New York Form Fillable For Attorney

Description

How to fill out Trust Agreement Between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., And The Bank Of New York?

Drafting legal paperwork from scratch can sometimes be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a a more straightforward and more affordable way of creating New York Form Fillable For Attorney or any other paperwork without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual library of more than 85,000 up-to-date legal documents covers almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-specific forms diligently prepared for you by our legal specialists.

Use our platform whenever you need a trustworthy and reliable services through which you can easily locate and download the New York Form Fillable For Attorney. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes little to no time to register it and navigate the library. But before jumping directly to downloading New York Form Fillable For Attorney, follow these tips:

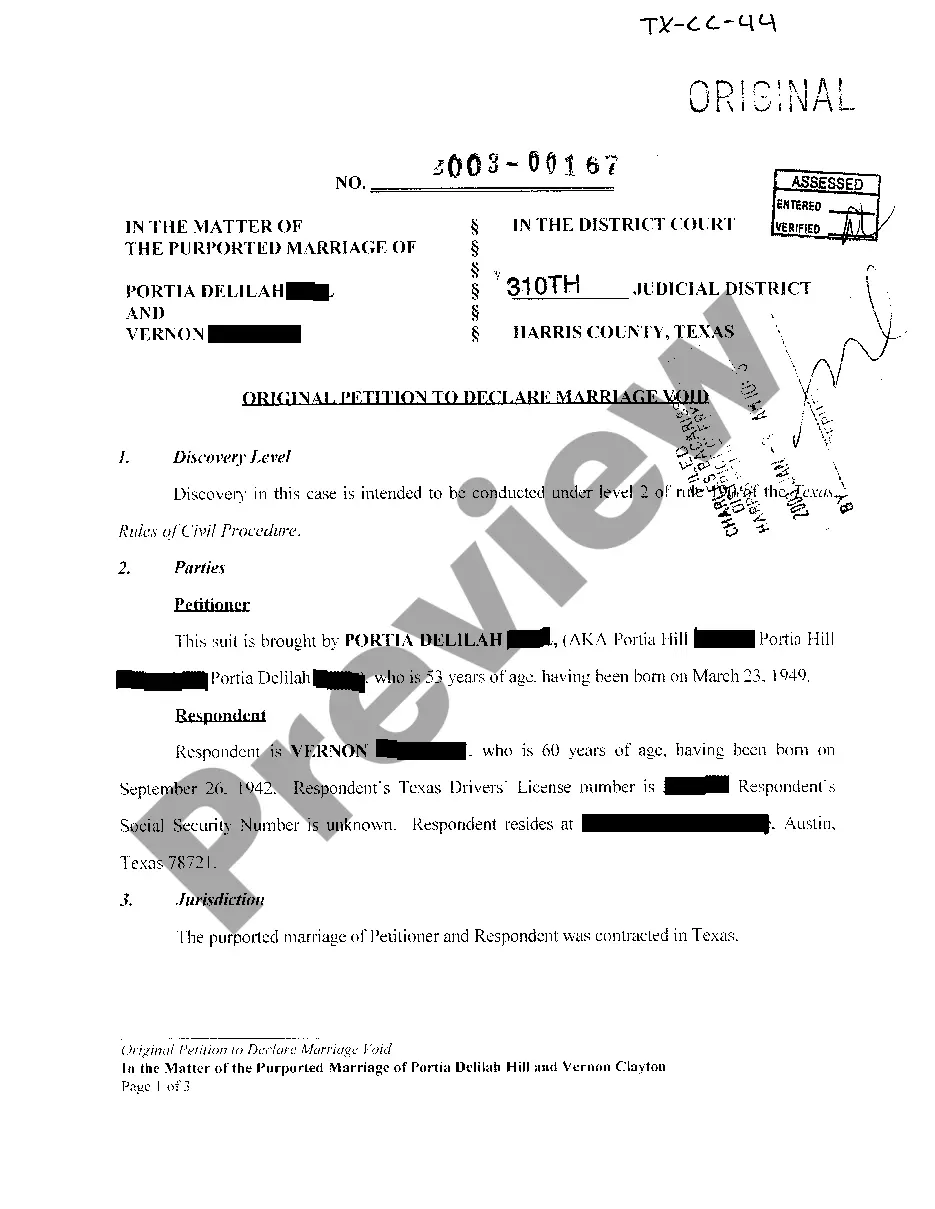

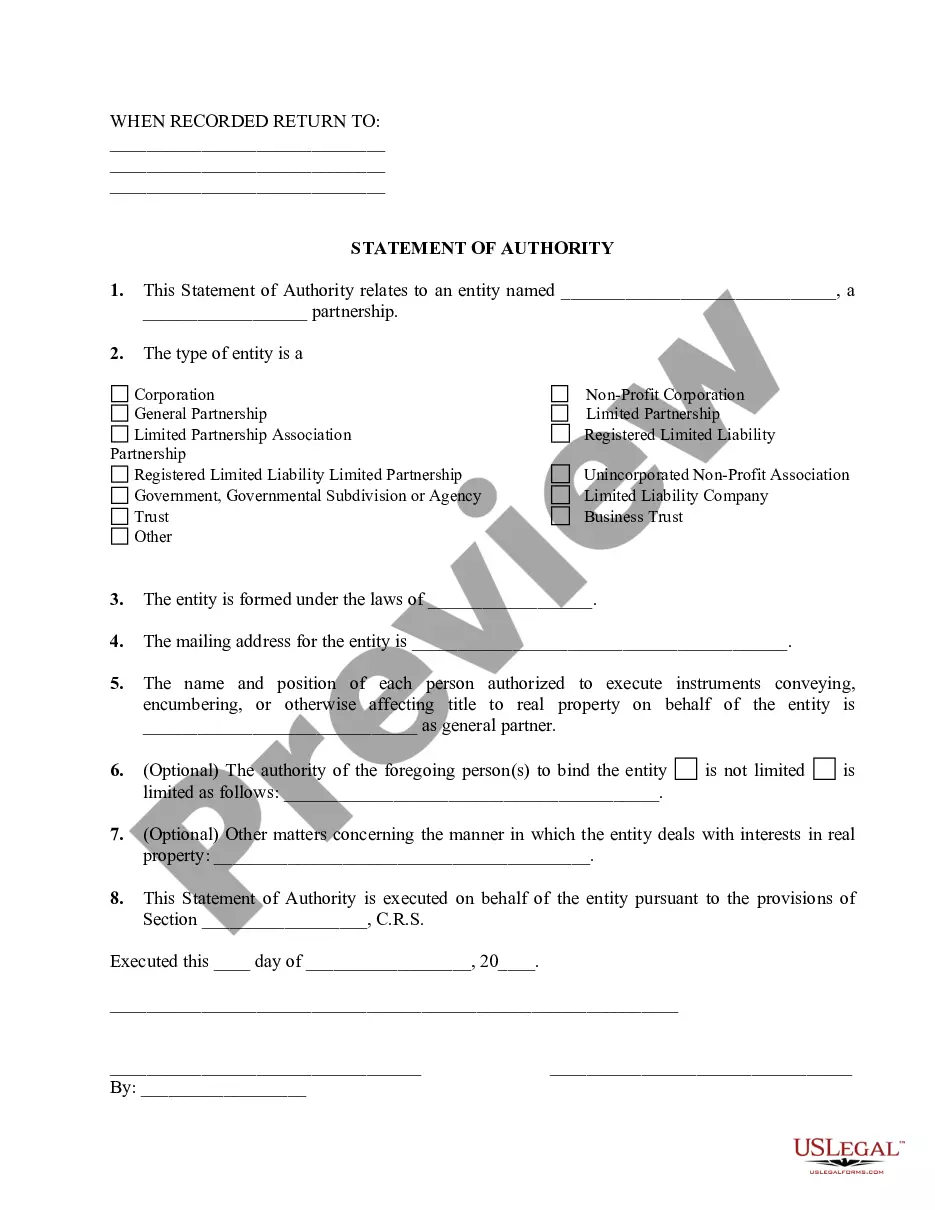

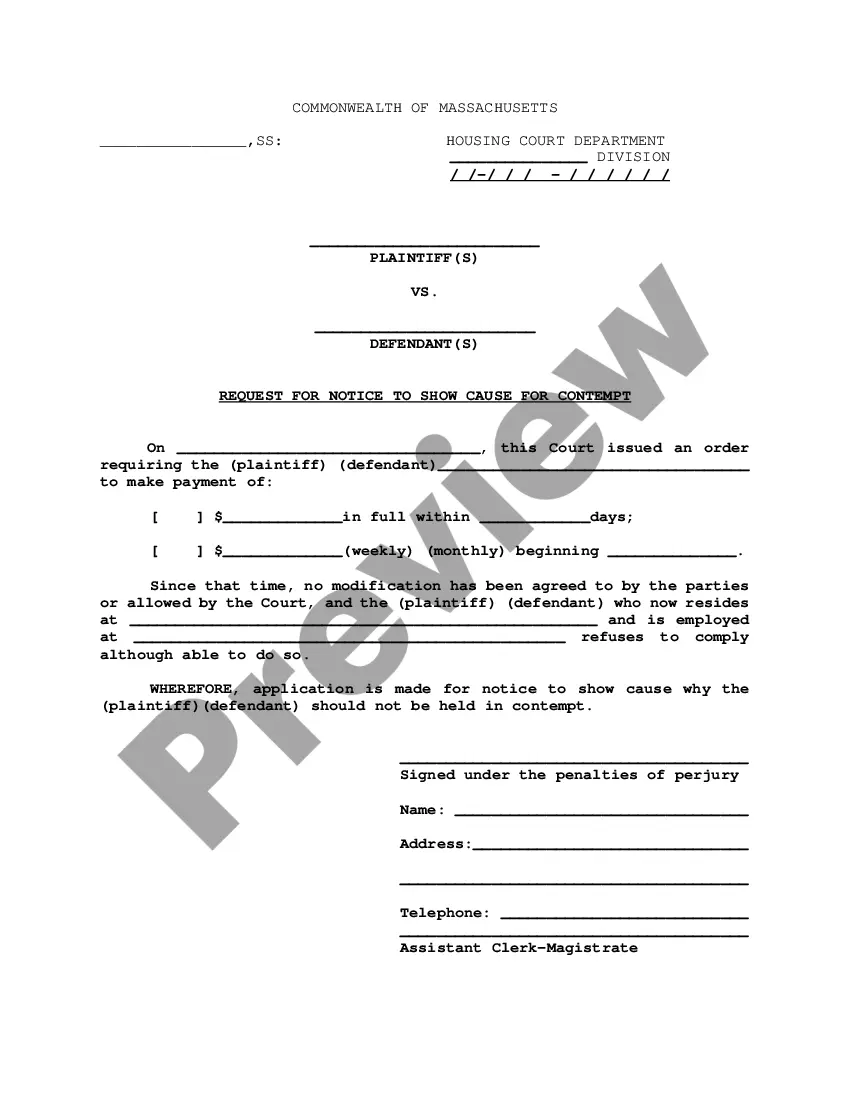

- Review the document preview and descriptions to ensure that you are on the the form you are searching for.

- Make sure the form you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to get the New York Form Fillable For Attorney.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us today and transform form completion into something simple and streamlined!

Form popularity

FAQ

On June 13, 2021, a new version of the New York Statutory Short Form Power of Attorney went into effect. Any powers of attorney executed before this date that complied with the earlier 2010 law continue to be valid.

When authorization is required for the release of personal property, it is usually referred to as an estate tax waiver or a consent to transfer. New York State does not require waivers for estates of anyone who died on or after February 1, 2000. For details, See Publication 603, Estate Tax Waivers.

All powers of attorney must now be witnessed by two persons who are not named as either agents or as permissible recipients of gifts. It is done in the same manner as witnesses to a will. The statute cross-references N.Y. Estates, Powers and Trusts Law (EPTL) 3-2.1(a)(2), and the notary may be one of the witnesses.

Use Form ET-14, Estate Tax Power of Attorney, when you want to give one or more individuals the authority to obligate, bind, or appear on your behalf before the New York State Department of Taxation and Finance (the department) with respect to estate tax matters.

Sign and date your POA in the presence of two witnesses, and have it notarized. In New York, your notary can also serve as one of your witnesses. (Remember, if you're making a health care proxy, you only need witness signatures ? not a notary.) Have your chosen agent sign and date your POA.