Irrevocable Trust Agreement for Benefit of Trustor's Children and Grandchildren with Spendthrift Trust Provisions

Definition and meaning

An Irrevocable Trust Agreement for Benefit of Trustor's Children and Grandchildren with Spendthrift Trust Provisions is a legal document that establishes a trust. This trust is designed to manage and protect the assets for the benefit of the Trustor's descendants — specifically their children and grandchildren. Unlike a revocable trust, an irrevocable trust cannot be altered or revoked once it is created, thus ensuring that the assets placed in the trust are effectively removed from the Trustor’s personal estate. This form typically includes provisions that prevent beneficiaries from accessing the assets before certain criteria are met, such as reaching a specified age.

Key components of the form

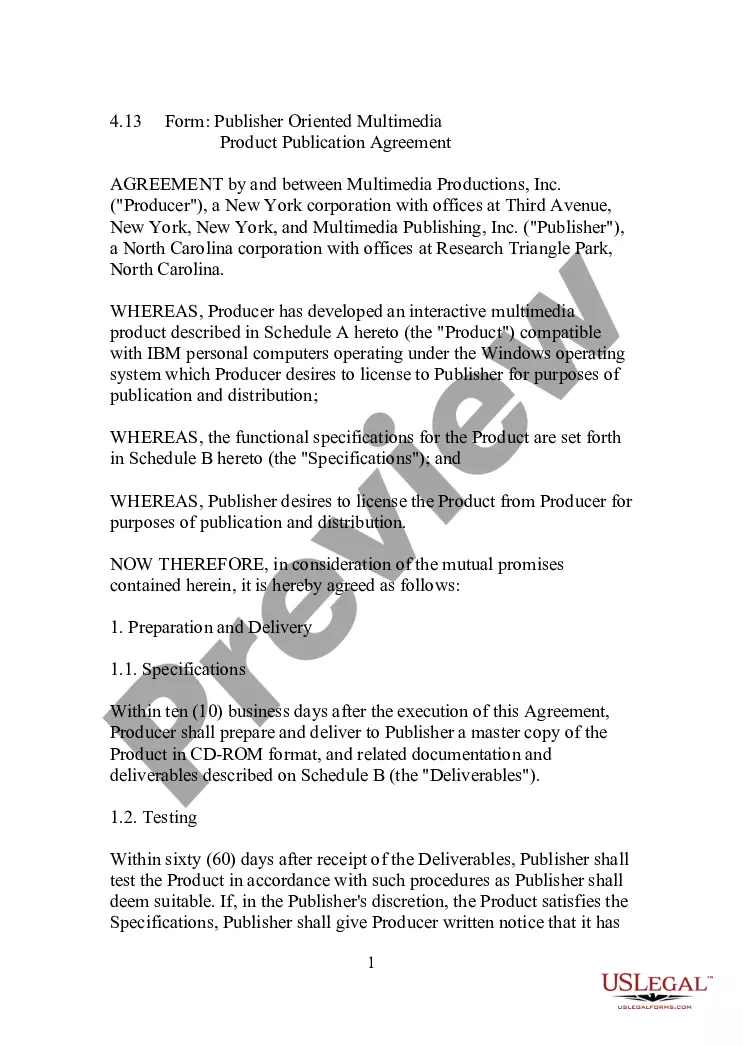

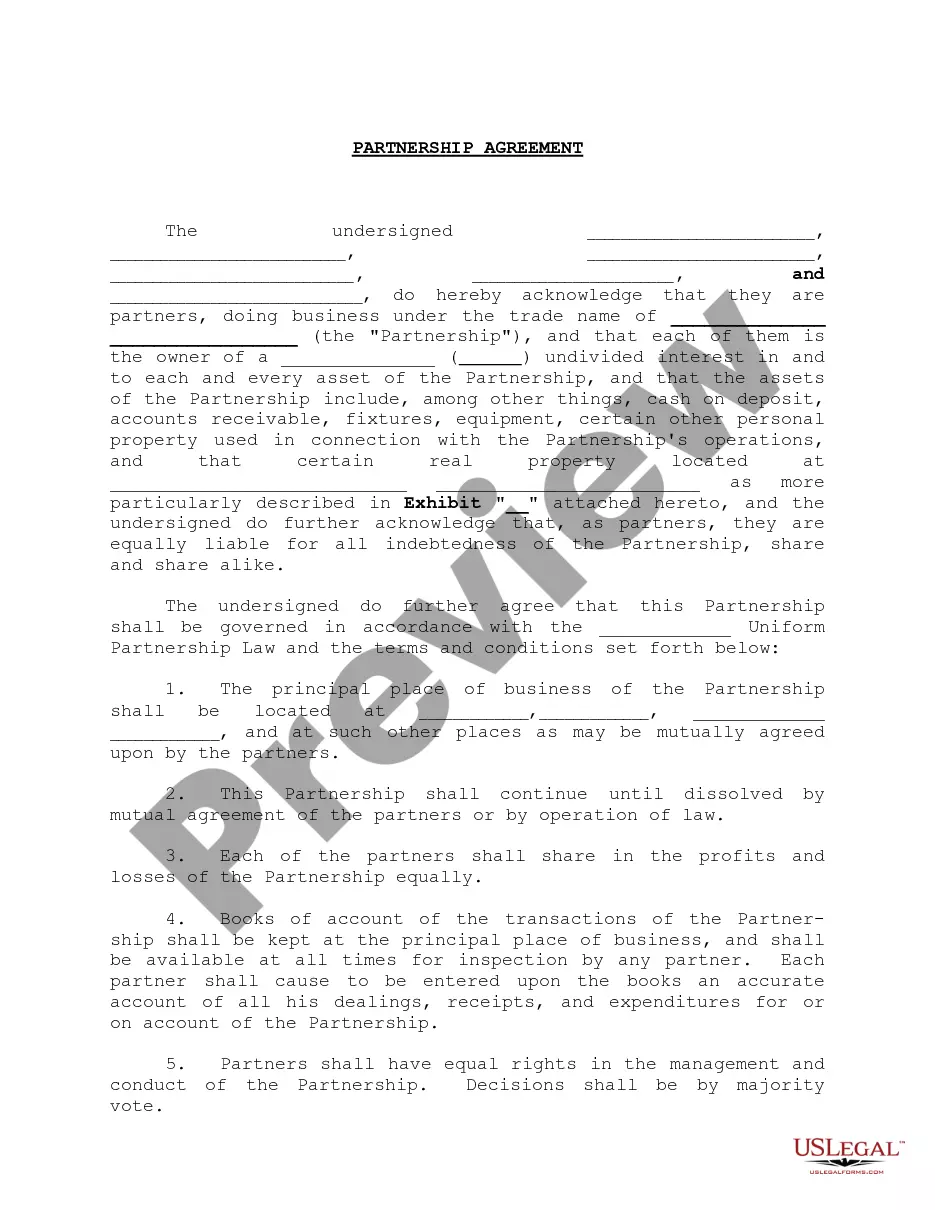

This form encompasses several critical elements:

- Trustor and Trustee Information: Basic details of the person creating the trust and the individual or institution responsible for managing it.

- Trust Property: A detailed list of assets being transferred into the trust, stipulated in Schedule A.

- Distribution Guidelines: Instructions on how and when beneficiaries receive trust assets, including provisions for children and grandchildren.

- Income and Principal Management: Directions for handling income generated by the trust assets and access to principal funds.

- Spendthrift Provisions: Clauses that prevent beneficiaries from pledging their interests in the trust to creditors or as collateral for debts.

How to complete a form

To complete the Irrevocable Trust Agreement, follow these steps:

- Begin by filling in the date of the agreement.

- Provide the full names and addresses of the Trustor and Trustee.

- List the property to be included in the trust in Schedule A.

- Define the initial distribution amounts for grandchildren and elaborate on the division into trusts for children.

- Include specific age requirements for grandchildren related to their rights to withdraw from the trust.

- Have both the Trustor and Trustee sign the document in the presence of a notary public.

Ensure all information is accurate to prevent any potential disputes in the future.

Who should use this form

This trust agreement is suitable for anyone looking to provide financial security for their children and grandchildren. It is particularly beneficial for individuals who wish to:

- Protect assets from creditors or divorce proceedings.

- Secure educational funds for future generations.

- Maintain control over the distribution of their estate posthumously.

- Ensure the proper management of assets through a trusted individual or institution.

It's advisable for users to consult with a legal professional to ensure that this form meets their specific needs.

Benefits of using this form online

Using the Irrevocable Trust Agreement form online offers several advantages:

- Accessibility: Access the form anytime and anywhere from your computer or mobile device.

- Convenience: Fill out the form at your own pace without the pressure of a legal office appointment.

- Cost-Effectiveness: Often cheaper than hiring an attorney, especially if your situation is straightforward.

- Guidance: Many online templates provide step-by-step instructions to help users fill out the form correctly.

Online resources simplify the process of creating legal documents, making them accessible to those with limited legal experience.

Form popularity

FAQ

Capital Gains Tax on an interest in possession trust Trustees are liable to Capital Gains Tax on any chargeable gains above an amount set each year called the 'annual exempt amount'. Beneficiaries are not taxed on any trust gains and do not get credit for tax paid by the trustees.

A spendthrift trust can be revocable or irrevocable in nature. A revocable trust is one that can be changed or modified by the grantor. On the other hand, an irrevocable spendthrift trust cannot be changed.

A spendthrift provision is valid only if the provision restrains both voluntary and involuntary transfer of a beneficiary's interest. When a Trust provides that the interest of a beneficiary is held subject to a spendthrift trust, or words of similar import, that is sufficient to invoke the rights.

Besides estate earnings, a spendthrift trust itself cannot be taxed like a corporate entity because it does not fit the legal definition of a corporate association. This frees it from legislative controls while allowing it to manage properties and assets, including businesses.

A spendthrift trust is a trust in which the beneficiary doesn't have direct access to the funds. Rather, one or more trustees are given broad discretionary powers to provide beneficiaries with funds for expenses to keep up their lifestyle.

Any income that trust inheritance assets earn is reported on the grantor's personal return and he pays taxes on it.If you inherit from a simple trust, you must report and pay taxes on the money. By definition, anything you receive from a simple trust is income earned by it during that tax year.

When trust beneficiaries receive distributions from the trust's principal balance, they do not have to pay taxes on the distribution.If the income or deduction is part of a change in the principal or part of the estate's distributable income, income tax is paid by the trust and not passed on to the beneficiary.

If the testator wants to provide for a person who she knows is wasteful, her best option is to create a spendthrift trust or to place a spendthrift provision in any other type of private trust. The beneficiary of a spendthrift trust cannot voluntarily alienate his or her interest in the trust.