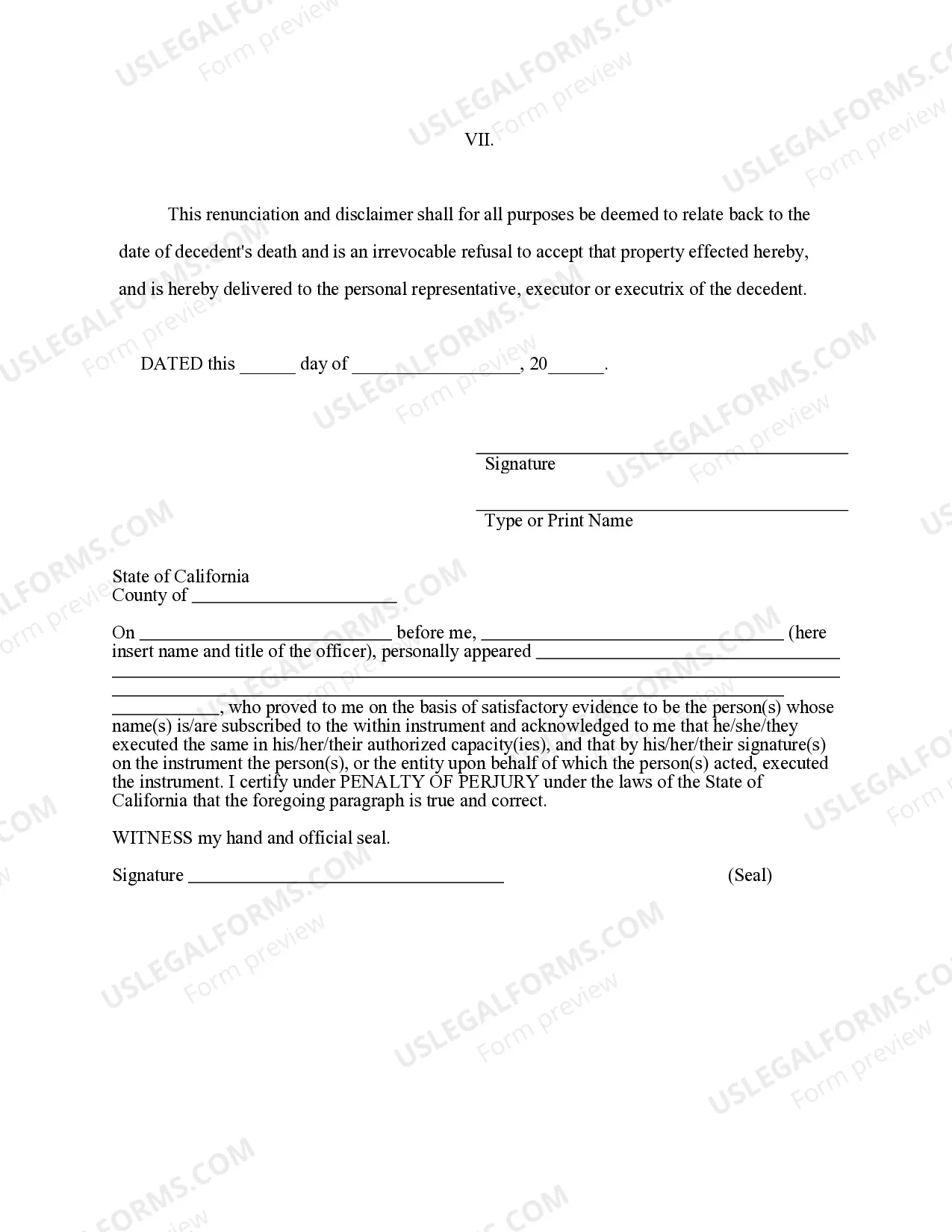

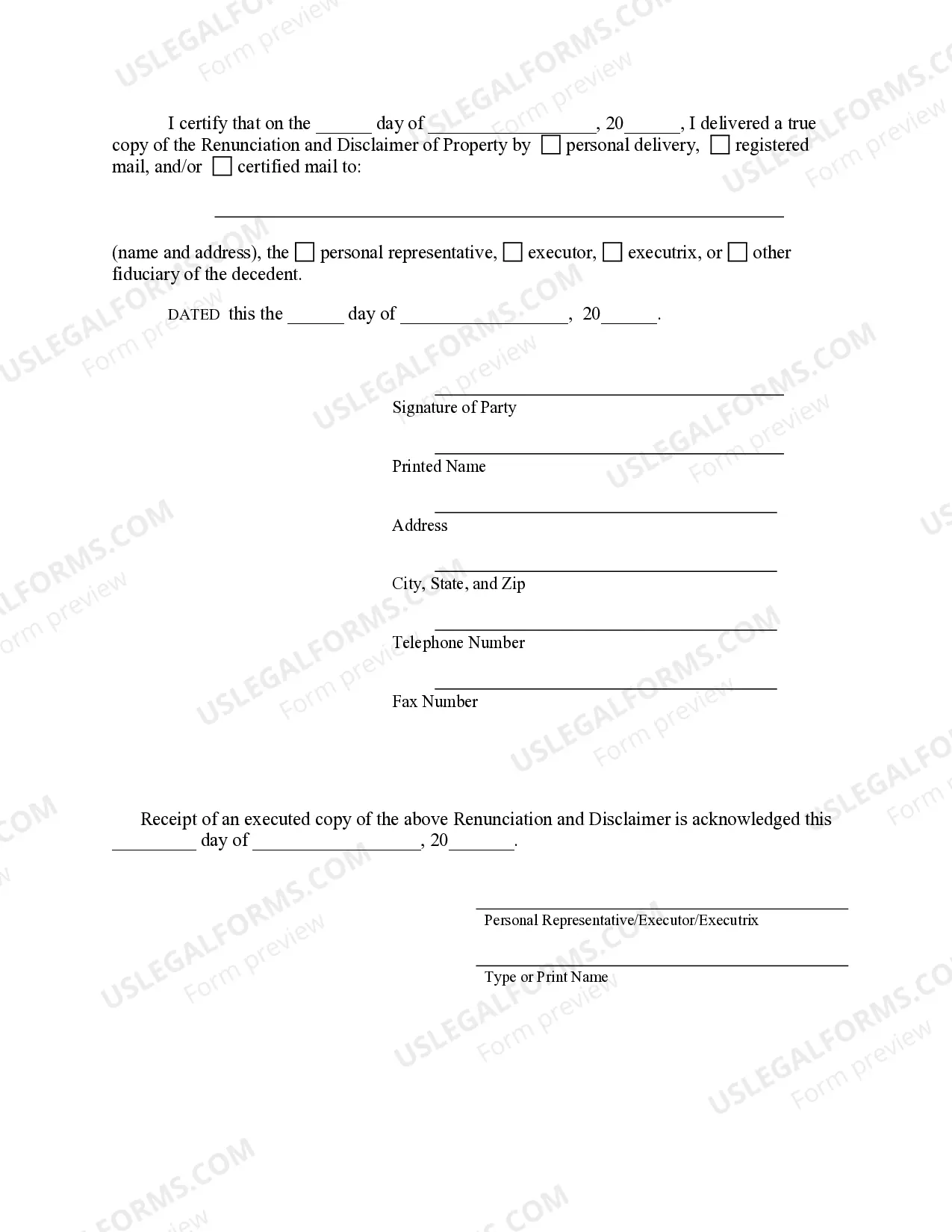

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out California Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

If you're looking for accurate California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract web templates, US Legal Forms is precisely what you need; obtain documents created and reviewed by state-certified legal professionals.

Utilizing US Legal Forms not only alleviates concerns regarding proper paperwork; it also saves you time, effort, and money! Downloading, printing, and completing a professional form is significantly less expensive than hiring an attorney to draft it for you.

And that's it. In just a few simple clicks, you will possess an editable California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. Once your account is set up, all future orders will be processed even more smoothly. If you have a US Legal Forms subscription, simply sign in to your account and click the Download button found on the form's page. Then, whenever you need to use this blank again, you will always be able to find it in the My documents section. Don’t waste your time and energy searching for various forms on multiple sites. Purchase accurate copies from one secure platform!

- To start, complete your registration process by entering your email address and creating a password.

- Follow the outlined steps to set up your account and locate the California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract template to resolve your issues.

- Use the Preview option or review the file details (if available) to ensure that the template meets your needs.

- Verify its validity in your state.

- Click on Buy Now to proceed with the purchase.

- Choose a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select a convenient format and save the document.

Form popularity

FAQ

To write an inheritance disclaimer letter, begin by clearly stating your intent to disclaim the property. Include specific details such as the nature of the property, your relationship to the decedent, and your signature. It is advisable to refer to a California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract template to ensure compliance with California laws. Templates and guidance on this matter can be found on UsLegalForms for your ease.

If you refuse your inheritance, it typically goes to the next beneficiary as defined in the will or by state law. This process allows the property to bypass any complications or taxes associated with your refusal. Utilizing a California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract ensures that your decision is formalized and recognized legally. The UsLegalForms platform can provide the necessary documentation to facilitate this process.

An estate disclaimer can be illustrated by a situation where an individual refuses an inheritance of real estate due to financial obligations associated with the property. By filing a formal disclaimer, this individual can redirect the inheritance to the next beneficiary without facing tax burdens. Using a California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract can help ensure that you make prudent decisions regarding your inheritance. Templates are available on UsLegalForms for your convenience.

To disclaim inherited property, you must submit a written disclaimer that states your intent to refuse the property. This disclaimer must meet specific criteria under California law, especially when dealing with life insurance or annuity contracts. A properly executed California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract will ensure that your refusal is legally acknowledged. For assistance, you can explore resources available on the UsLegalForms platform.

To report the sale of inherited property on your tax return, you must first determine the fair market value of the property on the date of the decedent's death. Then, you will calculate any gain or loss based on this value. It is vital to note that the California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract may affect how you handle the inheritance for tax purposes. Consulting a tax professional can simplify this process.

To disclaim inherited property, you must follow the procedures outlined in the California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. First, you should prepare a written disclaimer that clearly states your intention to renounce the property. Next, you need to sign and date the disclaimer, ensuring it meets the specific requirements of California law. Consulting with a legal expert can help you navigate this process effectively and ensure that your disclaimer is valid.

The purpose of a renunciation form is to officially notify the relevant parties that you are refusing certain inherited assets. This is a critical step in ensuring a clear record of your intentions, particularly in the context of California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. A well-drafted form helps protect you from possible legal disputes and clarifies the distribution of property.

Yes, you can disclaim an annuity in California by following specific legal steps. This typically involves drafting and submitting a formal renunciation document within the appropriate time frame. By utilizing resources like USLegalForms, you can easily ensure that your disclaimer adheres to the California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract requirements.

Renunciation of property means formally rejecting specific assets that you are entitled to inherit. This allows the property to pass directly to alternate beneficiaries without the renouncing party's involvement. In the context of the California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, it ensures compliance with state regulations while protecting the inheritor's financial interests.

Disclaiming assets can be advantageous if you want to prevent incurring taxes or managing unwanted properties. Many individuals find themselves receiving assets that do not fit their financial strategy, such as feeling unprepared to handle a life insurance payout. Through the California Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, disclaiming these assets can redirect them to someone better suited to manage them.