California Renunciation And Disclaimer of Property received by Intestate Succession

What is this form?

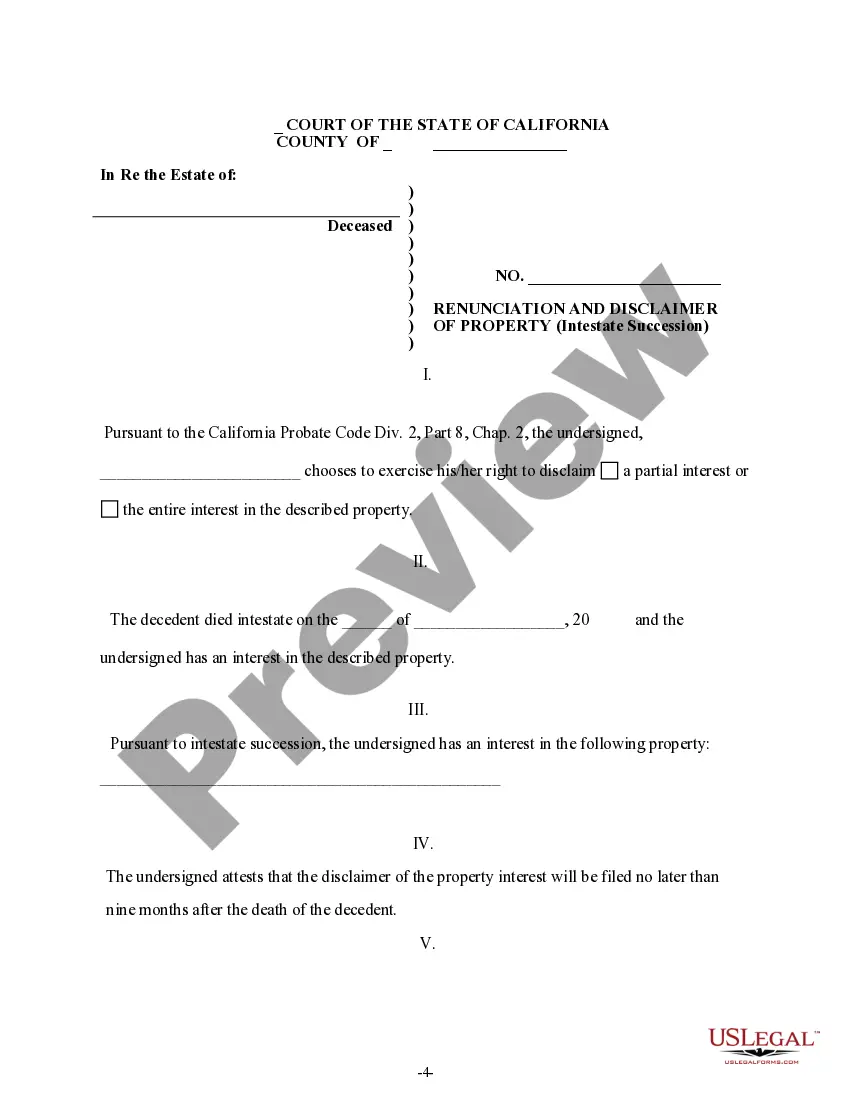

The California Renunciation and Disclaimer of Property gained through intestate succession is a legal document allowing a beneficiary to refuse their interest in property inherited from a decedent who died without a will. This form is particularly important because it formalizes a beneficiary's decision to disclaim their rights, which may then pass to other designated heirs, ensuring compliance with California law. Unlike other inheritance forms, this document specifically addresses the renunciation of inherited property rights following intestate succession.

What’s included in this form

- Identification of the beneficiary opting to disclaim property interest.

- Specification of the property being disclaimed.

- Details of the individuals who will inherit the property instead.

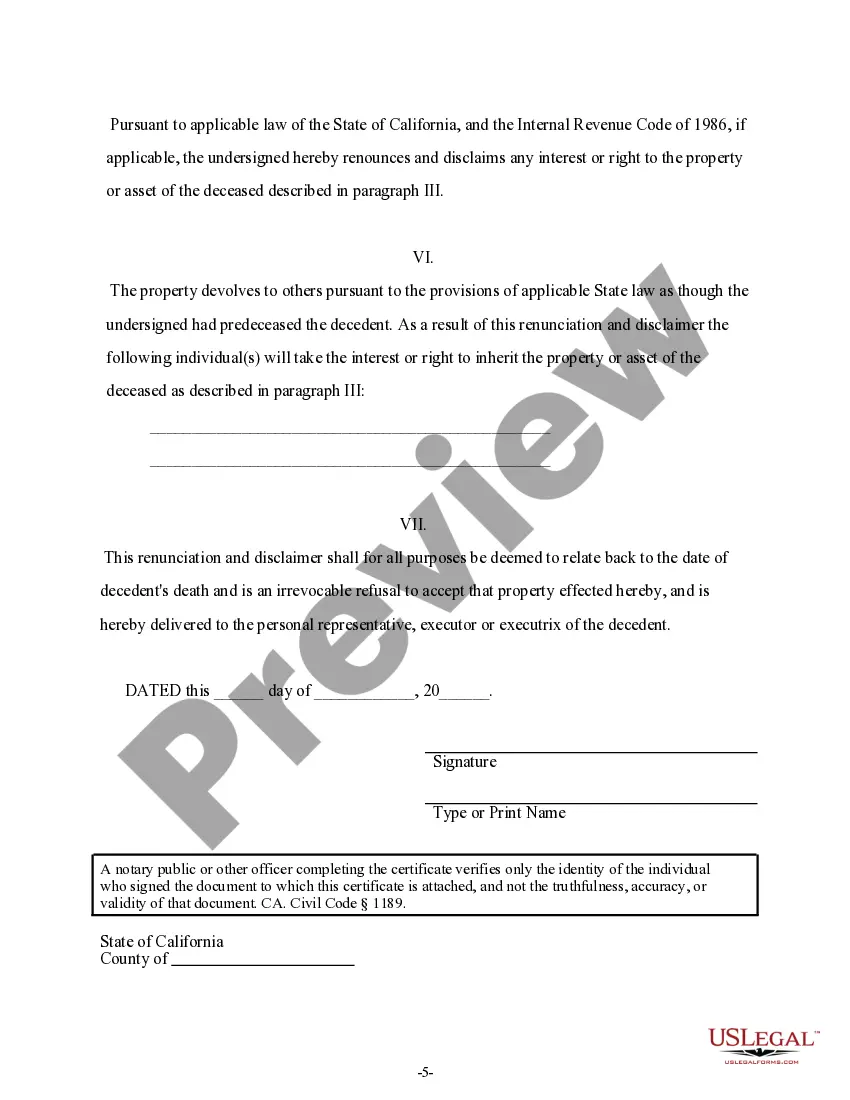

- A declaration that the renunciation relates back to the decedent's date of death.

- Signature of the disclaimed beneficiary.

State-specific requirements

This form is tailored for use in California, where the laws surrounding intestate succession and property renunciation are outlined in the California Probate Code, Division 2, Part 8, Chapter 2. It includes specific requirements and terminology relevant to California laws regarding disclaimers of property interests.

Situations where this form applies

This form is used when a beneficiary inherits property through intestate succession but wishes to disclaim their interest in it. Common situations include when a beneficiary wants to pass their inheritance directly to other relatives or to avoid tax implications associated with the asset. It can also be beneficial for those who may not want to manage the property or are facing financial difficulties that would complicate accepting the inheritance.

Who this form is for

- Beneficiaries who have received property through intestate succession and wish to renounce their interest.

- Individuals seeking to clarify the distribution of assets from a decedent who did not leave a will.

- Heirs who want to redirect their inheritance to other designated heirs.

How to prepare this document

- Identify the beneficiary who is renouncing their interest in the property.

- Specify the property being disclaimed in the designated section.

- List the names of individuals who will inherit the property instead.

- Date the form appropriately, indicating the day, month, and year.

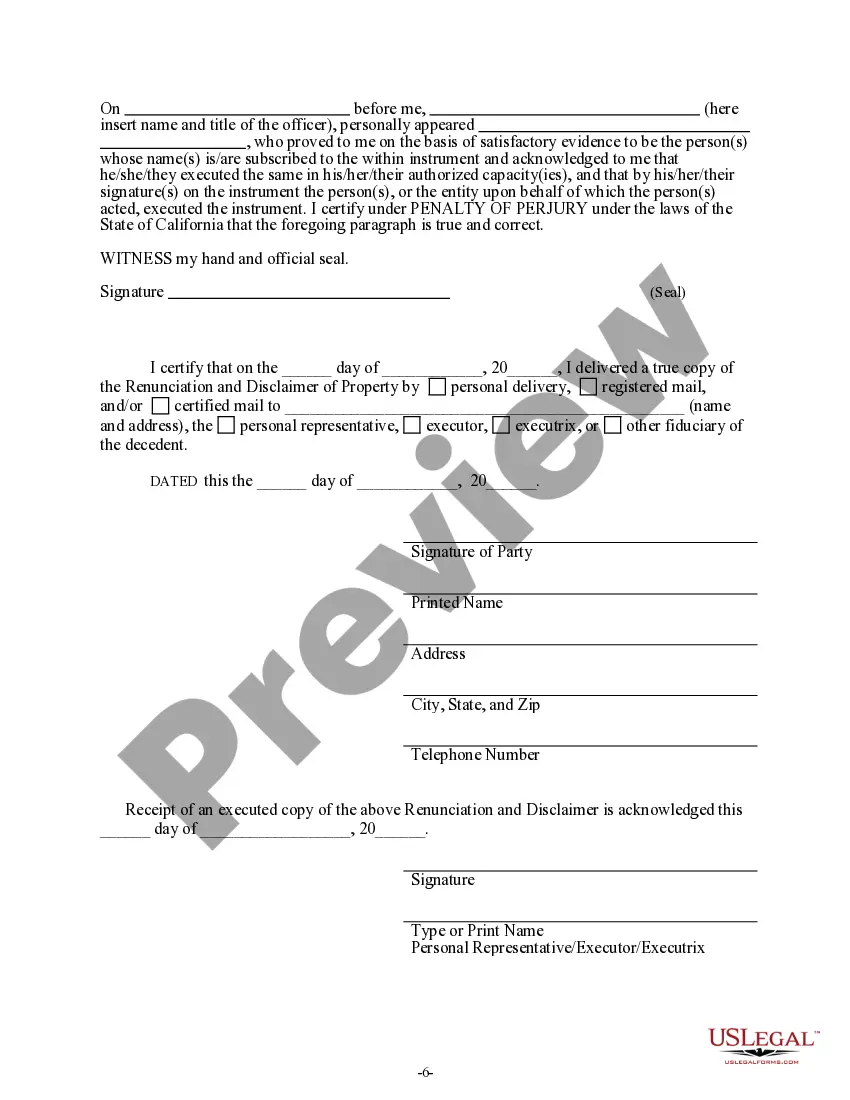

- Sign the form in the presence of a witness, if required.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Avoid these common issues

- Failure to properly identify all parties involved in the inheritance.

- Not listing the correct individuals who will take the property after the disclaimer.

- Omitting the date or signature on the form.

- Not understanding the legal implications of renouncing an inheritance.

Why use this form online

- Convenient access from any location to complete and download the form.

- Editability allows for easy updates and corrections before finalizing.

- Reliability of templates prepared by licensed attorneys, ensuring legal compliance.

- No need for in-person visits or extensive paperwork, streamlining the process.

Key takeaways

- Use the California Renunciation and Disclaimer of Property to formally refuse an inherited interest.

- The form helps redirect inheritance to other individuals, complying with state laws.

- Complete the form carefully to avoid common pitfalls associated with disclaiming property.

- Online access to this form makes it easy and efficient to manage the disclaimer process.

Form popularity

FAQ

In California, all heirs do not necessarily have to agree to sell inherited property. However, if one heir wants to sell and others disagree, mediation or court intervention might be necessary. This situation highlights the importance of the California Renunciation and Disclaimer of Property received by Intestate Succession, as it clarifies the rights of each heir. For assistance, consider using USLegalForms, which offers solutions to help resolve these types of disputes.

To force the sale of inherited property in California, beneficiaries typically must file a petition in probate court. This petition outlines reasons for the sale, such as disputes among heirs or financial burdens. By understanding the California Renunciation and Disclaimer of Property received by Intestate Succession, you can navigate this process more effectively. USLegalForms provides resources and forms to help you take the right steps and streamline your efforts.

In California, a beneficiary can pursue a sale of inherited property, particularly when disagreements arise among heirs. However, the process is not straightforward and often requires a court's involvement. It is essential to understand the California Renunciation and Disclaimer of Property received by Intestate Succession, as it outlines rights and responsibilities regarding inherited assets. If you face challenges, consider using USLegalForms for legal guidance tailored to your situation.

Probate Code 7000 in California outlines general provisions related to wills and intestate succession. This code is significant for understanding how property is handled when someone dies without a will. Familiarity with these laws supports a thorough California Renunciation And Disclaimer of Property received by Intestate Succession process. For a deeper dive into these codes, explore the comprehensive legal documents available at USLegalForms.

An estate disclaimer is a formal statement where an heir decides not to accept their inheritance. For instance, if a beneficiary renounces a property they received through intestate succession, this disclaimer must follow California's regulations under the probate code. Doing so helps avoid unintended tax implications or disputes. For practical examples and template disclaimers, visit USLegalForms, where you can find resources tailored to your situation.

To write an inheritance disclaimer letter, begin by clearly stating your intention to renounce the inheritance. Include specific details about the property and reference the applicable California laws, ensuring your statement aligns with California Renunciation And Disclaimer of Property received by Intestate Succession. It's important to keep the letter straightforward and formal. For examples and templates, check out resources at USLegalForms to streamline the process.

The probate code for intestate succession in California is found primarily within sections 6400 to 6414 of the Probate Code. These sections define how assets are distributed among heirs who are entitled to inherit from a deceased person without a will. If you wish to explore California Renunciation And Disclaimer of Property received by Intestate Succession, understanding these sections will be beneficial. For simplified legal documents, USLegalForms can provide templates to help you.

Probate Code 8110 in California pertains to the irrevocable nature of certain disclaimers. This law states that, once a disclaimer is made, it cannot typically be revoked. Understanding this aspect is crucial for anyone considering a California Renunciation And Disclaimer of Property received by Intestate Succession. For detailed guidance, consider visiting USLegalForms to access legal resources tailored to your needs.

Section 4712 of the California Probate Code addresses the procedure for disclaiming property under intestate succession rules. This section provides specific guidelines on how an individual can renounce their inheritance. Following these guidelines ensures that your California Renunciation And Disclaimer of Property received by Intestate Succession is legally valid. For more information, you might find useful templates and advice on platforms like USLegalForms.

In California, intestacy laws are governed by the California Probate Code, specifically sections 6400 to 6414. These sections outline how property is distributed when someone passes away without a valid will. Understanding these laws is essential for anyone dealing with California Renunciation And Disclaimer of Property received by Intestate Succession. If you need assistance, consider using resources like USLegalForms to navigate these legal complexities.