Financing Statement Amendment. This amendment is to be filed in the real estate records. This Financing Statement complies with all applicable state statutes.

Connecticut UCC3 Financing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut UCC3 Financing Statement?

The larger quantity of documentation you have to compile - the more anxious you become.

You can discover numerous Connecticut UCC3 Financing Statement templates online; however, you may be unsure which ones to rely on.

Eliminate the complications and simplify obtaining samples with US Legal Forms. Acquire professionally composed documents tailored to meet state requirements.

Enter the necessary information to set up your account and pay for the order using PayPal or a credit card. Choose a preferred document format and obtain your sample. Access every template you've downloaded in the My documents section. Simply navigate there to create a fresh copy of the Connecticut UCC3 Financing Statement. Even when using expertly crafted forms, it is still advisable to consult a local attorney to review the completed sample to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you currently hold a US Legal Forms account, Log In to your account, and you will find the Download button on the Connecticut UCC3 Financing Statement’s page.

- If you haven’t used our platform before, complete the registration process by following these steps.

- Verify that the Connecticut UCC3 Financing Statement is applicable in your residing state.

- Reconfirm your choice by reviewing the description or utilizing the Preview mode if available for the selected document.

- Press Buy Now to initiate the signup procedure and select a pricing plan that suits your requirements.

Form popularity

FAQ

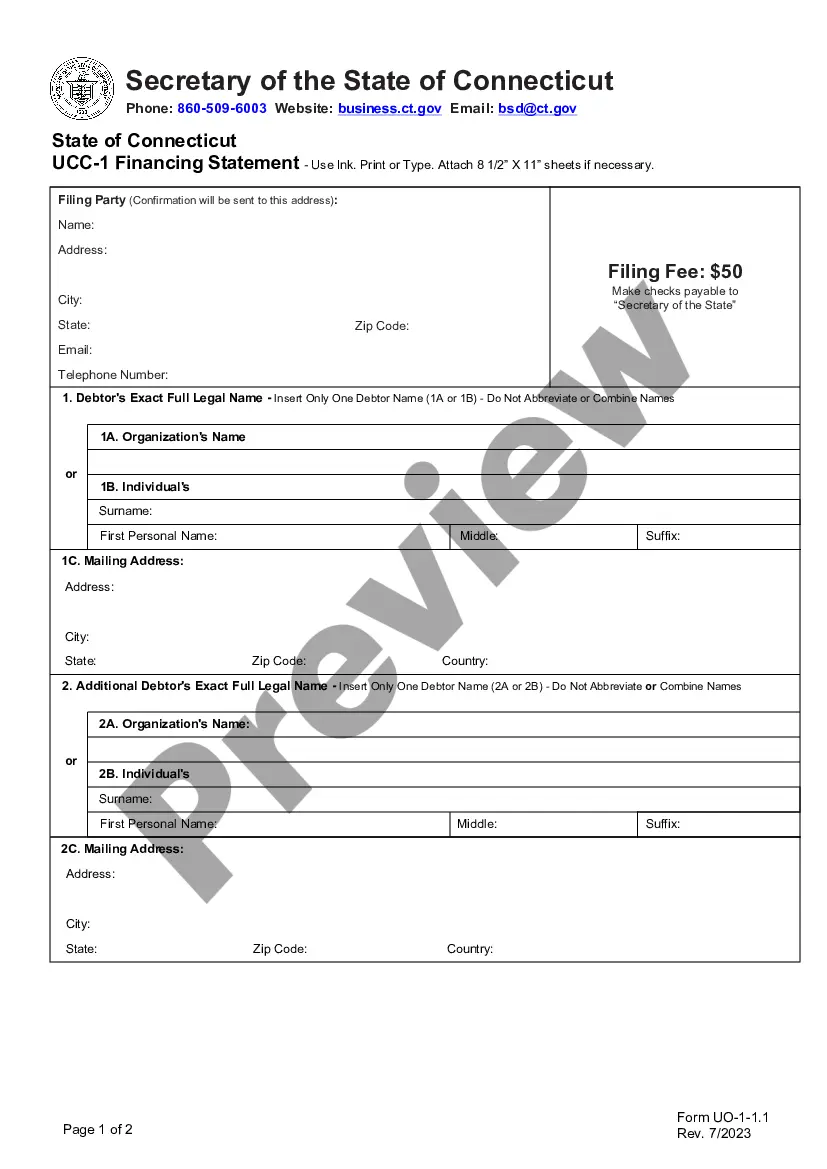

1 financing statement establishes a secured party's interest in collateral. By filing this statement, the creditor protects their rights before other potential creditors. It is important to note that a Connecticut UCC3 Financing Statement can further amend or terminate an existing UCC1. This process is essential for both lenders and borrowers to maintain clear records of secured transactions.

A UCC lien can significantly impact your financial standing. It serves as a public notice that a creditor has a claim against your assets. If you have a Connecticut UCC3 Financing Statement filed against you, it indicates that a lender could seize your property if you default. Understanding the seriousness of a UCC lien helps you manage your financial obligations effectively.

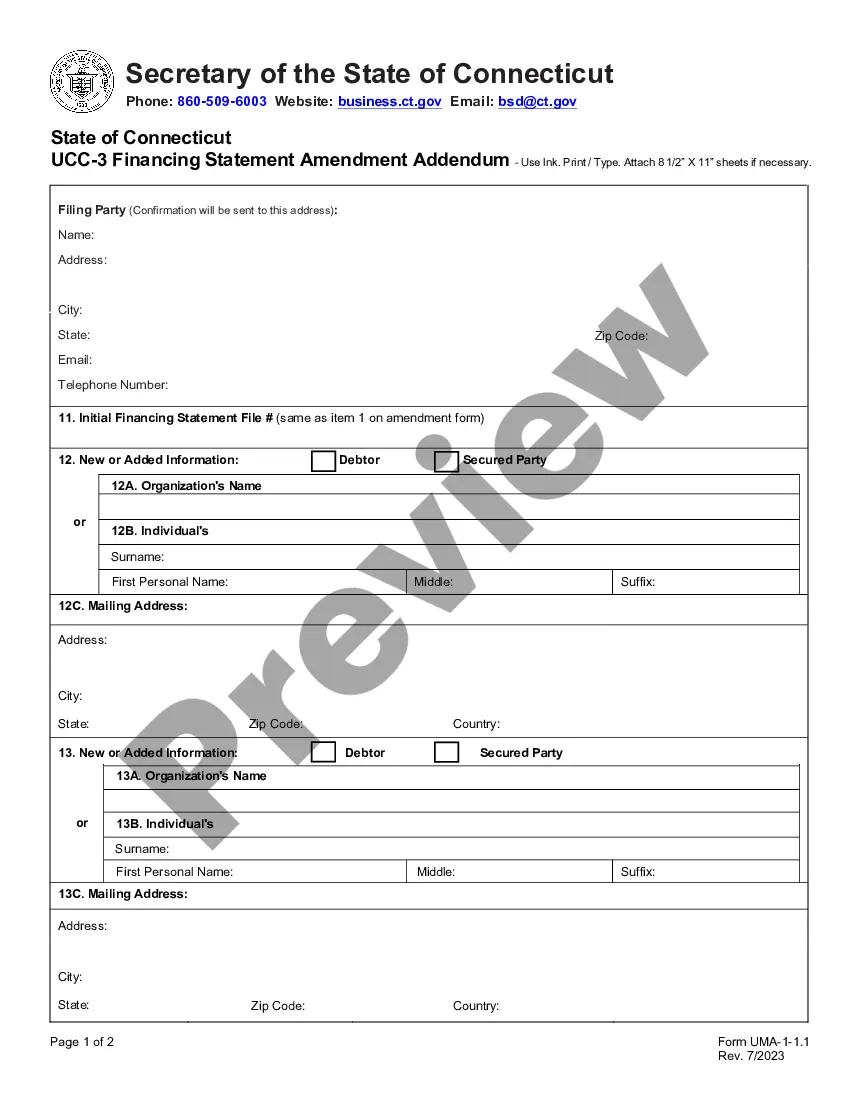

The primary purpose of filing a UCC-3 financing statement is to update the records regarding a secured interest or to terminate that interest. By completing this process, you provide crucial information to creditors and other interested parties. Filing a Connecticut UCC3 financing statement ensures that everyone involved has access to the most current information about security interests.

Filing a UCC in Connecticut involves completing the UCC-1 form and submitting it to the Secretary of State’s office. You can file online or through traditional mail, depending on your preference. Using platforms like uslegalforms can simplify this process, allowing you to efficiently navigate the paperwork and filing requirements.

The UCC-1 financing statement establishes a secured party's interest in collateral, while the UCC-3 financing statement amends or terminates that interest. Essentially, a UCC-1 creates the initial record of security interests, while a Connecticut UCC3 financing statement modifies that record as needed. This distinction ensures that all parties maintain clear and accurate financial records.

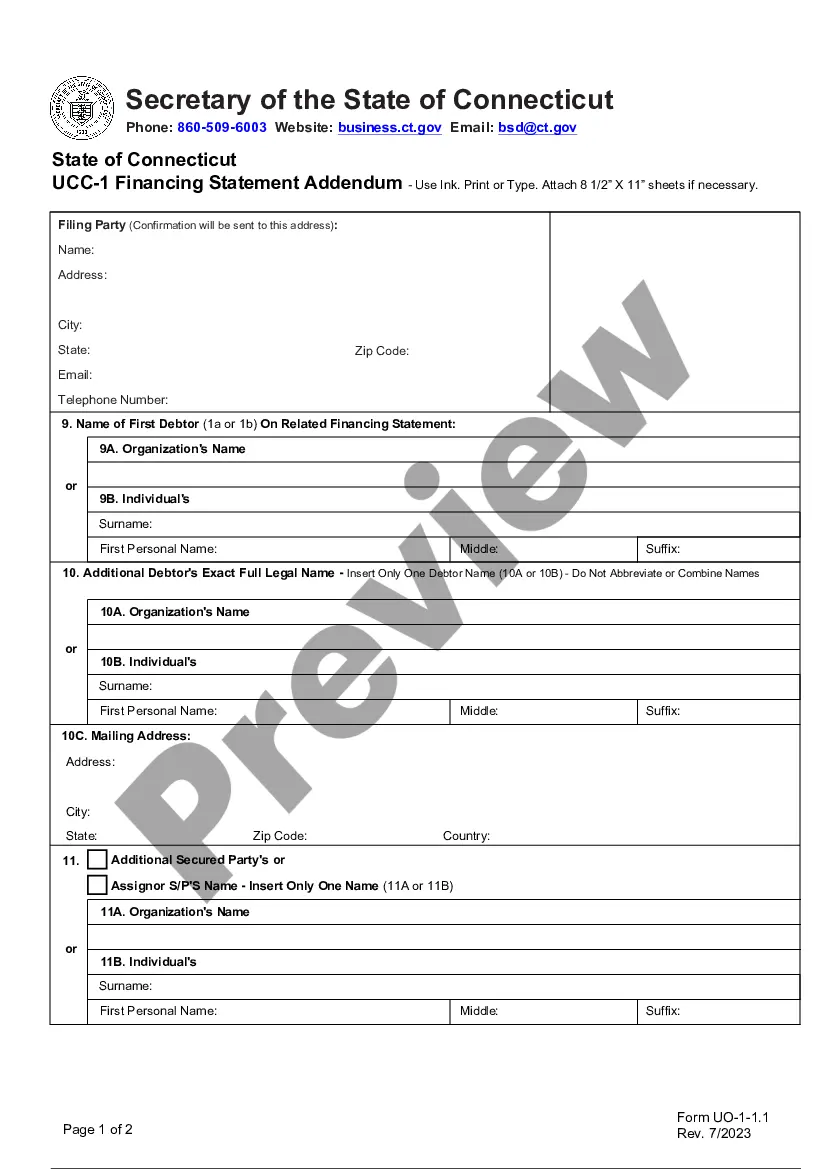

To assign a UCC financing statement, you will need to fill out a UCC-3 form, clearly stating the details of the assignment. After completing the form, submit it to the appropriate filing office in Connecticut. This action will officially transfer the security interest previously held under the UCC financing statement to another party.

Receiving a UCC financing statement typically means that a lender has filed this document to secure interest in your collateral. This filing indicates the lender's legal claim to certain assets in case of default. Understanding this process is essential, as it affects your financial standing and future borrowing potential.

3 financing statement is a document used to update, amend, or terminate a UCC1 financing statement. This form plays a crucial role in ensuring that the public record reflects the accurate status of security interests. When you file a Connecticut UCC3 financing statement, you maintain transparency and clarity in your financial dealings.

3 is a legal form recognized under the Uniform Commercial Code. It serves to amend or terminate a previously filed UCC1 financing statement. By filing a Connecticut UCC3 financing statement, you inform interested parties of changes in asset security or the termination of their claims against your assets.

Releasing a Connecticut UCC3 Financing Statement requires submitting a UCC-3 form, which declares that the lien is no longer in effect. You will need to provide specific details about the original filing, such as the debtor’s name and the filing date. Upon completion, submit the form to your state's Secretary of the State office for processing. To ease the process, uslegalforms enables you to access the correct UCC forms along with clear, actionable instructions.