California Warranty Deed for Fiduciary

Understanding this form

A Warranty Deed for Fiduciary is a legal document used to transfer ownership of real estate when the grantor is acting in a fiduciary capacity, such as an executor of a will, trustee, guardian, or conservator. This form is distinct from other types of warranty deeds, as it involves a fiduciary who is responsible for managing the interests of another party. The Warranty Deed guarantees that the property title is clear and that the grantor has the authority to convey the property on behalf of the beneficiary.

Key parts of this document

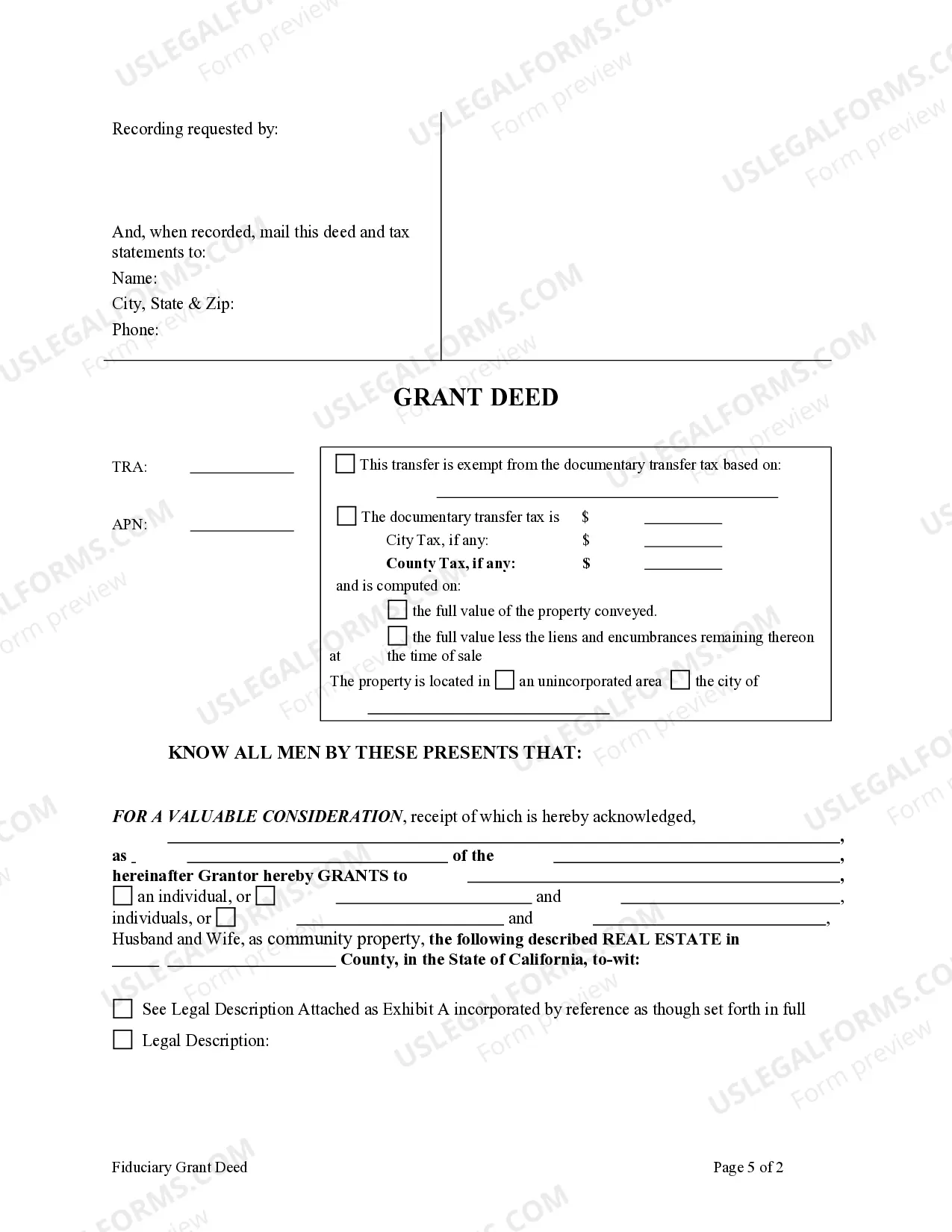

- Identification of the grantor (fiduciary) and grantee (beneficiary).

- Property description, including address and legal description.

- Language affirming the grantorâs authority to transfer the property.

- Warranty clause guaranteeing the title is free from defects.

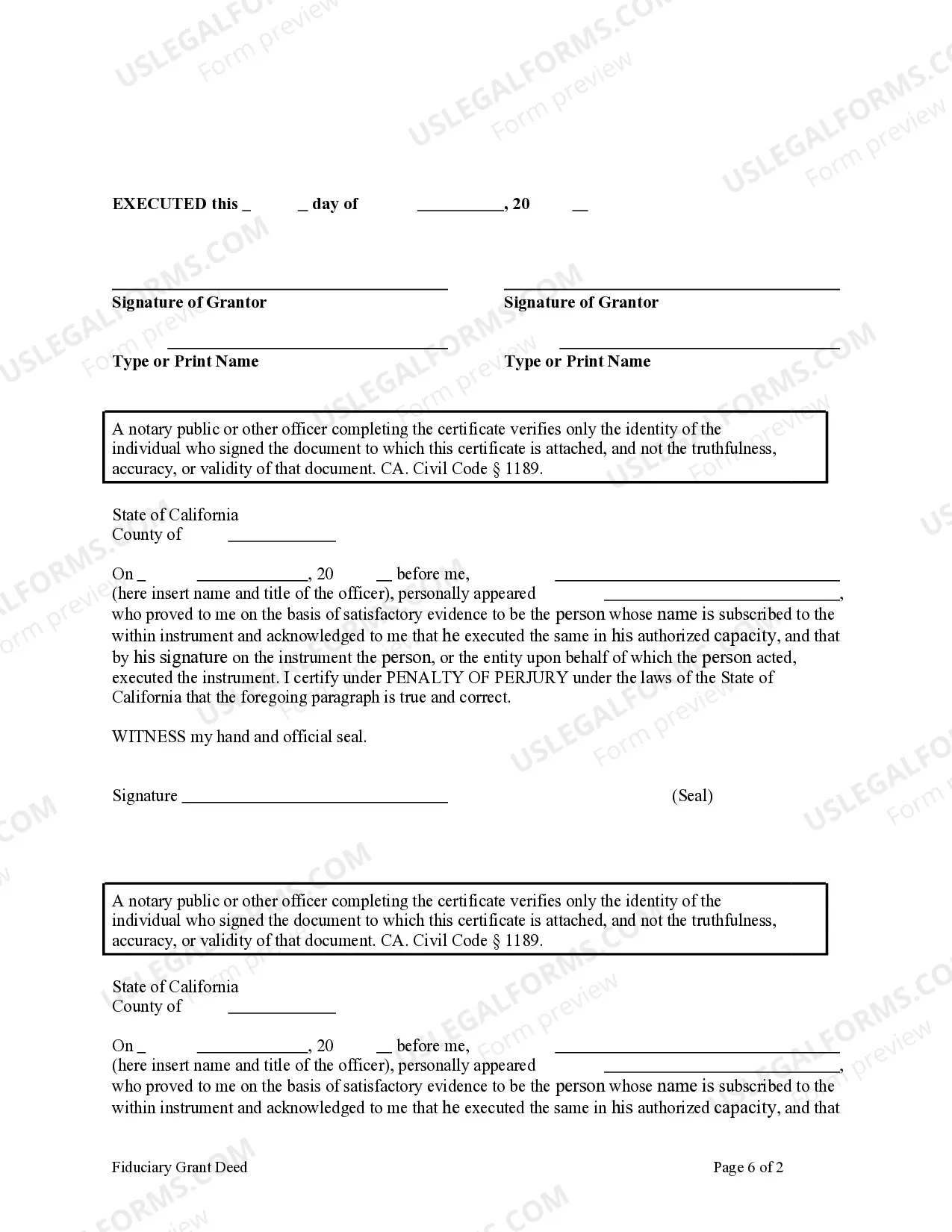

- Signature section for the grantor and, if necessary, a notary.

Situations where this form applies

This form is needed when a fiduciary wishes to convey real estate to another party as part of their duties to manage property on behalf of someone else. Situations may include transferring property from an estate during probate proceedings or managing assets held in a trust.

Who needs this form

- Executors of a will responsible for distributing property to beneficiaries.

- Trustees managing a trust and needing to transfer real estate to beneficiaries.

- Guardians or conservators handling assets on behalf of a minor or incapacitated individual.

How to complete this form

- Identify the fiduciary (grantor) and the beneficiary (grantee).

- Provide a detailed description of the property, including its legal address and any identifying information.

- Enter the date of the transaction and any exemption details related to transfer tax, if applicable.

- Read and include the warranty clause to ensure the title is clear.

- Sign the form in the designated area and obtain notarization if required.

Does this form need to be notarized?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to accurately describe the property or including incorrect information.

- Not having the form notarized when required, which can invalidate the deed.

- Omitting necessary signatures from the fiduciary or the beneficiary.

- Neglecting to check for potential transfer tax exemptions that may apply.

Why complete this form online

- Immediate access to a legally compliant template drafted by licensed attorneys.

- Convenience of completing the form at your own pace and on your schedule.

- Editability to ensure all information is correct before final submission.

- Cost-effective solution compared to hiring an attorney for basic documentation.

Main things to remember

- A Warranty Deed for Fiduciary is essential for transferring property on behalf of another party.

- Common users include executors, trustees, and guardians.

- Ensure the form is completed accurately and notarized to maintain its legality.

- Using this form online saves time and provides access to expert-drafted templates.

Looking for another form?

Form popularity

FAQ

The primary disadvantage of a warranty deed is the potential liability it imposes on the grantor. If any claims arise regarding the title or ownership after the transfer, the grantor must defend against those claims, which may involve additional legal costs. However, using a California Warranty Deed for Fiduciary can offer peace of mind, as it allows fiduciaries to fulfill their obligations while minimizing personal liability.

A fiduciary warranty deed is a specific type of warranty deed used by a fiduciary, such as an executor or trustee, to transfer property. This deed ensures that the fiduciary acts within their legal authority and protects the interests of the beneficiaries. When you opt for a California Warranty Deed for Fiduciary, you establish a strong legal foundation for the property transfer, ensuring compliance and security in the transaction.

The strongest form of deed is generally considered to be the warranty deed, as it provides the grantee with full legal protection against any claims to the property. Unlike other types of deeds, a warranty deed ensures that the seller guarantees clear title to the property and commits to defending against any future claims. When using a California Warranty Deed for Fiduciary, you receive additional benefits, as it carries forward these protections while allowing fiduciaries to act in compliance with legal standards.

A fiduciary deed serves to transfer property on behalf of another person, such as a trustee or an executor of an estate. This type of deed is crucial in estate planning and settling an estate, as it ensures that the property is properly handled according to the legal obligations of the fiduciary. Utilizing a California Warranty Deed for Fiduciary can provide the necessary legal backing to protect all parties involved in the transaction.

The key difference between a quitclaim deed and an Interspousal transfer deed in California lies in ownership transfer and the rights conveyed. A quitclaim deed transfers any interest the grantor has in the property, without assuming any warranty on the ownership. On the other hand, an Interspousal transfer deed is specifically designed for spouses to transfer property between each other, often with certain legal protections in place. If you are navigating property transfers, consider using a California Warranty Deed for Fiduciary for secure and efficient processing.

While a deed does not have to be recorded to be valid in California, recording it provides legal protection and public notice. By recording a California Warranty Deed for Fiduciary, you help prevent future disputes regarding property ownership. It is advisable to record your deed to ensure your rights are protected as the property owner.

In California, trust documents do not need to be recorded to be valid. However, recording a California Warranty Deed for Fiduciary associated with the trust can provide public notice of the trust's terms. This can protect the beneficiaries and ensure that the property is transferred according to your intentions. Consider recording relevant documents to maintain clarity and legality.

To record a deed of trust in California, first, complete the document with all necessary details. After that, you must find the local county recorder's office where the property is located. Submit the document along with the required fees, and ensure it includes the proper legal description of the property. Utilizing a well-drafted California Warranty Deed for Fiduciary can simplify this process.

To get the warranty deed for your property, you can visit your county’s recorder’s office or request a copy online, depending on your state’s regulations. If your property is in California and you require a California Warranty Deed for Fiduciary, consider using uslegalforms. Their platform can assist you in locating the correct forms and ensuring the deed is filled out properly.

To obtain a copy of your house deed in Missouri, you should contact the county recorder’s office where your property is situated. They can provide you with the necessary paperwork or facilitate an online request. If you need help navigating this process or looking for a specific deed type, uslegalforms has resources that can guide you effectively.