Capital Call Letter Example For 2023

Description

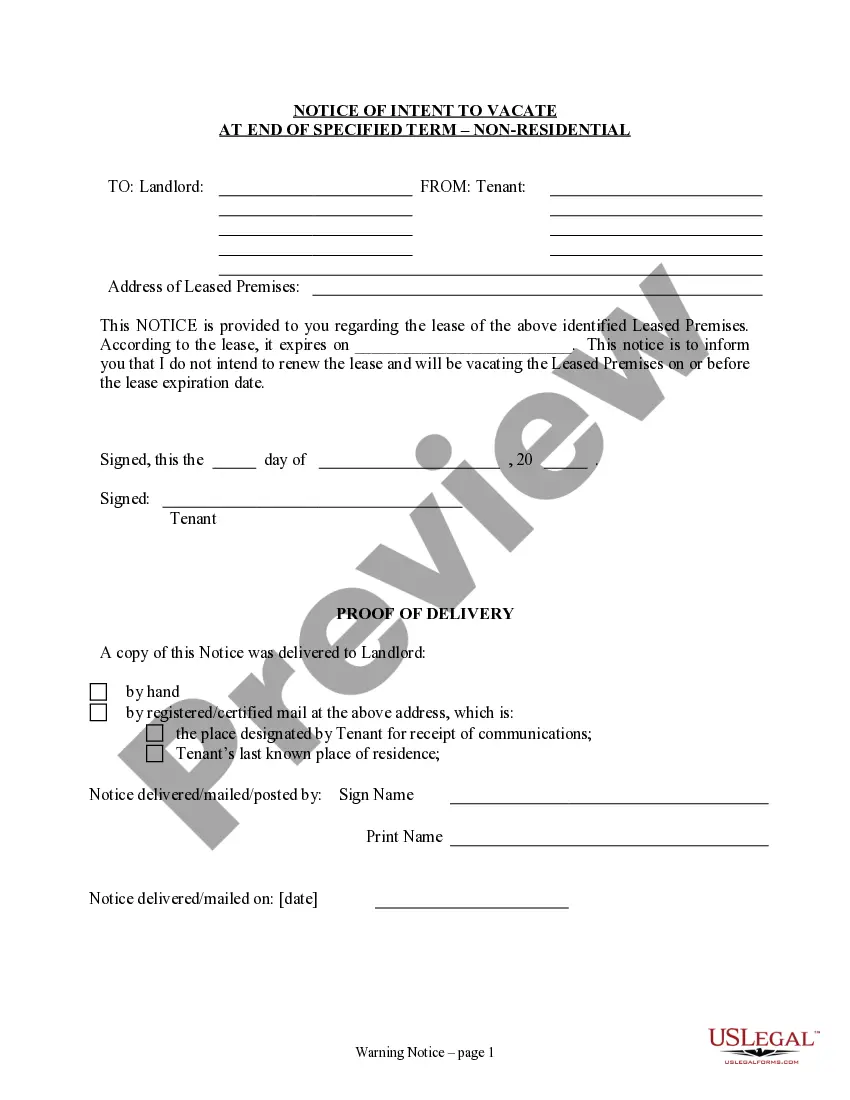

How to fill out Call Agreement Between Kelso And Company, LP, Unilab Corporation And Bankers Trust Company?

Using legal document samples that comply with federal and regional regulations is crucial, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the appropriate Capital Call Letter Example For 2023 sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life scenario. They are easy to browse with all documents grouped by state and purpose of use. Our experts keep up with legislative updates, so you can always be sure your form is up to date and compliant when obtaining a Capital Call Letter Example For 2023 from our website.

Obtaining a Capital Call Letter Example For 2023 is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the instructions below:

- Examine the template utilizing the Preview option or via the text description to ensure it meets your needs.

- Locate another sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the suitable form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Capital Call Letter Example For 2023 and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete earlier saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

A capital call (also referred to as a 'drawdown' or a 'capital commitment') is the means by which limited partners fund their investments in a private equity fund. An LP agrees to a certain capital commitment as part of their Limited Partnership Agreement (LPA) with a private equity fund.

While there is no standard format for a capital call notice, a typical capital call notice includes: The LP's share of the amount due, The portion of all committed capital called, Banking details, and. Payment due date.

A capital call line is a revolving line of credit that a lender provides to a private equity group (PEG). The line of credit is collateralized with a pledge of the right to call and receive capital contributions from the fund's investors.

Capital Call Example Let's say an investor commits $500,000 to a private equity fund. At the time of signing the agreement, the investor is only required to pay $100,000. Over a period of months or years, the fund issues capital calls until the unfunded $400,000 is paid into it.