Florida Amendment to Living Trust

About this form

The Amendment to Living Trust is a legal document used to make changes to an existing living trust without altering its fundamental purpose. A living trust, established during the trustor's lifetime, holds the trustor's assets and properties for estate planning. This form allows the trustor to amend specific provisions of the trust while ensuring that all other sections remain effective. Unlike other estate planning documents, it focuses exclusively on altering the terms of a trust, making it a vital tool for managing changes in your estate plan.

Form components explained

- Identification of the trustor and the revocable trust being amended.

- A detailed description of the amendments being made to the trust.

- Signature lines for the trustor(s) to affirm the amendments.

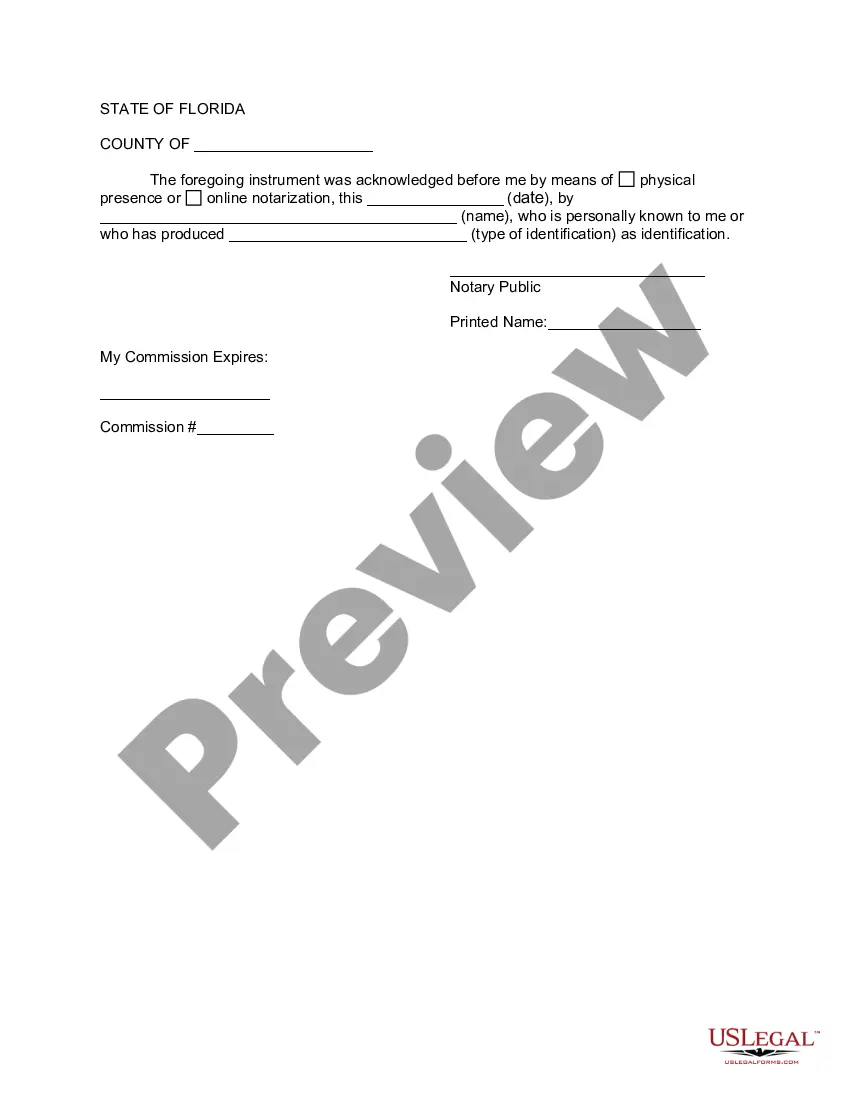

- A section for notarization to validate the signatures and the document.

- Declaration regarding the acknowledgement of the document before a notary public.

When this form is needed

This form is necessary when a trustor wishes to change certain aspects of their living trust, such as modifying beneficiary designations, altering property distributions, or updating trustee information. Common situations might include a changes in family structure, such as marriages or divorces, the birth of children or grandchildren, or shifts in financial circumstances that require adjustments to the trust's provisions.

Intended users of this form

This form is intended for:

- Individuals who have already established a living trust and wish to make amendments.

- Those experiencing life changes that necessitate updates to their estate plan.

- Trustors who want to ensure their trust accurately reflects their current intentions and circumstances.

How to complete this form

- Identify the date of the amendment.

- Fill in the names and details of the trustor(s) and the specific living trust being amended.

- Clearly describe the amendments being made to the trust provisions.

- Obtain the trustor(s) signatures, ensuring each signatory prints their name.

- Have the document notarized by a public notary to validate its enforcement.

Does this form need to be notarized?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to specify the exact changes made to the trust.

- Not obtaining proper notarization, which can invalidate the amendment.

- Overlooking necessary signatures from all trustors if there are multiple.

- Not keeping a copy of the original trust for reference after amendments.

- Using outdated forms that do not reflect current laws or personal circumstances.

Benefits of using this form online

- Convenience of downloading the form immediately for use at any time.

- Editable templates allow for personalized amendments to reflect current needs.

- Access to professionally drafted forms ensures legal compliance and accuracy.

- Secure storage and retrieval options for completed documents.

Looking for another form?

Form popularity

FAQ

Updating a living trust in Florida can require various steps depending on the extent of the changes. You might need to create an amendment for minor updates or, in some cases, establish a completely new trust. Always ensure that any update complies with Florida law by clearly outlining the changes and signing the new documents in front of witnesses. For a streamlined experience, consider utilizing the resources available on the US Legal Forms platform to manage your Florida amendment to living trust.

Writing an amendment to a living trust involves creating a document that outlines the specific changes you want to implement. Start with a title that indicates this is an amendment and reference the original trust document. Include the particular sections of the trust you are changing and provide the new details. If you're uncertain about the process, using US Legal Forms can simplify the drafting process for your Florida amendment to living trust.

To amend a living trust in Florida, you typically start by drafting a formal amendment document. This document should clearly state the changes you wish to make to your existing trust. Once you have prepared the amendment, sign it in front of a notary to ensure its legality. For assistance, consider using the US Legal Forms platform, which provides templates tailored for Florida amendments to living trusts.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

A trust restatement involves rewriting the original trust agreement with the changes included. You must be clear that you are not revoking the original trust, simply restating it. Like an amendment, you may need to execute the restatement in front of a notary and the Trustee may also need to sign the restatement.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

An amendment to a trust is not required to be notarized or witnessed unless the terms of the original trust require it.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

Generally, no. Most living or revocable trusts become irrevocable upon the death of the trust's maker or makers. This means that the trust cannot be altered in any way once the successor trustee takes over management of it.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.