Violation Fair Debt Forgiveness Program

Description

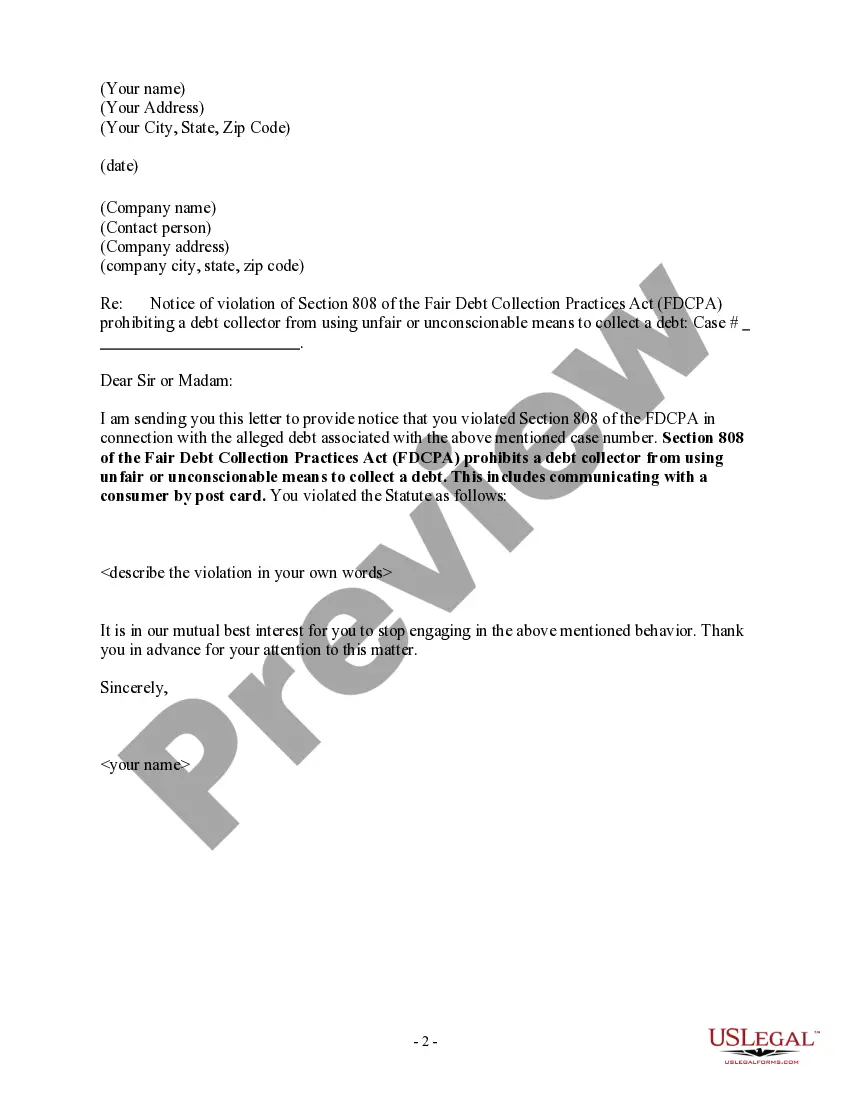

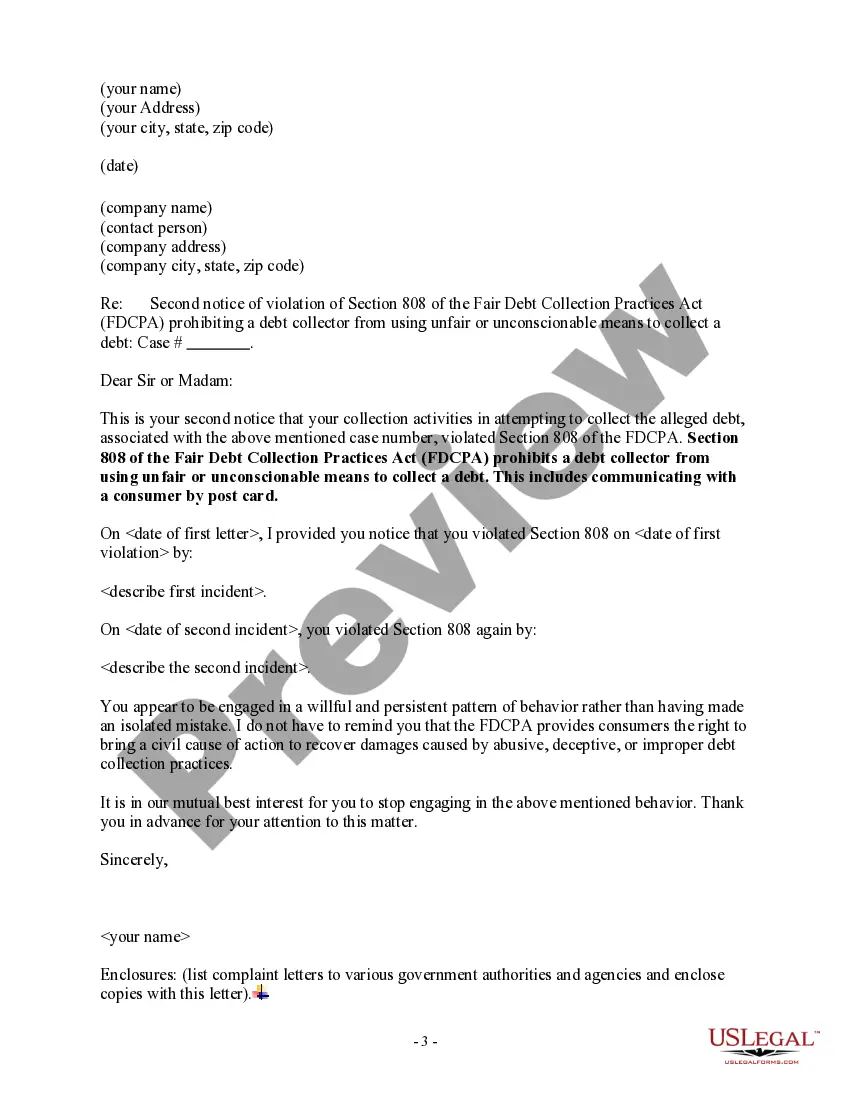

How to fill out Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

Identifying a reliable location to acquire the latest and suitable legal templates is a significant part of navigating through bureaucracy.

Selecting the appropriate legal documents requires accuracy and careful consideration, which is why it is essential to obtain Violation Fair Debt Forgiveness Program samples solely from credible sources, such as US Legal Forms.

Once you have the form on your device, you can edit it using the editor or print it out and fill it in manually. Eliminate the stress associated with your legal paperwork. Discover the vast US Legal Forms catalog where you can locate legal samples, assess their suitability for your situation, and download them immediately.

- Use the catalog navigation or search bar to find your template.

- View the form’s description to determine if it meets the criteria of your state and region.

- Access the form preview, if available, to confirm that the template is indeed the one you are looking for.

- If the Violation Fair Debt Forgiveness Program does not suit your needs, return to the search and look for the correct template.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you haven’t created a profile yet, click Buy now to acquire the form.

- Select the pricing plan that meets your needs.

- Proceed with the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading the Violation Fair Debt Forgiveness Program.

Form popularity

FAQ

Yes, you typically must report debt forgiveness to the IRS, as it may be considered taxable income. The creditor should send you a Form 1099-C, which details the amount of forgiven debt that you need to report. Ignoring this could lead to potential tax liabilities down the line. If you are unsure about any specifics related to a Violation fair debt forgiveness program, seeking advice from a tax professional or legal expert is advisable.

Recording debt forgiveness involves documenting the terms of the agreement reached with your creditor. It is crucial to keep a copy of any written communication indicating that the debt has been forgiven, as this proof may be necessary for your records. Furthermore, if you experience a Violation fair debt forgiveness program, having thorough documentation can significantly aid in resolving any disputes. For comprehensive recordkeeping, consider using platforms like U.S. Legal Forms.

To file a complaint under the Fair Debt Collection Practices Act, gather all relevant information, including the details of the debt and any correspondence you have had with the collector. You can submit your complaint to the Consumer Financial Protection Bureau (CFPB) through their website. They will review your complaint and may take action against the collector if a Violation fair debt forgiveness program is evident. You can also consult a legal professional for guidance through this process.

Yes, you can sue a debt collector if they violate the Fair Debt Collection Practices Act (FDCPA). This federal law protects your rights as a consumer and allows you to seek damages for improper collection practices. If you suspect a Violation fair debt forgiveness program, documenting your interactions can strengthen your case. Seeking assistance from a legal expert can also improve your chances of a favorable outcome.

To report debt forgiveness, start by obtaining a Form 1099-C, which the creditor issues when they forgive the debt. Make sure to review the details for accuracy, as this document outlines the amount that has been forgiven. You must then include this information when filing your annual tax return. If you have concerns about a Violation fair debt forgiveness program, consider consulting a legal professional.

Unfair debt collection practices include collecting more than what you owe or using unfair means to intimidate you. Debt collectors may not seize your property without proper authorization or misrepresent their authority. Understanding these practices can assist you in navigating the violation fair debt forgiveness program, offering pathways to improve your financial situation.

Prohibited behaviors under the Fair Debt Collection Practices Act include using threats or harassment to collect a debt. Debt collectors cannot falsely claim legal actions or contact you without proper identification. Knowing these actions helps you protect your rights and may guide you toward utilizing the violation fair debt forgiveness program for relief.

A violation of the Fair Debt Collection Practices Act occurs when a debt collector contacts you at unreasonable hours, such as early in the morning or late at night. It can also happen if they fail to provide correct information regarding the debt you owe. Being aware of these violations can empower you to seek redress, especially when exploring options like the violation fair debt forgiveness program.

An example of the Fair Debt Collection Act is the requirement for debt collectors to inform you about your debt and your rights. This includes giving you details about the amount owed and the creditor's name. Understanding this law is essential to recognize your rights under the violation fair debt forgiveness program, which helps protect consumers in financial distress.

If a debt collector violates the Fair Debt Collection Practices Act, you have the right to take legal action against them. You can seek damages for any emotional distress or financial impact caused by their actions. Utilizing resources from US Legal Forms can help you understand your options and prepare the necessary paperwork. This is especially important for situations involving a violation of the fair debt forgiveness program, ensuring you hold collectors accountable.