Donation Donee Tax For Us

Description

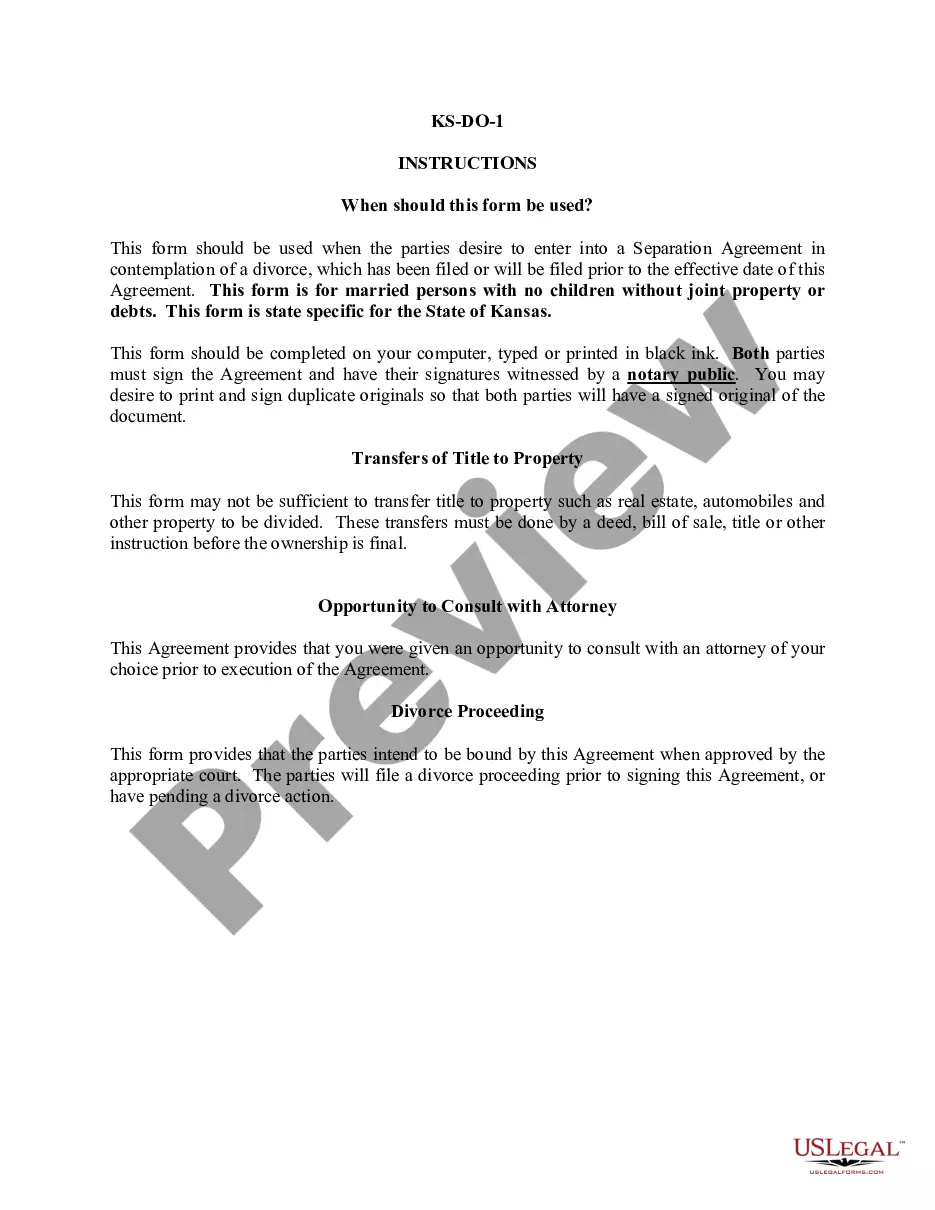

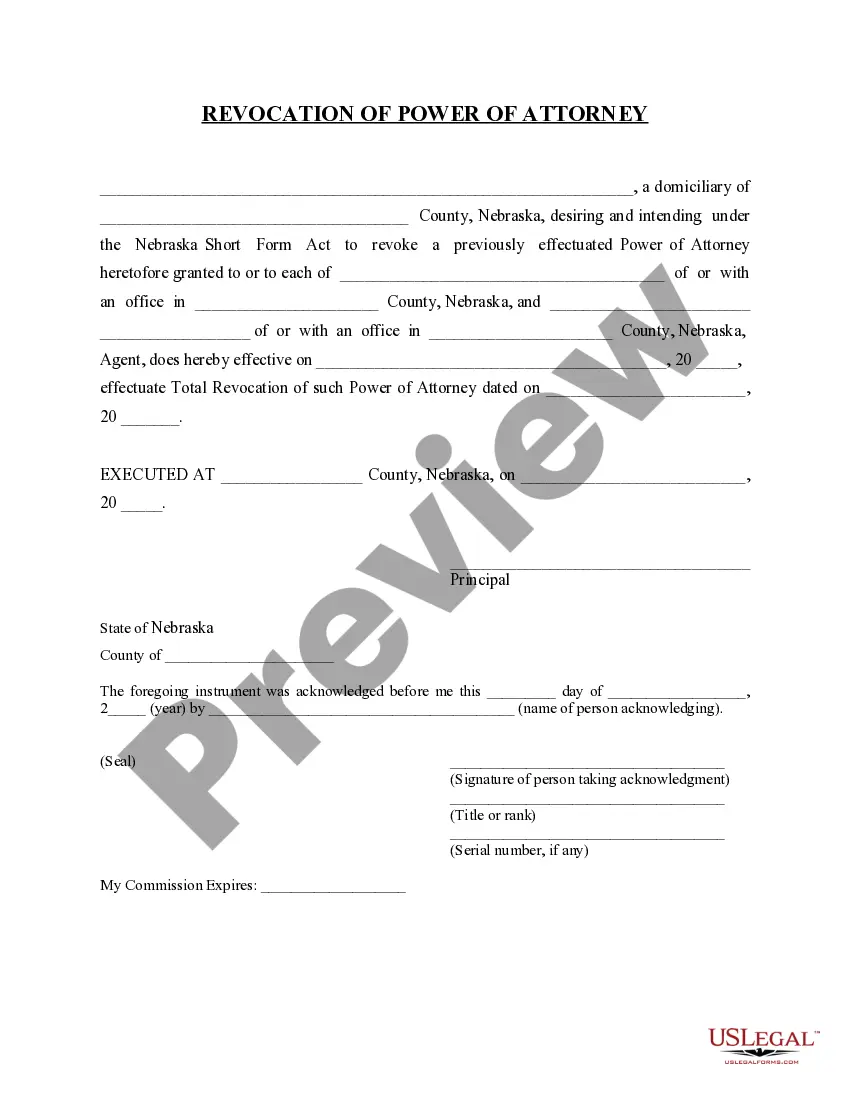

How to fill out Virginia Educational Trust Letter?

- If you're a returning user, simply log in to your account. Ensure your subscription is active before downloading any forms.

- For first-time users, start by exploring the extensive Preview mode and form descriptions to find the template that suits your needs and complies with local jurisdiction requirements.

- If the initial form isn't suitable, utilize the Search tab to find alternative templates tailored to your specific requirements.

- Proceed to purchase the chosen document by clicking on the Buy Now button and selecting your preferred subscription plan, which requires account registration.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Finally, download your form to your device and access it anytime from the My Forms section of your profile.

Using US Legal Forms not only speeds up the process of obtaining necessary legal documents but also provides access to a vast library of over 85,000 fillable and editable forms. Whether you are an individual or an attorney, US Legal Forms simplifies legal documentation.

Don't miss out on the convenience and expertise offered by US Legal Forms. Start your journey today and ensure your documents are both accurate and compliant!

Form popularity

FAQ

To prove your donations for taxes, maintain a comprehensive record that includes receipts, bank statements, and any acknowledgement letters from the donee organizations. It's also advisable to take pictures of valuable items donated. These documents serve as evidence and substantiate your claims for the donation donee tax for us.

You may write off up to $250 in donations without a receipt, provided you can prove your contribution through bank statements or payroll records. However, for any donation exceeding this amount, a receipt or written acknowledgement from the donee organization is essential. Understanding these limits can help you effectively manage your donation donee tax for us.

To record donations for taxes, maintain a clear list of all donations made throughout the year. Use a spreadsheet or tax software to input the date, amount, and recipient organization. Be diligent in saving corresponding receipts and any other relevant documentation. This organized approach will benefit you when filing your donation donee tax for us.

A donee acknowledgement on Form 8283 is a statement that confirms the donee organization received your donation. It includes details such as the date of the donation, description of the property, and signature of an authorized representative of the donee. Having this form ready is essential for correctly reporting your donation donee tax for us.

Documenting donations for taxes involves keeping accurate records of each contribution you make. Collect receipts, bank statements, or acknowledgement letters from donee organizations. Make sure to categorize your donations and maintain them in a dedicated file. This practice helps simplify your preparation for the donation donee tax for us.

To fill out a donation tax receipt, start with your name and contact information, then include the name and information of the donee organization. Record the date of the donation and describe the items donated, including their fair market value. Finally, don’t forget to sign and date the receipt. This documentation supports your donation donee tax for us.

Not all donations qualify as a 100% tax write off, but many do. For donations to recognized charities, a deduction may apply, allowing you to reduce your taxable income. However, the exact amount that you can write off depends on various factors, including the type of organization and the total amount donated. To better understand how Donation donee tax for us affects your contributions, consider consulting resources on the US Legal Forms platform.

In the context of the Donation donee tax for us, the donor is typically responsible for filing a gift tax return. If you give a gift that exceeds the annual exclusion limit, you must report it to the IRS. This includes any donations made to individuals or organizations that surpass the specified threshold. Additionally, using a platform like US Legal Forms can simplify the process of preparing and filing these returns accurately.

You can claim US charitable donations on your taxes if you meet certain conditions. The donation donee tax for us enables individuals to deduct contributions made to eligible charitable organizations. Make sure you keep proper documentation and follow IRS rules for claiming these deductions. Properly managing your claims can lead to worthwhile tax benefits.

In the USA, charitable donations are typically tax-deductible if made to qualified organizations. The donation donee tax for us applies to most gifts you make, allowing you to receive an added benefit on your taxes. Review the IRS guidelines to ensure your contribution qualifies. This deduction can enhance your overall tax strategy.