Independent Contractor Form Document For Transportation Services

Description

How to fill out Research Agreement - Self-Employed Independent Contractor?

There’s no longer a requirement to squander time looking for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in a single location and made their access easier.

Our platform offers over 85k templates for any business and personal legal situations categorized by state and purpose.

Using the Search field above to find another template if the previous one didn’t meet your needs. Click Buy Now next to the template title when you identify the correct one. Select your preferred pricing plan and create an account or Log In. Pay for your subscription with a card or through PayPal to proceed. Choose the file format for your Independent Contractor Form Document For Transportation Services and download it to your device. Print your form for handwritten completion or upload the sample if you prefer to fill it in using an online editor. Preparing legal paperwork under federal and state laws and regulations is quick and straightforward with our library. Give US Legal Forms a try today to maintain your documentation in order!

- All forms are professionally drafted and verified for legitimacy, ensuring you receive the latest Independent Contractor Form Document For Transportation Services.

- If you are acquainted with our platform and already possess an account, it’s essential to confirm your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained paperwork whenever necessary by accessing the My documents tab in your profile.

- If you’ve never interacted with our platform before, the process will necessitate a few additional steps to complete.

- Here’s how new users can acquire the Independent Contractor Form Document For Transportation Services from our library.

- Examine the page content thoroughly to confirm it includes the sample you require.

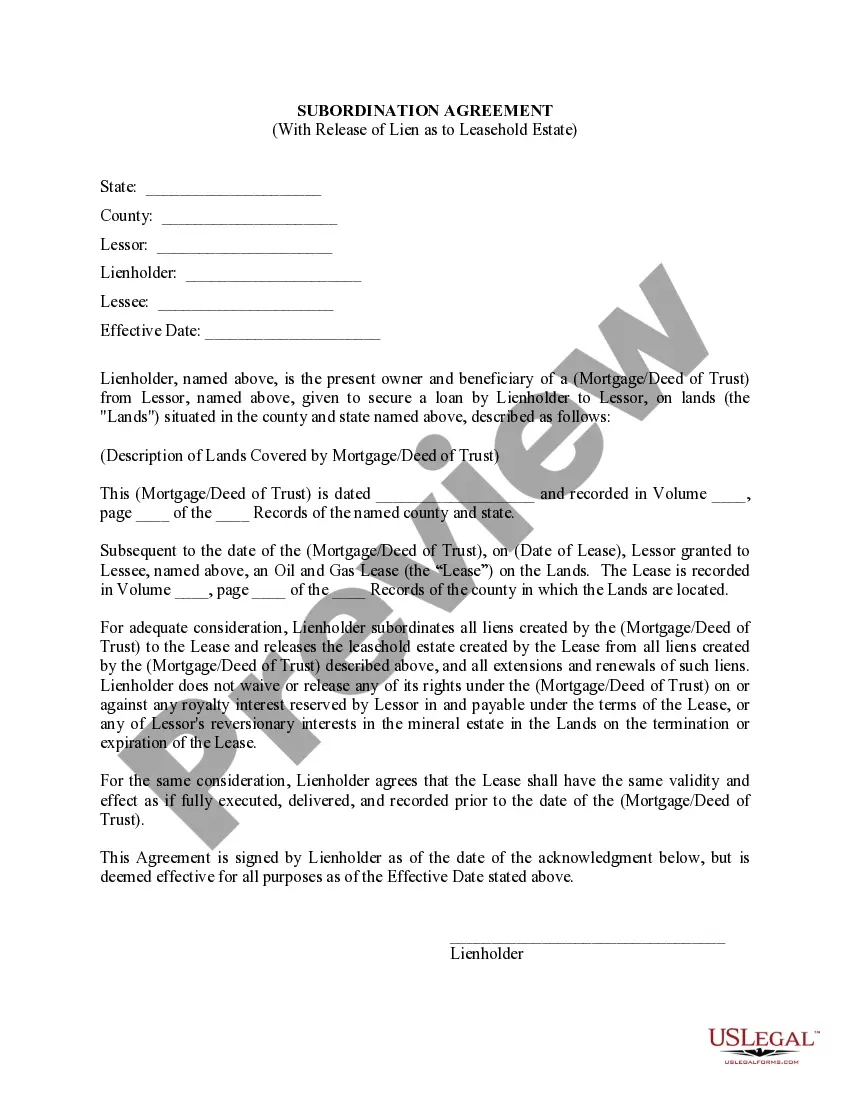

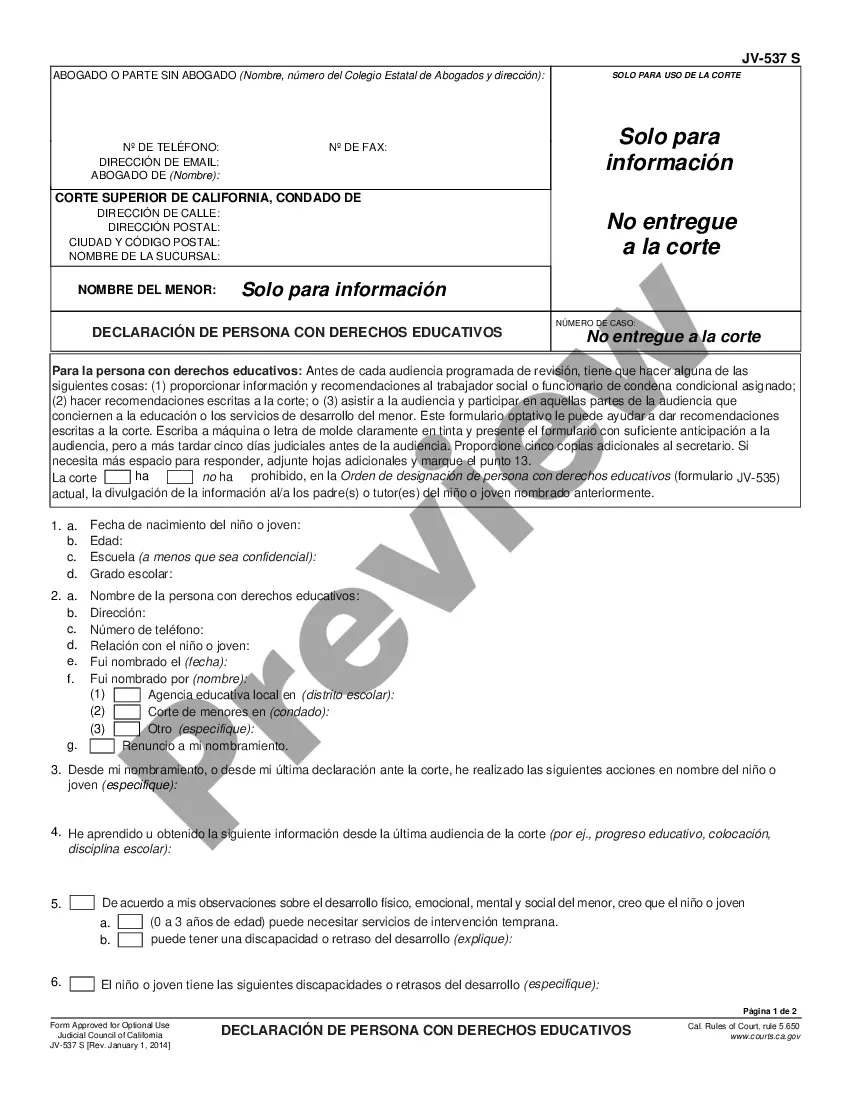

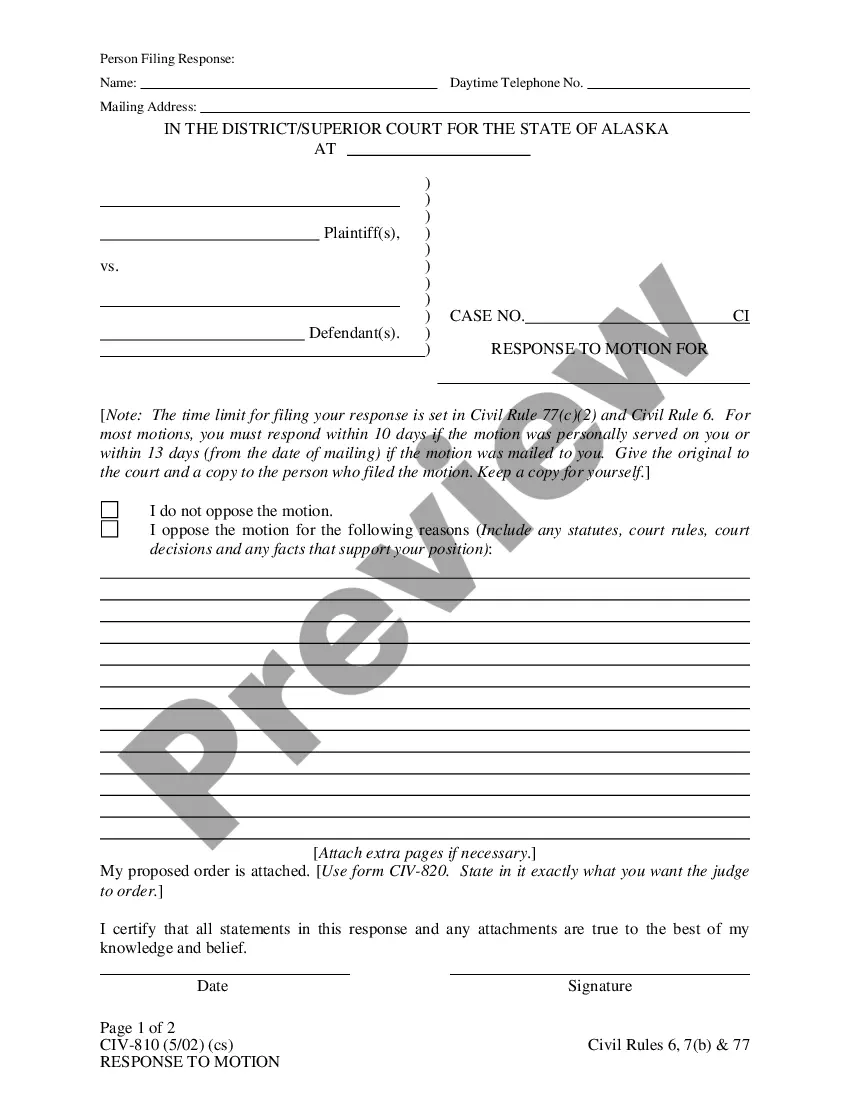

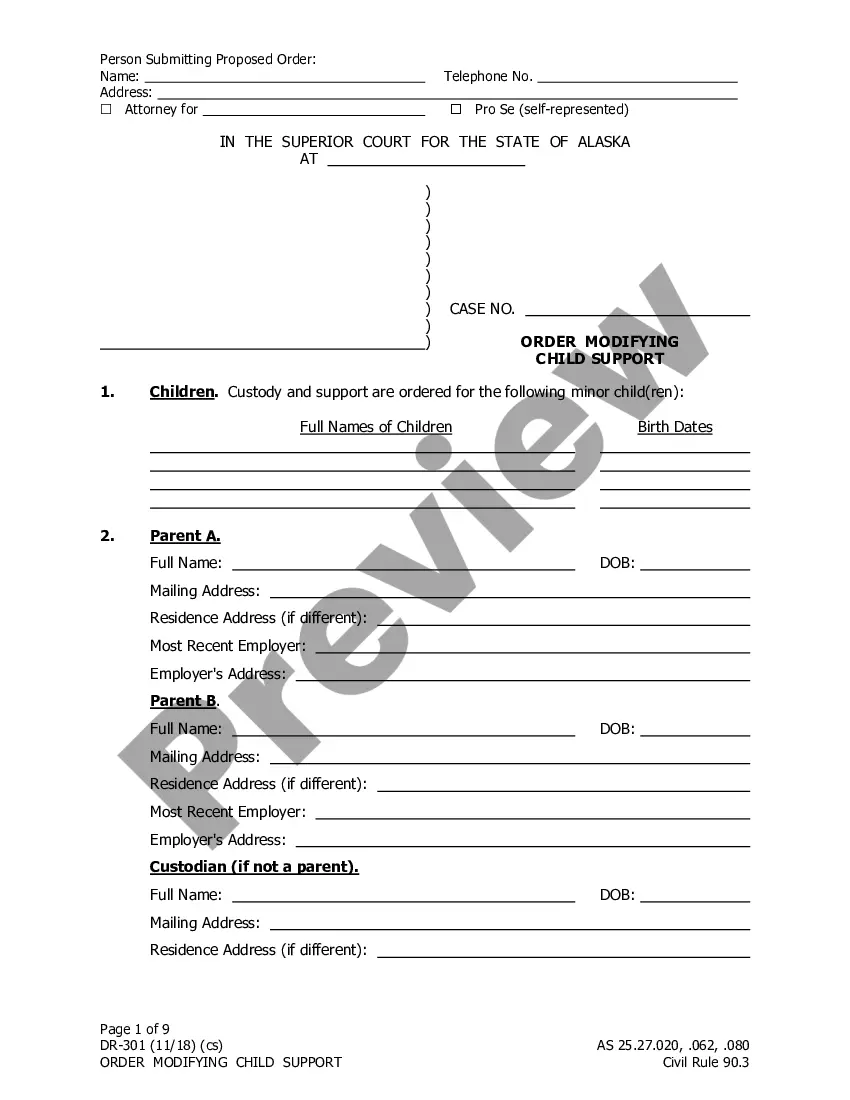

- Utilize the form description and preview options if available.

Form popularity

FAQ

Transport agreement means a written agreement between two or more service programs that specifies the duties and responsibilities of the agreeing parties to ensure appropriate transportation of patients in a given service area. Sample 1.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Generally speaking, Transportation Contracts are created to set forth the terms and payment details for transport services that will be provided. With signatures from the transport company and the cargo owner, this contract helps each party to set expectations and reduce the risk of disagreements.

The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.

Independent contractors generally report their earnings to the IRS quarterly using Form 1040-ES, Estimated Tax for Individuals. This covers both their federal income tax and self-employment tax liabilities. They may also have to pay state and local taxes according to their state and local government guidelines.