Connecticut Closing Statement

What this document covers

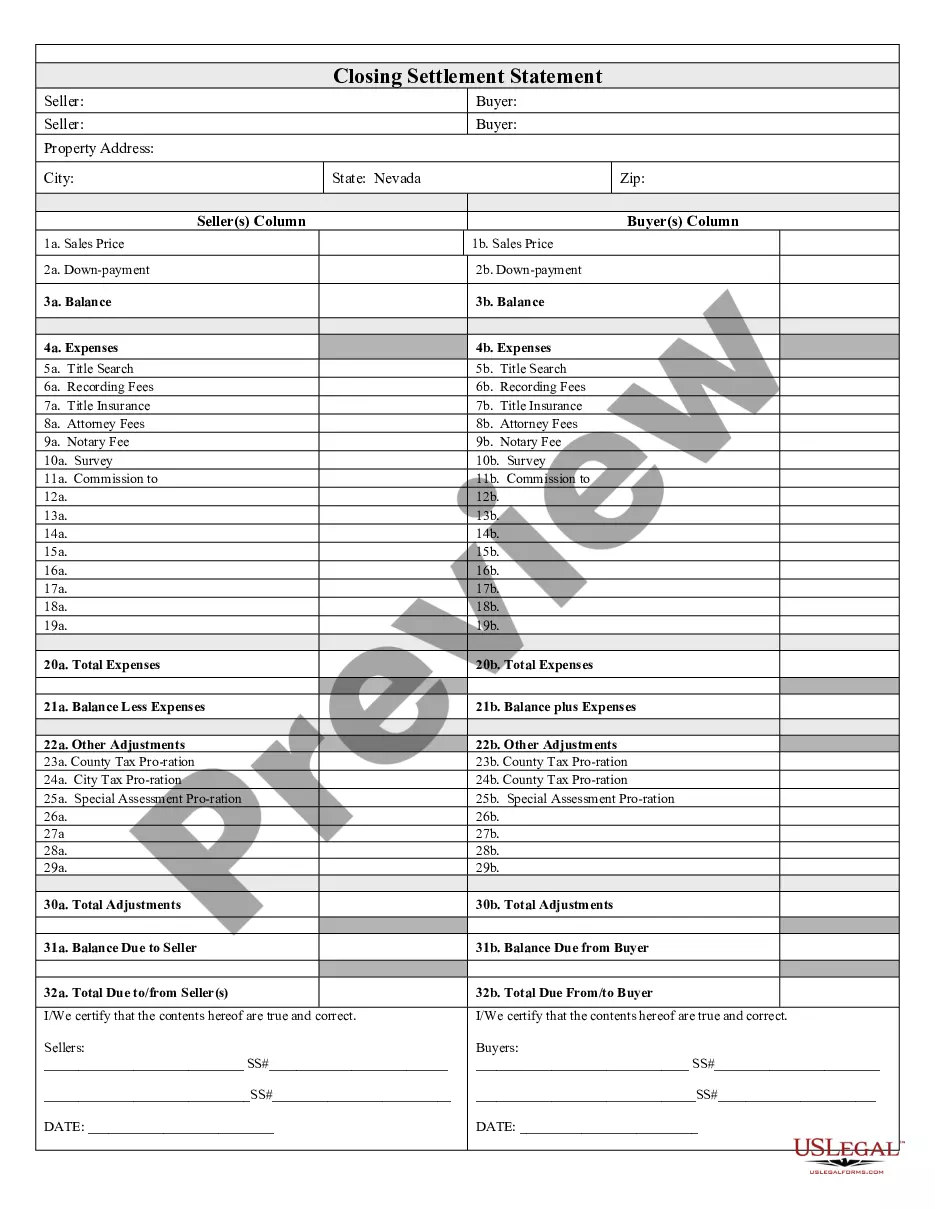

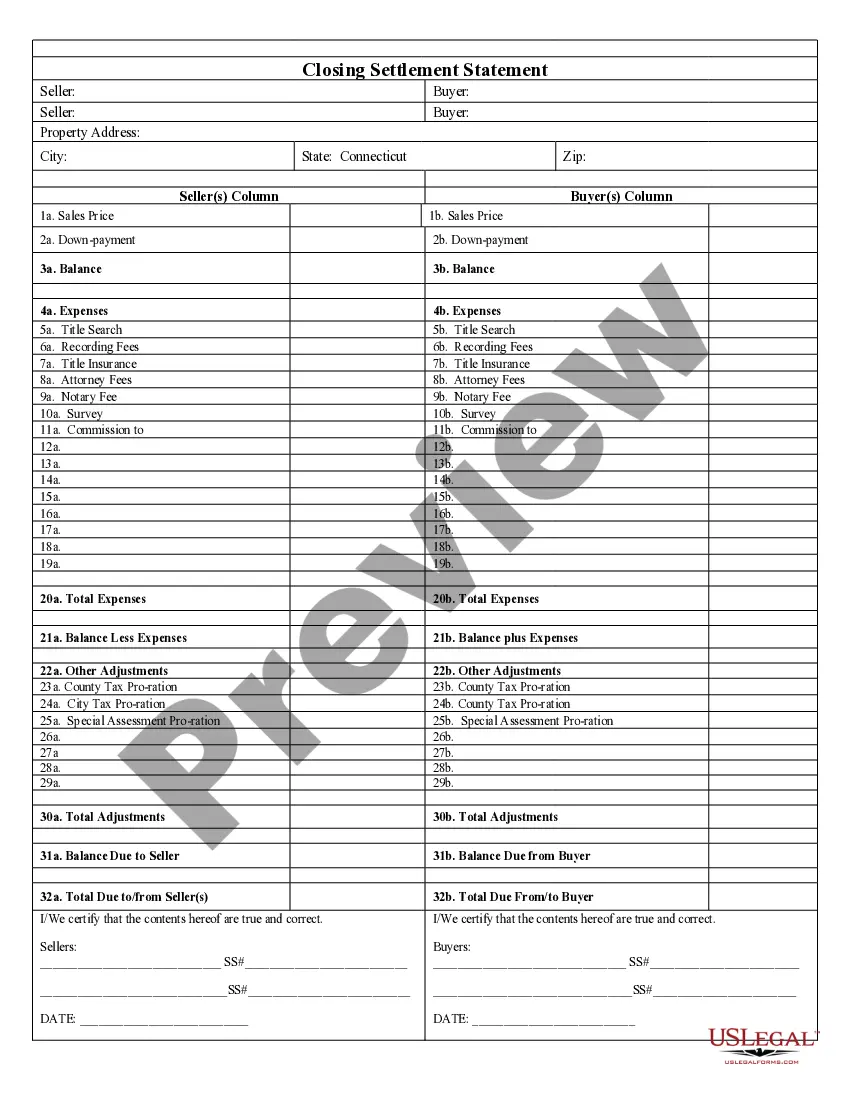

The Closing Statement is a crucial document used in real estate transactions, particularly for cash sales or owner-financed properties. It summarizes the details of the sale, providing a clear account of all expenses and adjustments related to the transaction. Unlike other forms, the Closing Statement is verified and signed by both the seller and the buyer, ensuring transparency and accuracy in the financial aspects of the deal.

Key components of this form

- Section for documenting total expenses related to the transaction.

- Fields for title search costs, recording fees, and title insurance.

- Space to outline attorney fees, notary fees, and survey costs.

- Commission details for real estate agents involved in the transaction.

- Adjustment calculations for property taxes and special assessments.

- Declaration statements signed by both seller and buyer certifying the accuracy of the information.

When to use this form

This form should be used whenever a real estate transaction occurs, particularly when the agreement involves a cash sale or owner financing. It is essential for any sales agreement that requires a detailed accounting of costs and payments to ensure both parties are fully informed and agree on the financial obligations involved.

Who can use this document

- Homebuyers and sellers involved in cash transactions.

- Individuals participating in owner-financed real estate sales.

- Real estate agents and brokers facilitating sales.

- Attorneys overseeing real estate closings.

How to prepare this document

- Identify the names and contact information of the seller and buyer.

- Document all incurred expenses associated with the transaction.

- Calculate and record any adjustments for taxes and assessments.

- Ensure all sections are filled completely and accurately.

- Have both parties review and sign the form to certify its accuracy.

Does this document require notarization?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include all expenses and adjustments.

- Not having both parties sign the document.

- Neglecting to review calculations for accuracy.

- Omitting important dates related to the transaction.

Benefits of using this form online

- Instant access to downloadable and printable forms.

- Editability allows for customization to specific transaction details.

- Reliable templates drafted by licensed attorneys ensure legal compliance.

What to keep in mind

- The Closing Statement is essential for transparency in real estate transactions.

- Accurate documentation helps prevent disputes between parties.

- Using a reliable online template can save time and ensure legal correctness.

Looking for another form?

Form popularity

FAQ

Yes, Connecticut is an attorney closing state, which means a licensed attorney must oversee the closing process. The attorney ensures that all legal documents are in order and that the Connecticut Closing Statement is accurate. This added layer of legal guidance protects both buyers and sellers during the transaction. Working with an experienced attorney will facilitate a smoother closing experience.

To retrieve your closing statement, connect with your title company or lender, as they are responsible for preparing it. It is usually provided during the closing meeting or shortly afterward for your records. If you experience any difficulties, use platforms like USLegalForms to help you navigate this process efficiently. The Connecticut Closing Statement is vital for your transaction records.

A typical closing statement includes a detailed breakdown of fees, credits, and debits associated with the property transaction. It serves as a financial summary for both the buyer and the seller. Specifically, in Connecticut, the Closing Statement includes taxes, title fees, and other closing costs. Understanding this document is crucial for ensuring transparency in your real estate transaction.

To obtain a bank closing statement, contact your bank directly. They typically issue these statements as part of the mortgage process. You can either call their customer service or access your online banking account to find the necessary documents. Ensure you mention that you need the Connecticut Closing Statement specifically to streamline the process.

Closing on a house in Connecticut typically spans from 30 to 60 days, depending on various factors like financing and due diligence. To expedite the process, both buyers and sellers should prepare their documentation ahead of time. By cooperating with your attorney and ensuring everything related to the Connecticut Closing Statement is in order, you can help speed up your closing.

The average closing time in Connecticut generally ranges from four to six weeks. This duration can vary based on the complexity of the transaction and the parties involved. Keeping track of your Connecticut Closing Statement and ensuring timely responses from all parties will help in achieving a quicker closing.

To close your business in Connecticut, you must follow state regulations, which often include filing dissolution documents with the Secretary of State. Additionally, settling any outstanding debts, notifying employees, and closing accounts is essential. Using US Legal Forms can simplify this process by providing the necessary forms and guidance for preparing your closing documents.

Closing on a house in Connecticut usually takes around 30 to 60 days on average. Various factors can influence this timeline, including financing, inspections, and title searches. By being organized and ensuring all documents are in order, you can help facilitate a smoother process for your Connecticut Closing Statement.

The closing statement is typically prepared by the closing agent or the attorney handling the transaction. In Connecticut, this is often the real estate attorney representing the buyer or seller. They ensure that all financial details are accurately displayed on the Connecticut Closing Statement, reflecting the costs and adjustments associated with the property transfer.

To obtain a copy of your Connecticut Closing Statement, you can contact the closing agent or attorney who handled your transaction. They are responsible for preparing and distributing this document to involved parties. If you used the US Legal Forms platform, you could also access your closing statement through your account. This service streamlines the process, making it easier for you to manage your real estate documents.