Agreement Level Document With Entity-selection Attention

Description

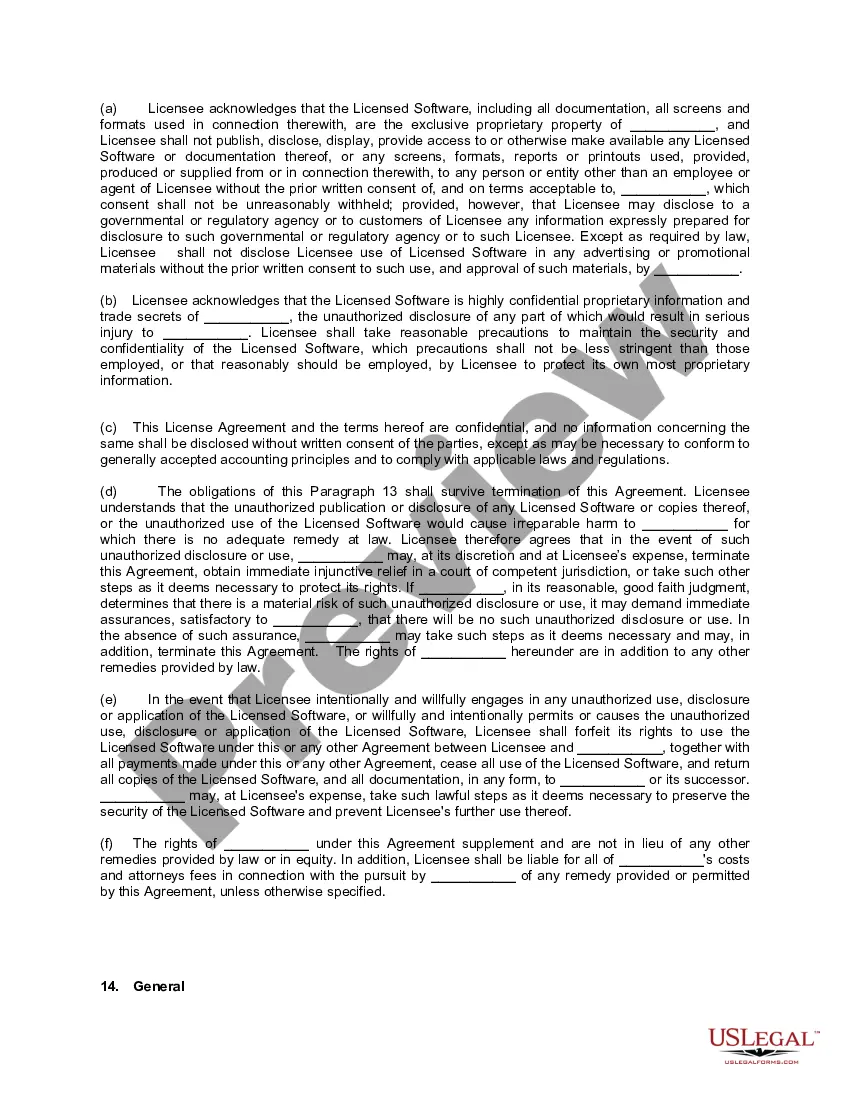

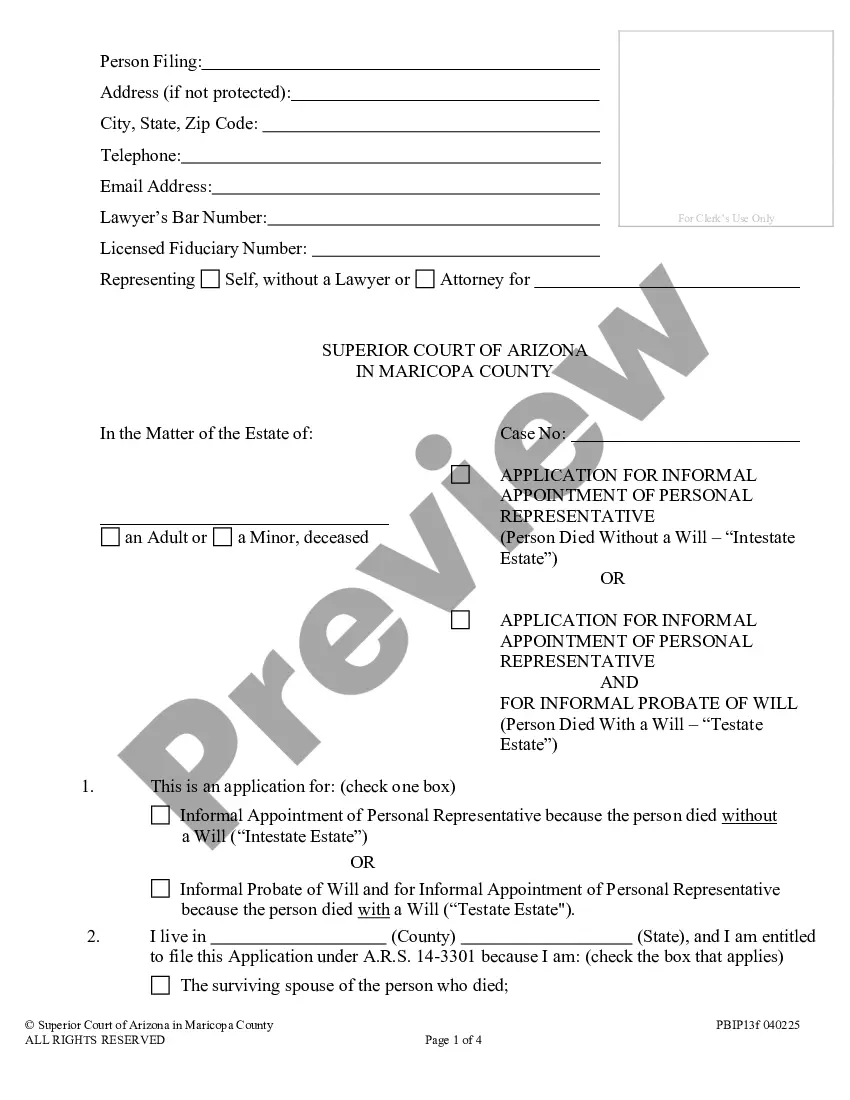

How to fill out License Subscription Agreement With Service Level Options?

It’s well-known that you cannot transform into a legal expert instantly, nor can you swiftly learn to create Agreement Level Document With Entity-selection Attention without a specialized background.

Drafting legal documents is a lengthy process that demands specific education and expertise. So why not entrust the creation of the Agreement Level Document With Entity-selection Attention to the experts.

With US Legal Forms, one of the most comprehensive legal template collections, you can locate everything from court forms to templates for internal communication.

You can re-access your documents from the My documents section at any time. If you’re a returning customer, you can simply Log In, and find and download the template from the same section.

Regardless of the purpose of your forms—whether financial, legal, or personal—our platform has you covered. Try US Legal Forms today!

- Identify the form you need by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if Agreement Level Document With Entity-selection Attention is what you require.

- Initiate your search again if you need another template.

- Create a free account and choose a subscription plan to purchase the template.

- Select Buy now. Once the payment is finalized, you can obtain the Agreement Level Document With Entity-selection Attention, complete it, print it, and send or mail it to the appropriate individuals or entities.

Form popularity

FAQ

The difference between LLC and PC is straightforward. A limited liability company (LLC) combines the tax benefits of a partnership and the limited liability protection of a corporation. A professional corporation (PC) is organized ing to the laws of the state where the professional is licensed to practice.

Additionally, PCs are taxed differently than PLLCs. PLLCs can opt for pass-through taxation. They may also choose S-corps taxation, which offers a form of pass-through taxation but includes some corporate taxation done at the level of the business. PCs are taxed like regular corporations.

However, the type of entity you choose for your business determines how your company is structured and taxed. For example, by definition, a sole proprietorship must be owned and operated by a single owner. If your business entity type is a partnership, on the other hand, this means there are two or more owners.

The primary considerations in the choice of business entity will be how to protect your personal assets from liabilities of the business; tax strategies such as maximizing the tax benefits of startup losses, avoiding double (or even triple) layers of taxation, and converting ordinary income into long term capital gain, ...

Choosing the right entity is an exciting and important step in the lifecycle of a business. The entity you choose helps outline roles and responsibilities among owners, guides you in conducting your business, and provides you with exit options, among other things.