District of Columbia Deed of Distribution - Personal Representative to an Individual

About this form

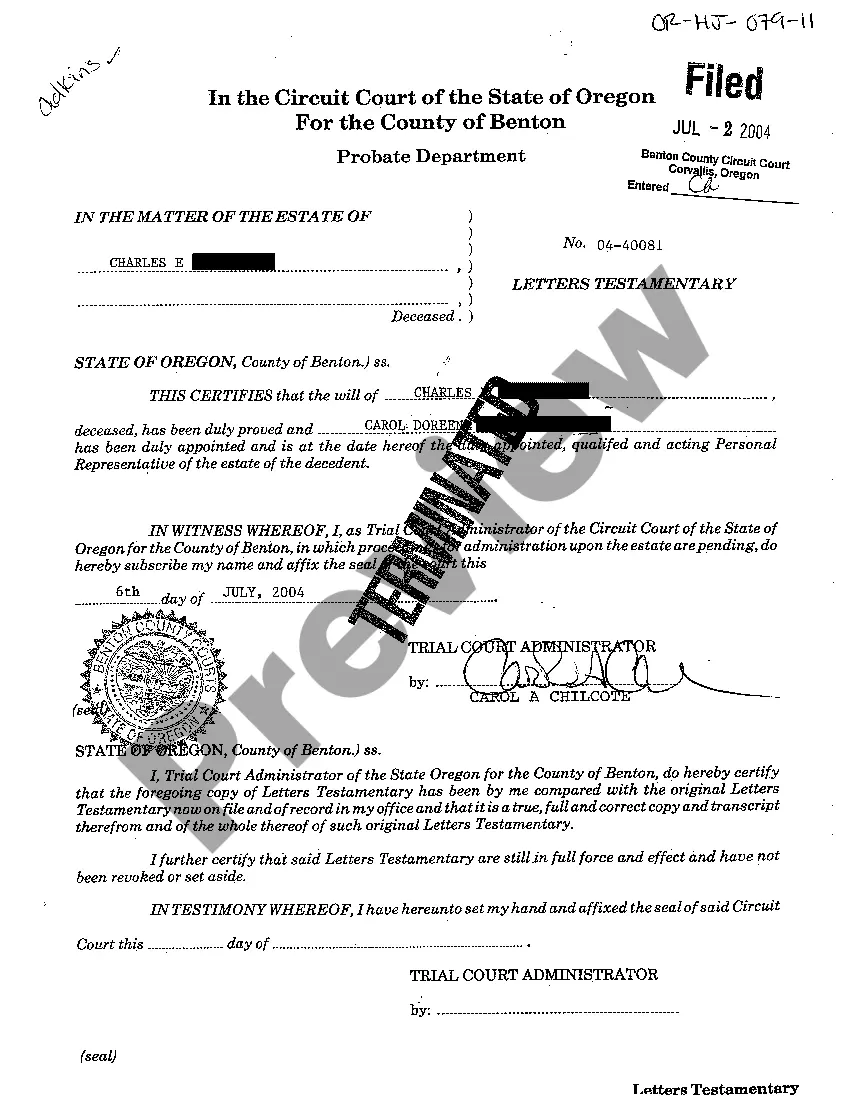

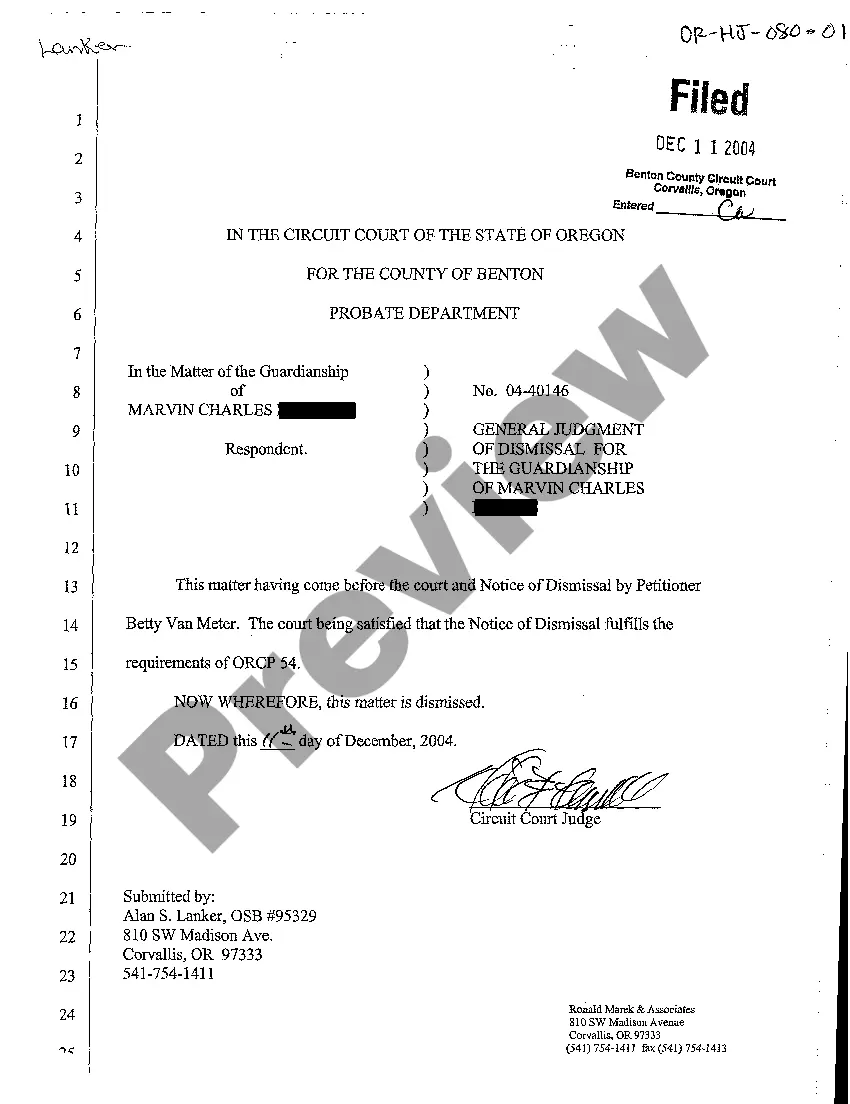

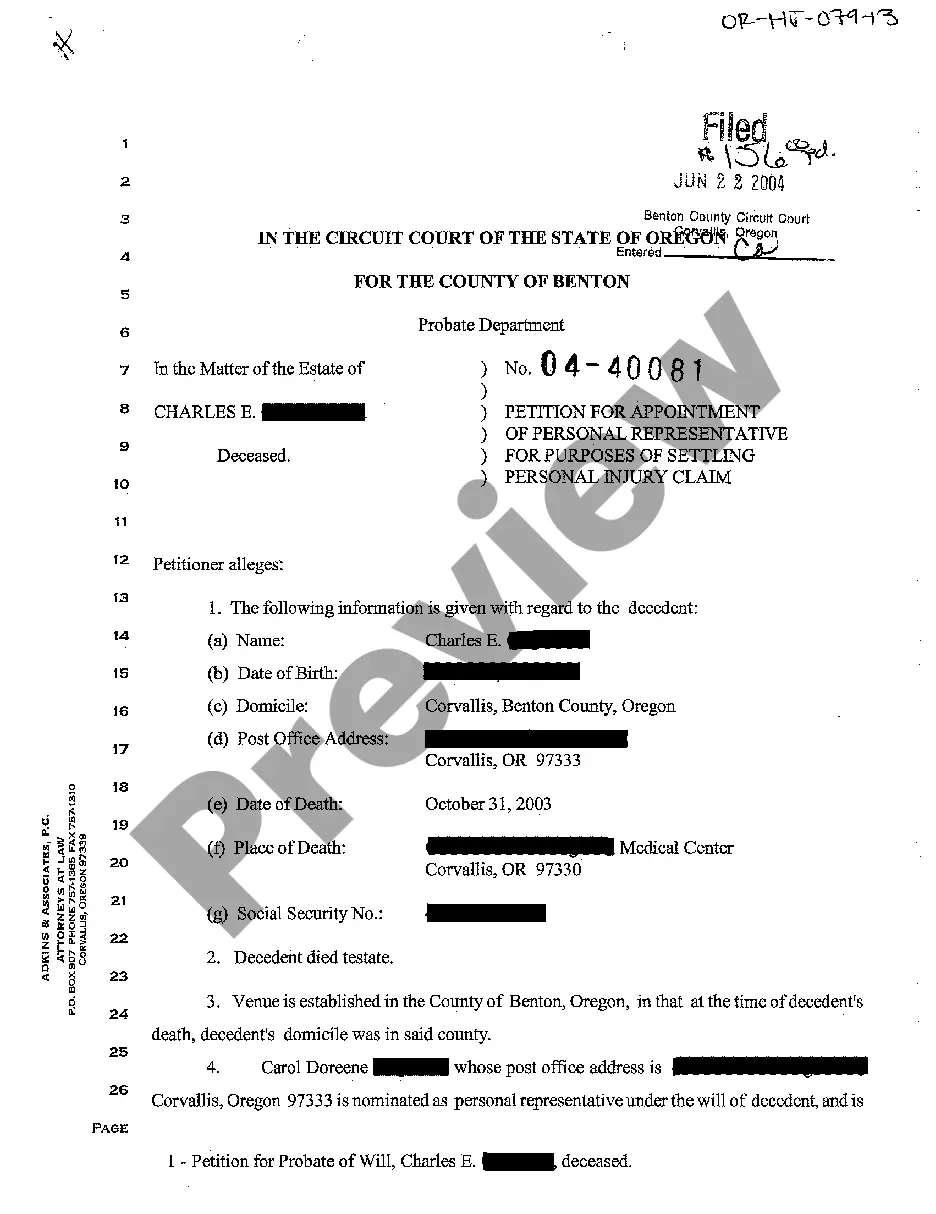

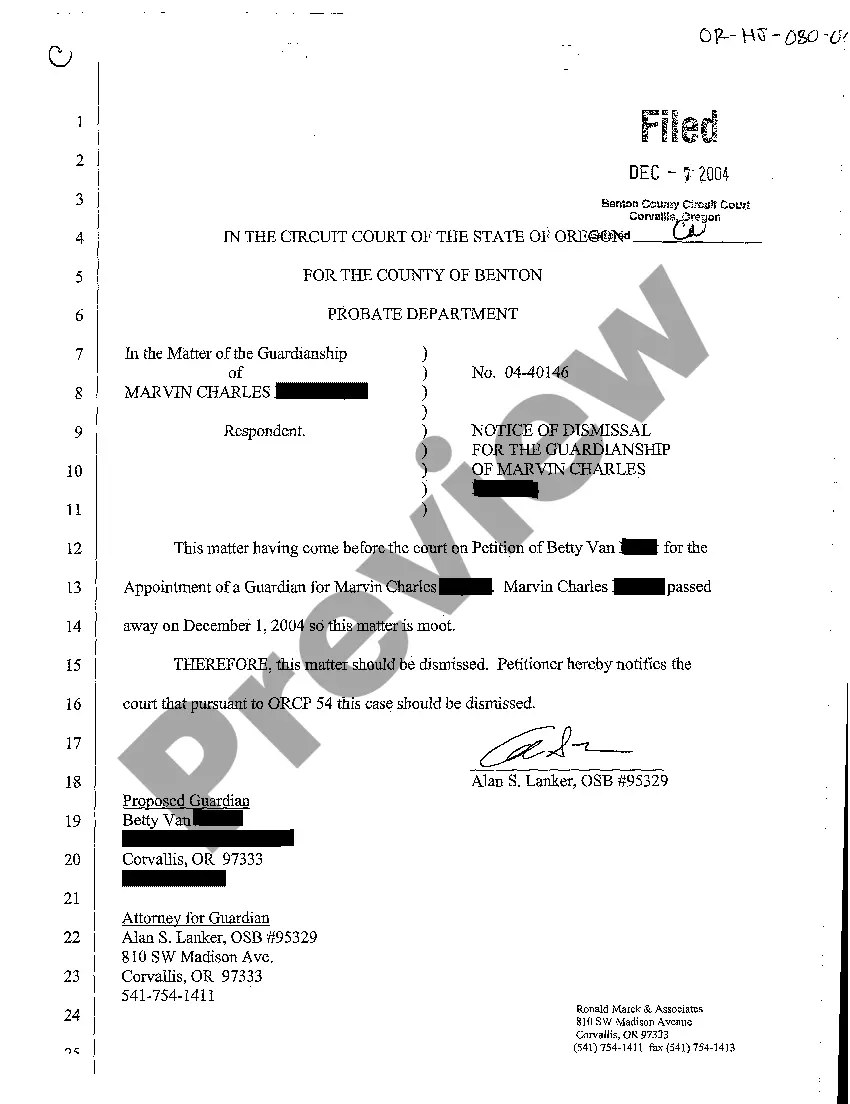

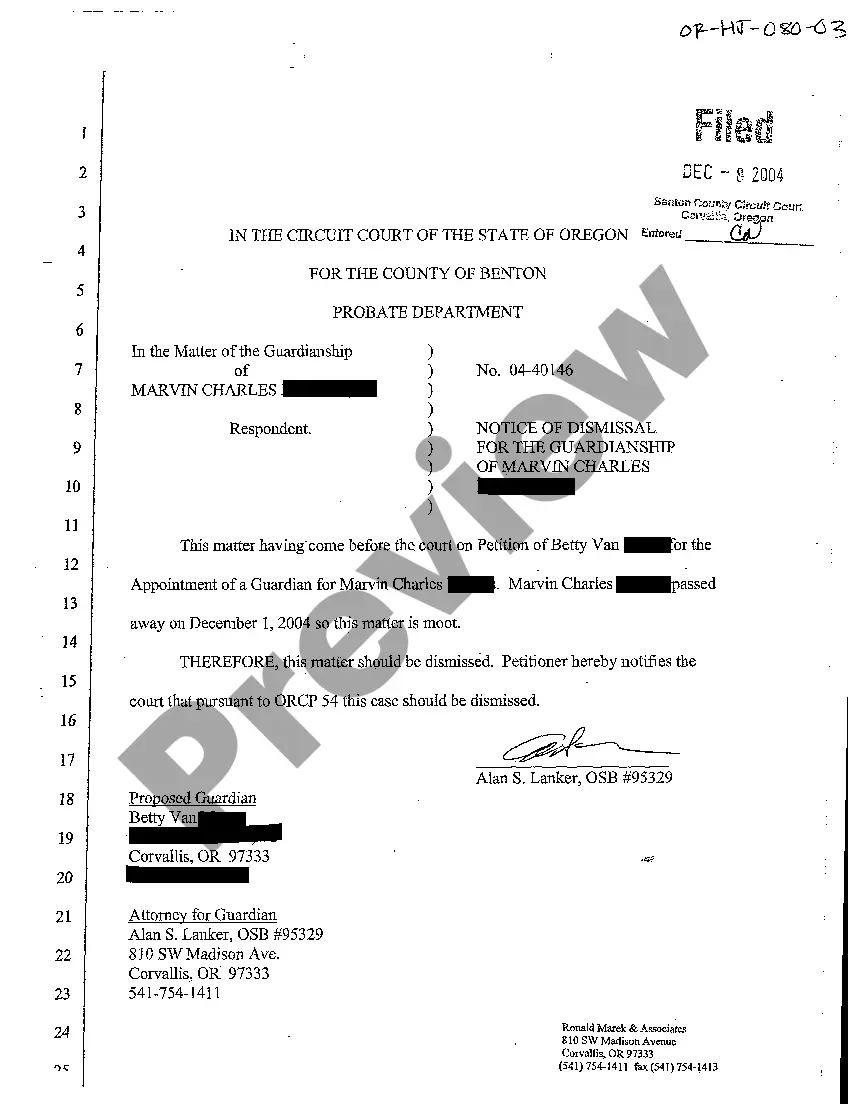

The Deed of Distribution - Personal Representative to an Individual is a legal document used to transfer ownership of property from the personal representative of an estate to an individual beneficiary. This form is essential for formalizing the distribution of assets as outlined in a decedent's will. Unlike other property transfer documents, this deed specifically relates to the distribution of estate assets managed by a personal representative, ensuring that the transfer complies with the relevant legal procedures.

Key components of this form

- Identification of the grantor, who is the personal representative.

- Identification of the grantee, the individual beneficiary of the estate.

- Legal description of the property being transferred.

- Statement of the conveyance of property via quitclaim.

- Signature and acknowledgment by the grantor before a notary public.

Situations where this form applies

This form is used when a personal representative needs to officially transfer property to a beneficiary as part of the estate's distribution process. Situations may include the closing of an estate after probate, or when specific assets are designated to be passed on to heirs as outlined in the will. It is vital to have this document completed to ensure clear legal ownership is established for the beneficiary.

Who should use this form

- Personal representatives managing estate distributions.

- Beneficiaries receiving property from an estate.

- Executors or administrators of a will during the estate settlement process.

How to complete this form

- Identify the parties involved: the grantor (personal representative) and the grantee (individual beneficiary).

- Provide a detailed legal description of the property being transferred.

- Fill in the date of the deed execution.

- Have the grantor sign the document in the presence of a notary public.

- Ensure all information is accurate and that the form is filed appropriately as required.

Does this form need to be notarized?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide a complete legal description of the property.

- Not having the document notarized, if required by local law.

- Incorrectly identifying the grantor or grantee.

- Providing false or incomplete information that may invalidate the deed.

Why use this form online

- Convenient access to legal forms that can be completed at home.

- Editable formats allow for correction and information entry at your own pace.

- Reliable templates drafted by licensed attorneys ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

The main difference lies in the appointment method and legal implications. An executor is named in a will, whereas a personal representative may be appointed by the court, especially in cases without a will. Understanding both roles is essential for navigating the complexities of estate management in a District of Columbia Deed of Distribution - Personal Representative to an Individual, ensuring your loved one's estate is handled with care and according to the law.

In general, a personal representative and an executor refer to the same function, but the term 'personal representative' is broader. An executor is specifically appointed under a will, while a personal representative can also be appointed by the court to oversee an intestate estate. This distinction is important when considering a District of Columbia Deed of Distribution - Personal Representative to an Individual, as it highlights the different pathways to managing an estate.

Yes, a personal representative named in a will typically acts in the capacity of an executor. Both roles involve overseeing the estate administration process. A District of Columbia Deed of Distribution - Personal Representative to an Individual plays a key role in fulfilling the intentions of the deceased, ensuring assets are distributed fairly and legally.

A personal representative is often referred to as an administrator or executor, depending on the context. This term broadly encompasses individuals appointed to manage a deceased person's estate. In the context of a District of Columbia Deed of Distribution - Personal Representative to an Individual, this individual ensures the proper distribution of assets according to the will or state laws.

One disadvantage of an executor involves the potential for personal liability. If the executor mishandles estate assets or fails to comply with legal requirements, they could face legal repercussions. Additionally, the executor must navigate complex probate procedures, which can be stressful and time-consuming. Understanding the role of a District of Columbia Deed of Distribution - Personal Representative to an Individual can help clarify responsibilities.

In Michigan, a personal representative has significant powers, including managing estate assets, paying debts, and distributing property. Their authority is limited to what the will states or what the court permits. Engaging with resources like the District of Columbia Deed of Distribution - Personal Representative to an Individual can help clarify these powers and ensure compliance with legal requirements.

Yes, an executor can distribute assets to themselves, but it must be done following the guidelines set out in the will and applicable laws. Transparency and fairness are essential in this process, as missteps can lead to disputes among beneficiaries. The District of Columbia Deed of Distribution - Personal Representative to an Individual provides a framework to handle such distributions appropriately.

The person listed on the deed is generally considered the legal owner of the property in question. However, this status can be complex if the property is part of an estate under probate. The District of Columbia Deed of Distribution - Personal Representative to an Individual can clarify ownership issues, ensuring proper transfer aligns with the decedent’s wishes.

An executor can transfer property to themselves, but this action must be carefully considered and documented. It typically requires transparency with all beneficiaries and may need a court's approval to avoid conflicts of interest. Using the District of Columbia Deed of Distribution - Personal Representative to an Individual ensures all transfers are conducted legally and ethically.

A personal representative on a deed is the individual appointed to manage an estate's assets, including real property. This role includes overseeing the sale or transfer of assets according to the decedent’s wishes. Understanding the significance of the District of Columbia Deed of Distribution - Personal Representative to an Individual helps clarify the responsibilities and powers associated with this position.