Will And Estate Planning Checklist

Description

How to fill out Estate Planning Questionnaire?

Managing legal documents can be exasperating, even for experienced professionals.

When you're looking for a Will And Estate Planning Checklist and lack the time to dedicate to finding the suitable and current version, the process can be taxing.

Access legal and business forms specific to your state or county.

US Legal Forms caters to all your requirements, from personal to corporate documents, all in one location.

If it's your first experience with US Legal Forms, create an account for unlimited access to all the platform's benefits. Here are the steps to follow after obtaining the form you need.

- Utilize advanced tools to complete and manage your Will And Estate Planning Checklist.

- Tap into a repository of articles, guides, and resources related to your circumstances and requirements.

- Save time and energy searching for the documents you require and leverage US Legal Forms’ advanced search and Preview feature to find your Will And Estate Planning Checklist effortlessly.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and access it.

- Check your My documents tab to review the documents you've previously saved and manage your folders as desired.

- A comprehensive online form directory can be a transformative solution for anyone wishing to handle these matters effectively.

- US Legal Forms is a frontrunner in online legal documents, with over 85,000 state-specific legal templates available to you at all times.

- With US Legal Forms, it’s feasible to.

Form popularity

FAQ

In Ohio, a will is considered valid if it is in writing, signed by the testator, and witnessed by at least two individuals who are not beneficiaries. It's crucial to meet these requirements to avoid disputes later. Utilizing a will and estate planning checklist can help ensure that your will adheres to Ohio's legal standards, providing peace of mind for you and your loved ones.

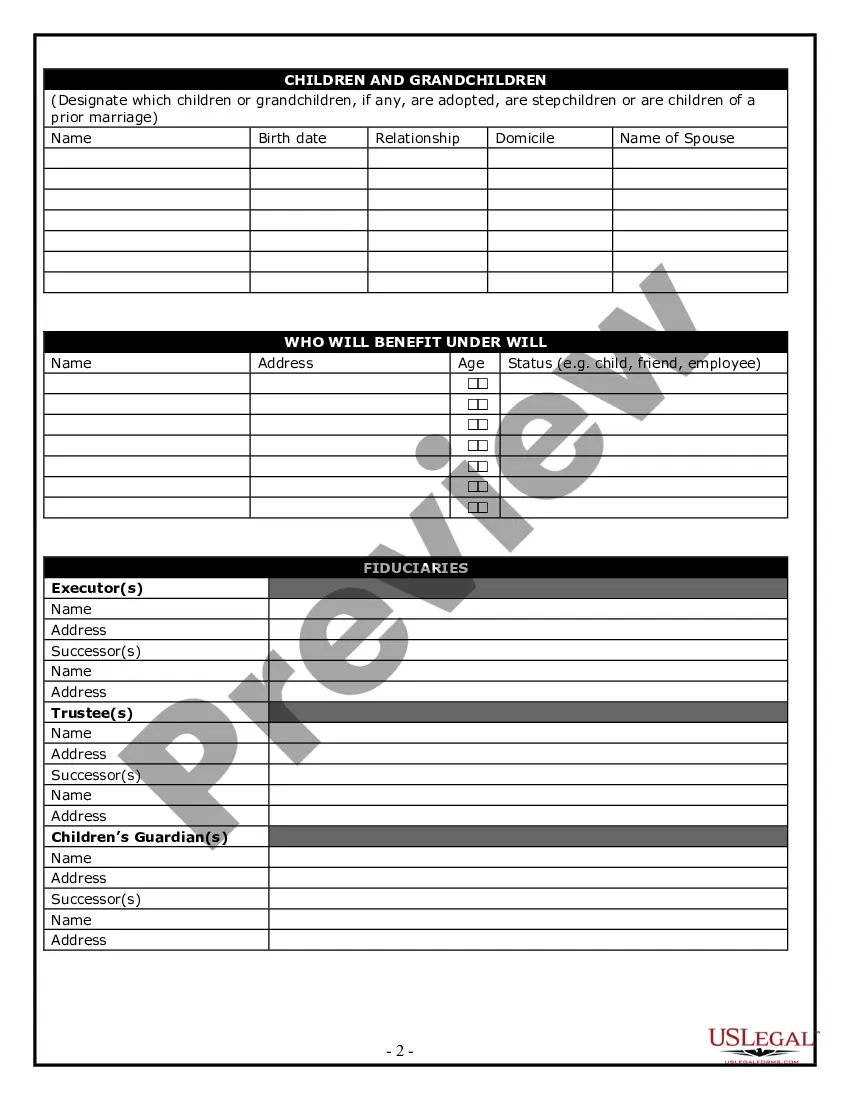

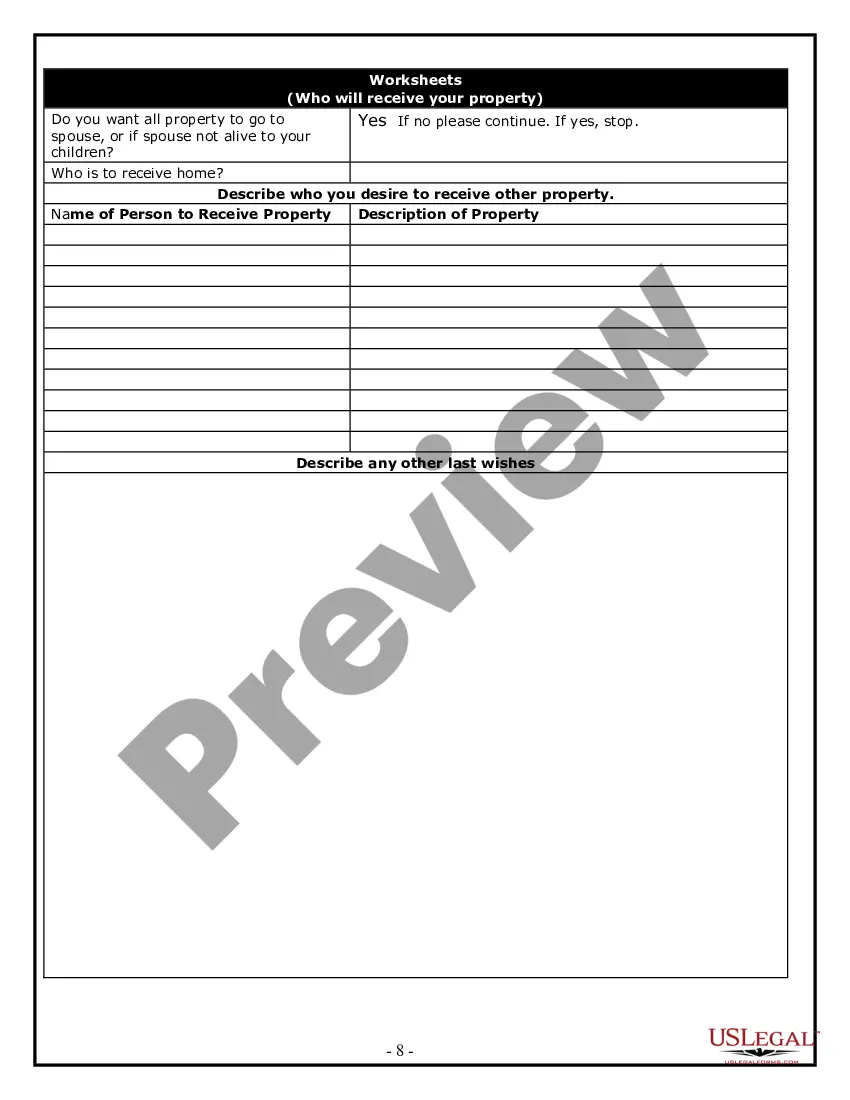

To include someone in your will, you need their full legal name, date of birth, and possibly their address. If you are designating specific assets or responsibilities to them, make sure to detail that in the will as well. Using a comprehensive will and estate planning checklist can assist you in gathering and confirming the necessary information to ensure clarity and legality.

When you're ready to file a will, you will need the will itself, a completed petition to open probate, and sometimes a witness affidavit. Depending on your state, additional documents may also be required. Using a will and estate planning checklist can help you gather all necessary materials, making the process smoother and more efficient.

To file a will, you typically need the original will document, a death certificate, and any required forms from your local probate court. It's essential to follow the court's specific guidelines, as these can vary by jurisdiction. Additionally, having your will and estate planning checklist organized will streamline this process, ensuring you have everything ready when you need it.

One significant mistake parents often make when establishing a trust fund is failing to clearly define the terms or intended use of the trust. Without specific instructions, beneficiaries may mismanage the funds or stray from the parents’ wishes. To avoid this oversight, consult a reliable resource and include comprehensive details in your will and estate planning checklist, ensuring that your intentions are preserved and understood.

The 5 and 5 rule combines the aspects of the 5 or 5 rule, allowing beneficiaries to withdraw 5% of their inheritance annually while also permitting a cumulative $5,000 limit on withdrawals in certain conditions. This rule can help prevent excessive withdrawals that may drain the estate quickly. When creating your will and estate planning checklist, incorporating this rule ensures a balanced approach for supporting heirs without jeopardizing the estate’s longevity.

The 5 or 5 rule in estate planning refers to the provision that allows a beneficiary to take up to 5% of their inheritance each year without incurring certain gift taxes. This rule can provide flexibility for those managing their estate and help beneficiaries receive funds gradually. Including this concept in your will and estate planning checklist is vital to ensure you follow tax regulations while supporting your heirs.

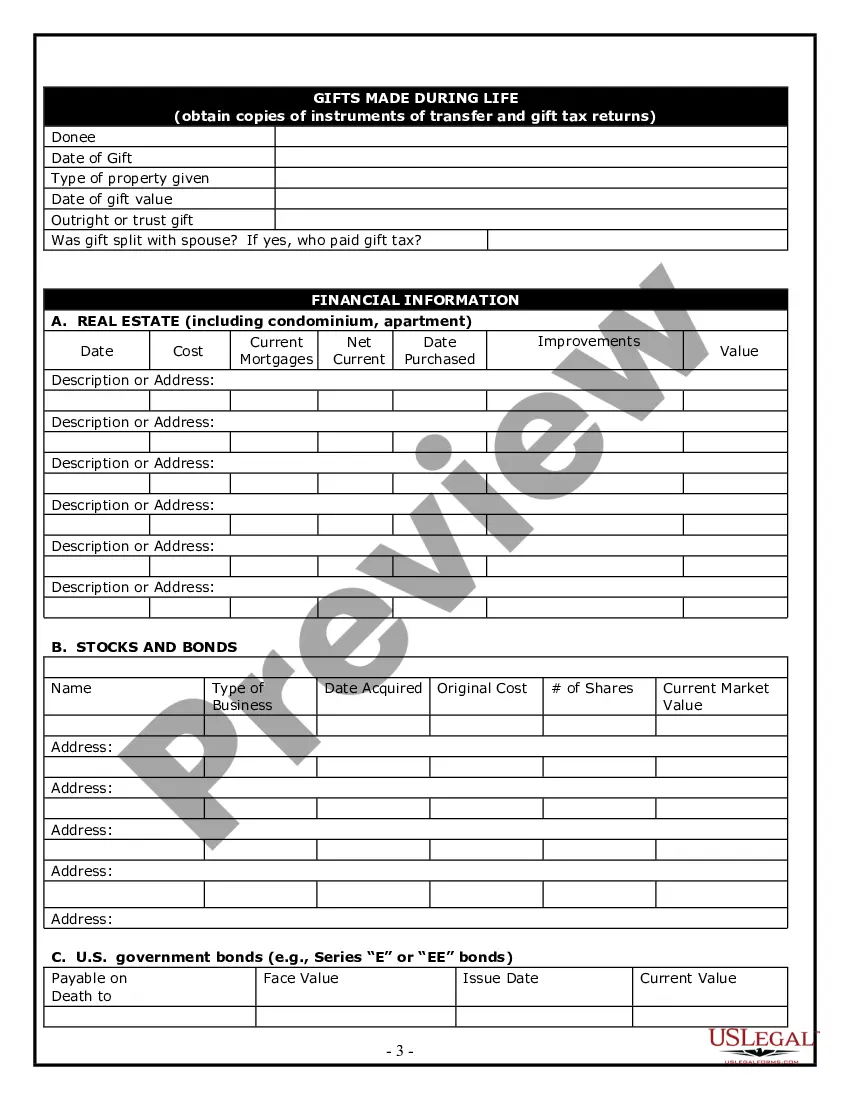

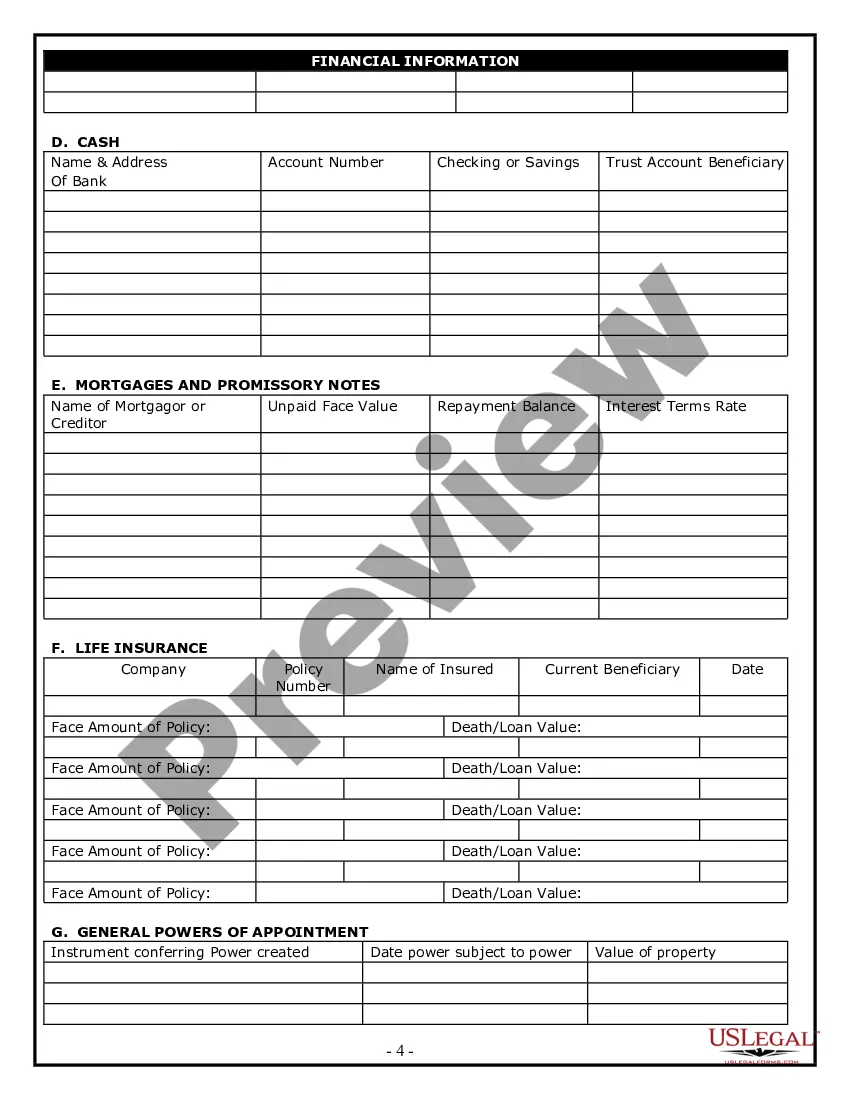

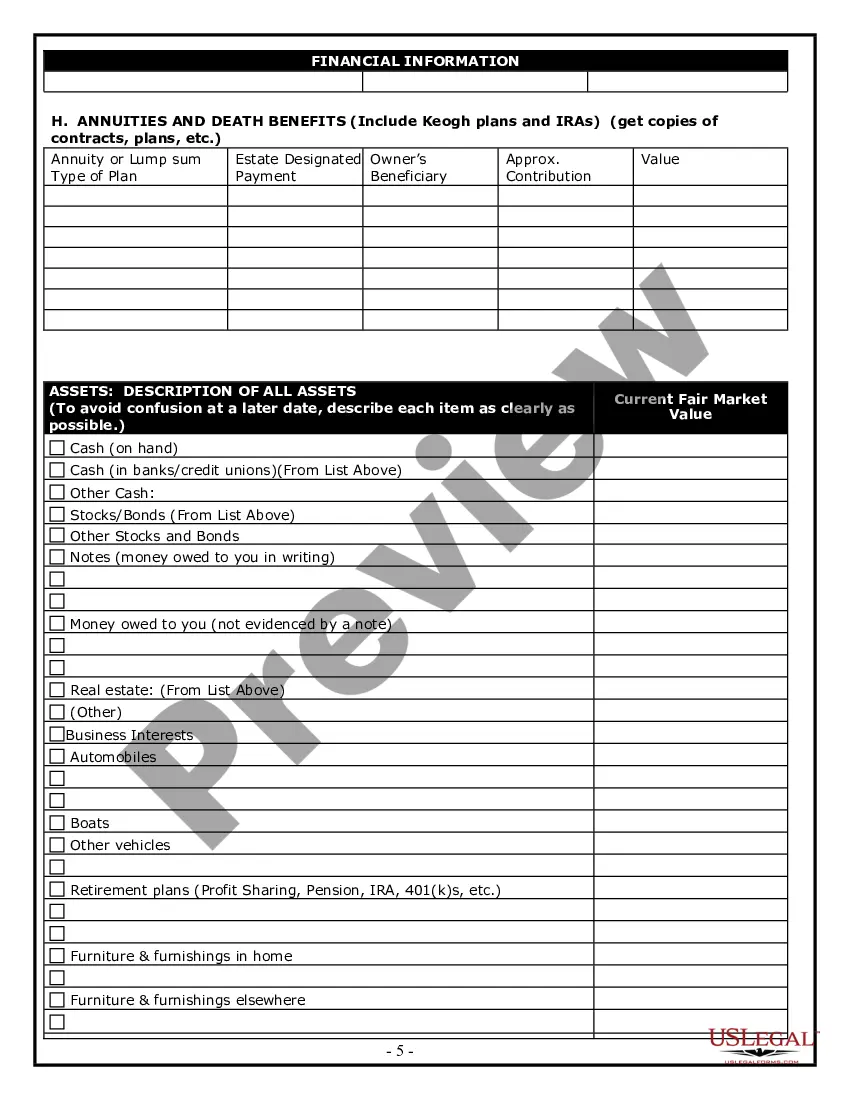

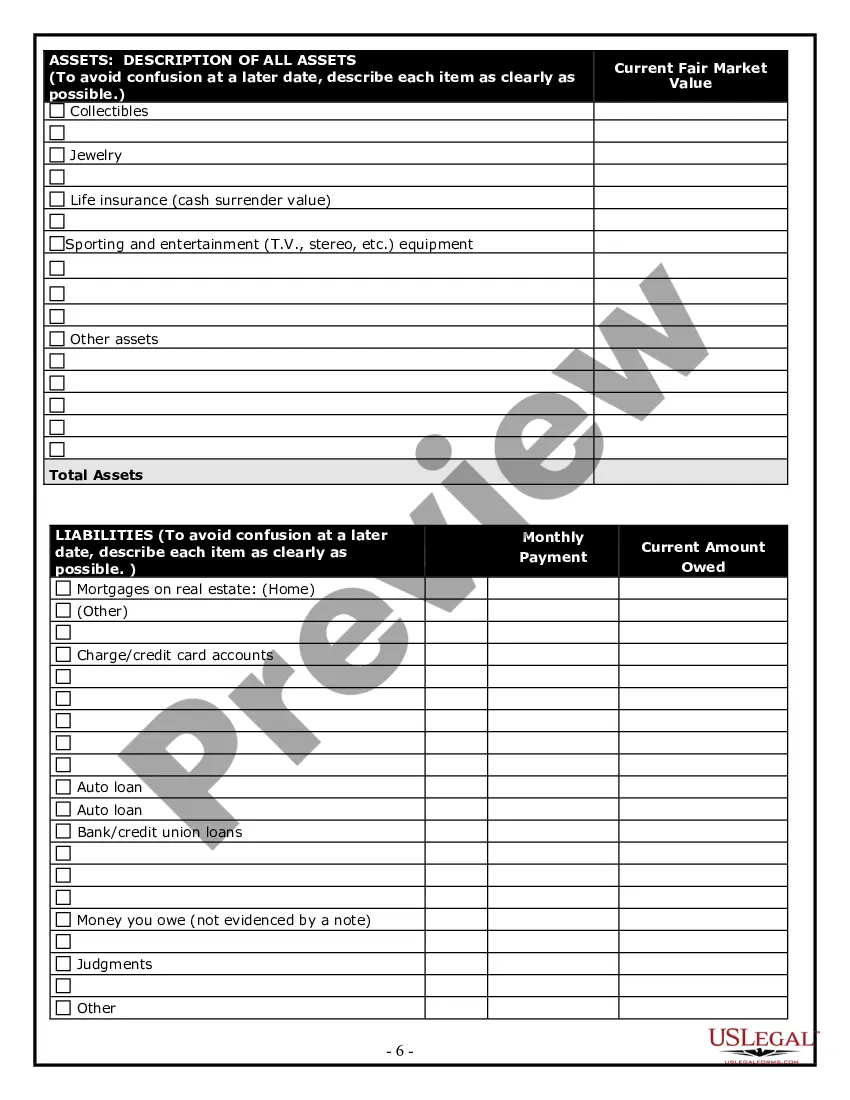

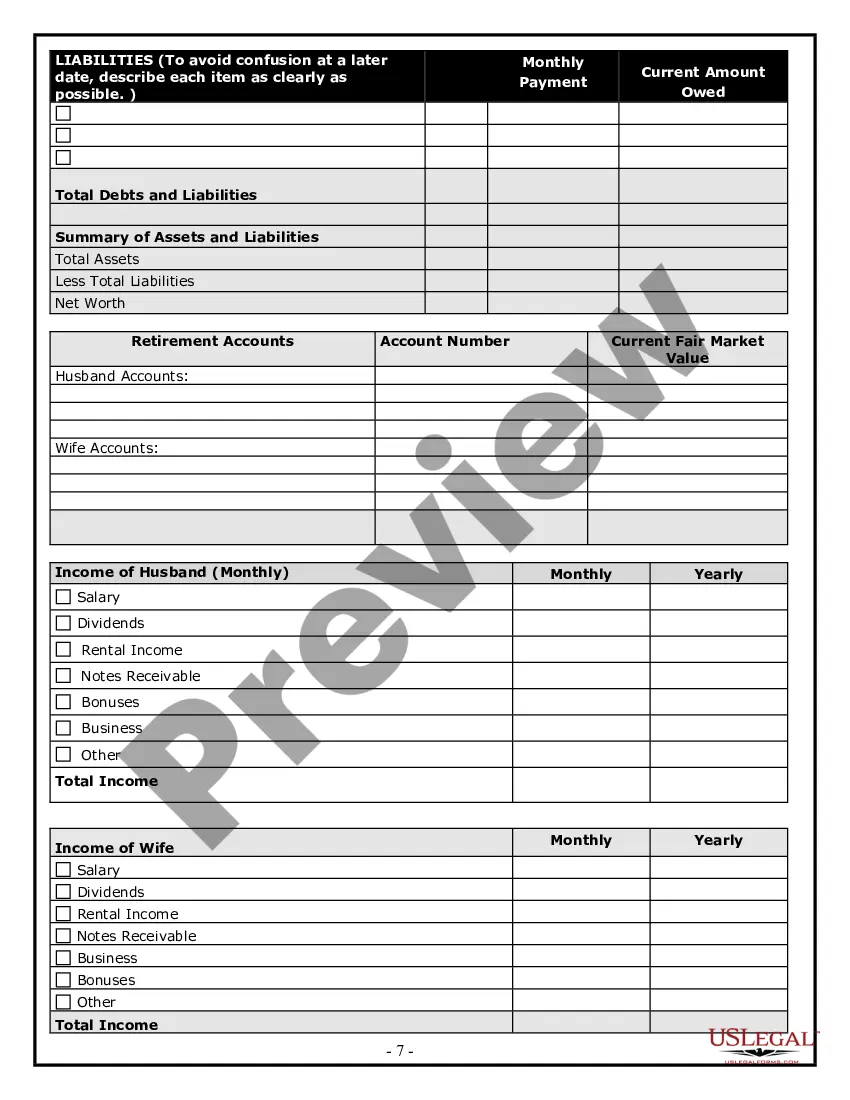

The estate planning process includes several key steps to ensure your wishes are clearly outlined and executed. It typically starts with gathering your financial information, including assets and debts, to create a comprehensive overview. Next, you should identify your goals for asset distribution and appoint trusted individuals as executors or guardians. After that, consider drafting essential documents like wills and powers of attorney, keeping a will and estate planning checklist handy throughout this process to ensure nothing is overlooked.

death checklist helps you organize crucial information for your estate planning. Key elements include gathering your financial documents, identifying beneficiaries, and updating your Will. It’s also wise to prepare a list of assets, debts, and contact information for your advisors. Utilizing a thorough Will and estate planning checklist can provide clarity and ensure your wishes are honored.

The 5 by 5 rule is a guideline that helps you focus on essential elements of a Will and estate planning checklist. Under this rule, you review your estate plan every five years and make adjustments every five years. This regular review ensures that your documents reflect your current wishes and circumstances. Staying on top of these changes can provide peace of mind for you and your loved ones.