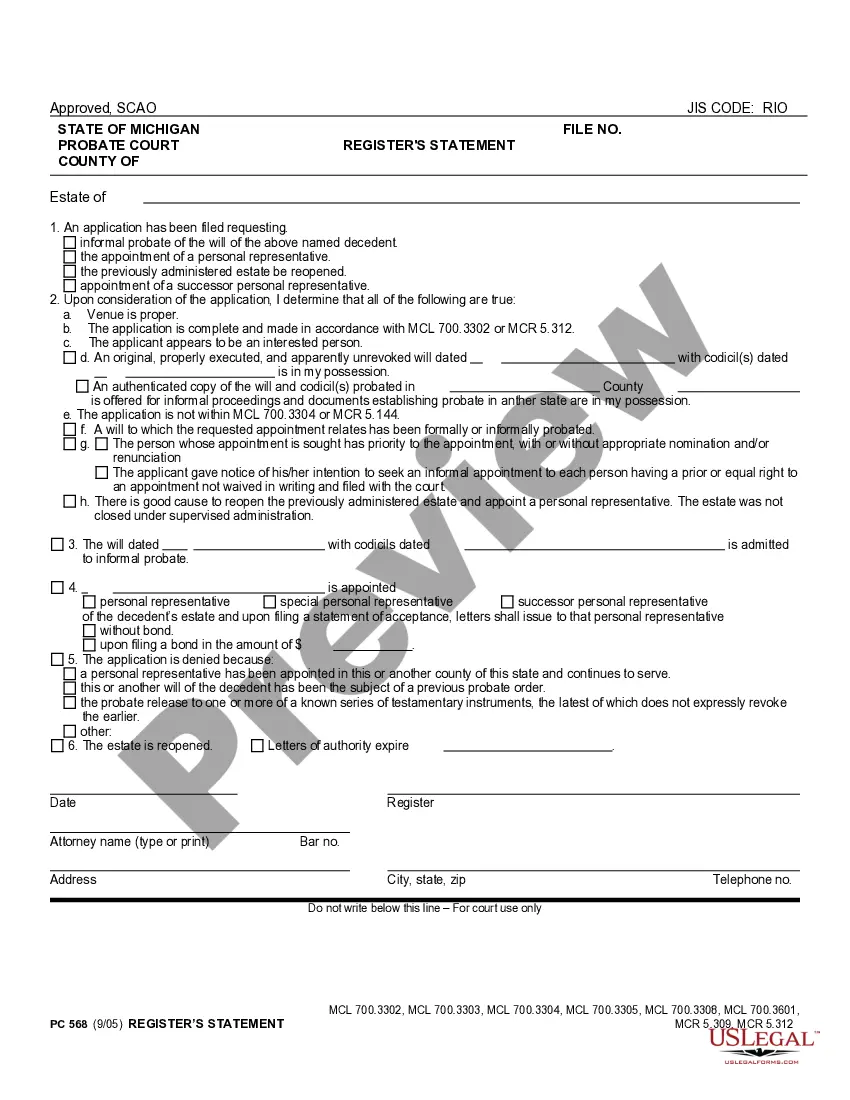

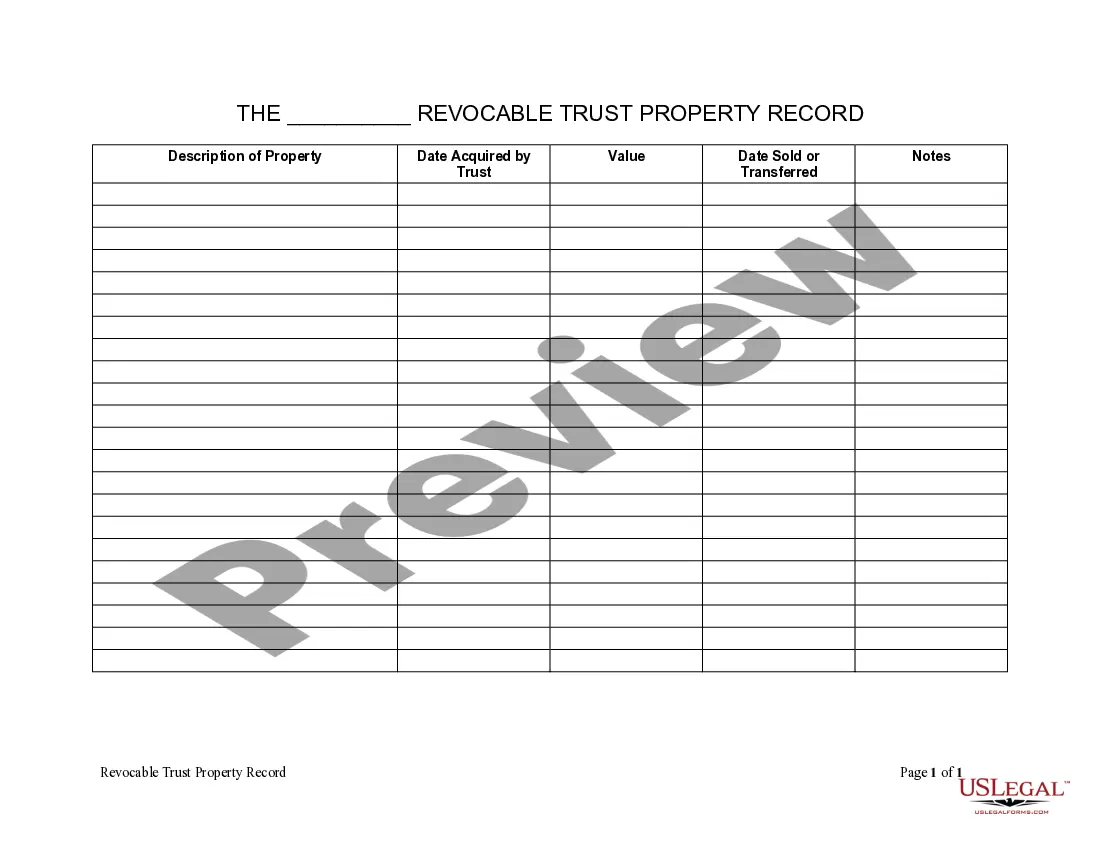

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Connecticut Living Trust Property Record

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Living Trust Property Record?

The greater the number of documents you need to prepare, the more anxious you become.

You can find countless Connecticut Living Trust Property Record templates online, but discerning which ones are trustworthy can be challenging.

Eliminate the stress of obtaining samples by utilizing US Legal Forms.

Click Buy Now to initiate the registration process and choose a pricing plan that fits your requirements. Enter the requested information to create your profile and make the payment with PayPal or credit card. Select a convenient file format and download your copy. Access each document in the My documents section. Simply visit there to prepare a new version of the Connecticut Living Trust Property Record. Even with expertly designed templates, it's advisable to consult your local lawyer to verify that your completed document is accurate. Achieve more for less with US Legal Forms!

- Receive accurately formulated documents that comply with state regulations.

- If you already possess a US Legal Forms subscription, Log In to your account to find the Download option on the Connecticut Living Trust Property Record’s webpage.

- If you haven't previously used our service, follow these guidelines to complete the registration process.

- Verify that the Connecticut Living Trust Property Record is acceptable in your residing state.

- Double-check your selection by reviewing the description or using the Preview feature if available for the chosen document.

Form popularity

FAQ

Yes, Connecticut property records are public, and anyone can access them through the appropriate town or city clerk's office. These records include information about property ownership, assessments, and transactions. While this helps maintain transparency, keep in mind that details linked to living trusts may not be as easily visible in these records. Understanding how this pertains to your Connecticut Living Trust Property Record is essential for estate planning.

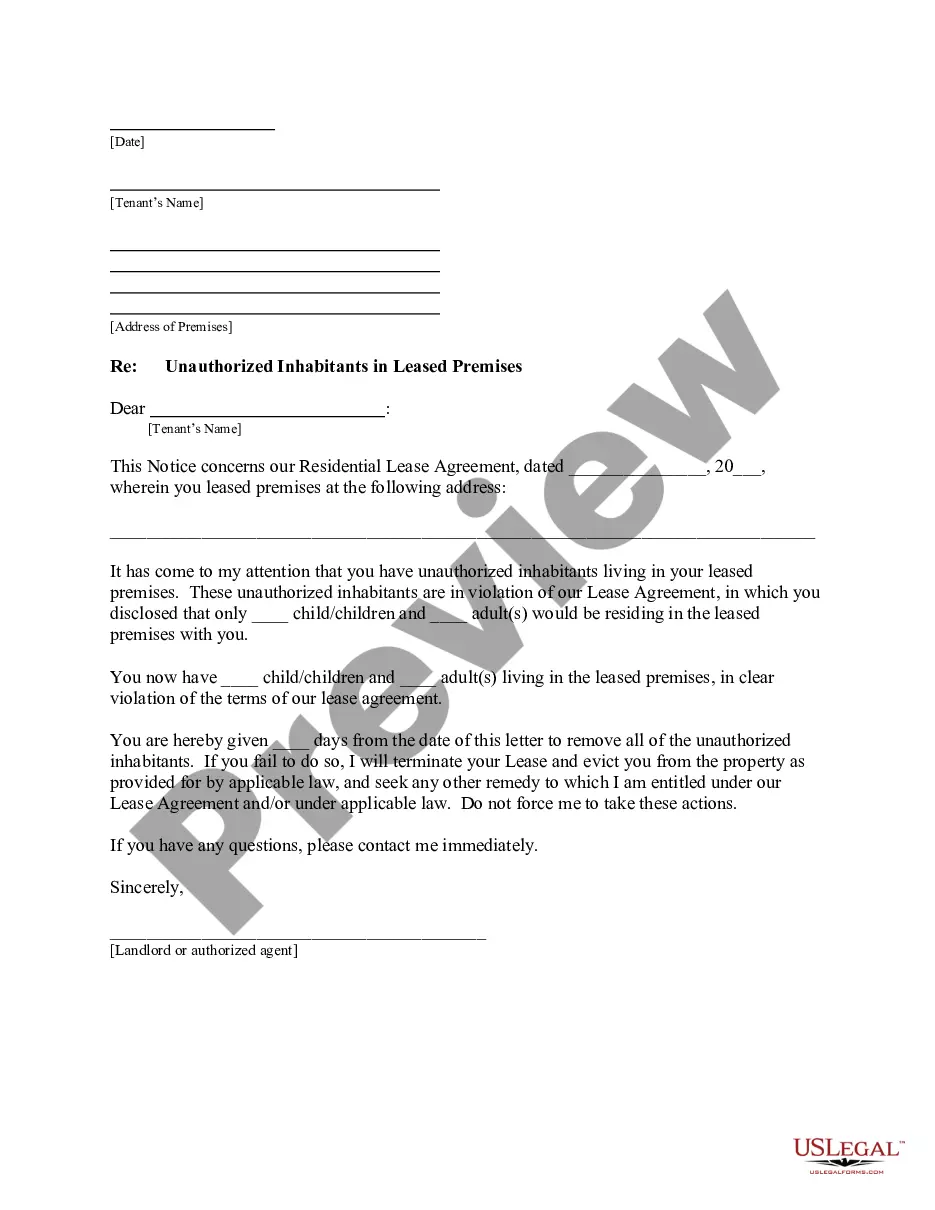

To put a house in a trust in Connecticut, you will need to create a living trust document and then execute a deed transferring ownership of the property into that trust. This process generally involves drafting a new deed that names the trust as the property owner. It is beneficial to consult with an estate planning attorney to ensure all legal requirements are met. This step is crucial for accurately updating your Connecticut Living Trust Property Record.

Individuals often choose to establish a living trust to avoid probate and ensure a smoother transition of their assets upon death. This tool allows you to maintain control over your property while also providing for your beneficiaries according to your wishes. Additionally, a living trust can help manage your assets in case you become incapacitated, giving peace of mind to you and your family. Ultimately, this offers a significant advantage in handling your Connecticut Living Trust Property Record.

A living trust in Connecticut is a legal document that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after they pass away. This arrangement can include various types of property, including real estate and bank accounts. Utilizing a living trust provides a way to bypass probate, making the distribution process smoother and more efficient. It also helps maintain privacy regarding your Connecticut Living Trust Property Record.

A living trust can be deemed invalid for several reasons, such as lack of proper notarization, failure to include all required assets, or if the grantor loses mental competency. Additionally, if the trust does not meet state-specific requirements, it may not hold up legally. Therefore, ensuring your Connecticut Living Trust Property Record is accurate and legally compliant helps maintain its validity. Using trusted services like US Legal Forms can guide you in creating a solid living trust.

To place your house in a trust in Connecticut, you need to create a deed that transfers the property from your name to the trust's name. This deed should be properly recorded in your local land records office, ensuring your Connecticut Living Trust Property Record reflects this change. You may wish to consult with an attorney or use resources available on the US Legal Forms platform to complete this process accurately.

While it is not mandatory to record a living trust in Connecticut, doing so can simplify processes like property transfer. Your Connecticut Living Trust Property Record serves as clear evidence of your intentions, making it easier for your heirs to follow your directives. Consider using a reliable platform like US Legal Forms to help you navigate the recording process with confidence.

Recording a living trust is not legally required in Connecticut. However, it can be beneficial to have your Connecticut Living Trust Property Record available for transparency and clarity. This can help protect your property and ensure that your wishes are honored after your passing. By documenting your living trust, you facilitate easier management and transfer of your assets.

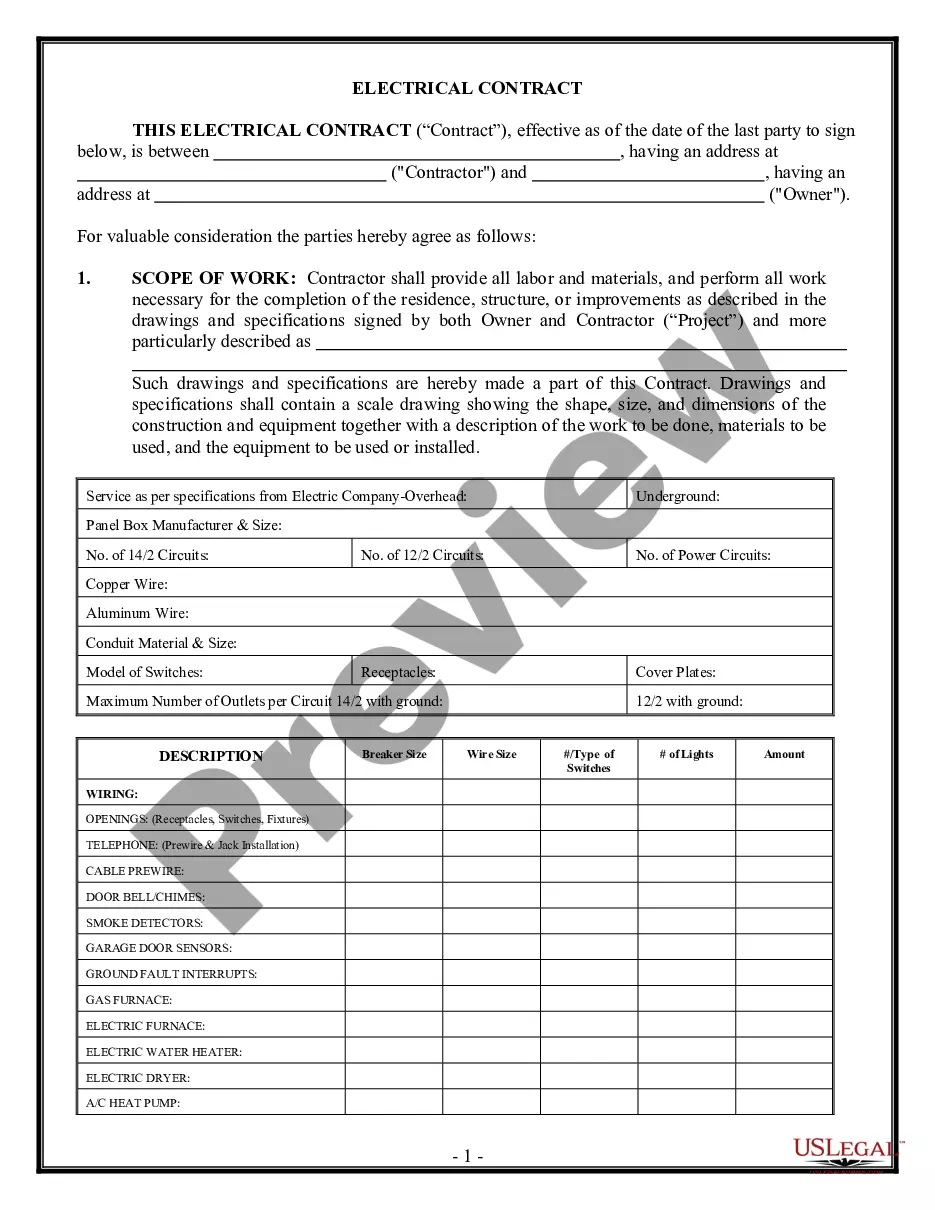

Filling a living trust typically involves drafting the trust document, which outlines how assets should be managed and distributed. You will then need to transfer ownership of assets into the trust, ensuring that the Connecticut Living Trust Property Record reflects these changes. Templates on platforms like uslegalforms can simplify this process, guiding you step by step through the necessary requirements.

One significant downfall of having a trust is the potential complexity involved in managing it, which can lead to confusion if not properly organized. Additionally, some individuals may neglect to transfer assets into the trust, leaving them outside its protection. Lastly, understanding the details related to the Connecticut Living Trust Property Record is crucial to avoid unintended consequences.