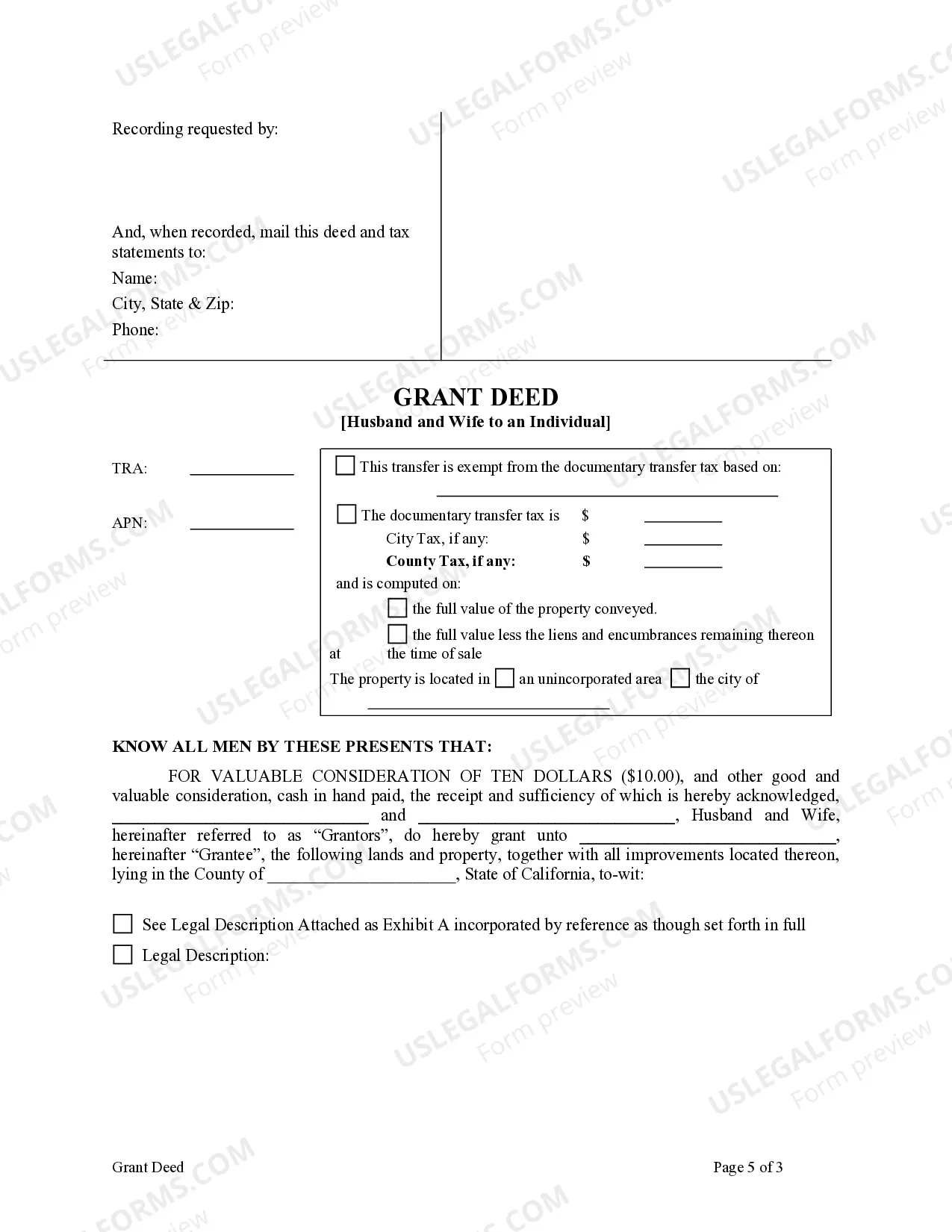

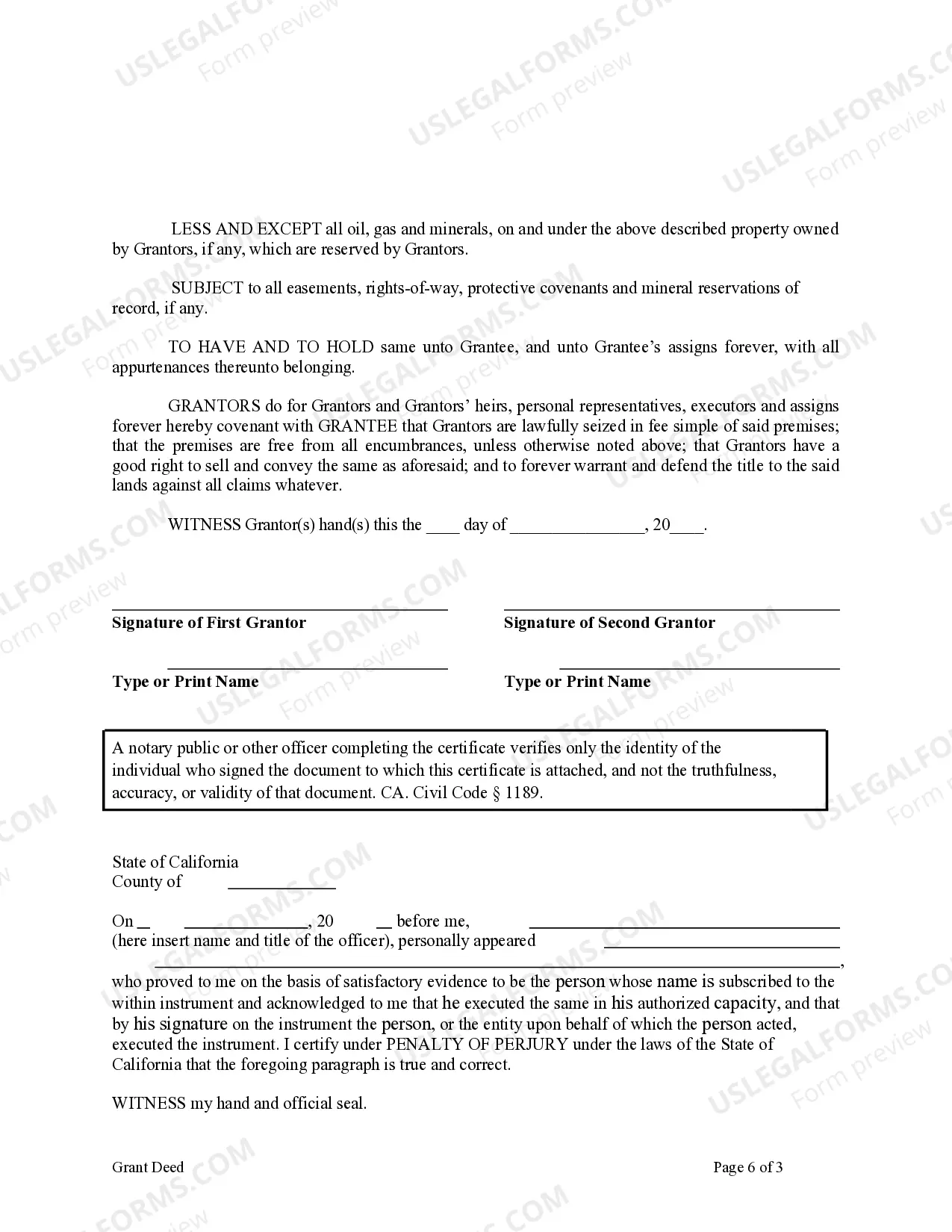

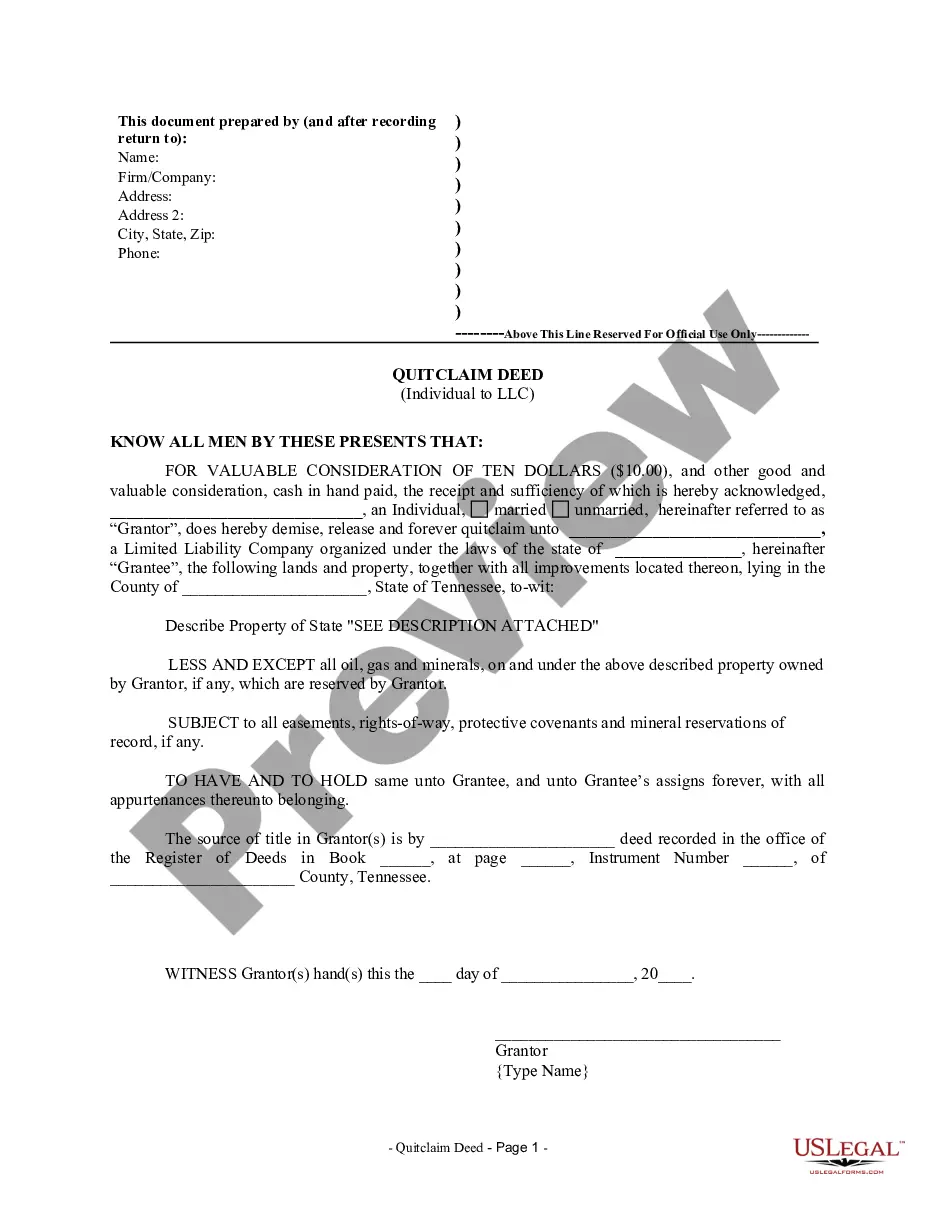

This form is a Warranty Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and warrant the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

California Grant Deed from Husband and Wife to an Individual

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Grant Deed From Husband And Wife To An Individual?

If you're seeking accurate California Grant Deed examples from Husband and Wife to an Individual, US Legal Forms is what you require; discover documents created and reviewed by state-certified attorneys.

Utilizing US Legal Forms not only spares you from hassles related to legal paperwork; additionally, you conserve valuable time and resources, as well as money! Downloading, printing, and filling out a professional template is considerably less expensive than hiring a lawyer to do it for you.

And that's it. In just a few simple steps, you obtain an editable California Grant Deed from Husband and Wife to an Individual. Once you have an account, all future requests will be even more straightforward. If you hold a US Legal Forms subscription, simply Log In to your profile and click the Download button visible on the form's page. Then, whenever you wish to access this sample again, you'll always be able to find it in the My documents section. Don't waste your time and effort searching through numerous forms on different online platforms. Obtain professional documents from a single secure source!

- To begin, finish your registration by entering your email and creating a password.

- Follow the instructions below to set up your account and acquire the California Grant Deed from Husband and Wife to an Individual template to resolve your needs.

- Utilize the Preview option or review the document details (if available) to ensure that the template is the one you seek.

- Verify its validity in your jurisdiction.

- Click on Buy Now to finalize your purchase.

- Select a suitable pricing plan.

- Create your account and pay using a credit card or PayPal.

- Choose a preferred format and download the document.

Form popularity

FAQ

In California, a grant deed is generally not revocable unless there is a specific provision allowing for it or the deed itself was executed fraudulently. If a grant deed needs to be changed, creating a new California Grant Deed from Husband and Wife to an Individual might be necessary. Consider seeking guidance from legal professionals or utilizing platforms like US Legal Forms for assistance in preparing the right documents.

Removing someone from a deed in California typically involves executing a California Grant Deed from Husband and Wife to an Individual to transfer the property interest. You must draft a new deed that specifies who is being removed and who will remain the owner. Be sure to record the new deed with the county's office to finalize the change and always consider legal advice to navigate this process smoothly.

To amend a grant deed in California, you need to prepare a new grant deed that reflects the changes you wish to make, whether it’s changing names or updating ownership status. This new California Grant Deed from Husband and Wife to an Individual should be signed, notarized, and then recorded at your local county recorder's office. It's advisable to seek assistance from professionals to ensure the accuracy and legality of the amendments.

Yes, you can remove a co-owner from a property title through a California Grant Deed from Husband and Wife to an Individual. This process involves drafting a new grant deed that specifies the current owner and the change in ownership. Once completed, the new deed must be recorded with the county recorder's office to make it official. It's important to consult with a real estate attorney to ensure compliance with California law.

The interspousal transfer grant deed is a legal document used in California to transfer property between spouses. This type of grant deed allows a husband and wife to transfer real estate to an individual without facing property tax reassessments, making it a beneficial option for couples. Essentially, it simplifies the process of changing ownership while ensuring that the rightful party retains their interest in the property. For those seeking to complete this transfer, platforms like USLegalForms can provide the necessary templates and guidance.

Transferring property from husband to wife after death can be done through a process called probate, which can sometimes be initiated online. However, it's essential to have a California Grant Deed from Husband and Wife to an Individual in place to establish the intent for exclusive ownership. For assistance with forms and the process, consider using resources from uslegalforms to navigate your options smoothly.

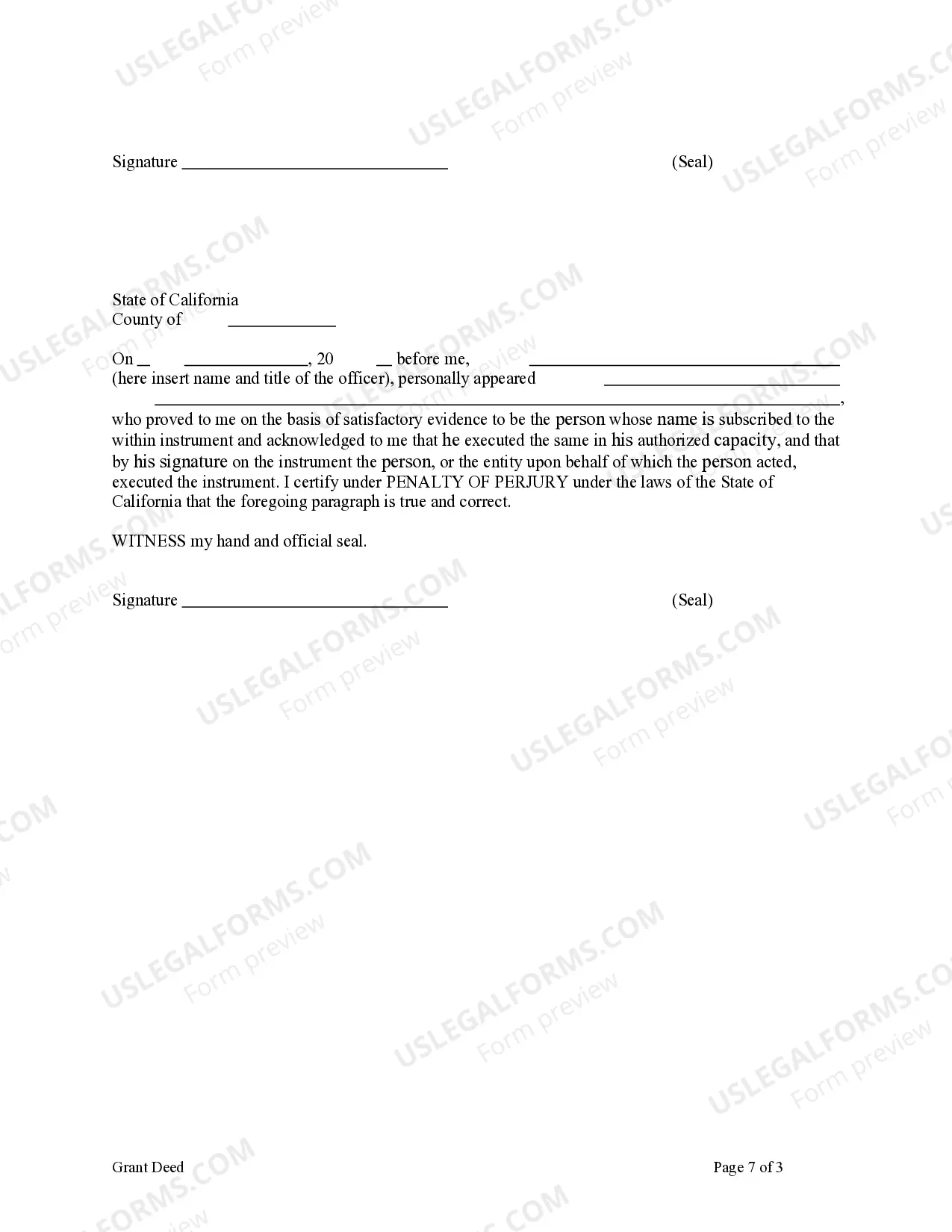

Transferring ownership typically involves executing a grant deed, such as a California Grant Deed from Husband and Wife to an Individual. You must prepare the deed, sign it in front of a notary, and then file it with the county recorder's office. Following these steps ensures that the transfer is official and recognized by local authorities.

To add your spouse to a grant deed in California, you would typically execute a California Grant Deed from Husband and Wife to an Individual. This deed must clearly state both spouses' names and include appropriate notarization. Completing this process legally establishes joint ownership, protecting both spouses' rights to the property.

Filling out a California Grant Deed is simple once you understand the required information. You'll need to include details such as the names of the current owners, the names of the new owners, a legal description of the property, and the signatures of the current owners. For ease, consider using templates provided by platforms like uslegalforms, which can guide you through the process.

The most common way to transfer ownership in California is through a grant deed, specifically a California Grant Deed from Husband and Wife to an Individual. This deed provides a straightforward method to convey property between spouses or from spouses to another individual. Sometimes, people also use wills or trusts, but a grant deed is typically more immediate and straightforward.