Alabama Business Credit Application

What this document covers

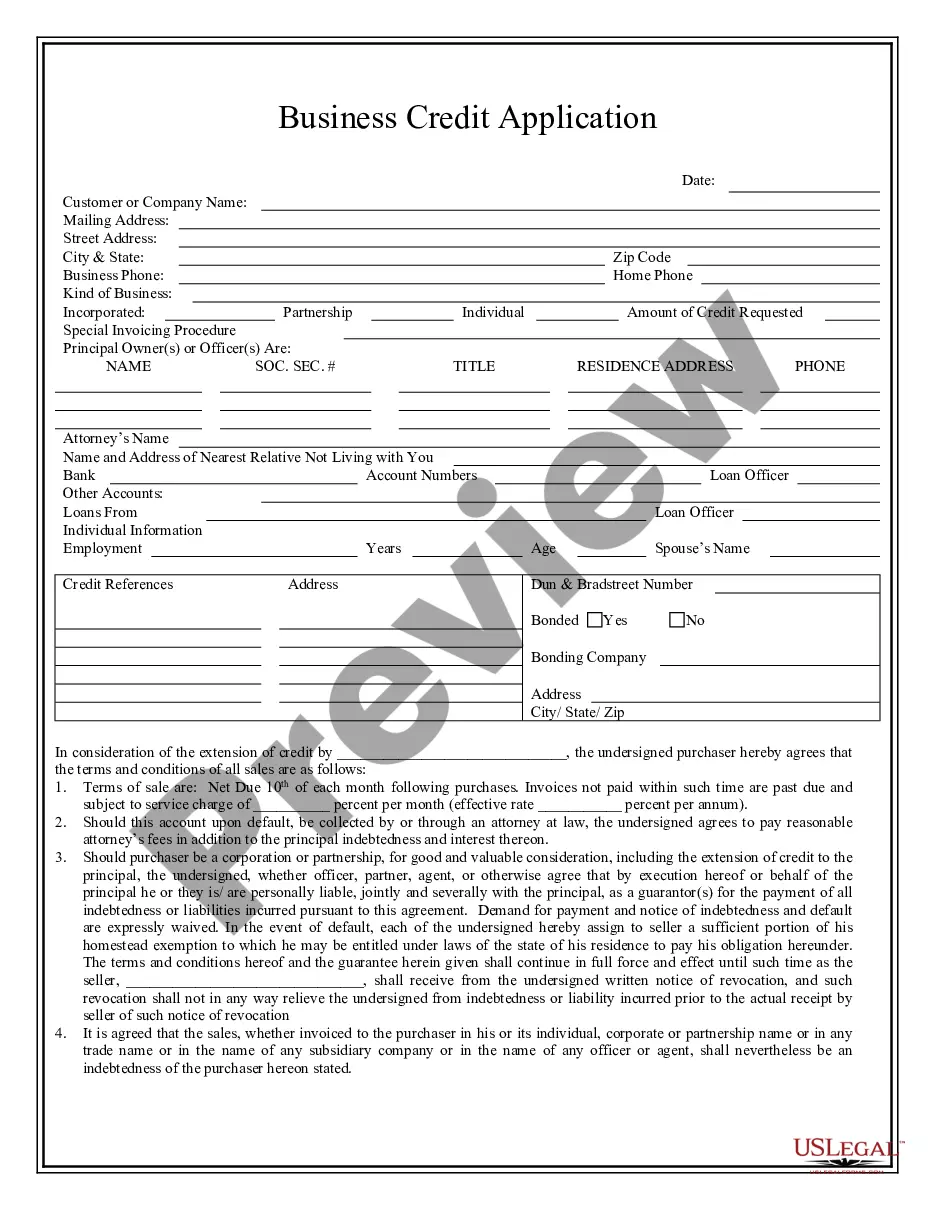

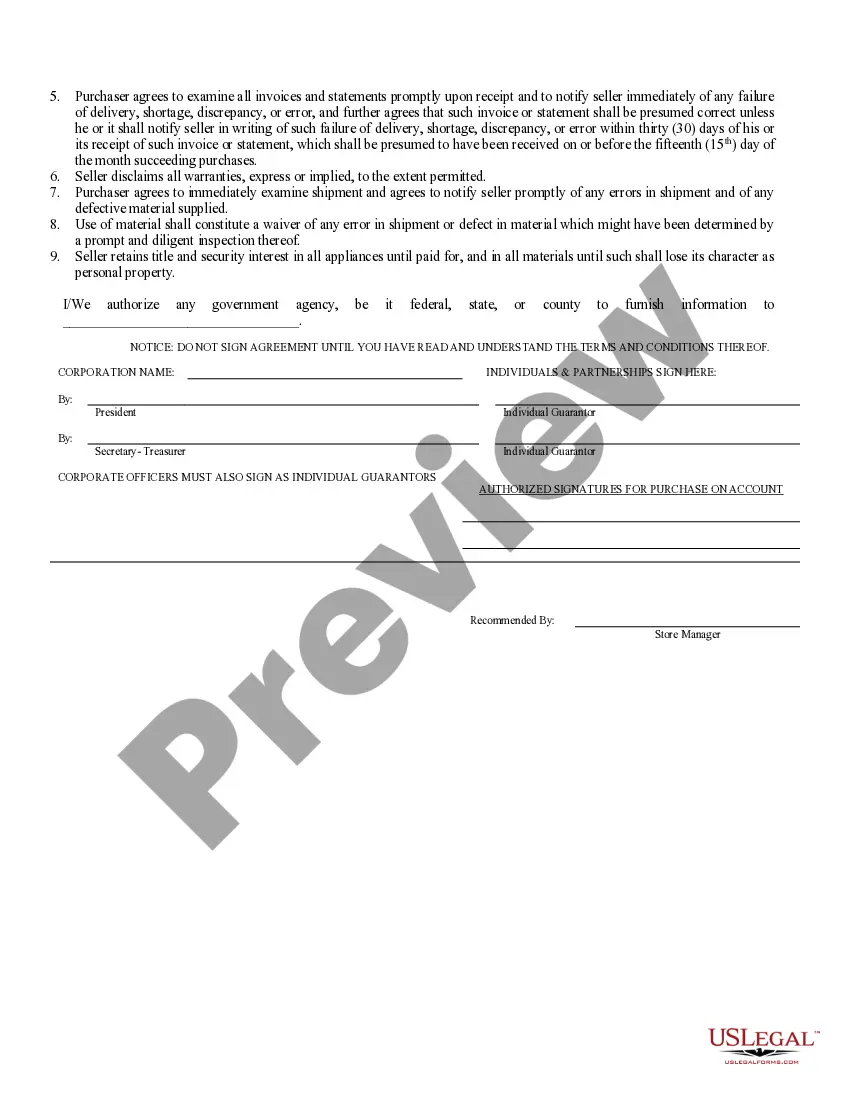

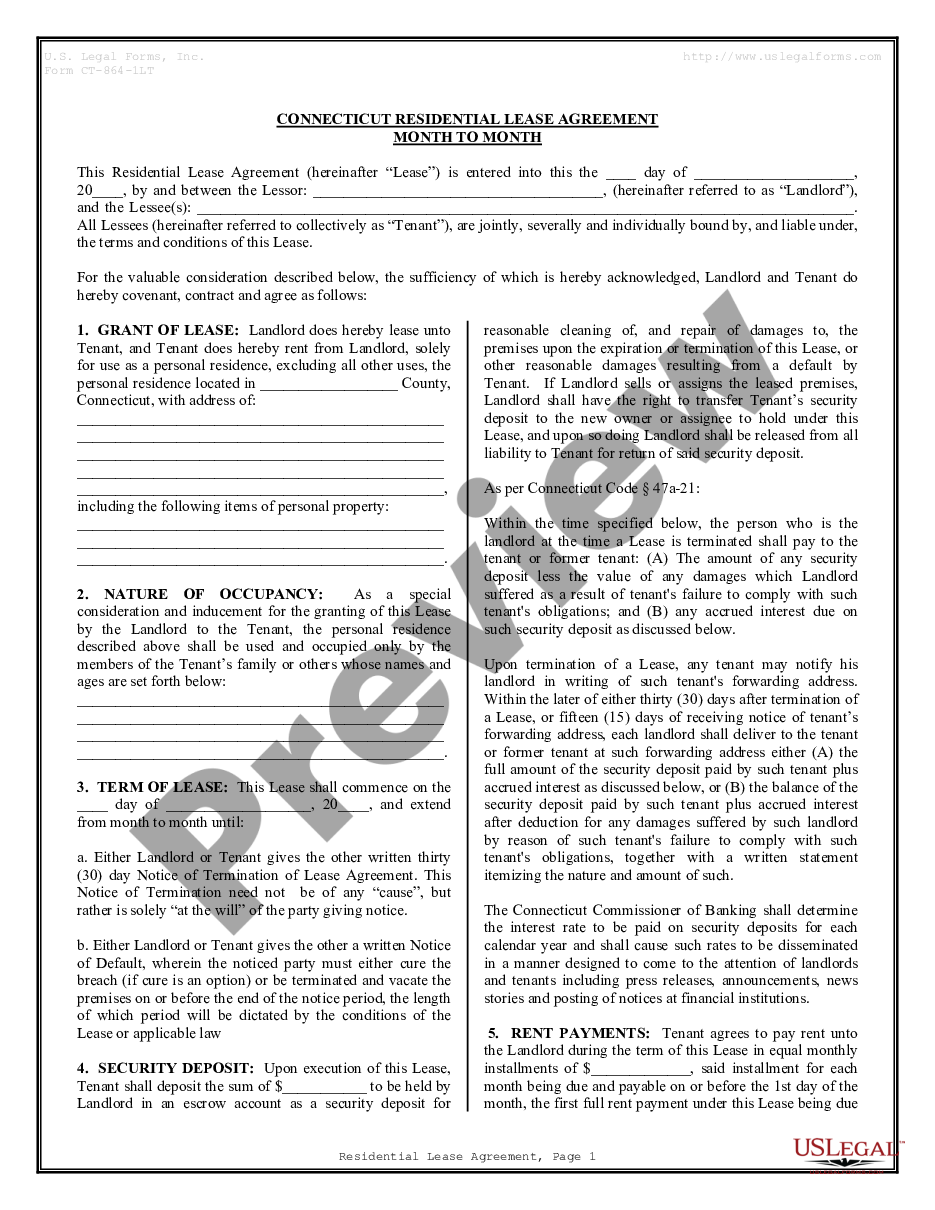

The Business Credit Application is a legal document used by individuals or businesses seeking to obtain credit for purchases. This form outlines the repayment terms, interest, and default provisions, ensuring that both parties understand their obligations and rights. Unlike informal agreements, this form offers structured terms drafted by licensed attorneys, making it more enforceable in court.

Form components explained

- Identification of the seller and purchaser.

- Repayment terms, including due dates and interest rates.

- Default provisions outlining penalties for non-payment.

- Disclaimer of warranties by the seller.

- Retention of title for goods until fully paid.

Common use cases

This Business Credit Application should be used when a purchaser wants to establish a credit relationship with a seller for the purchase of goods or services. It is appropriate in situations where the seller allows deferred payment, especially in business transactions where substantial amounts of credit are involved.

Who can use this document

- Any individual or business looking to obtain credit from a seller.

- Businesses, including corporations or partnerships, seeking to formalize their purchase agreements.

- Individuals acting as guarantors for corporate or partnership accounts.

How to prepare this document

- Identify the seller and enter their business name.

- Provide the purchaser's details, including business type (individual, partnership, corporation).

- Set the repayment terms, including interest rates and due dates.

- Sign and date the agreement, including any required personal guarantees.

- Ensure all parties understand the obligations before signing.

Notarization guidance

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to read and understand the terms before signing.

- Not providing accurate information about the business or personal guarantors.

- Overlooking the requirement to notify the seller about any delivery issues within the specified time frame.

Benefits of completing this form online

- Convenience of downloading and completing the form at your own pace.

- Editability allows for adjustments to payment terms or other sections as necessary.

- Access to professionally drafted documents, ensuring legal reliability.

Looking for another form?

Form popularity

FAQ

Establishing credit for your LLC involves a few key steps. Start by registering your business and obtaining an EIN. Next, open a business bank account and apply for a business credit card to begin building a credit history. When you fill out an Alabama Business Credit Application, be sure to showcase your business’s financial responsibility and timely payments. Using platforms like US Legal Forms can guide you through each step, making the process smoother.

To quickly obtain business credit for your LLC, start by ensuring your business is registered with the state and has all necessary licenses. Next, open a business bank account and establish a solid financial history. When you complete an Alabama Business Credit Application, consider seeking accounts with vendors that report to credit bureaus, as this can rapidly build your credit profile. US Legal Forms can help streamline this process with their resources and templates.

Yes, you can use your Employer Identification Number (EIN) to build business credit. The EIN acts as a unique identifier for your business, much like a Social Security number does for individuals. When you apply for an Alabama Business Credit Application, lenders will often use your EIN to review your business credit profile. It is essential to ensure your business is registered and that you use the EIN consistently for all credit-related transactions.

A business credit application form is a document that businesses complete to apply for credit lines or loans from lenders. This form typically requires details about your business, including its structure, financial history, and credit needs. Submitting an Alabama Business Credit Application can give lenders a clearer picture of your financial health and increase your chances of securing funding.

No, you do not need an LLC to start a small business in Alabama; however, forming one can offer liability protection and potential tax benefits. You can choose other business structures like sole proprietorship or partnership. Regardless of your choice, an Alabama Business Credit Application remains a key step in establishing your business credit, which is essential for growth.

Yes, having an LLC does not automatically exclude you from obtaining a business license in Alabama. Local governments often require businesses to apply for licenses depending on the services or products offered. Applying for an Alabama Business Credit Application is beneficial as it helps formalize your business activities and demonstrate compliance with state regulations.

Registering as a small business in Alabama involves choosing a business structure, such as an LLC or corporation. You will need to file the necessary forms with the Alabama Secretary of State. Once registered, applying for an Alabama Business Credit Application can assist you in building your business credit reputation, which is vital for securing loans and credit in the future.

To establish a business credit file, start by registering your business with the appropriate state authorities and obtaining a federal Employer Identification Number (EIN). Next, open a business bank account and ensure that your business is listed with major credit bureaus. An Alabama Business Credit Application will help you formally create and report your credit activity, paving the way for future financial benefits.

The credit application form for business is a specific request document that businesses must complete to apply for credit or loans. This form gathers vital information about your company, such as its revenue, credit history, and financial statements. Submitting a well-prepared Alabama Business Credit Application can improve your chances of securing the financial resources you need. Proper completion and submission of this form are crucial steps toward accessing credit for your business.

The Alabama employer tax credit is a financial incentive offered by the state to encourage businesses to hire and retain employees. This credit can significantly reduce your tax burden and enhance your overall financial strategy. Understanding these credits can be advantageous for your business growth. For those exploring financing options, the Alabama Business Credit Application can streamline the process of obtaining the necessary funds to capitalize on such opportunities.