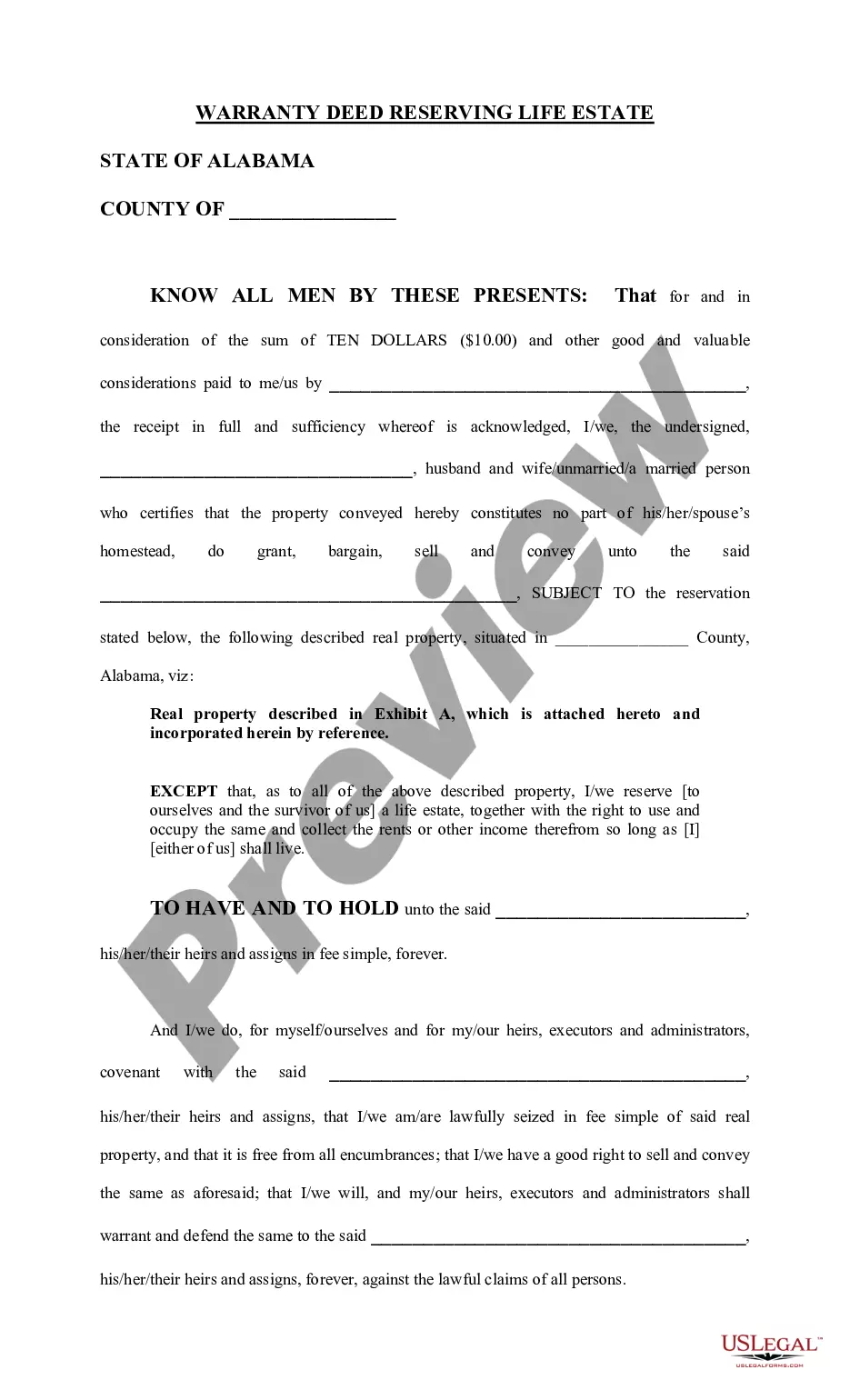

This deed warrants that the grantor is the lawful owner of the property at the time the deed is made and delivered and that the grantor has the right to convey the property. However, the grantor is reserving a life estate interest a life estate, together with the right to use and occupy the same and collect the rents or other income therefrom so long as he shall live. The form is available in both word and word perfect formats.

Alabama Deed Reserving Life Estate

Description

Key Concepts & Definitions

Deed reserving life estate: A legal document that transfers property ownership while granting the original owner the right to continue living on the property until death. Life tenant: The individual who retains the right to use the property during their lifetime under a life estate. Apply EIN: An Employer Identification Number application process required for estates in the United States.

Step-by-Step Guide to Creating a Deed Reserving Life Estate

- Contact an estate planning attorney to discuss your specific situation and goals.

- Decide who will be the life tenant and who will be the remainderman.

- Prepare the deed with necessary details including property descriptions.

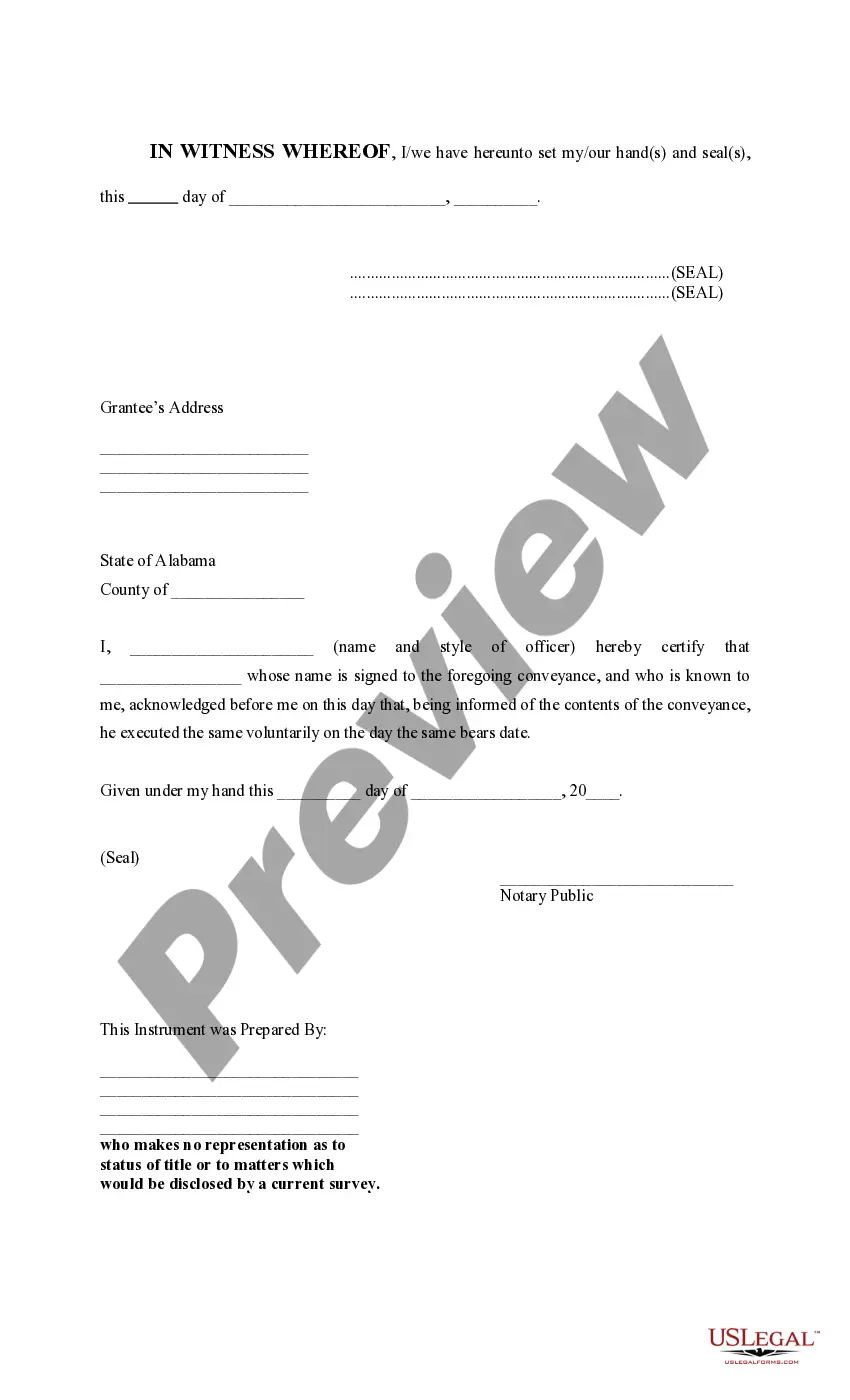

- Sign the deed in the presence of a notary service to ensure its legal validity.

- Record the deed with the local county clerk to make it official.

- Ensure online notarization if unable to be physically present for signing.

Risk Analysis

Creating a deed reserving life estate involves several risks:

- Legal disputes: Confusion or disagreements over property rights after the life tenant's death.

- Financial implications: Potential tax implications for the remainderman.

- Maintenance issues: Unclear responsibilities regarding property upkeep can arise between the life tenant and remainderman.

Best Practices

- Always consult with a qualified estate planning attorney.

- Clearly communicate expectations and responsibilities in the deed to prevent future conflicts.

- Consider involving a financial advisor to discuss the impact on estate taxes and inheritance.

Common Mistakes & How to Avoid Them

- Failing to properly document: Ensure all paperwork, including notarization, is correctly completed and recorded.

- Neglecting future changes: Revisit and possibly update estate plans regularly to reflect changes in laws or in personal circumstances.

FAQ

- What is a life tenant's responsibility in maintaining the property? The life tenant is usually responsible for the property's upkeep, taxes, and insurance.

- Can a deed reserving life estate help in avoiding probate? Yes, it can bypass probate for the property included in the deed, directly transferring rights to the remainderman upon the death of the life tenant.

How to fill out Alabama Deed Reserving Life Estate?

Utilizing Alabama Deed Reserving Life Estate samples created by skilled attorneys helps you avoid frustration when completing paperwork. Simply download the form from our site, fill it in, and ask a legal expert to review it. This approach will save you significantly more time and effort than trying to find a lawyer to draft a document entirely from the beginning to meet your needs.

If you already possess a US Legal Forms subscription, just Log In to your account and navigate back to the form webpage. Locate the Download button next to the template you are examining. After downloading a document, you will find all your saved samples in the My documents section.

If you do not have a subscription, that’s not a major issue. Just follow the instructions below to register for an account online, access, and complete your Alabama Deed Reserving Life Estate template.

Once you have completed all of the steps mentioned above, you will have the capability to fill out, print, and sign the Alabama Deed Reserving Life Estate sample. Ensure to double-check all entered information for accuracy before submitting it or sending it out. Minimize the time you spend on completing documents with US Legal Forms!

- Verify and ensure that you’re downloading the correct state-specific form.

- Utilize the Preview option and read the description (if provided) to determine if you need this specific template, and if you do, simply click Buy Now.

- Search for another file using the Search bar if necessary.

- Select a subscription that fulfills your needs.

- Start with your credit card or PayPal.

- Choose a file format and download your document.

Form popularity

FAQ

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

For example, life tenants retain the Income Tax Deduction for Real Estate Taxes. As the owner of the property by virtue of the life estate, a life tenant may continue to deduct the real estate taxes he pays on his federal income tax return.

A life estate is a form of co-ownership that allows owners to hold interests at different points in time. One ownercalled a life tenantcan hold title to the property for his or her life. At the life tenant's death, the property passes automatically to another owner called a remainderman or remainder beneficiary.

Can a life estate deed be contested? The answer is YES! The Life estate is an agreeable choice, particularly where there is an advantage in having the life estate revert back to its real owner (Grantor or Life Tenant).

The person holding the life estate -- the life tenant -- possesses the property during his or her life. The other owner -- the remainderman -- has a current ownership interest but cannot take possession until the death of the life estate holder.

The two types of life estates are the conventional and the legal life estate. the grantee, the life tenant. Following the termination of the estate, rights pass to a remainderman or revert to the previous owner.

When a person dies, beneficiaries might learn that the decedent made a deed that conflicts with the specific wording in his will. Generally, a deed will override the will. However, which legal document prevails also depends on state property laws and whether the state has adopted the Uniform Probate Code.

A life estate deed allows you to transfer property while reserving an interest during your lifetime or during the lifetime of someone else. Once the person who holds the life estate passes away, the Grantee fully owns the property.