Contract Attorneys For Hire

Description

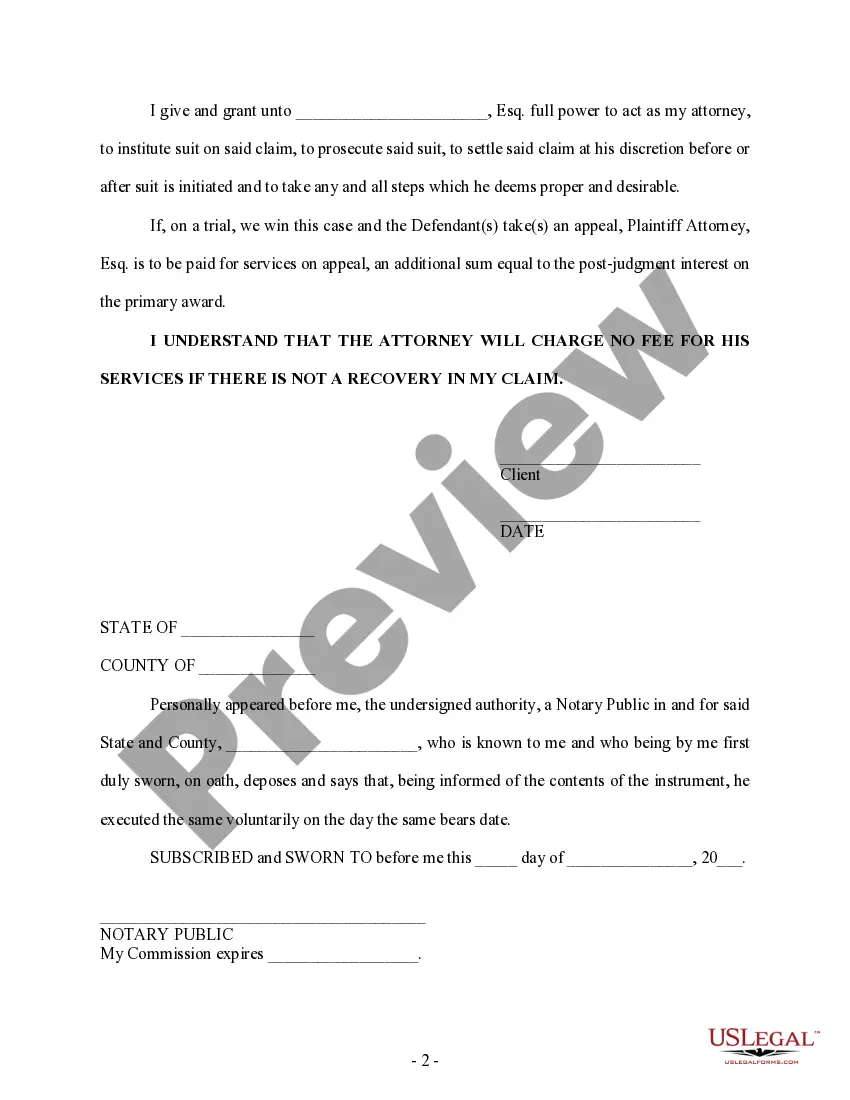

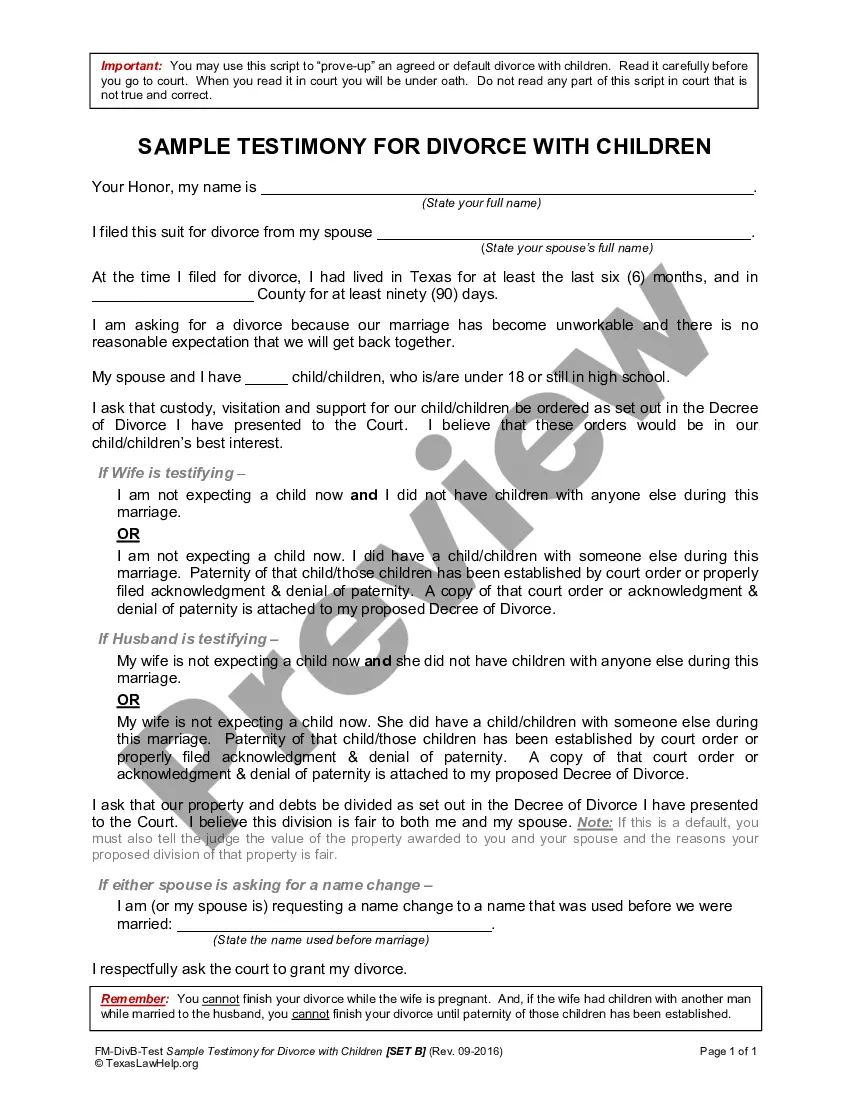

How to fill out Attorney Fee Contract - Contingency - 50%?

Creating legal documents from the ground up can often be daunting.

Certain situations may require extensive research and significant financial investment.

If you seek a more straightforward and cost-effective method of producing Contract Attorneys For Hire or any other paperwork without complicated procedures, US Legal Forms is consistently available to assist you.

Our online repository of more than 85,000 current legal forms covers nearly all facets of your financial, legal, and personal affairs. With merely a few clicks, you can swiftly gain access to templates specific to your state and county, meticulously crafted by our legal experts.

Ensure the form you select adheres to the regulations and laws relevant to your state and county. Select the appropriate subscription plan to acquire the Contract Attorneys For Hire. Download the form, then complete, certify, and print it. US Legal Forms boasts a flawless reputation and over 25 years of experience. Join us now and simplify the process of form completion!

- Utilize our website whenever you require dependable and trustworthy services that allow you to easily locate and download the Contract Attorneys For Hire.

- If you are familiar with our services and have previously established an account, simply Log In to your account, select the form, and download it or re-download it anytime from the My documents section.

- No account? No problem. Setting it up takes minimal time, allowing you to explore the library.

- Before diving into the download of Contract Attorneys For Hire, please consider these guidelines.

- Review the document preview and descriptions to verify you are accessing the correct document.

Form popularity

FAQ

Types of Promissory Notes Simple Promissory Note. ... Student Loan Promissory Note. ... Real Estate Promissory Note. ... Personal Loan Promissory Notes. ... Car Promissory Note. ... Commercial Promissory note. ... Investment Promissory Note. ... Installment Payments.

There are three types of promissory notes: unsecured, secured and demand. An unsecured promissory note is one that is not backed by any type of collateral. ... A secured promissory note is one that is backed by some type of collateral. ... A demand promissory note does not have a specific due date for repayment.

You can get a copy of your Master Promissory Notes by going to studentloans.gov and entering your FSA ID. Click on ?Completed Master Promissory Notes? under the menu bar heading that says ?My Loan Documents.? The completed Master Promissory Notes will appear, and you can download them directly.

A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.

The parts of a promissory note are: Lender details and contact information. Borrower name and contact information. Interest rate and how it's been calculated. Principal loan amount. Loan maturity date. The date of the first payment is required. Fees and charges. Date and place of issuance.

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like eForms or .

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.