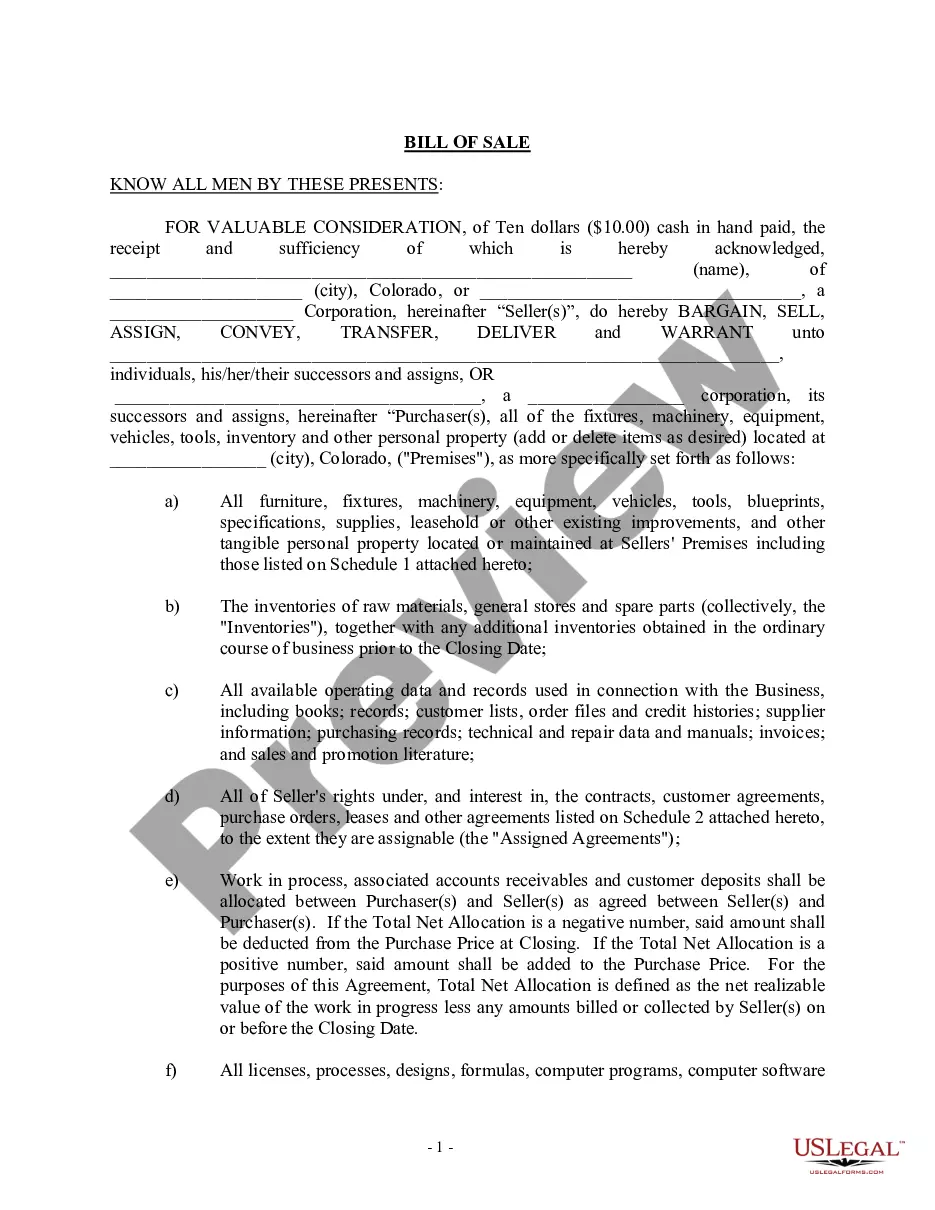

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Colorado Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

The greater the number of documents you need to generate, the more anxious you become.

You can find numerous templates for the Colorado Bill of Sale associated with the Sale of Business by Individual or Corporate Seller online, but you are unsure which ones to trust.

Eliminate the stress of finding examples more easily with US Legal Forms.

Simply choose Buy Now to initiate the registration process and select a pricing plan that suits your needs. Provide the necessary information to create your account and pay for the order using PayPal or a credit card. Choose an easy file format and obtain your sample. You can access every template you download via the My documents menu. Just head there to create a new copy of the Colorado Bill of Sale associated with Sale of Business by Individual or Corporate Seller. Even when using expertly drafted templates, it is still advisable to consult a local legal professional to ensure your form is correctly filled out.

- Obtain accurately prepared forms that comply with state regulations.

- If you are already a subscriber to US Legal Forms, Log In to your account, and you will see the Download option on the webpage for the Colorado Bill of Sale connected to Sale of Business by Individual or Corporate Seller.

- If you have not yet used our service, follow these steps to complete the registration process.

- Verify that the Colorado Bill of Sale in connection with Sale of Business by Individual or Corporate Seller is valid in your state.

- Reconfirm your selection by reading the description or utilizing the Preview mode if available for the chosen file.

Form popularity

FAQ

A handwritten bill of sale is acceptable in Colorado, provided it includes all essential details of the transaction. Nonetheless, clarity and accuracy are vital to avoid misunderstandings. To ensure your document meets legal standards, consider using a professional template from uslegalforms. This way, you can create a solid Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

Absolutely, you can write your own bill of sale in Colorado. Just make sure to include all pertinent information, as an incomplete document can lead to problems later. Consider using a template from uslegalforms to ensure you cover all necessary points, enhancing the reliability of your Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

Yes, a bill of sale is essential when selling a business. It serves as a legal document that records the transaction between the seller and the buyer. This document protects both parties by outlining the terms of the sale. If you are looking for a reliable template, uslegalforms can help you draft a thorough Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

In most cases, a Colorado bill of sale does not need to be notarized. However, some buyers or lenders may require notarization to ensure validity. It's advisable to check any specific requirements related to your transaction. Using uslegalforms can provide you with insights and templates for a Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, tailored to your needs.

Yes, you can handwrite a bill of sale in Colorado. However, it's crucial to ensure that the document includes all necessary details related to the sale. This includes information about the seller, buyer, item sold, and the terms of the sale. Using a standardized template from uslegalforms can simplify this process and help you create a comprehensive Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

If you do not have a bill of sale, documenting a business transfer may become complicated. A Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is crucial as it legitimizes the ownership transfer. Without it, you may face challenges proving ownership or the terms of the agreement. To avoid such issues, consider using platforms like uslegalforms to generate a bill of sale tailored to your needs.

California does not mandate a bill of sale for every business sale, but it is a prudent choice to have one. Using a Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller in Californian transactions can provide both parties protection and clarity. This document helps establish timelines and responsibilities associated with the sale. Therefore, including a bill of sale can make the process smoother and more secure.

A bill of sale in business terms is a legal document that records the transfer of ownership from a seller to a buyer. Specifically, a Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller details the transaction terms, including asset descriptions and payment agreements. This document acts as proof of the sale, providing security and clarity for both parties involved. It is a fundamental aspect of any business sale.

Tennessee does not explicitly require a bill of sale for all business transactions, but it is highly recommended. Utilizing a Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can protect both parties in the event of future disagreements. It serves as legal proof of the sale and can help in tax and legal matters down the line. Having this documentation can simplify the process.

Yes, a Colorado Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller provides title to the business equipment included in the sale. This legal document confirms that the seller has transferred ownership to the buyer. It is essential to clearly list all equipment and assets covered by the bill of sale to prevent disputes later. Always ensure both parties sign to validate the transfer.