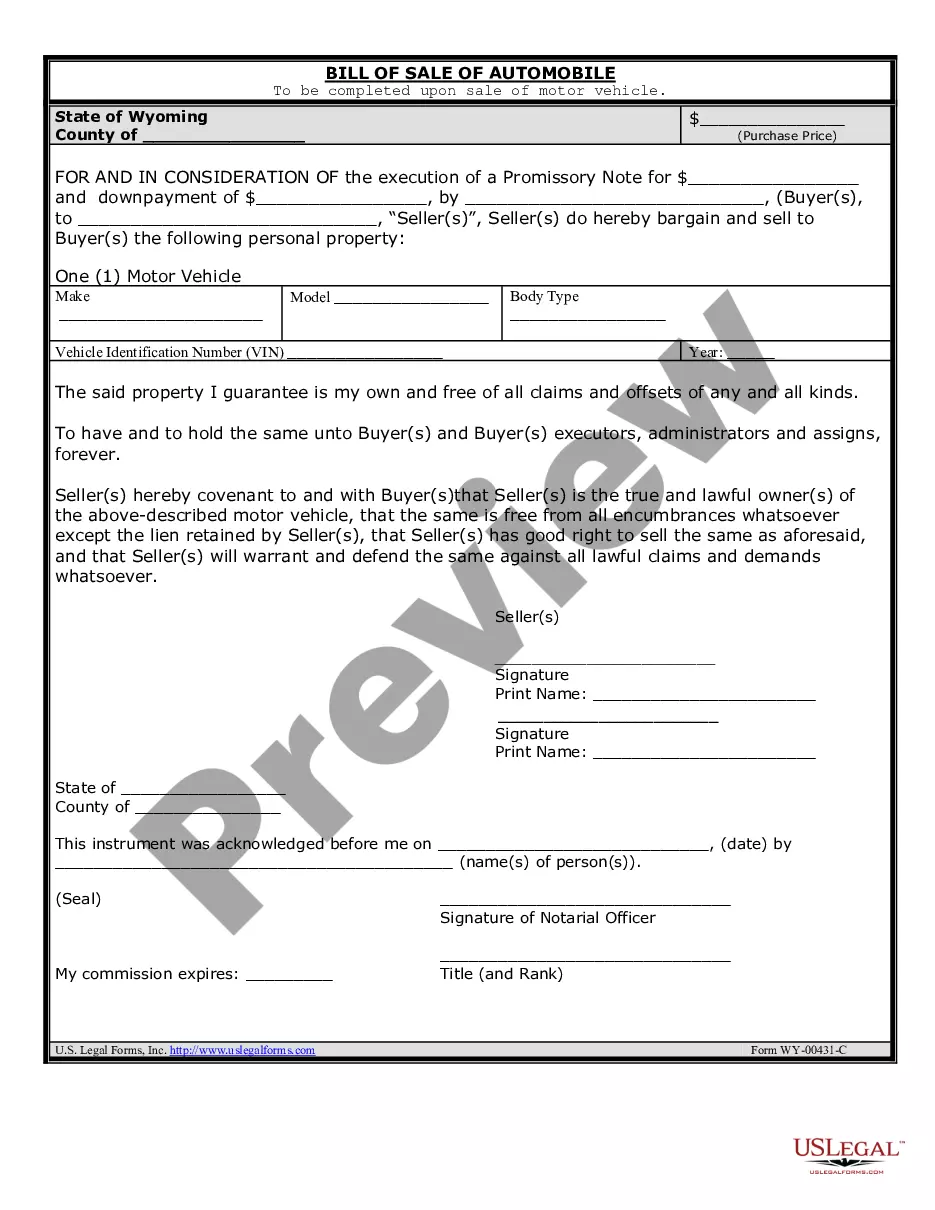

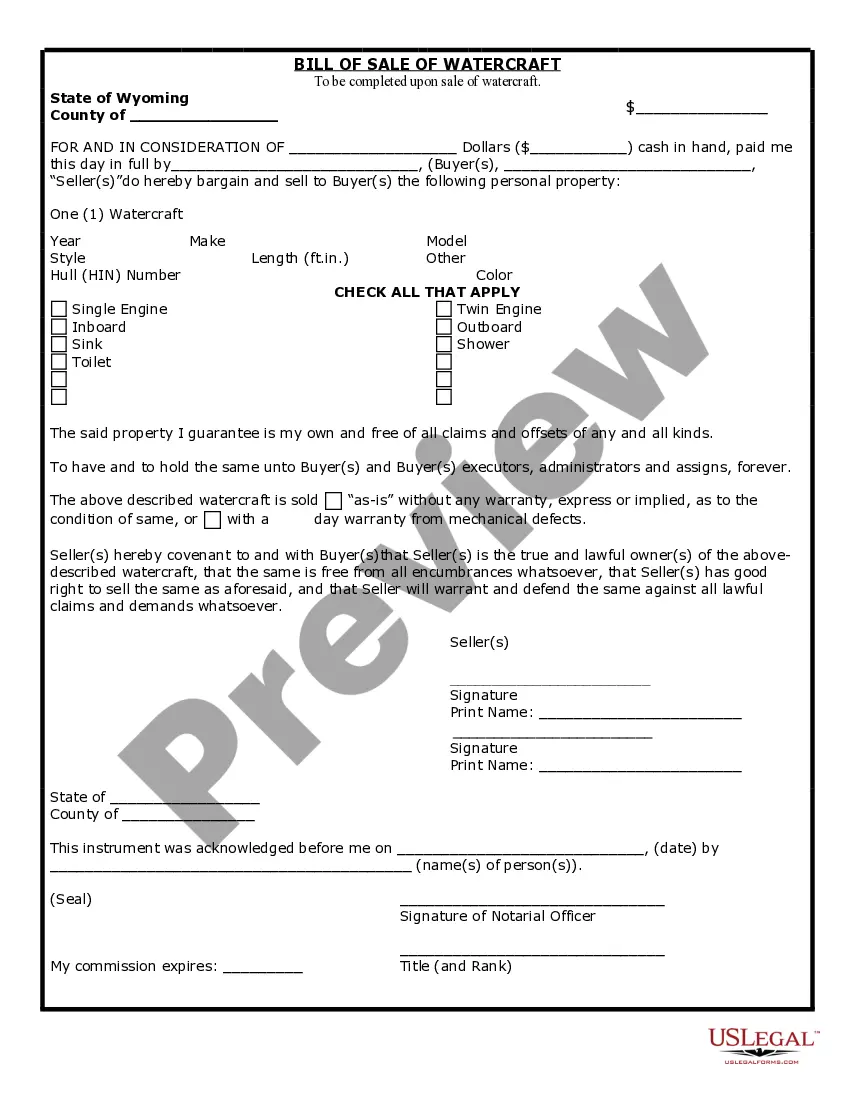

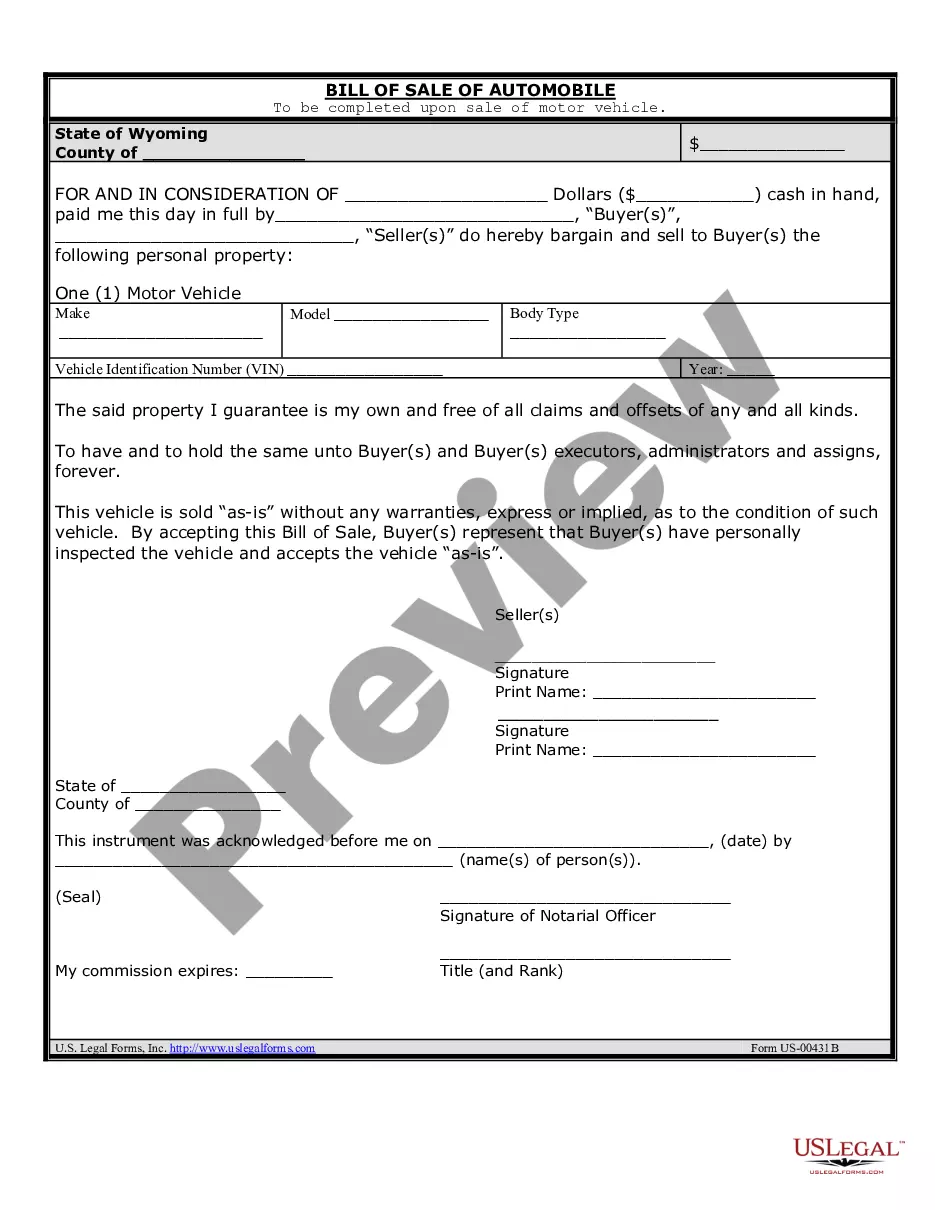

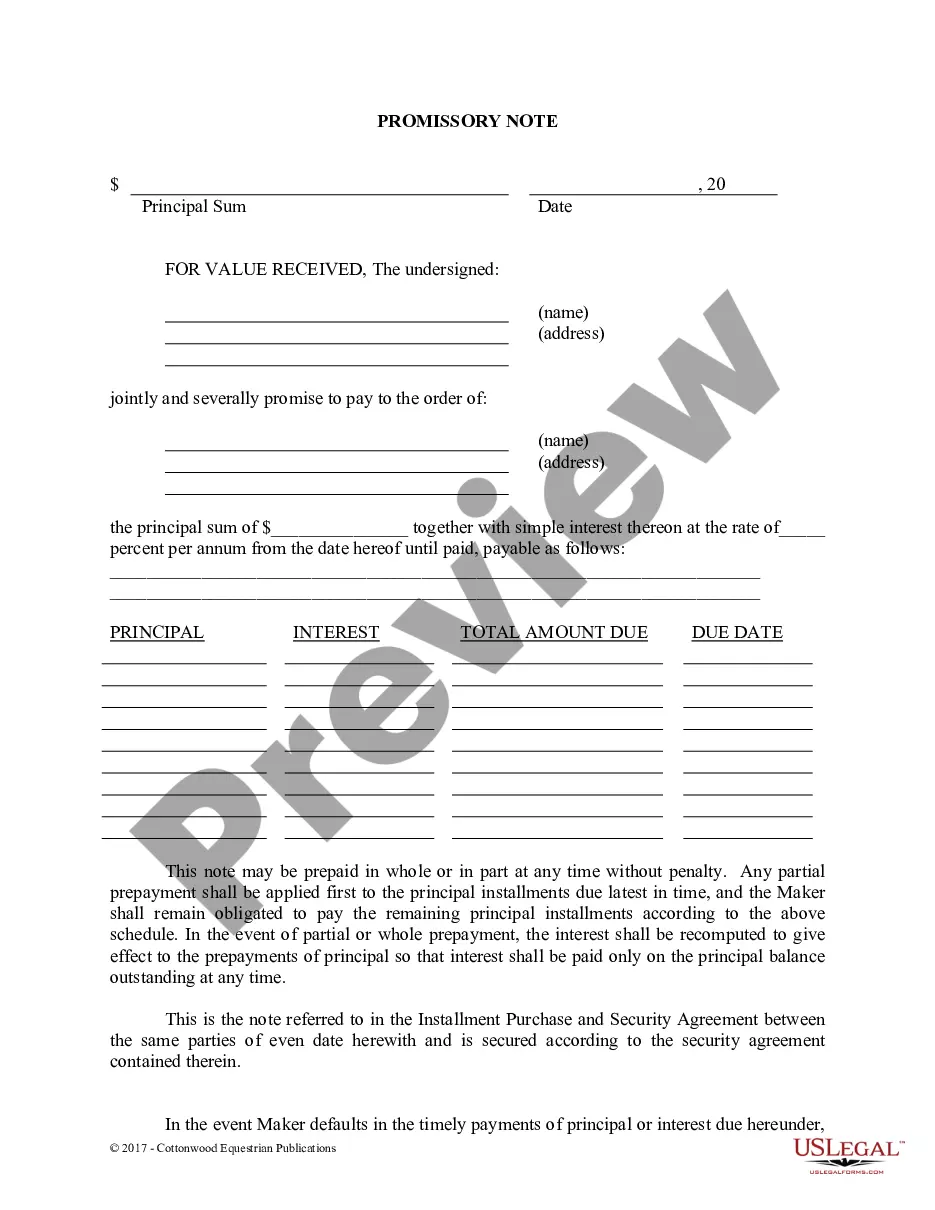

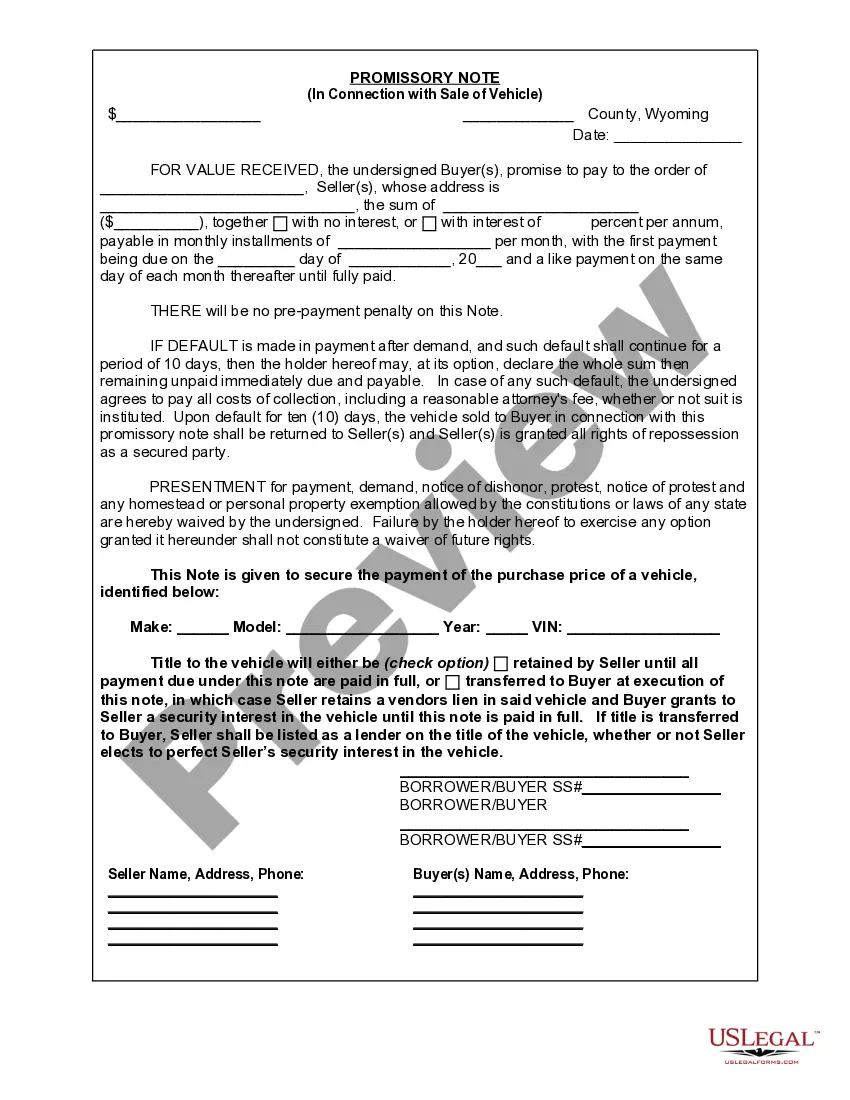

This Promissory Note in connection with the sale of a vehicle is a legal document acknowledging a buyer's promise to pay a portion of the vehicle's purchase price over time. This note is essential for transactions where the seller retains ownership until the note is fully paid, or transfers ownership to the buyer while retaining a vendor's lien. This differentiates it from standard sales agreements, as it provides specific repayment terms and security interests in the vehicle involved.

Key parts of this document

- Date of the agreement.

- Details of the vehicle (make, model, year, VIN).

- Terms regarding the retention of title and vendor's lien.

- Default clause and consequences for non-payment.

- Signatures of the buyer and seller.

State-specific requirements

This form is designed to be compliant with the laws of Wyoming. Ensure you understand the specific legal implications in this jurisdiction, particularly concerning the retention of title and vendor's lien rights.

Situations where this form applies

This form is used during the sale of a vehicle when the buyer is not making the full payment upfront. It's applicable when the seller wishes to either keep the title until payments are complete or allow the buyer to take the title while retaining a security interest. It is critical in ensuring that both parties understand their rights and obligations regarding payment and vehicle ownership.

Intended users of this form

This form is intended for:

- Individuals buying or selling a used vehicle through installment payments.

- Buyers who need a formal agreement to outline their promise to pay over time.

- Vehicle sellers who want to secure their interests until full payment is received.

How to prepare this document

- Write the date of the agreement clearly at the beginning of the document.

- Fill in the details of the vehicle including make, model, year, and VIN.

- Select whether the seller retains the title until the note is paid or transfers it with a vendor's lien.

- Ensure both the buyer and seller sign the agreement, including their addresses and phone numbers.

- Review the terms regarding defaults and penalties to ensure understanding before finalizing.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Mistakes to watch out for

- Failing to include accurate vehicle details which could lead to disputes.

- Not signing the document, resulting in unenforceability.

- Overlooking the default terms and penalties, which can lead to financial issues.

Why use this form online

- Convenient access to legal document templates prepared by licensed attorneys.

- Easy to fill out and customize based on individual needs.

- Reliable format that ensures compliance with legal requirements.

Form popularity

FAQ

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

A general Wyoming bill of sale does not need to be notarized. It is used for your personal records. When it is completed, both the buyer and seller should keep several copies.

Most states do not require a notary to witness the signing of a bill of sale. However, by law, a notary public must witness both parties signing the document in Louisiana, Nebraska, Maryland, New Hampshire, West Virginia, and Montana. Notaries are optional in other states.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Debt Classification A promissory note is a type of written contract a lender uses for secured debts where the lender has collateral to seize in the event of default. It is more likely your car loan is a promissory note if you have a schedule of payments and a fixed interest rate spelled out on your loan document.

200b200bThe promissory note should contain: The car's VIN number, model, make and year of manufacture. The statement that the borrower promises to pay the lender a specific amount, how much each payment will be, the annual interest rate and when the loan will be completely repaid.

Original Wyoming title signed by all parties whose names appear on the front of the title. The Seller must sign in front of a notary. Even if the names on the title appear as John OR Jane Doe, both parties must sign as seller`s on the title and have their signatures notarized.

A vehicle may be operated by the new owner for 60 days when accompanied by a completed bill of sale, or 45 days with a title. If an out-of-state dealership issues a temporary for less than 60 days, a Wyoming resident can still legally drive with the paperwork for 60 days.