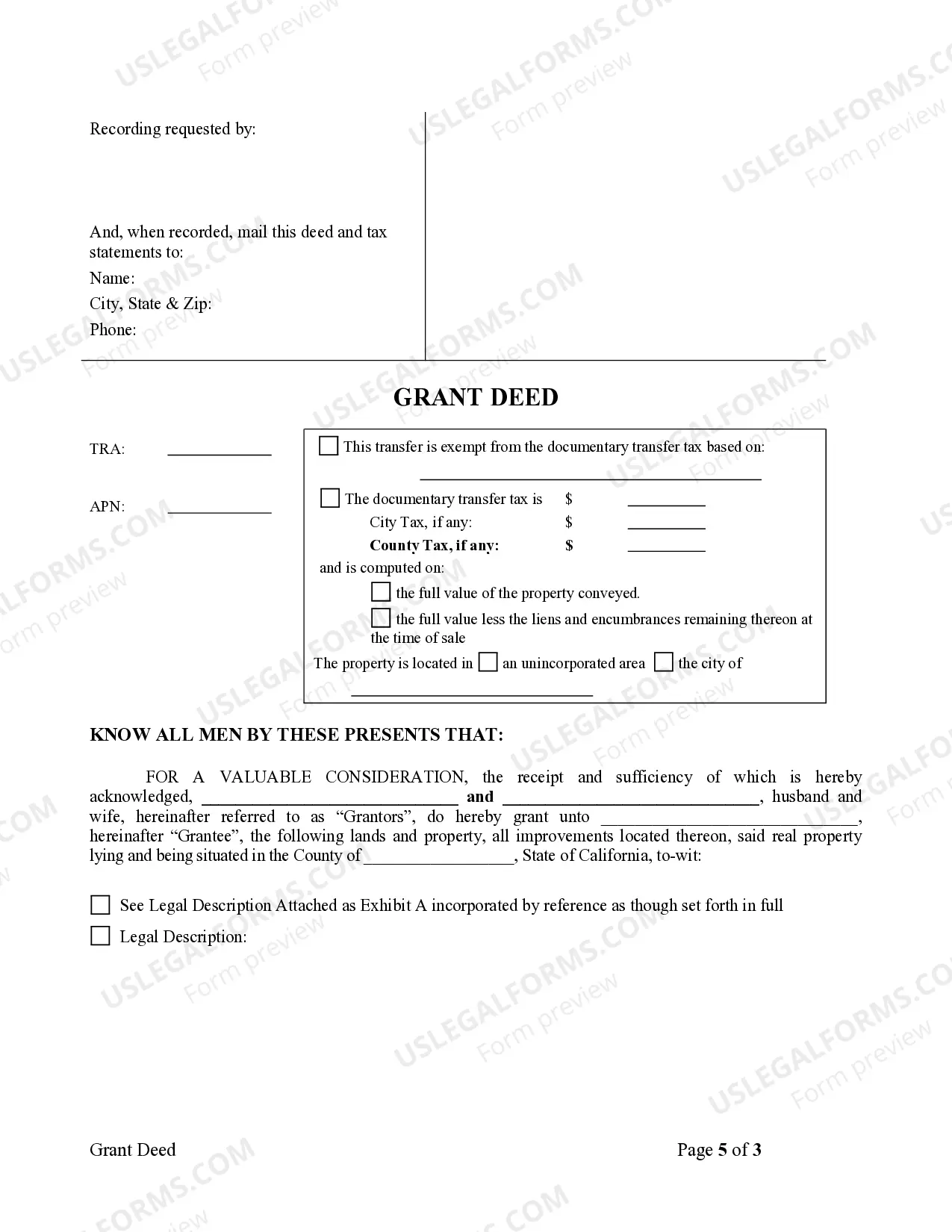

This form is a Grant Deed where the Grantors are Husband and Wife and the Grantee is an Individual. Grantors convey and grant the described property to the Grantee. This deed complies with all state statutory laws.

California Deed Form Contract

Description Grant Deed Form California

How to fill out Grant Deed Form Download?

If you're looking for correct California Grant Deed - Husband and Wife to Individual web templates, US Legal Forms is what exactly you need; get documents provided and checked out by state-certified lawyers. Benefiting US Legal Forms not merely saves you from worries relating to legal papers; furthermore, you help save time and effort, and cash! Downloading, printing out, and submitting a professional template is much cheaper than asking a legal professional to do it for you.

To start, finish your enrollment process by providing your electronic mail and creating a secret password. Adhere to the steps listed below to create your account and find the California Grant Deed - Husband and Wife to Individual exemplar to remedy your issues:

- Take advantage of the Preview option or look at the file information (if available) to be certain that the form is the one you need.

- Check out its applicability in your state.

- Click Buy Now to make your order.

- Select a preferred pricing plan.

- Create an account and pay out with the bank card or PayPal.

- Select a suitable file format and save the record.

And while, that’s it. In just a few simple actions you have an editable California Grant Deed - Husband and Wife to Individual. When you create your account, all upcoming orders will be processed even easier. When you have a US Legal Forms subscription, just log in account and click the Download option you can find on the for’s page. Then, when you need to use this blank once again, you'll always be able to find it in the My Forms menu. Don't spend your time and effort comparing countless forms on several platforms. Get professional documents from a single safe platform!