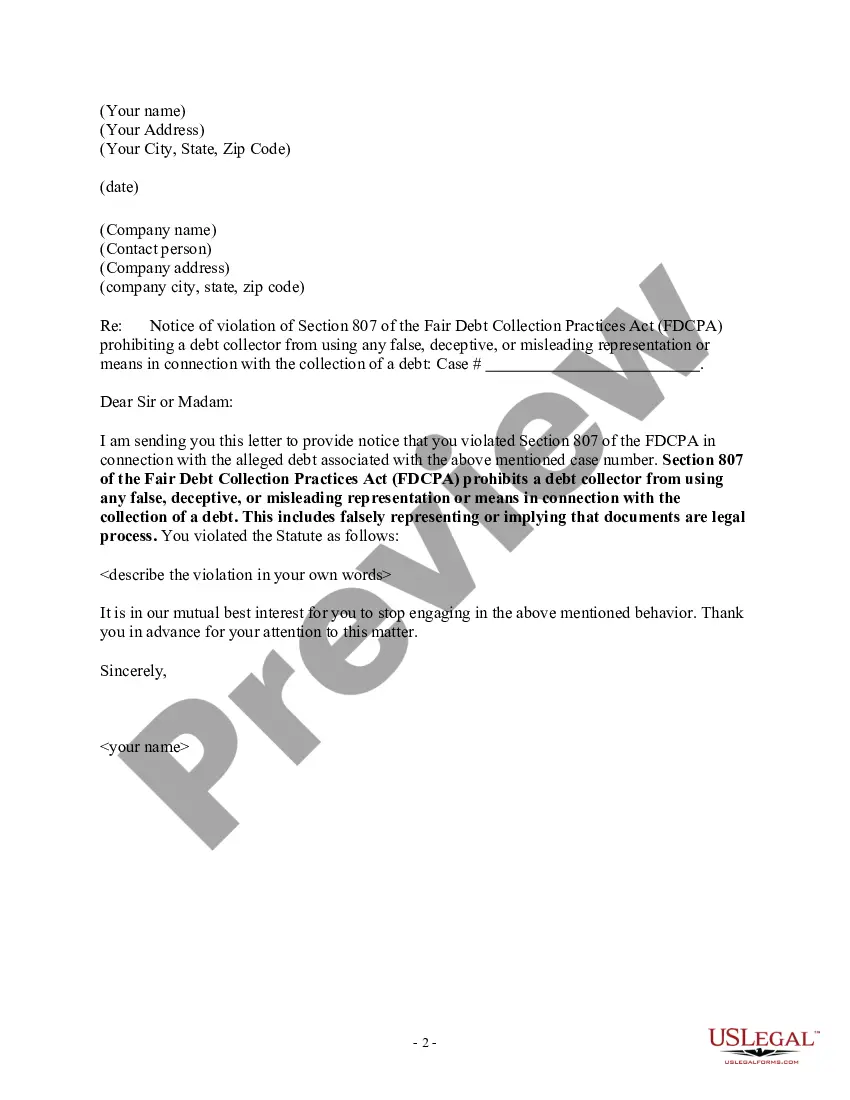

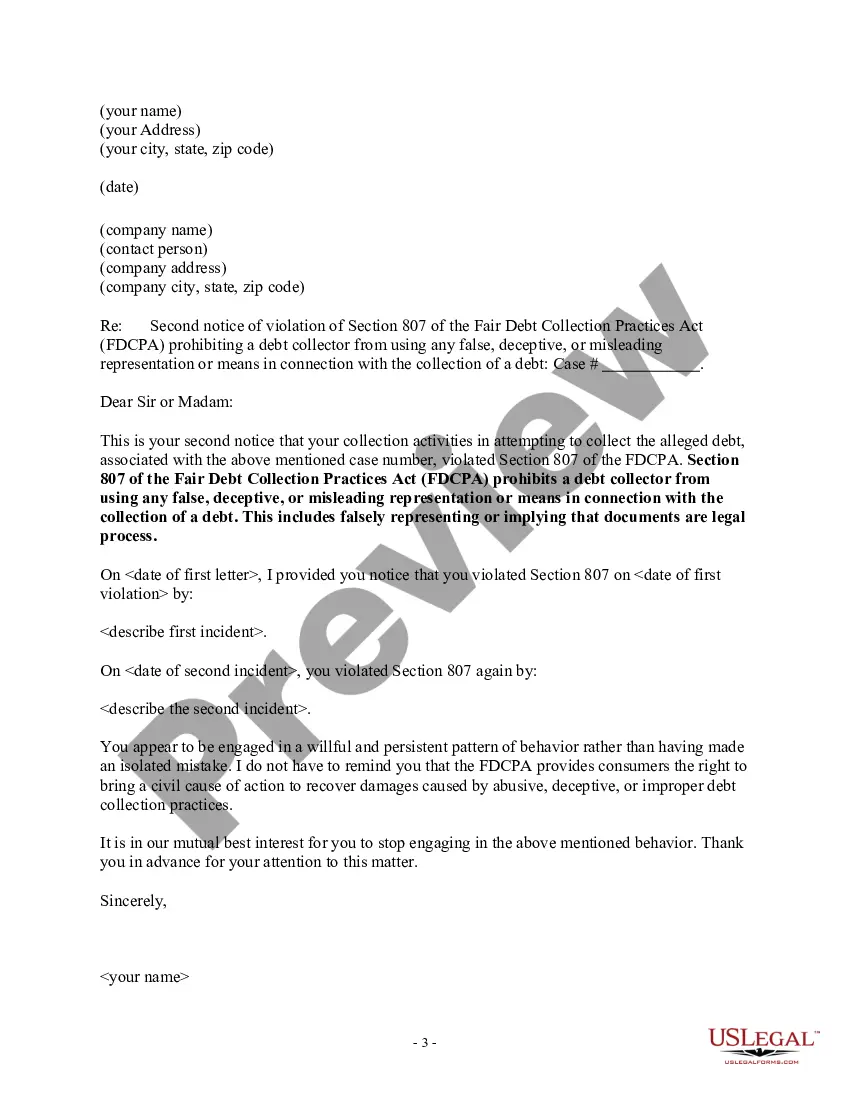

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are legal process.

Notice to Debt Collector - Falsely Representing a Document is Legal Process

Description

How to fill out Notice To Debt Collector - Falsely Representing A Document Is Legal Process?

When it comes to drafting a legal document, it’s better to leave it to the professionals. Nevertheless, that doesn't mean you yourself can not find a sample to utilize. That doesn't mean you yourself can’t get a template to utilize, however. Download Notice to Debt Collector - Falsely Representing a Document is Legal Process straight from the US Legal Forms web site. It offers a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users simply have to sign up and select a subscription. As soon as you are signed up with an account, log in, find a specific document template, and save it to My Forms or download it to your gadget.

To make things less difficult, we have incorporated an 8-step how-to guide for finding and downloading Notice to Debt Collector - Falsely Representing a Document is Legal Process fast:

- Be sure the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Click Buy Now.

- Choose the suitable subscription for your requirements.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Select a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

After the Notice to Debt Collector - Falsely Representing a Document is Legal Process is downloaded it is possible to complete, print and sign it in any editor or by hand. Get professionally drafted state-relevant papers within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Reach out to the company the collector says is the original creditor. They might help you figure out if the debt is legitimate and if this collector has the right to collect the debt. Also, get your free, annual credit report online or at 877-322-8228 and see if the debt shows up there. Dispute the debt in writing.

Challenging the debt: You have a right to dispute the debt. If you challenge the debt within 30 days of first contact, the collector cannot ask for payment until the dispute is settled. After 30 days you can still challenge the debt, but the collector can seek payment while the dispute is being investigated.

No. Debt collectors are prohibited from deceiving or misleading you while trying to collect a debt. Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Can You Sue a Company for Sending You to Collections? Yes, the FDCPA allows for legal action against certain collectors that don't comply with the rules in the law. If you're sent to collections for a debt you don't owe or a collector otherwise ignores the FDCPA, you might be able to sue that collector.

That's right, you read that sentence correctly absolutely nothing can be safely placed on the envelope, except for the collector's address. A collector cannot even put its own name on the envelope, unless the collector is certain the name does not indicate that the company is in the debt collection business.

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing. Dispute the debt on your credit report. Lodge a complaint. Respond to a lawsuit. Hire an attorney.

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).